SEA's Digital Champions Analysed

Who to Own, What to Watch, and How They Will Monetise

In Part 1, we explored the structural shifts reshaping Southeast Asia’s digital economy, adapting insights from the 81-page annual SEA digital report by Temasek, Google and Bain.

(I’ve removed the paywall on the piece, so please feel free to check it out.)

From the rise of video-driven e-commerce and the post-pandemic rebound in mobility and food delivery, to the maturation of digital financial services. We saw how key players like Sea Limited and Grab pivoted toward sustainable growth, and how newcomers (e.g. TikTok in social commerce) are shaking up the status quo.

In Part 2, I would like to translate these themes into investable insights for public equity investors. Which companies are best positioned to capture the next five years of outperformance? What monetisation levers and business model evolutions will drive value? What should investors be looking out for to pick winners?

I will focus primarily on Sea Limited, Grab, and TikTok, the three dominant forces in SEA’s digital ecosystem, breaking down each company’s positioning, revenue drivers, and competitive edge.

We’ll then examine emerging private companies in the region (Xendit, Kredivo, Atome, Mynt, and more). How do they fit in this landscape? Could they challenge the incumbents?

1. Context

As we discussed in the previous article, Southeast Asia’s digital economy remains on a strong growth trajectory, but the narrative has shifted from land-grab expansion to monetisation and profitability.

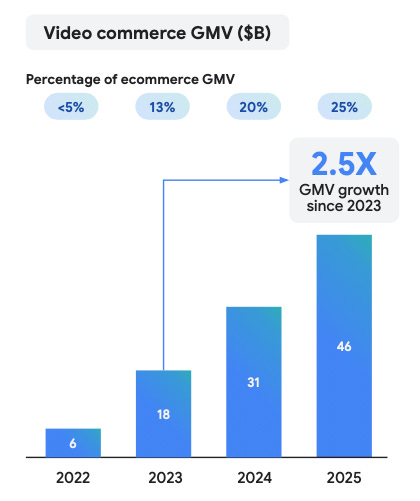

Revenue is scaling faster than ever, with a decisive push toward monetisation strategies such as higher pricing tiers, premium services and diversified revenue streams. Video-commerce now accounts for 25% of total e-commerce GMV, a 5x jump from just 3 years ago, thanks to the boom in live-selling and content-driven shopping.

These shifts have huge investable implications. First, companies that successfully monetise their user base, through advertising, fintech cross-sell, subscription tiers, or higher take rates, are seeing improved margins and profitability. Private funding in SEA tech ticked up 15% last year, with a notable tilt to late-stage, profitability-focused deals.

DFS startups attracted nearly half of all funding while VCs and corporates have poured money into AI (30% of recent funding), betting that AI adoption will unlock new efficiencies and products. This is a key theme to watch imo, DFS and AI are emerging as new growth engines.

Perhaps the biggest change in market mindset is a valuation reframing. Margin expansion is now driving the multiple re-rating. In the previous decade, investors rewarded sheer GMV/user growth with sky-high multiples. But as global rates rose and easy money dried up, SEA tech stocks were harshly rerated in 2022-2023 unless they showed a credible path to profitability. Companies that demonstrated improving unit economics saw their stock prices surge, even if it meant slower GMV growth.

With that context, let’s analyse the region’s 3 digital titans in detail.

2. Sea Limited

Positioning

Sea has built itself around one core idea, owning the digital consumer journey in Southeast Asia. Shopee handles where people shop, Monee helps people pay and finance purchases while Garena facilitates gaming.

The key piece in all this really, is Shopee, where its positioning is built around localisation, mass-market acquisition and integrated financial rails. In my view, Shopee is attempting to own the digital mall experience for the average Southeast Asian consumer. This is an entirely new concept in the region, and one that the market can’t fathom, until it happens.

If we look at the items Shopee is selling today, it is essentially an all-in-one mall, providing greater product selection than any physical mall in the world. It now allows for same-day delivery on thousands of products with increasingly low delivery fees.

Revenue Drivers

Sea is now shifting its engine towards monetising the scale they’ve built over the past decade. They possess three core revenue drivers to do so:

Transaction Fees/Take-Rate Growth

Today, Shopee monetises through commissions, fulfilment and value-added seller services. This is perhaps the most direct way to turn dominance into cash; increasing take-rates once consumers become used to the product/service. Sea has managed to do this meaningfully without scaring buyers/sellers away.

Advertising

As more buyers and sellers flood onto the platform, it becomes harder for sellers to become recognised. This leads to sponsored slots and seller bidding for screen time. This is an extremely high-margin revenue stream, as evidenced with Amazon’s ad engine.

FinTech

Every consequential business in Southeast Asia is creating a FinTech arm. In Sea’s case, this effectively creates a second business on top of the first, where every dollar financed increases ARPu and locks users into Shopee. Sea monetises through wallets, payments, BNPL, merchant credit, instalment loans and more.

Competitive Edge

Sea’s moat comes from integration and scale, not a single feature. The defensibility comes from several areas:

An enormous buyer and seller network where it’s harder for entrants to match marketplace liquidity.

Country-by-country operating depth, local fulfilment models, seller onboarding and targeted marketing campaigns. All of this is made possible through years of subsidy wars and intense localisation.

FinTech woven into the platform through wallets, payments and instalment plans reduce friction and increase conversion rates.

This is perhaps less obvious. The ability to toggle between growth and profit mode, will be absolutely key in winning the long-term battle. Sea has extensive experience here that is rare among emerging-market platforms.

The Challenge

Shopee still dominates transactional commerce, while TikTok dominates entertainment-driven commerce. The issue with this, is that video commerce is becoming an increasingly more dominant segment of e-commerce.

Sea now needs to ensure that users open Shopee, not just to buy, but also to browse, watch and discover. It is also utilising YouTube and Meta as complementary channels to tap into the emerging Gen Z and Millennial crowd. Cracking the content piece while keeping its marketplace efficiency will allow Sea to grow its moat from strong to perhaps untouchable.

3. Grab

Positioning

Grab isn’t trying to own everything online (at least I hope not, because I think they will get crushed if they try to bite off more than they can chew). Instead, Grab appears laser-focused on the online-to-offline economy.

In the real world, people constantly move around, eat, pay for daily life. This allows Grab to sit in the highest-frequency use cases. Unlike e-commerce where consumers use a few times a month in most cases, Grab’s core businesses touch users multiple times a week, if not daily.

That gives Grab more behavioural data, more chances to upsell and higher customer lifetime value. Keeping mobility, food and payments under one roof makes it harder (pointless?) for users to churn.

Revenue Drivers

Three engines are driving Grab’s revenues today. Firstly, reduced incentives and higher take rates in deliveries. As competition wanes, Grab is gaining market share and hence enabling them to become slightly lighter on subsidies and heavier on value-added fees.

Secondly, the expansion into FinTech. Admittedly, Grab is still figuring this piece out and as a shareholder, I would expect growth rates to be much higher. That said, I think Grab has the potential to be a major player in this space due to their superior data collection capabilities.

Thirdly, advertising. Right now, it’s still a very small segment of Grab’s overall business. As of end 2024, it was a single digit percent of the business. However, it is growing 60% YoY and with over 200,000 monthly active advertisers on its platform, it has all the ingredients to become Grab’s highest margin profit driver.

Grab owns daily, high-intent user behaviour, which is arguably the most valuable ad inventory in SEA.

Ads are pure margin and Grab can scale it across mobility, food and fintech. Sponsored listings, order-tracking ads, map ads, restaurant placement, FMCG promotions, credit/insurance offers all generate 80-90% gross margins.

Grab sees cross-vertical behaviour across rides, food, payments, wallets, and credit. This allows hyper-targeted, contextual ads that no other platform in SEA can replicate.