Portfolio Review (November 2025)

2 NEW positions!

November 2025 Markets Review

S&P 500: +0.13%

NASDAQ: -1.45%

November was a rough month for my portfolio, with the largest drawdown since the April tariff tantrum. In my October portfolio update, I highlighted:

“My view is that as long as we have Trump in the White House, things will be volatile and sharp drops are to be expected. This is why I advocate against all forms of leverage, margin, and options.”

This month reinforced that view. The drop was not pleasant for my portfolio, but had no fundamental impact due to no options and no margin. Instead, the decline simply allowed me to accumulate more shares of businesses I already have deep conviction in, and at more attractive prices.

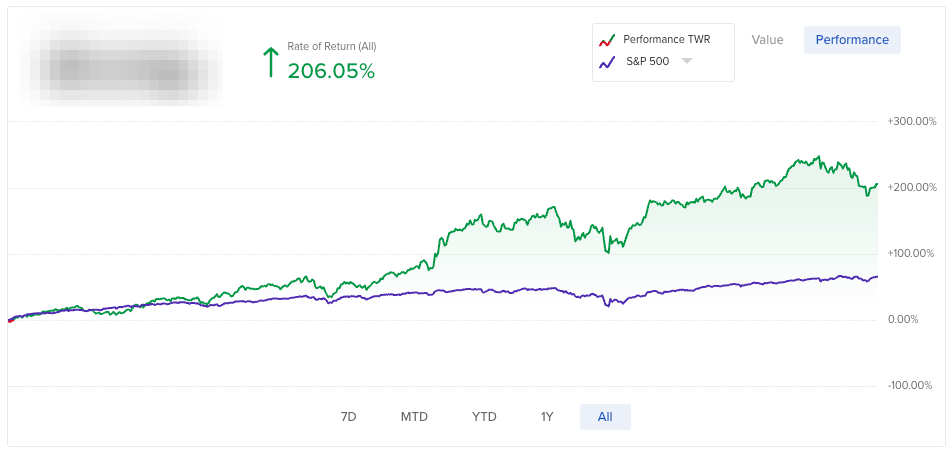

Portfolio Performance (Since Inception)

(Portfolio Inception Date: 27th October 2023)

Portfolio: +206.05%

S&P 500: +65.55% (Outperformance: +140.5%)

NASDAQ: +88.47% (Outperformance: +117.58%)

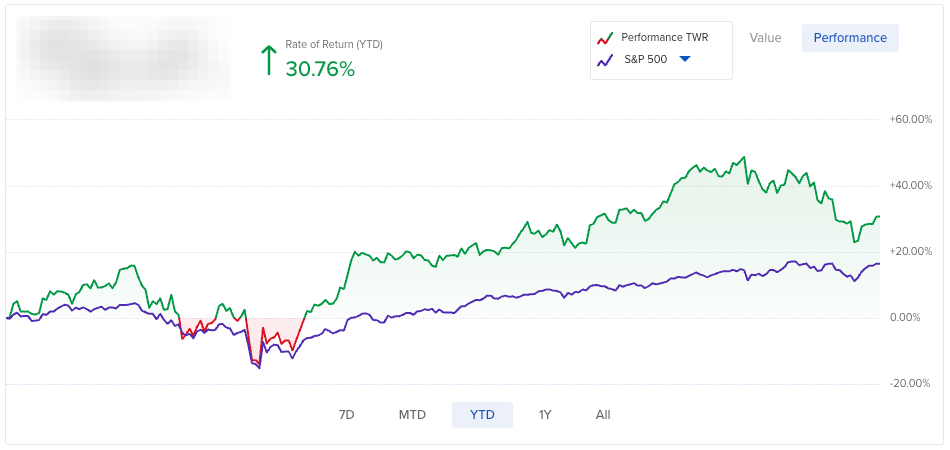

Portfolio Performance (YTD)

Portfolio: +30.76%

S&P 500: +16.45% (Outperformance: +14.31%)

NASDAQ: +21.75% (Outperformance: +10.01%)

Portfolio reviews are exclusively for paid subscribers. If you would like to gain access to my portfolio holdings, deep dives, and tons of other articles, do consider subscribing.

I post several articles per month, ranging from extensive 50-60 pager deep dives on the most interesting businesses I can find, to shorter articles on valuations, market musings and specific verticals/geographies.

In the past month, I’ve shared several articles with subscribers:

Free subscribers get access to posts too, of course, with the coverage of Grab, Sea Limited and dLocal’s earnings, all for free.

In the next few segments, I discuss my general thoughts on the market, performance, portfolio allocation and portfolio changes.