Sea Limited Q2 2025 Earnings Review

Phenomenal Quarter, 94% Growth in Loan Book and Highest Growth in 13 Quarters!

Sea Limited reported Q2 2025 earnings before the market open on 12th August 2025.

The stock closed the day up 19%.

Revenue: $5.26B v $4.97B (+38.2% YoY) 🟢

EPS: $0.65 v $0.73 (+364% YoY) 🔴

Selected Key Metrics

Total Gross Profit: $2.4B

Total Net Income: $414.2M

Total Adjusted EBITDA: $829.2M

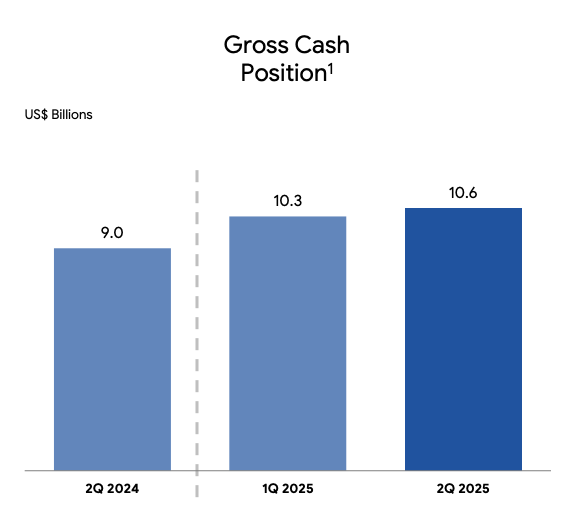

Cash & Cash Equivalents: $10.6B

E-Commerce (Shopee)

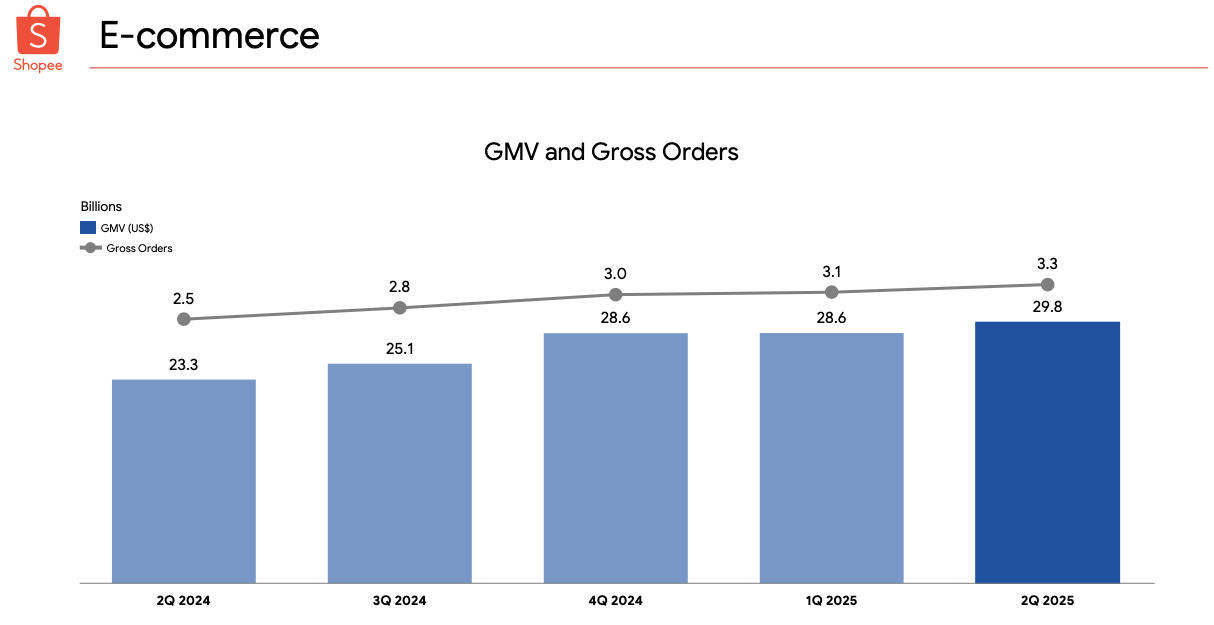

Gross Orders: 3.3B (+28.6% YoY)

GMV: $29.8B (+28.2% YoY)

Revenue: $3.8B (+33.7%)

Adjusted EBITDA: $227.7M v -$9.2M (YoY)

Digital Financial Services (Monee)

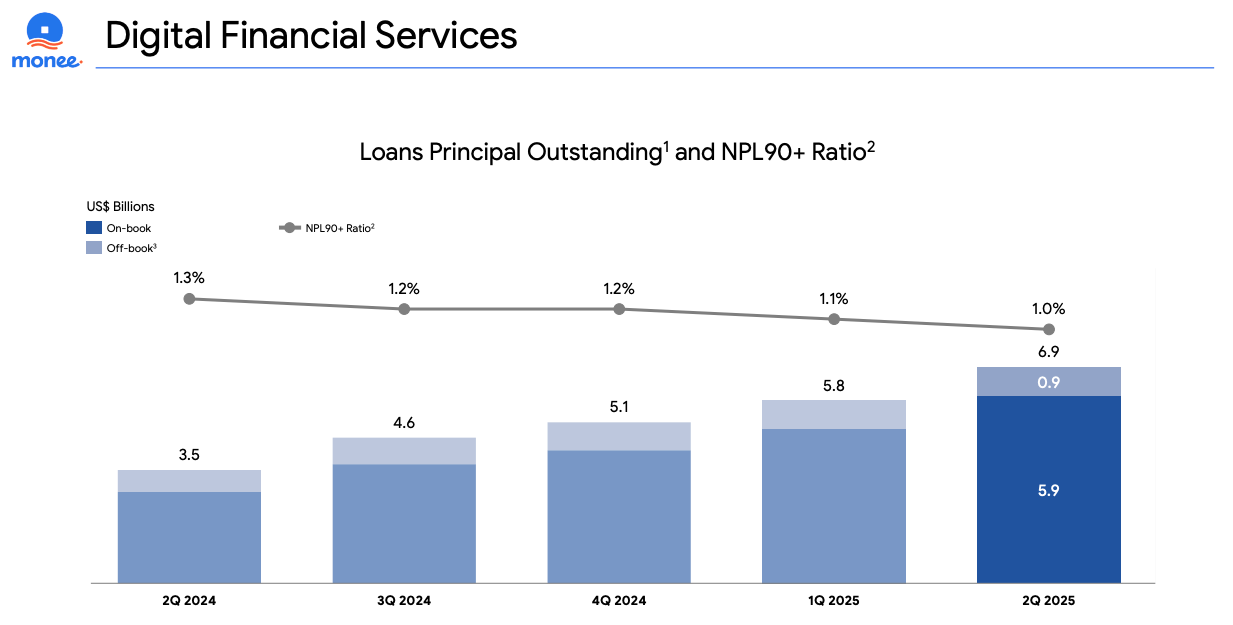

Consumer & SME Loans Outstanding: $6.9B (+94% YoY)

Revenue: $882.8M (+70% YoY)

Adjusted EBITDA: $255.3M (+55% YoY)

Digital Entertainment (Garena)

Bookings: $661.3M (+23.2% YoY)

Revenue: $559.1M (+28.4% YoY)

Adjusted EBITDA: $368.2M (+21.6% YoY)

Quarterly Active Users: 664.8M (+2.6% YoY)

Quarterly Paying Users: 61.8M (+17.8% YoY)

Overall, I thought this was yet another great quarter for Sea Limited, particularly for Shopee and Monee. As i’ve discussed repeatedly, I expect Monee to be a bigger contributor over time owing to its incredible growth rates.

This is what I believe will allow the business to grow at extended rates for a much longer period than most expect. My base case is over 20% growth for the next decade to come. Most people do not expect this, the market certainly does not.

But if i’m right about this, Sea Limited remains a bargain at $100B.

In this piece, I will break down what I liked about the report, management commentary and what i’m personally watching moving forward.

I will also be doing a valuation analysis on Sea Limited exclusively for subscribers. Consider subscribing if you are interested.

Introduction

Shopee (E-Commerce)

Monee (Digital Financial Services)

Garena (Digital Entertainment)

Financials

Management Commentary

Concluding Thoughts

1. Introduction

Sea Limited is a digital conglomerate that operates primarily in Southeast Asia but has in recent years expanded into Brazil, with a view of contesting Latin America.

It started off as a gaming business (Garena) before adding an e-commerce segment (Shopee) and financial services business (Monee), making it the most powerful digital business in Southeast Asia today.

In terms of revenue generation, Shopee dominates with 71% share, while Monee and Garena account for 17% and 12% respectively.

However, Garena still brings in the most in terms of profits with operating income of $276M this quarter, compared to $243M for Monee and $155M for Shopee.

That said, it is inevitable that as Monee and Shopee begin to turn on the profitability switch, Garena becomes the least profitable segment too.

There is a close synergy between Shopee and Monee with a large majority of Monee’s revenues being earned from Shopee users and merchants. This has allowed Monee to grow at incredible rates with no signs of slowing.

For Q2 specifically, it is important to add context that Chinese New Year and Ramadan fell in Q1 this year, which may lead to some seasonal weakness in Q2, especially when comped against Q1 of this year.

With that in mind, let’s get started!

2. Shopee

Shopee continued to grow GMV strongly, with a quarterly uptick to $29.8B, meaning we are very likely to see a FY2025 GMV of $120B.

This follows Q1’s momentum where GMV came in in-line with Q4 2024’s numbers which are typically stronger due to seasonality reasons.

Gross Orders for the business was equally impressive, growing to 3.3B orders.

This set up yet another record-breaking quarter, with management highlighting a sustained increase in active buyers and purchase frequency, extremely key metrics for a business like Shopee.

Revenues came in at $3.8B for the quarter, bolstered by higher take-rates of 12.6%. This was incredibly encouraging considering the quarter on quarter fall in Q1. It is pretty clear to see that we should expect higher take-rates in Q3 and Q4 respectively.

This will likely lead to a continued profitability inflection in the business. A large reasons for this has been Shopee’s breakout success in Brazil with average monthly active buyers growing over 30% YoY in Q2 2025.

Importantly, this also quells fears that Mercado Libre’s strong quarter and reduction in free shipping threshold's may have led to a deterioration in Shopee’s market share in Brazil. I think it is fair to say that the key losers have been smaller competitors, while Mercado Libre and Shopee continue to dominate.

New Initiatives

Instant Delivery allows buyers to receive their orders within as little as 4 hours of order placement. It was first piloted in Indonesia and has since been rolled out to Vietnam and Thailand as well.

Shopee also started intelligent demand forecasting, where commonly ordered products are pre-shipped to warehouses closer to where they expect buyer demand to come from, reducing buyer waiting times when actual orders are placed.

Shopee’s VIP membership program has also shown extremely strong momentum in Indonesia. Total GMV from VIP members in the country grew nearly 50% QoQ and VIP members bought a monthly average of 30% more after subscribing. VIP members have also shown a 20% higher retention rate compared to non-members. Shopee has since expanded the programme to Thailand and Vietnam. As of the end of June, total VIP subscribers in these markets reached 2 million, with planned roll outs to more markets in 2H 2025.

Logistics (SPX Express)

Sea’s logistics focus has been the key differentiator for the business, with it being the 2nd largest logistics player in SEA, behind only logistics giant J&T Express.

In Brazil, logistics cost-per-order fell by 16% while Shopee reduced average delivery time by more than 2 days YoY. In the greater São Paulo region, about one in four Shopee parcels were delivered the next day, and 40% within two day – up from single-digit percentages in the same period last year.

Tariffs? What Tariffs?

In April, Sea stock fell to ~$100 off fears of impact on the business by Trump tariffs. I thought this was an incredible over-reaction by the market and added heavily to my Sea position.

I then wrote a longer post on X detailing this.

Shopee is critical digital infrastructure for the entire region and possibly the LatAm region in the years to come. I find it hard to see the trend stopping, even when a recession hits. We may see some sub-20% growth years, but overall I expect growth to average over 20% for the foreseeable decade.

3. Monee

Monee had one of its best quarters yet with its loan book growing 94% YoY to $6.9B.

The business also added over 4 million first-time borrowers in the quarter and now has over 30 million consumer and SME loans active users, representing over 45% YoY growth.

Despite the rapid growth, the NPL90+ ratio has remained stable at 1.0% for the quarter. Malaysia’s loan book surpassed $1B as of the end of June, the 3rd market to reach the milestone after Indonesia and Thailand.

Management highlighted 3 unique advantages that Monee has:

Seamless integration with Shopee ecosystem

Large base of users who are growing their credit track records over the years

Increasing use of AI to improve credit models

These have specifically helped in pushing for growth across the 3 credit product lines: on-Shopee SPayLater, off-Shopee SPay Later and cash loan products.

Sea’s SPayLater business continues to grow strongly, both on and off Shopee. On-platform, credit adoption reached mid-teens GMV penetration, driven by new features like interest-free installments, tiered pricing for prime users, and credit limit increases.

Off-platform, SPayLater expanded via QR network integrations in Malaysia and Thailand, growing over 40% QoQ in Malaysia. Sea also scaled personal cash loans, doubling its loan book YoY by targeting high-quality borrowers.

Overall, Monee is gaining traction with diversified growth and solid credit quality, and management sees significant long-term potential in its consumer credit offerings.

Management also reiterated guidance of loan book size growing meaningfully faster than Shopee’s GMV annual growth in 2025.

4. Garena

Garena’s QAUs saw yet another multi-year high at 664.8M and QPUs now firmly in the 9% range.

It might be somewhat surprising to some to see the QPU ratio falling, but as I discussed previously, it should be expected, with QPU ratios typically higher during seasonal celebrations like Q4 and CNY/Ramadan.

Free Fire continues to be at the heart of Garena, with over 100 million average daily active users well into their 8th year.

However, management also highlighted that its other key titles; Arena of Valor, EA Sports FC Online and Call of Duty: Mobile, all delivered double-digit growth in Q2.

Free Fire also launched its new map, Solara, in celebration of its 8th anniversary in Q2. It took roughly 2 years of hard work from its developer team and has been incredibly popular among both new and veteran gamers.

The team also capitalised on excitement around the new map by introducing a new camera mode that lets players capture photos and videos of their gameplay more easily, which has led to average daily shares of in-game footage growing by nearly 4x. Free Fire also continued its highly successful IP collaborations with Netflix’s Squid Game and NARUTO SHIPPUDEN Chapter 2 into July which has been met with an extremely positive response.

Management also raised full-year guidance for Garena, expecting bookings to grow more than 30% in 2025, year-on-year.

5. Financials

Revenue

Sea Limited’s revenues grew 38.2% YoY, representing an acceleration in its top-line. This was the highest ever revenue growth of any quarter over the past 3 years.

Most interestingly to me, is that the market predicts the following growth rates in the coming quarters. Yes, comps are likely to be much tougher for the business in 2026, following these stellar results. However, I do not expect a sudden deceleration in the business to just 13% growth in 5 quarters.

Revenue (Estimates)

The 38% revenue growth was driven primarily by Shopee and Monee.

Shopee saw 33.7% YoY growth in revenue largely supported by advertising revenue while Monee saw 70% YoY growth driven by expansion in its credit business.

EBIT / Operating Income

Sea reported positive EBIT on all 3 segments for the 3rd consecutive quarter. This was also yet another record quarter of profitability.

Still, these are the early innings for Sea, and we should expect much more profits to flow through as the business flexes its operating leverage in the quarters to come.

Cash Flows

Sea generated $2.4B in operating cash flows in the first half of 2025, a significant increase from the previous years $1.1B.

Cash now sits at $10.6B, up from $9B the year prior.

6. Management Commentary

This section focuses mainly on the earnings call, with key highlights of what I believe are important points to takeaway. I may adjust a few words here and there for clarity purposes (English is not the main language for many of Sea’s management team) but I will not change the meaning of these quotes.

On Brazil E-Commerce:

“For Brazil, we have seen some actions from competitors in recent months. However, our business has continued to grow well, even after those adjustments, with no observable impact so far. Our focus has been on maintaining the best cost structure, particularly in logistics. Delivery speed has improved, we are now two days faster than last year, while costs have continued to decline. We believe our cost structure is significantly lower than our competitors’, even compared to their slower shipping options.

In terms of pricing, publicly available benchmarks still show we remain highly competitive across all categories. On the brand seller side, we’ve been expanding into higher-ticket items over the past few quarters, and we expect that trend to continue, unaffected by competitor movements. Overall, we are confident in our position in Brazil and expect our growth trajectory to persist, supported by our strong fundamentals in cost, pricing, and seller expansion.”

On Competition from Temu and TikTok Shop in Brazil:

“For Brazil, cross-border for Brazil has been relatively a smaller percentage due to the tax structure. So Temu has remained to be relatively smaller players in the market so far. We will observe how this evolves over time. For TikTok, it just started. And again, the amount of orders -- the size of orders is still relatively small in the market. We will continue to observe as we have been quite familiar with their businesses. And Brazil is quite a different market compared to Asia. I think it's something we will observe, but structural-wise, we don't see any fundamental change to the market structure that will impact our view on the market or change our trajectory of the growth in the market so far.”

On Digital Financial Services in Brazil:

“We see Brazil as a very important market for us on the finance side. We have seen very good growth on the loan books in the second quarter. Our active user for loans grew 2x year-to-year. Our outstanding loans in Brazil also grew more than 2x year-to-year. One of the key things we did, I think we shared in the last earnings call is we combined the personal cash loan and SPayLater limit to one limit, which is different from how we operate in Asia. We also integrate more external data to our risk assessment system compared to Asia. And this is because in Brazil, there is more external data available compared to the SEA market.

We also have better integration between our Monee product offering and the Shopee product offerings. All this enables us to grow our loan book quite meaningfully and reduce our risk in the market. We have formed partnerships with some external lenders already to support the lending funds in Brazil market. So in general, we are very optimistic about the potential upside on the digital finance services in Brazil. And I think we are still in a very early stage compared to Asia in terms of the growth trajectories. The penetration o SPayLater Shopee site is still around the single-digit to double-digit range. If you compare to Asia, we still have very large room to grow. Our personal loans are still very early stage. We have many other products in the pipeline to be rolled out to the market.”

On Ad Take Rates:

“Our current take rate is still well below the peers we have seen in the regions. We have probably around 2% as we are. And as you rightly pointed out, I think there is quite sizeable room for us to grow over time.”

On AI Benefitting Garena:

“Personally, I believe game industry will be among the first batch of industries largely benefited by the AI advancements and the technologies. And so far, we have seen a lot of kind of upside on the development and the production side. And, for example, to develop any new content new map, we need to generate a lot of original arts.

And now a lot of very, very basic arts can be generated by AI. The quality is very decent in terms of the efficiency, the volumes being generated and the varieties being generated is much, much better than what humans can do. So this has largely improved our productivity, and it's really exciting.”

7. Concluding Thoughts

Sea just delivered one of its strongest quarters in its history. The mix got better with Fin Services being a larger piece of the pie, and credit scaling without cracks (NPL90+ ratio at 1.0%).

Shopee’s monetisation is inflecting as expected with ads and fees trending upwards while logistics helps bring costs down. With GMV tracking to ~$120B for FY25, every +10 bps of marketplace take rate is roughly ~$120M of high-margin revenue. Pairing that with Monee’s stable asset quality and Garena’s bookings guide >30%, I think we are set up for a very strong 2nd half of the year.

Moving forward, I am watching a few key items:

On-book vs. off-book mix and funding costs for Monee

Paying user ratio + bookings cadence at Garena

Ads take rate (closing the gap to regional peers)

Some of the first signs of a slowdown would be:

Marketplace monetisation stalling

Marketplace growth no longer outpacing value-added services/logistics

Credit-related growth

Provisions begin to rise faster than loan growth and NPL90+ breaks meaningfully above ~1.5%

This quarter provisions rose 93% YoY compared to 94% YoY growth in loan book. Tracking closely is ideal here as it signals prudence.

Garena: bookings roll over for three consecutive quarters

This would signal real weakness, not just seasonal noise.

Brazil unit economics deteriorate as competition escalates.

For example, delivery speed slips or cost per order rises

I recently added to my position in the ~$150 range as I shared with followers on X. I also shared a note with subs on 22nd July following the irrational 8% dip for no fundamental reason.

My base case remains that Sea can compound >20% for longer than the market is discounting. If I’m right, $100B still undervalues the duration and quality of growth.

I’ll be sharing a full valuation breakdown (with sensitivity to take rate, credit losses, and Garena bookings) for subscribers next.

Thanks for reading, and as always thank you all for the amazing support!

Great analysis, thanks for sharing

Guess I should have pulled the trigger around $145 haha

Thanks for the article, will look at this ticker soon