Grab Holdings: The 2026 Thesis

Hello all. It’s been awhile since I’ve written a piece on Grab.

To recap, I first started covering the stock publicly in mid-2024, entering a position at $3.19. I have continued adding to my position as the business has proven itself, effectively averaging up along the way. I should also add that I’ve been a Grab user since 2015, which has given me a long, first-hand view of how the product and ecosystem have evolved over time.

In my view, Grab has never been a stock meant to sprint to $20 or $30 in a year or two. It is a steady compounder, building its moat in a largely predictable manner while growing more deeply embedded in the region with each passing year.

Fundamentally, the business is in the strongest position it has ever been. If execution continues at the current pace, I believe outcomes such as $30 or even $50 are inevitable, though patience will be required.

In this piece, I will lay out my 2026 thesis and re-evaluate the bull and bear case from here.

2025 Recap

We started off the year with news that a potential merger with GoTo would be happening, creating a 91% monopoly in the 200M-population strong Indonesian market. Of course, that came to naught, but merger rumours were a recurring theme the entire year.

In March, Grab acquired the Everrise chain of supermarkets, the largest and fastest growing chain of supermarkets in Sarawak, East Malaysia. This included 19 outlets and was the 2nd purchase of a supermarket chain, following the 75% acquisition of Jaya Grocer in 2023. This is all part of Grab’s plan to be the one-stop app for transportation, food delivery, payments and now groceries.

Later that month, Grab announced a partnership with 4 autonomous tech firms to study self-driving vehicles (Autonomous A2Z, Motional, WeRide and Zelos). This was a follow-up from the previous earnings call where CEO Anthony Tan highlighted Grab’s plan to become a partner to AV firms.

In April, Grab hosted its first ever Product Event. It launched a total of 10 products that were quickly integrated into the business including “Dine out Discovery”, “GrabFood for One” and “AI Merchant Assistant”. I’ve detailed my thoughts in this post that you can read for more clarity.

In the same month, Grab (Specifically GXS Bank) also announced its acquisition of Validus Capital’s Singapore arm, a leading digital lending platform for SMEs. The deal was fully funded by cash and enabled access to SME lending, the backbone of the Southeast Asian economy.

On 11th June, Grab announced a $1.5B offering of zero coupon convertible senior notes due 2030. The conversion price was set at $6.55, a 40% premium to the date’s price. The initial offering was set at $1.25B but upsized due to a huge over-subscription.

In August, Grab announced an investment in WeRide, that it has previously partnered. This was an extension of that deal with the investment expected to close in 1H26. Later in the year, WeRide and Grab achieved the first autonomous vehicle testing in Singapore with plans to release it to public passengers by early 2026.

In October, Grab invested in May Mobility, a US-headquartered AV firm, with May disclosing that Grab had made a significant equity investment in the business as part of its plans to expand into Southeast Asia next year.

Grab also licensed its proprietary GrabMaps technology to Tino, the Mongolian SuperApp, creating the potential for a standalone revenue stream. Tino and GrabMaps will together map Ulaanbaatar, Mongolia’s capital, before expanding into other cities.

In November, Grab announced a definitive agreement to invest $60M investment in Vay Technologies, a German AV firm. In addition, Grab will increase its equity interest in Vay with an additional $350M within the first year after closing. This marked the 6th investment/partnership Grab has made with an AV firm.

Just last month, Grab announced its investment and partnership with Momenta, an AV tech firm headquartered in Suzhou, China. Momenta has over 400,000 vehicles on the rod equipped with its software, including models from BYD, Mercedes, Toyota and more. Momenta also established a strategic partnership with Uber earlier this year, and have plans to start L4 Robotaxi testing in Munich in 2026.

Summary:

It has clearly been a very eventful year for the business, and the pace of execution has clearly accelerated. Grab is deploying its war chest of cash slowly but surely in autonomous efforts. Essentially, Grab’s bet is that autonomy will not be a winner take all market but rather a commoditised business where multiple winners surface and dominate their respective geographies and niches. I tend to agree.

Just in time for this article, we also saw Nvidia’s partnership with Mercedes and the release of Alpamayo, its AI reasoning model for AVs. I think this will eventually commoditise the technology.

Who wins in such a scenario? My bet is the players with distribution and scale.

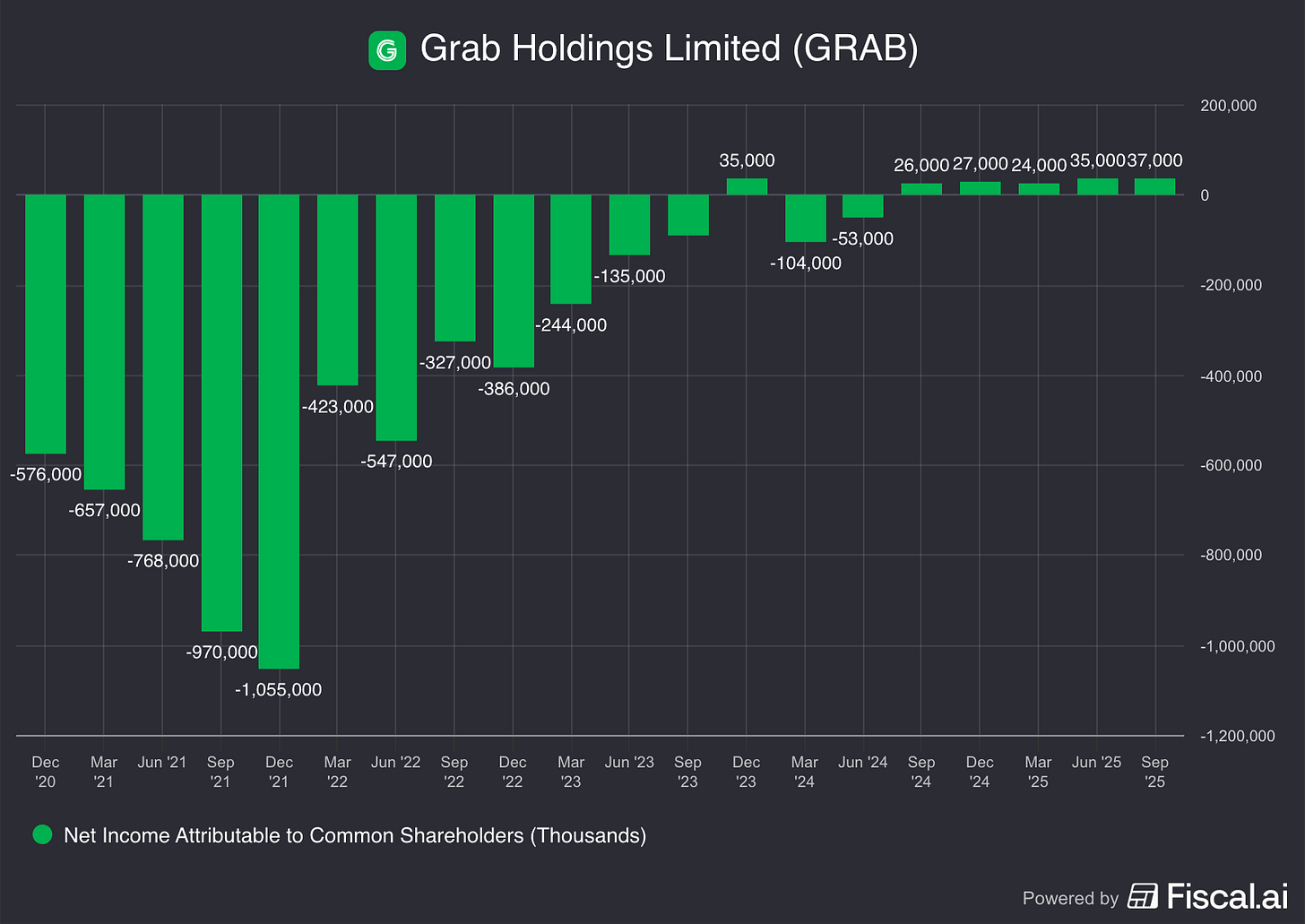

2025 also marked the first year where Grab has been profitable in each quarter. From burning up to $1B per quarter to now turning a profit, it has not been an easy ride. We now sit in a scenario where Grab attempts to balance growth with profitability. For me as an investor, it is an ideal situation. It means Grab can decide to switch on the tap for profitability at any moment which will see incredible earnings growth and subsequent re-ratings.

Grab continues to dominate its competition in both mobility and deliveries. The competitive landscape has relaxed, with players cutting back on aggressive incentives and the environment has matured. This is part of a trend that I’ve highlighted that you may want to read:

On Financial Services, I think more can be done on that front. GFin continues to be a key growth driver for the business but I believe growth could be quicker.

As of the past few quarters, GFin’s revenues have hovered around the 40% mark. In contrast, Sea Limited that operates in a similar geographical context has 10x the loan book size while growing revenues at 50-70%.

I think 2026 is the year Grab can afford to grow more aggressively. It needs to secure the user base, even if that may lead to reduced profitability.

The comparison with Sea is important not just because Grab should replicate Sea’s playbook, but because it highlights the latent opportunity. Grab sits on a similarly dense transaction graph across mobility, food, and payments.

If Grab can responsibly scale GFin to even a fraction of Sea’s penetration over the next 3-5 years, the incremental ROE potential is enormous.

2026 Bull Case

I’ve written extensively on the reasons that I’m invested in Grab so I shall not cover this in tons of detail. I’ll go straight to the point and list the reasons I continue to own Grab going into 2026.

The core business is now scaling profitably

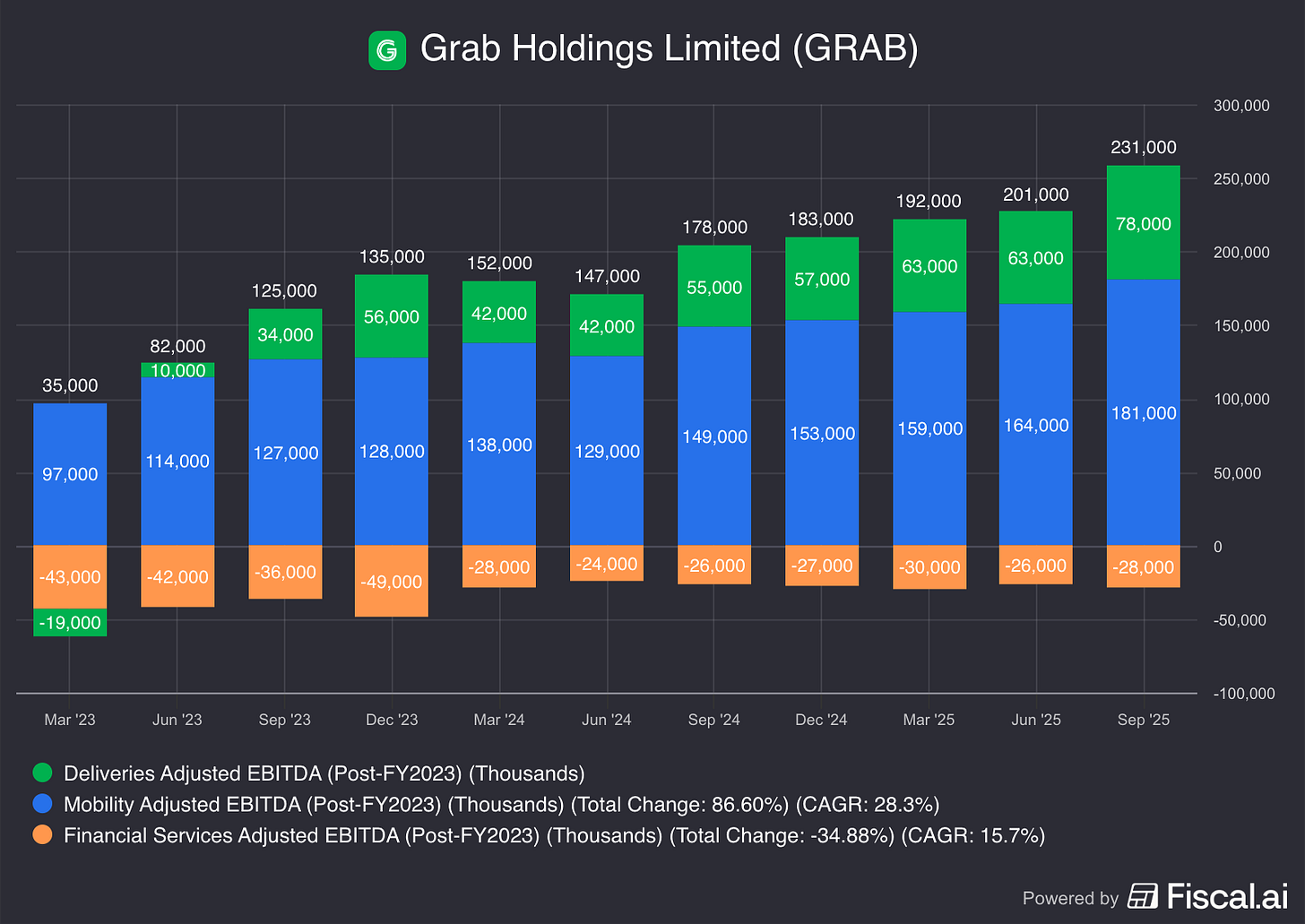

The model has been proven to work with FY net profit and continued Adj EBITDA expansion. Grab started 2025 projecting $440-$470M in Group Adj EBITDA for FY25. It has continually raised these projections with Q3 projections for FY25 Group Adj EBITDA in the $490-$500M range.

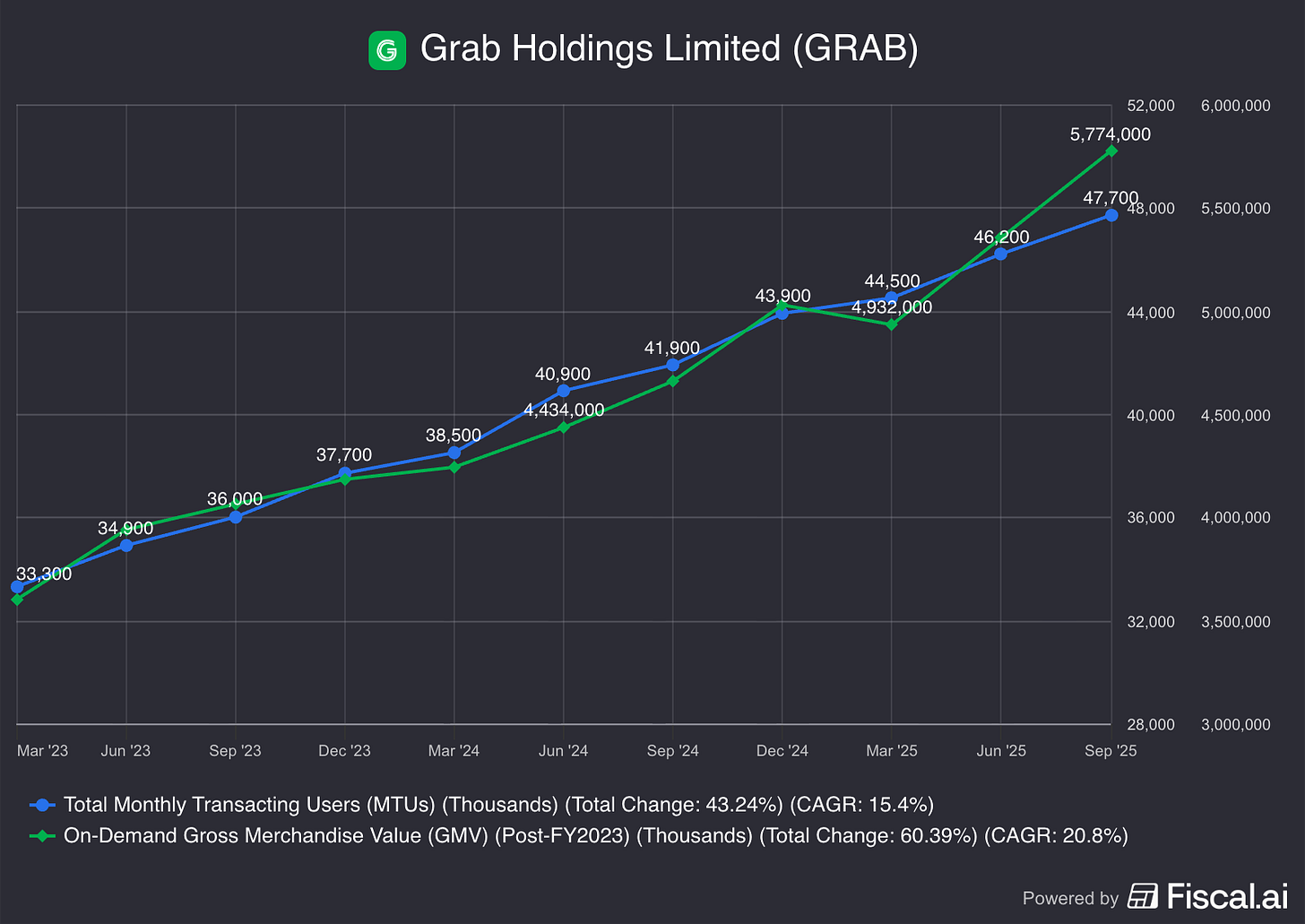

The bull case here is pretty simple. The business simply needs to continue compounding GMV and MTUs while incentives stay disciplined. This will almost certainly lead to higher profit margins while stock price will eventually follow.

Deliveries can be monetised heavily

Mobility is a cash engine but ultimately a commoditised product. Grab can be sustainably profitable from the business but it cannot expect massive margin expansion in the long-term.

Deliveries on the other hand, can be differentiated. That happens through merchant lock-in. Unlike Mobility, merchants can be incentivised to prioritise only one app, and consumers have food preferences.

This is why Grab has placed much emphasis on GrabSignatures. These are restaurants that are strictly available only on the Grab platform. Consumers won’t be able to order from them on FoodPanda, Deliveroo, ShopeeFood, you name it. Why would these restaurants lock themselves into the Grab ecosystem? Because Grab already owns a significant share of the market in most geographies (north of 60%). Grab simply needs to promise lower commissions and these merchants can be converted easily.

This merchant lock-in partnership is not a new idea, DoorDash has employed this strategy for years, and it has worked very well. (Check out this article on Wingstop and DoorDash’s partnership, a true win-win).

The key here is to be a helpful partner to merchants, providing them with tools to optimise operations, reduce complexity, maximise their marketing impact, and that is exactly what Grab is targeting through the AI Merchant Assistant that they launched in April this year. Nobody’s talking about this, and I think with scale, Grab is going to see exponential growth in profits within this segment. (Today, their segment adjusted EBITDA is just 2.1% of GMV, and management’s long-term target is 4%+)

GrabAds

I’ve discussed this in detail in my article in July but will give a short summary here.

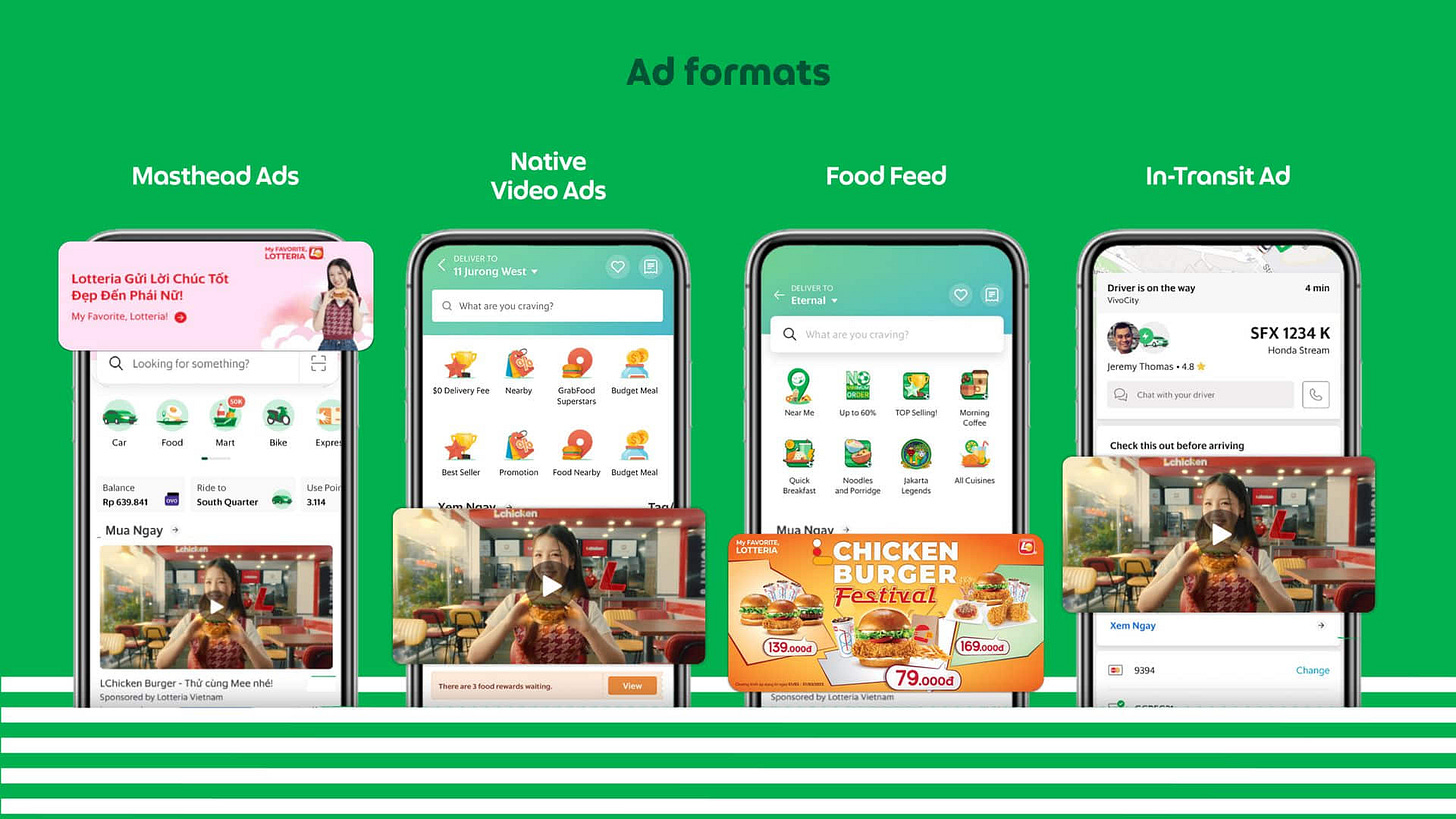

GrabAds is the newest key segment but one that is very important to its future. It is already running at a $216m annualised revenue run-rate, growing ~60% YoY, yet it is buried inside the Deliveries segment and largely ignored by investors.

At just 1.7% of Deliveries GMV, Ads is materially under-monetised. Even a modest move toward peer levels could add hundreds of millions of high-margin revenue with very strong EBITDA flow-through.

More importantly, Ads leverages Grab’s unique, closed-loop data across food, mobility and fintech, giving advertisers provable ROI. Over time, I see GrabAds becoming one of Grab’s largest profit pools and a key driver of multiple expansion, helping shift the narrative away from being a low-margin, commoditised business.

GFin turns profitable this year

Management has guided for GFin to turn profitable on a segment basis by the second half of 2026. Currently GFin is losing about $20-30M each quarter on a segment level, and likely more at a group level. Assuming it gets to break-even, it will lead to a minimum 10% bump on segment-level profitability.

GoTo Merger/Acquisition

I’m sure we’re all tired of hearing about the impending GoTo merger/acquisition but it certainly is a catalyst for the business. I’m personally torn on whether I want this to happen. For one, I think Grab will eat GoTo’s mobility and deliveries up within half a decade so it could be a waste of funds.

On the other hand, GoTo’s FinTech business is very strong. Its GTV and Revenue is around the same level as Grab, which would mean a doubling in top-line metrics upon merger. More importantly, GoTo’s FinTech business is already segment-level positive.

Grab acquiring its mobility and deliveries business would give it control of Indonesia, the largest market in SEA by far. It would lead to certain anti-competitive concerns and perhaps protests, but narrative-wise, I think it would be a positive for Grab stock.

Risks

Of course there are also some risks that I’m watching.

Incentives (Partner + Consumer)

Grab’s profitability at the moment is highly sensitive to incentives. In Q3 2025, incentives were ~10% of GMV. A 100 bps increase in incentives on FY25 GMV (~$22B) implies $220M of incremental cost.

That would wipe out ~45% of FY25’s Adjusted EBITDA guidance ($490-500M).

For now, this is the single most important variable in the model and one that has to be watched closely. However, we have to note that this fluctuates quarter to quarter, and it would be more important to watch the overall trend.

Regulatory intervention on fees or labour

Grab operates in countries with volatile political climates. In 2025, there were widespread protests in Indonesia over pay with 25,000+ car and motorcycle drivers joining in.

Even a 50-100 bps cap on take rates in large markets would directly hit EBITDA in a material manner.

Market refuses to re-rate the stock

Unfortunately, markets do what they want at times. Even with execution, re-rating is not guaranteed. Grab currently trades in a manner where the market doesn’t believe it can sustain these growth rates for more than half a decade.

My bet is that Grab can sustain double-digit growth rates for over a decade. However, in the short-term, Grab can only do so much. Whether the market re-rates it or not, is out of our control.

Competitive Fears

One of the concerns that some investors have highlighted to me is the sticky nature of certain competitors in individual markets. In Singapore for example, on the mobility side, Gojek and Tada remain competitive players while FoodPanda and Deliveroo remain competitive on the deliveries end.

What’s more important to note in these markets, however, is that Grab’s dominance has continued to grow while competitors have slowly pulled out. In May 2025, FoodPanda ceased all operations in Thailand after 13 years. In Sept 2024, Gojek pulled out of Vietnam. Over this same period, Grab has steadily increased margins and take-rates of its services. Competitors are now following suit too, showing that the competitive landscape has calmed down and players are settling into a more rational equilibrium.

Xanh SM

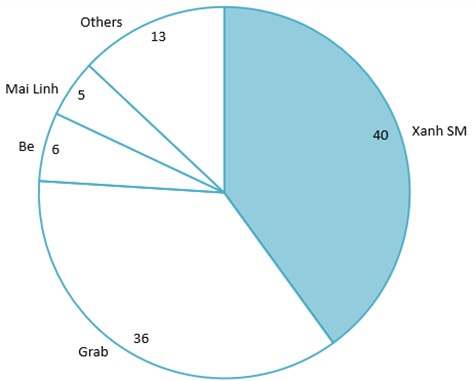

Another concern that investors have is the emergence of Xanh SM in Vietnam. I’ve covered them in the past but will re-hash it for the benefit of first-time readers.

Xanh SM is a subsidiary of Vingroup, run by entrepreneur Phạm Nhật Vượng. It operates a fully electric fleet of cars and motorbikes that are largely sourced from VinFast, which is also a subsidiary of Vingroup and manufactures electric vehicles.

In recent years, Vingroup has spent billions of dollars subsidising a push into the mobility market, and it has succeeded. Xanh SM took pole position in Q1 2025 with ~40%. Grab is 2nd at ~36%, with other smaller players such as Be and Mai Linh making up the remainder.

The approach taken has been particularly interesting and has been described as “I buy first, you buy later”. VinFast used Xanh SM as an initial buyer of its vehicles, allowing for rapid scaling and reinvestment into related infrastructure. In 2023, VinFast sold 72% of its cars and 46% of its scooters to Xanh SM. Two years later, this fell to just 22% and 13% respectively, suggesting these tactics have worked and reflecting the growing EV adoption among Vietnamese consumers. Xanh SM has also begun expanding internationally, albeit with limited success so far.

The counter-argument, however, is that VinFast has been losing money hand over fist. In its latest Q3 2025 results, revenues grew 47% year-on-year, but losses widened to $910M from $500M the year before. Gross margins deteriorated further to negative 56.2%, compared with negative 24% last year. I think this is a fair strategy, and one that many businesses have pursued, but it is not sustainable indefinitely.

Despite its local traction, VinFast remains a relatively small global player. In the first nine months of 2025, VinFast sold around 100,000 electric cars in Vietnam, roughly 27% of the country’s total sales. For comparison, BYD sold 4.55 million cars in 2025 alone, more than 45x the scale. Competing on price over the long term against players of that scale will be extremely difficult.

All this is to say that I do not think VinFast will become a dominant global player, and as a result, Xanh SM’s position may weaken once subsidies eventually subside.

I think the most important factor to consider, is that Xanh SM currently operates only in the mobility vertical. Grab’s competitive edge lies in its multi-vertical ecosystem spanning mobility, deliveries, advertising, payments, merchant tools, and more. While this is a risk worth monitoring, I am not overly concerned as a Grab shareholder. Vietnam accounts for roughly 10% of Grab’s business, and Vietnam mobility likely represents closer to 4% overall.

Conclusion

Overall, Grab remains a high-conviction holding for me. The price has stayed relatively stagnant over the past year, which is not unexpected, as it will follow free cash flow and profitability.

For investors who want to make a quick buck, my advice would be to look away. However, I think Grab is likely to be a fantastic long-term investment for investors who focus deeply on the fundamentals of the business, ignoring quarter to quarter volatility and sentiment.

Grab has transformed from a business looking to survive and prove the sustainability of its business model. Today, it simply requires disciplined execution, compounding GMV, expanding take-rates gradually and maintaining incentive discipline. I believe Anthony and co. are the right people to take it forward and earnings growth will follow naturally.

There is massive optionality to this business too, from Ads, Financial Services, and perhaps even Autonomy. But even without assigning aggressive assumptions to those segments, the core business alone supports meaningful long-term upside.

Thanks for reading!

If you enjoyed this piece, please do me a favour and like/re-stack in order to give this more visibility. Every bit helps, I truly appreciate it.

-Gab

Paid Subscription Upgrade

If you’d like to support the work I do, consider becoming a paid subscriber. Your support will allow me to spend more time finding asymmetric opportunities in the market, writing and analysing various businesses.

As a reminder, paid subscribers get access to:

Monthly Portfolio Updates (+98% in 2024, +26% in 2025)

Earnings Reviews on Portfolio Companies (SE, GRAB, DLO, MELI etc)

Archive of Deep Dives and Posts (12 Deep Dives and counting)

Southeast Asian coverage of industries and companies

Great work Gab! Grab surely very looks well-positioned to continue their steady and strong growth trajectory in the next few years!

I think DIDIY is a far better value than GRAB. DIDIY generates much higher revenue than GRAB and is much cheaper than GRAB on almost any valuation metric (other than EV/EBITDA). Basically, DIDIY is much cheaper given regulatory risk and so the growth premia you see in GRAB is not reflected in DIDIY stock price. Over time though DIDIY will only grow more as its balance sheet is much stronger.