Axon Enterprise (Deep Dive)

A 30-year mission to protect life, and how it plans to continue

Axon Enterprise is a business I’ve loved for a long time. I’ve listened to countless interviews of the management team and have been very impressed by their mission and progress in the 30+ years the company has been in business.

Axon is the leading provider of public safety technology, yet remains far from a household name despite serving 95% of all U.S. law enforcement agencies. Its products, however, are definitely familiar to most of you.

The TASER was first developed and commercialised by Axon. In fact the company was previously named TASER International before changing its name to Axon in 2017. It also pioneered the widespread deployment of body-worn cameras, which are now standard issue across American police departments.

Today, Axon sells far more than just Taser’s and body-worn cameras. It has built a vertically integrated, recurring revenue ecosystem that combines connected hardware with cloud software running on long-term contracts with law enforcement agencies around the world.

The business model is genius. Every Taser or body-worn camera sold pulls in multi-year cloud subscriptions through its “Axon Cloud” suite (evidence management, records, dispatch, training). It’s the typical razor and blade setup where each device sold locks in software revenue for years.

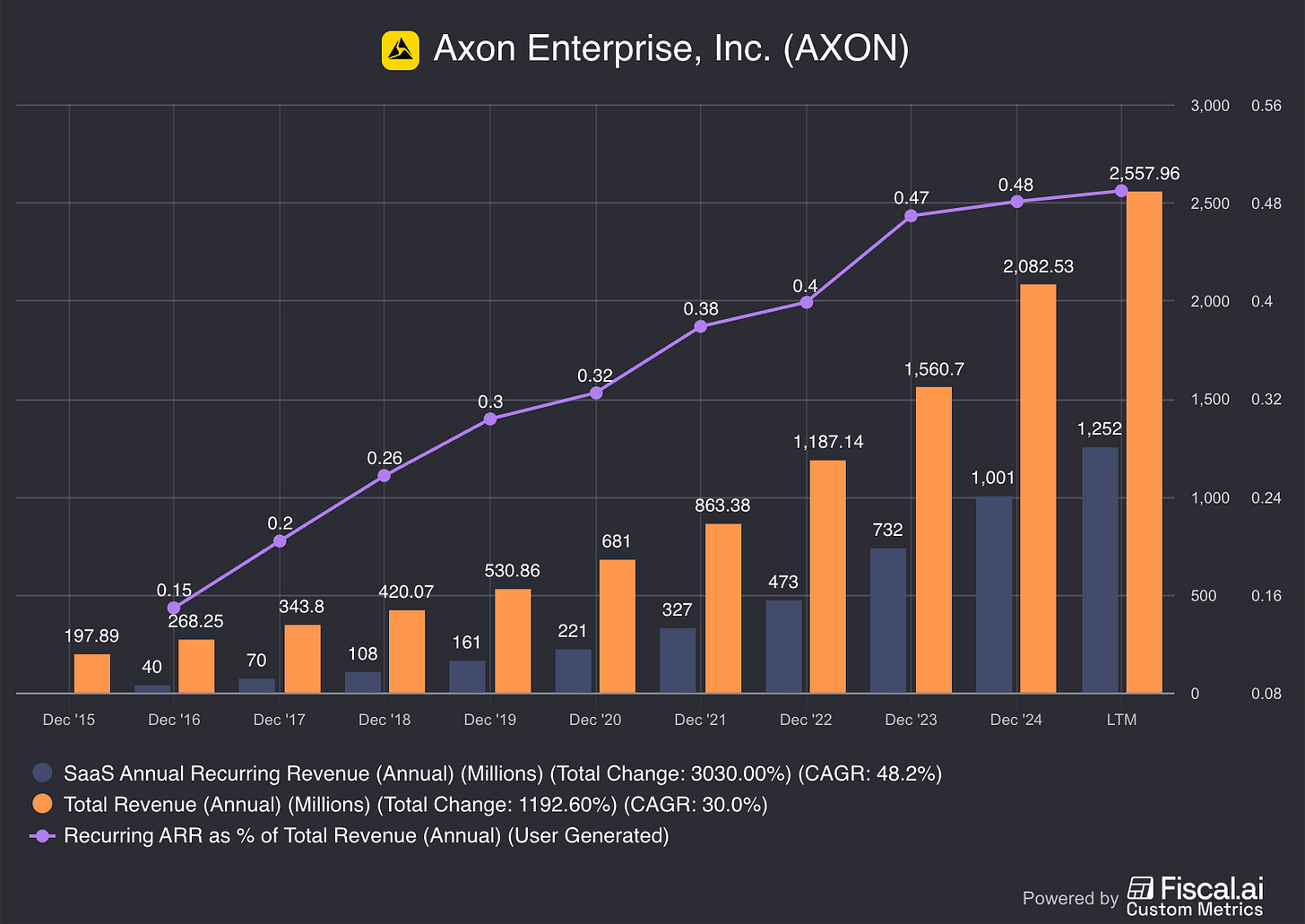

A large segment of its sales are now recurring or subscription-based, and gross margins continue to expand as software becomes a larger slice of the pie that was once dominated by hardware sales.

Its founder, Rick Smith remains in charge and has ~5% ownership of the business. He has a vision that extends far beyond law enforcement into drones, robotic integration, and even civilian self-defence applications. He has a singular mission: Protect Life. So far, his track record of execution speaks for itself.

Table of Contents

Company History

Value Proposition

Business Model

Product Offerings

Moats & Differentiation

Market Context & Industry Positioning

Competitive Landscape

Financials

Ownership & Management

Valuation

Catalysts & Outlook

Bull and Bear Case

GabGrowth Quality Score

Concluding Thoughts (What I am personally doing)

1. Company History

Origin Story (1993-2001)

Axon’s story began in 1993 when founder and current CEO Rick Smith started the company, originally named AIR TASER, Inc., with the goal of developing less-lethal weapons for law enforcement.

Rick was inspired by a tragedy where two of his schoolmates were killed in a shooting. He set out to create an alternative to firearms that law enforcement officers could use to stop violent suspects without lethal force.

In 1974, NASA researcher Jack Cover had actually developed the TASER that used gunpowder as its propellant. However, this led to it being classified as a firearm, a decision that limited sales.

In 1993, Rick and Tom Smith partnered with Jack Cover to form AIR TASER, Inc., to develop a new version using compressed gas instead of gunpowder to avoid firearm classification. They were successful in their mission but struggled with sales in the first few years.

After nearly going bankrupt marketing other products, the company renamed itself as TASER International and introduced its TASER M26 weapon in 1999. This was the business’ first big success, and saved them from financial ruin.

IPO & Breakthrough (2001-2009)

In 2001, the company filed for an IPO and began trading on NASDAQ under the ticker symbol TASR. Rick later mentioned that this was only possible as investment banks were desperate for new IPOs following the lack of interest after the dot-com crash. Unlike the myriad of internet companies, Axon stood out as a business selling real products with revenue.

They tried different marketing techniques before finally succeeding by offering to pay police officers to train others on how to use their products. This was very successful for them, allowing the business to reach $24.5M in net sales by 2003 and $68M the year after.

Throughout the 2000s, TASER devices became widely used by U.S. law enforcement agencies, though not without controversy over safety and misuse. Mid-decade, they experienced a surge in growth as police forces nationwide equipped officers with Tasers. By 2005, over 7,000 law enforcement agencies were using TASER devices.

The Next Phase of Growth (2009-2016)

However, the next phase of Axon’s evolution came from recognising the growing demand for digital evidence and accountability. In the late 2000s, amid calls for police transparency, TASER launched its first body-worn camera and accompanying cloud software Evidence.com (around 2009). This marked a pivotal “pivot to body-cams and law enforcement technology,” expanding beyond weapons into tech solutions. By October 2010, at least 45,000 TASER Cams had been sold.

The Axon Transformation (2017-2019)

In April 2017, TASER International rebranded itself as Axon Enterprise, Inc., reflecting its broader mission in connected law enforcement technology (the “Axon” name was initially used for its camera line and is derived from a neural axon, symbolising connectivity).

At the same time, Axon made a bold push to capture the market: it offered free body cameras and one-year trials of Evidence.com to police agencies, jump-starting adoption of its cloud platform. The strategy was successful, driving agencies to continue with paid subscriptions after experiencing the benefits. This period also saw Axon acquire a key competitor in body cameras, Vievu, in 2018, further consolidating the market under Axon’s umbrella.

Expansion beyond Hardware (2019-2022)

Over the last decade, Axon greatly expanded its product suite. It launched new Taser models (e.g. TASER 7 in 2018 and TASER 10 in 2023) and iterated on camera hardware (from Axon Body 1 in 2014 to the latest Axon Body 4 in 2023). The company also invested heavily in software R&D, culminating in products like Axon Records (a modern cloud-based police records management system, launched in 2019) and Axon Dispatch (computer-aided dispatch software).

Axon entered adjacent domains such as digital evidence management, analytics, and even virtual reality training for de-escalation. In 2022, Axon announced a controversial concept of a Taser-armed drone for school security; although the plan prompted backlash (including resignations from Axon’s AI ethics board) and was put on hold, it underscored Axon’s ambition and willingness to explore unconventional solutions.

Building a Platform (2023-Now)

In recent years, Axon has also begun venturing into new areas through strategic acquisitions. In 2023 and 2024, Axon made two notable acquisitions. Firstly, it acquired Fusus, a leading real-time crime center video integration platform, and then Dedrone, a counter-drone and drone operations company.

These moves have expanded Axon’s portfolio into city-wide surveillance integration and autonomous drones for public safety. By 2024, Axon was shipping over 200,000 TASER devices and 300,000 body cameras annually, serving law enforcement, federal agencies and public safety teams globally.

In 2025, Axon accelerated its platform ambitions with perhaps two of its most strategically important acquisitions yet:

Prepared: a real-time evidence sharing and collaboration platform that allows civilians, officers and dispatchers to stream live video, photos and critical data during emergencies.

Carbyne: a next-generation 911 call handling and emergency communications platform that replaces legacy systems, enabling precise caller location, live video streaming, texting, and rapid data sharing at the moment of crisis.

Together with Fūsus, Respond, Carbyne and Prepared, Axon now owns the full emergency data loop which it expects to be a key part of policing in the future.

2. Value Proposition

If we think about the value Axon provides, it is all about delivering safer, more accountable and efficient outcomes through technology.

Let’s walk through each of the products/services that it provides and how it creates a compelling value proposition for its customers:

Saving Lives with Less Lethal Force

Axon’s flagship device has now become commonplace among law enforcement officers and provides them with an effective alternative to firearms, which helps reduce fatal encounters.

Every Taser deployment that prevents a shooting, potentially saves a life or serious injury and costly litigation. This resonates well with Axon’s customers and stakeholders, and provide significant value.

Transparency and Accountability

Axon produces body-worn and in-car cameras that it bundles with its Axon Evidence cloud platform. This allows agencies to record, store and manage video evidence of police encounters.

This addresses public demand for transparency in policing. Incidents captured on Axon cameras can exonerate officers from false accusations or, conversely, provide documentation of misconduct. This is a win-win for good cops and innocent civilians.

Boosting Productivity and Effectiveness

Axon’s software tools streamline many aspects of an officer’s work. For example, Axon Records and most recently Axon’s new AI-powered report drafting tool (Draft One) significantly reduces time spent on paperwork by helping officers auto-generate incident reports from body-cam footage or dictation.

There is also Axon Respond that gives dispatchers and command staff live GPS and video feeds from the field.

All of these help officers and agencies operate more efficiently, which allows officers to spend more time in the community and less on administrative tasks.

Each of Axon’s solutions, whether it be hardware, software or services, tackle critical challenges for law enforcement. It helps to reduce lethal force, increase transparency and improve efficiency.

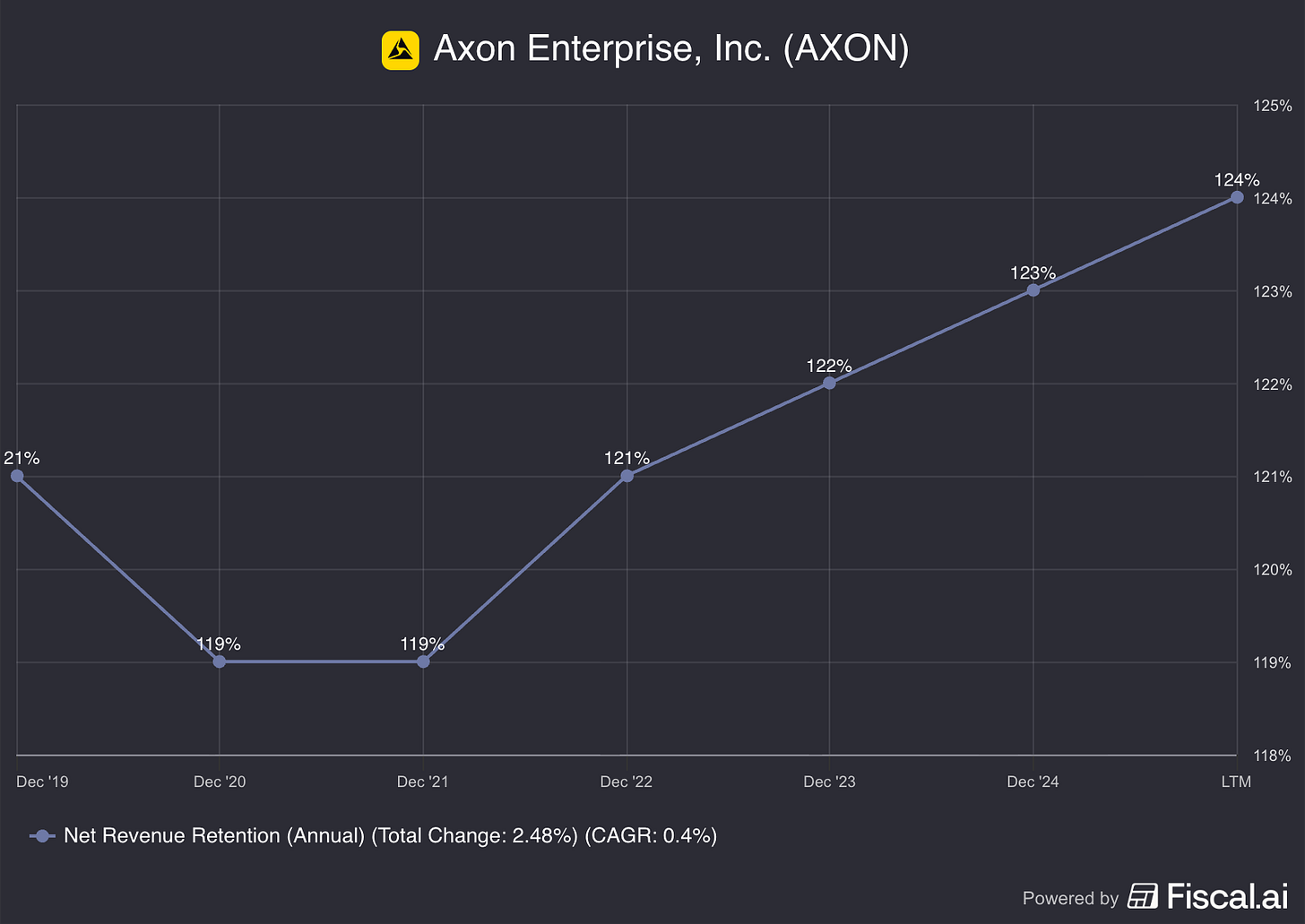

Axon also closely collaborates with its customers to develop products that fit public safety workflows. This customer-centric approach has led to a net revenue retention rate of 124% in the most recent quarter, reflecting agencies expanding their usage over time and deep entrenchment of Axon’s platform in their ecosystem.

Impressively, NRR numbers have only gone up since 2020.

3. Business Model

At a high level, Axon generates revenue in two categories:

Product Revenue (Sales of Devices and Hardware)

Services Revenue (Subscriptions, Cloud Software, Digital Evidence Storage)

The company’s strategy is to utilise its must-have hardware like Tasers and cameras as a gateway to drive adoption of its software platform, which yields ongoing subscription revenue and higher margins. This combination of product sales and subscription-based services create a powerful flywheel of recurring revenue.

There are several key elements of Axon’s business model. Each of these combine to make Axon the ideal business:

Razor/Razorblade Strategy

The hardware they provide is the core product (the razor), and the software/cloud service is the necessary complement (the blade) that is continuously consumed.

Most of Axon’s devices are sold as part of multi-year bundles that include full software access. For instance, an agency might purchase Axon Body cameras bundled with 5 years of Evidence.com cloud access, hardware refresh upgrades, unlimited storage and warranty service.

This locks customers into Axon’s ecosystem long term, which creates switching costs and dependency. In 2016, 15% of Axon’s revenues were recurring in nature. Today, 49% of Axon’s revenues are recurring in nature. In that time, Axon has 30x-ed its ARR, evidence of the successful subscription model ramp-up.

Annual or Multi-Year Contracts

Axon primarily sells to government agencies, which often prefer predictable budgeting. Hence, Axon has leveraged this by signing multi-year contracts (typically 5-year deals, although some are longer).

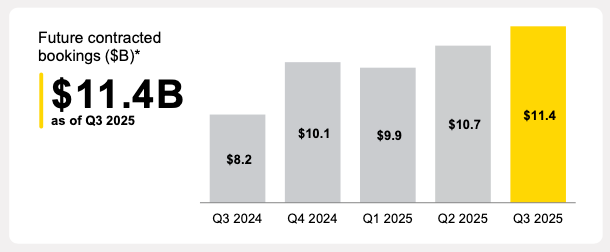

This has allowed Axon to build a substantial backlog of future revenue. As of Q3 2025’s earnings, Axon has $11.4B in future contracted bookings and that number has grown 39% YoY. Axon expects to fulfil between 20-25% of this balance over the next 12 months and the remainder over the following 10 years.

This provides high visibility into future revenue and allows for very predictable cash flows for the business. This is incredibly important for Axon as it re-invests a large chunk of its profits into R&D.

Land and Expand

Axon also follows a land and expand strategy in customer accounts. Initial deals might cover Taser or body cams for a police department. Axon then works to upsell additional services such as Axon Records for report writing, or Axon Fleet cameras for patrol cars.

Since Axon’s products are integrated, this often creates a network effect where adding one product increases the value of others. For example, using Axon Respond real-time software makes having more Axon cameras even more useful.

Hardware Refresh & Upgrade Cycle

Axon benefits from a refresh cycle on devices. Tasers have a recommended service life (often ~5 years) and camera technology improves rapidly, encouraging agencies to upgrade every few years. Axon’s subscription bundles include hardware refreshes.

For example, an agency on the Axon subscription gets the newest model camera or Taser when it’s released as part of their plan. This creates a built-in upgrade path and keeps customers on the latest technology, while also keeping revenue steady.

New product launches, such as the release of TASER 10 in 2023, can spur a wave of upgrades, boosting sales. This incentivises R&D for Axon and also increases the gap between itself and competitors.

4. Product Offerings

Axon has a broad and growing portfolio of products and services. These can be grouped into 3 main categories: Taser Devices, Sensors (Cameras etc), and Software.

Here, we will look into each of these key offerings:

TASER Devices

Professional Law Enforcement TASERs

Axon is the sole manufacturer of TASER conducted energy weapons, which incapacitate targets via neuromuscular incapacitation.

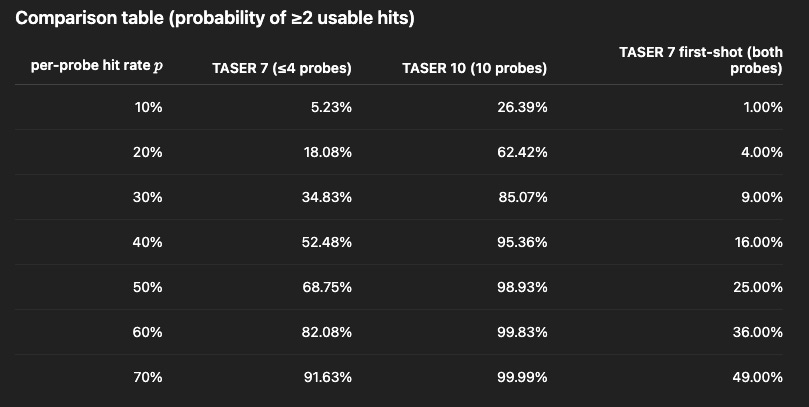

The current flagship product is the TASER 10 which was launched in 2023, carrying 10 probe cartridges with an effective range of 45 feet. This is a massive leap from the predecessor model, the TASER 7 which had just 2 shots with 2 probe cartridges each.

This might be confusing so let me explain. For a TASER to work, 2 probes have to hit a target to complete the circuit and therefore cause neuromuscular incapacitation. With the TASER 7, each shot fired a 2-probe cartridge which meant officers had two chances to hit the target.

With the new TASER 10, officers are allowed multiple attempts without reloading. Each shot fired a single probe cartridge which means the device can automatically pick the best 2 probe connections to incapacitate the target.

For the nerds like me, here is the statistical probability of effectiveness of the TASER 10 vs the TASER 7.

Safe to say, the TASER 10 is a big statistical improvement. Even at a very modest per-probe effectiveness (say p=0.2), the TASER 10 gives ~62% chance to get two usable hits within the magazine, whereas the TASER 7 only gives ~18%.

Consumer TASERs

Axon also offers consumer versions of the TASERs such as the TASER Pulse, Bolt, and the flashlight-version StrikeLight. These are typically lower-powered and shorter-range devices that are aimed at civilians in jurisdictions where they’re legal.

However, competition in consumer self-defence is much broader (pepper spray, stun guns, defence alarms etc).

VR Training and Simulation

Under the TASER category, Axon also includes its VR training programs for police. They have developed training modules that teach de-escalation and mental health crisis response using Oculus headsets, often paired with a mock TASER device for realism. This service is usually subscription-based per officer.

Axon’s VR offering competes with a number of simulation training companies (e.g., VirTra, MILO). Axon’s key differentiator here is their emphasis on their enormous proprietary content library and integration with actual Axon weapons for realism.

Training and Certification

Axon runs training academies (e.g., Axon’s Master Instructor School) and certifies officers in TASER use. Training content and cartridges consumed in training also generate revenue. The company even holds an annual conference (TaserCon) to cultivate its user community.

Sensors: Body-Worn, In-Car Cameras and Connected Devices

Body-Worn Cameras

Axon’s Body series cameras are market-leading in law enforcement. The latest Axon Body 4 that was released in 2023 offers improvements like better low-light video, real-time live streaming, and an integrated cellular module.

Axon also produces specialises cameras like Axon Flex 2, a small camera that can be mounted on glasses, for more covert or flexible use. Body cams are often sold with docking stations and accessories, and they integrate with Axon’s Signal technology.

Axon’s Signal technology is a system that automatically activates Axon body-worn and in-car cameras in response to critical events, allowing officers to focus on their situation instead of manual camera activation.

This area is certainly more competitive than the TASER market with the main players being Motorola with its WatchGuard cameras, Panasonic with its i-PRO series, Safe Fleet and a host of smaller players.

In-Car Cameras

Axon Fleet 3 is Axon’s latest in-car camera system for police cruisers. It provides dual HD cameras, one in the front dashboard and the other in the rear cabin. Axon also introduced an integrated license plate reading capability via AI on the camera.

These fleet cameras upload footage to Axon Evidence automatically, which helps with generating reports for officers. Axon also recently introduced a consumer-style dash-cam for commercial and private use, though the core focus is police in-car systems.

Axon Air (Drones)

Axon Air is the company’s drone program. Rather than manufacturing its own outdoor drones, Axon partners with drone makers such as Skydio and previously DJI, to integrate their hardware with Axon’s software.

An agency can manage drone footage through Axon Evidence and live-stream via Axon Respond. In 2024, Axon also acquired Dedrone, which in tandem with the partnership with Skydio has positioned them as a full “Drone as a First Responder” solution.

This means dispatching autonomous drones to incident scenes (e.g., a 911 call location) to feed live intel to officers, often arriving even before ground units. Axon’s drone software handles flight permissions, live-streaming and data integration. This is one of the emerging areas where only niche competitors are currently competing.

Software & Cloud Services

This is Axon’s fastest growing category, encompassing all its cloud-hosted applications and digital services. It is also the highest-margin segment, and one that enables Axon to create a network effect within their ecosystem.

Axon Evidence

This is the cornerstone cloud platform that stores and manages digital evidence (videos, photos, audio, documents). It is the world’s largest cloud repository of public safety video data (yes, larger than YouTube, Netflix etc).

Evidence.com provides chain of custody (refers to the tamper-evident, auditable record that tracks digital evidence from the moment it is captured to the moment it is presented in court), sharing tools, redaction and analysis tools, and robust permissions. This makes it a no brainer for users.

Axon sells this software on a subscription basis per user or device, charging for data storage and has various tiers of service. It faces competition from Motorola, FileOnQ, NICE and Oracle, but Axon’s head-start and tight integration with its cameras give it a massive edge.

Productivity Applications

Axon’s flagship under this suite is Axon Records, which functions as the central operating system for police data, incident reporting, case files and evidence linking. It works by turning scattered police data into a single source of truth, reduces paperwork and strengthens legal defensibility.

Axon also recently rolled out Draft One, an AI report-writing tool that generates the first draft of a police report using body-cam audio and incident data. This has been proven to decrease time spent on reports by up to 82%, saving officers tens of hours each week.

Axon Respond

This is a live operations platform that enables real-time GPS tracking of units, geofence alerts, live video streaming from body cams or drones in the field, and unified communications.

With the addition of Fūsus (global leader in real-time crime center (RTCC) technology) that was acquired by Axon in early 2024, Axon can now pull in fixed surveillance feeds, automated license plate recognition, and private camera feeds into the same interface.

Axon 911

This is Axon’s newest service that they are in the midst of building. In the past 2 months, Axon has agreed on major acquisitions of two public-safety software platforms: Prepared and Carbyne.

Prepared is a real-time evidence sharing and incident collaboration platform. Essentially, it allows citizens, officers or responders to stream live video, photos, audio and location to dispatch (pictures/videos of the suspect, location etc). This speeds decision making which is crucial in emerging operations.

Carbyne is a next-gen 911 emergency communication platform built to replace the old analog 911 call infrastructure. In simple terms, when someone calls 911, Carbyne can show the caller’s exact location automatically, let dispatch see live video from the caller’s phone, receive texts, photos, medical info etc.

Axon plans to bring both together, combined with Fūsus and Axon’s body-worn cameras to enable a seamless data stream that allows for more speed and efficiency. Personally, I think this has the opportunity to be a huge segment for Axon. These services are a no brainer for all public safety departments around the world.

5. Moats & Differentiation

Axon has developed a competitive moat over the past 3 decades, largely built on three pillars: technology, strategy, network effects. There are several key elements of this differentiation, let’s break it down:

Integrated Ecosystem and Switching Costs

Axon’s biggest moat is the seamless integration of its hardware and software ecosystem. Agencies that adopt Axon’s cameras, for instance, often integrate them deeply into daily workflows. Over years, those agencies accumulate terabytes of critical evidence in Axon’s cloud.

This creates high switching costs, where moving to a competitor would require not only buying new hardware, having to familiarise hundreds of thousands of officers with it, but also migrating data.

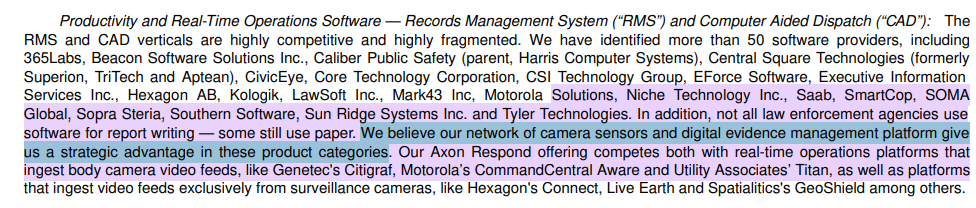

Axon’s own 10-K filing notes that the network of Axon cameras and its digital evidence platform give it a strategic advantage in expanding to adjacent product categories.

Once an agency is on Axon’s platform, Axon can upsell new features at far lower cost than a competitor could convince that agency to rip-and-replace existing systems. This ecosystem stickiness is similar to an enterprise software suite, but strengthened by the physical presence of Axon’s devices in the field.

Strong Brand and Trust

“TASER” is a household name often used synonymously with stun guns, and Axon’s brand carries significant weight in law enforcement.

Axon has always emphasised that it stands with law enforcement officers, and that its tools are built to materially make their jobs safer, simpler, legally defensible and harder to dispute. They understand that officers are their main customers and has taken the time to build trust and relationships that are hard for new entrants to replicate.

Axon has taken the initiative to host conferences, training programs and have involved former officers heavily in product design.

When an agency purchases critical equipment like weapons or evidence systems, vendor reputation is especially crucial as any failure could have life or death consequences.

Patents and Proprietary Technology

Axon holds numerous patents, especially on TASER technology and some camera and software features. For example, Axon has patented elements of the TASER cartridge and waveforms, making it very hard for a direct Taser clone to emerge without infringement.

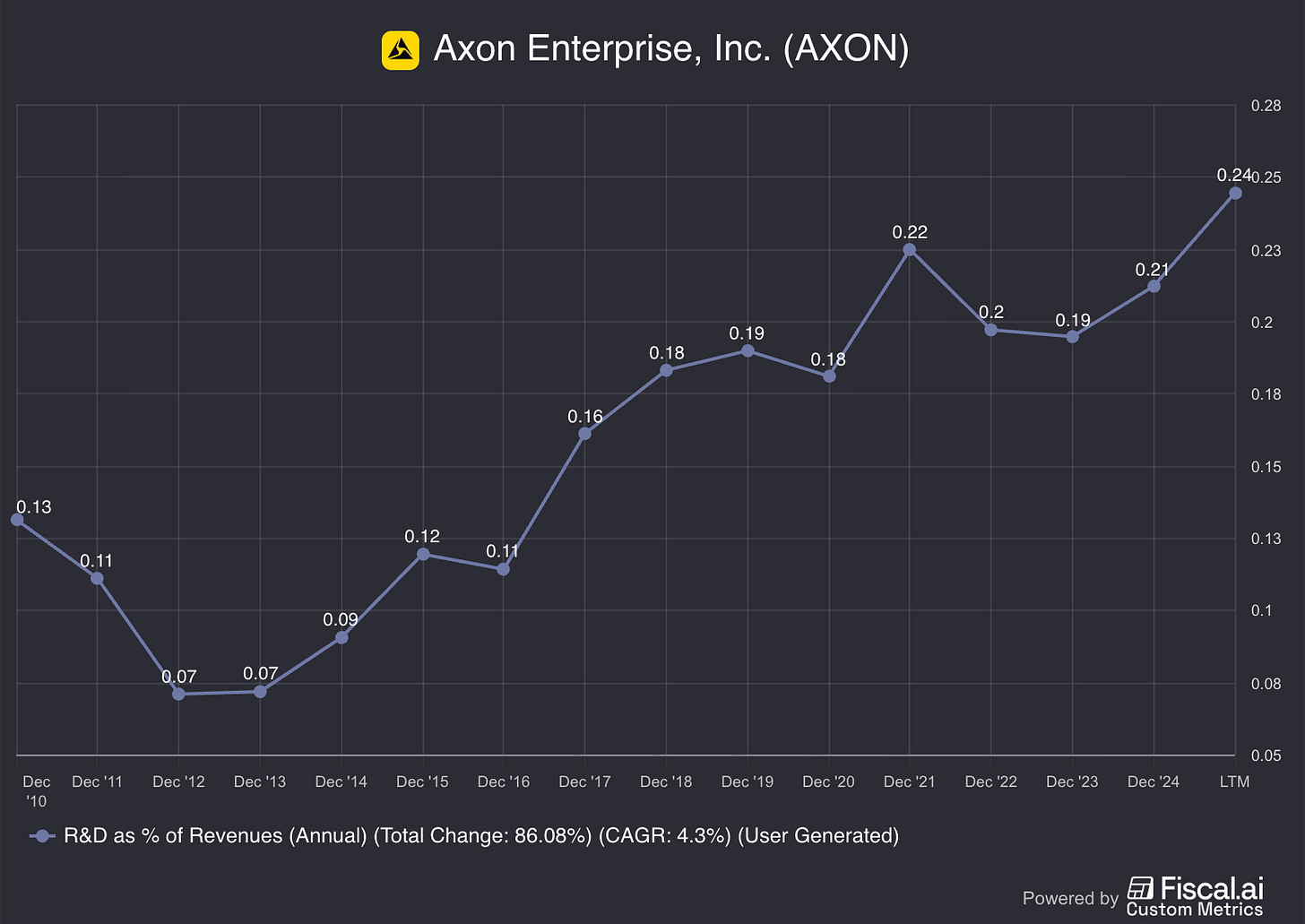

However, patents are typically limited to 10 or 15 years, and hence are not a sustainable long-term advantage. To that end, Axon has invested heavily in R&D. In recent years, R&D has ticked up to over 20% of revenues, enabling them to stay ahead of competitors technologically.

Network Effects

Axon benefits from a key form of network effect: inter-agency collaboration. This is only possible as it is the largest provider of body cameras and evidence management.

Prosecutors, defence attorneys, and neighbouring agencies often need access to evidence. If they all use Axon Evidence, sharing is easier (a digital handoff via the cloud). Some states have started to adopt Axon statewide (e.g., all police agencies in a region using Axon), which reinforces this network effect.

Additionally, Axon’s growing dataset and user base give it an advantage in AI development. For instance, training algorithms to auto-tag footage of perform transcription can leverage this vast data source.

Scale

Axon’s scale allows it to invest more in product development and customer support than smaller competitors. It is now a $50B company and spits out hundreds of millions of free cash flow per year.

It also has $2.4B in cash that enables it to afford initiatives like offering trial hardware, investing heavily in R&D projects in AI, AR/VR, drones, that would be extremely costly for startups.

Axon also possesses manufacturing scale (including a large facility in Arizona and partners globally) that drives down unit costs, allowing competitive pricing.

Comprehensive Product Suite

Many of Axon’s competitors focus on one niche. Axon’s unique differentiator is offering a one-stop shop for agencies. This is a moat in the sense that agencies increasingly prefer integrated solutions to reduce complexity.

Axon’s solution means one login, one vendor, one data ecosystem, rather than a patchwork of systems that may not talk to each other. It also means Axon can bundle products at a value price. For example, a competitor might undercut on body camera price, but can they also provide an evidence platform and a taser and a drone integration? Axon’s breadth thus not only attracts customers but also stifles competitors who lack a similar breadth.

In summary, Axon’s moat is a combination of multiple factors that act as a synergistic combination. Axon’s lead is not unassailable, but it is one of the strongest i’ve seen, and allows them to dominate their markets with relative ease.

6. Market Context & Industry Positioning

Axon operates at the intersection of the public safety technology market and the broader movement to modernise law enforcement. Understanding the market context involves looking at law enforcement agencies’ needs, funding environment, regulatory drivers, and Axon’s position globally.

I think this is particularly important for Axon as the industry is not something that is second nature for us.

Total Addressable Market

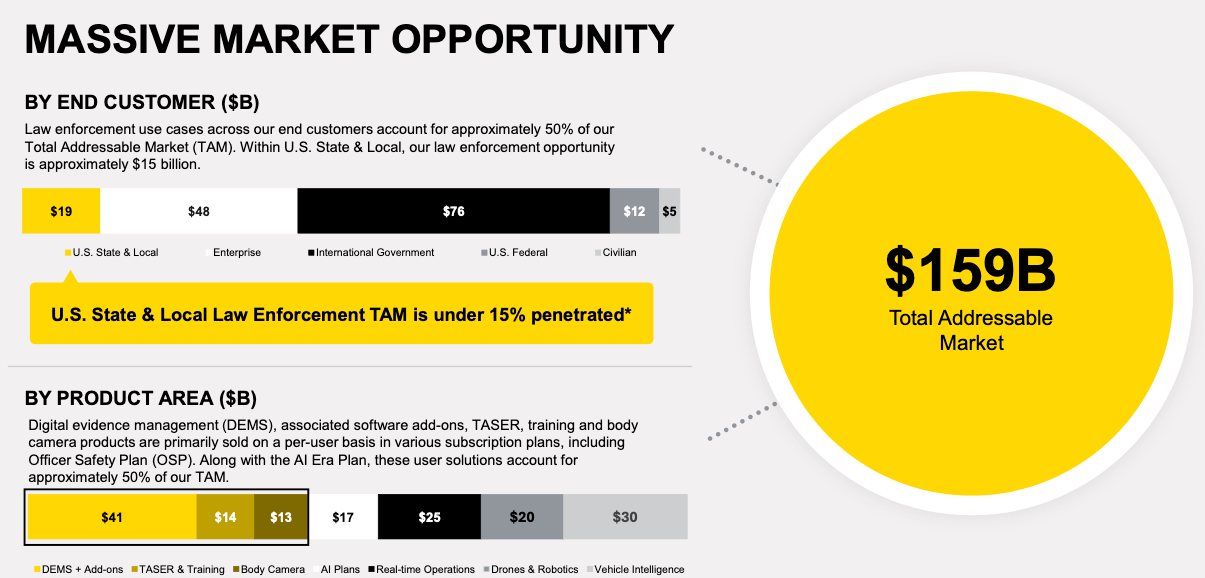

Axon discusses its TAM often and emphasises its desire to continually expand its TAM over time. And it has managed to over time.

In the latest Q3 earnings, Axon mentioned that with the acquisitions of Prepared and Carbyne, the total addressable market for the business is now $159B. Axon’s TTM revenue is $2.56B (only 1.6% of TAM).

This suggests a very large runway remaining, especially as Axon broadens into new customer types like fire departments, EMS, corrections, commercial enterprises with security forces, and international militaries.

Market Drivers and Trends

High-profile incidents and social movements over the past decade have driven widespread adoption of body cameras in the U.S., and increasingly abroad. In many jurisdictions, body cams are now mandated or at least strongly expected in response to this demand for transparency and accountability.

This is a secular trend that directly benefits Axon. Similarly, the push for de-escalation and avoiding lethal force adds momentum to TASER deployments and training, as communities and police departments seek safer outcomes.

There is also the increasing digital transformation within policing. For decades, police agencies have stuck to the same outdated technology (paper records etc). There’s a generational shift as new leadership embraces cloud solutions and data-driven policing.

The fact that Axon Evidence is cloud-based (vs. competitors offering on-premise servers) initially faced some resistance about data control, but now cloud is widely accepted, especially as Axon proved its security measures.

Global Expansion

For most of its history, Axon’s customer base was primarily U.S. law enforcement. In recent years, international markets have become a major focus.

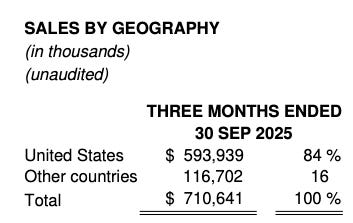

Yet, international markets remain a small component of overall revenue. In the latest report, the U.S. continued to account for 84% of revenues.

Countries like the UK, Canada, and Australia have been early adopters of Axon products. For instance, every police force in the UK uses TASERs and some are now adopting Axon cameras.

Axon has been opening offices and hiring local teams in EMEA, Asia-Pacific, and Latin America. The international TAM is huge. For example, Europe has more police officers combined than the U.S., and most do not yet universally have body cams or conducted energy weapons.

Notably, two of Axon’s top ten deals in Q3 2025 came internationally, including a nine-figure European cloud contract, Axon’s first major EU Axon Cloud deployment.