Mercado Libre Q2 2025 Earnings Review

Reinvesting in Growth, Short Term Pain for Long Term Gain

Mercado Libre reported Q2 2025 earnings after the market close on 4th August 2025.

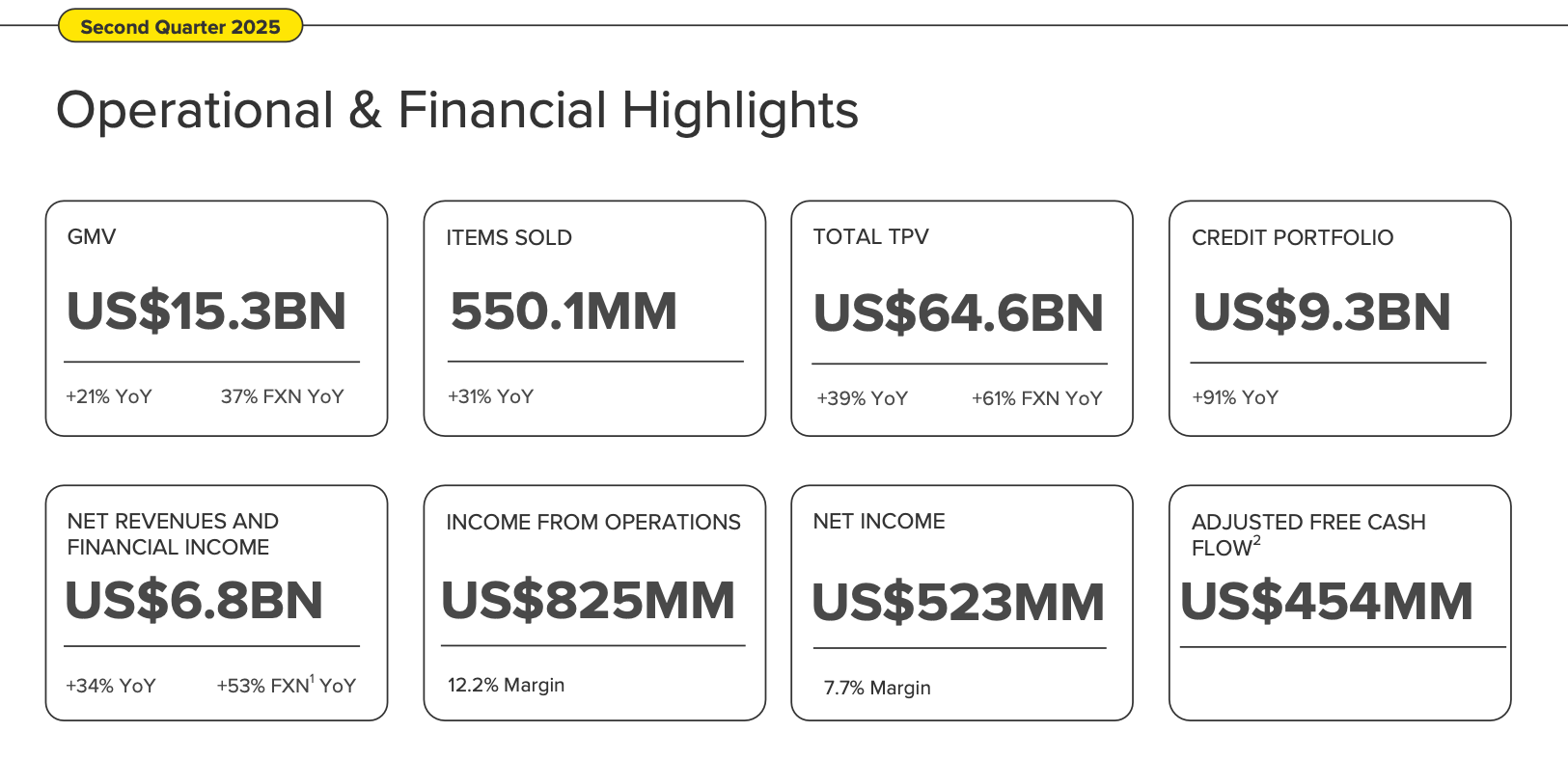

Revenue: $6.79B v $6.66B (+34% YoY, +53% FXN) 🟢

EPS: $10.31 v $11.39 (-2% YoY) 🔴

Selected Key Metrics

*FXN = FX Neutral (MELI reports in USD but transacts in various other currencies)

Top-line numbers were incredible, beating estimates. In particular, the growth in the credit portfolio was way above expectations. The bottom-line was slightly less impressive with lighter margins on both income from operations and net income.

In this piece, I will break down what I liked about the report, reasons for the bottom-line miss and what I’ll be watching moving forward.

Table of Contents

Introduction

Mercado Libre (Commerce)

Mercado Pago (FinTech)

Mercado Ads (Advertising)

Mercado Envíos (Logistics)

Mercado Crédito (Credit)

Financials

Management Commentary

Concluding Thoughts

1. Introduction

For those who are unfamiliar with Mercado Libre (MELI). MELI started off as an e-commerce business but has since expanded into a multi-pillar ecosystem. I will focus on 5 key segments for this review, namely commerce, fintech, advertising, logistics and credit.

At the core sits the marketplace commerce business, MELI’s largest revenue engine (56% of Revenue) and the funnel that feeds the rest of the stack. To keep the parcels moving, MELI built Envíos, its Amazon-Prime style logistics system that dominates Latin America.

Payments were a by-product of commerce. Today however, Pago is a standalone FinTech business (44% of Revenue) with regional reach beyond MELI’s own site. Using the rich transaction data in hand through Pago, MELI began extending credit to both buyers and sellers through Crédito.

Finally, Ads is the high-margin business that is built on top of Libre, allowing brands to bid for search, display, and video slots across the site.

Together, these five pillars reinforce each other in a powerful flywheel: commerce drives payment volume and ad reach, payments deepen user engagement and unlock credit demand, logistics boosts user satisfaction, and data from all of it strengthens monetisation and retention.

2. Mercado Libre (Commerce)

MELI’s Commerce GMV totalled $15.3B, up 21% in USD terms and 37% on a FXN basis. Items sold rose by 31% YoY to ~550M units.

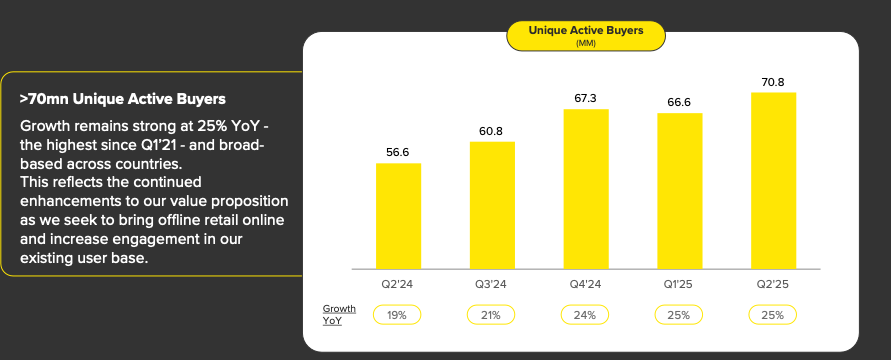

Unique buyers also soared 25% YoY to 70.8M. This was a continued acceleration and shows MELI’s increasing focus on attracting new buyers onto their platform. This is particularly amazing when you consider that Mercado Libre has been operating in the region for 25 years (!)

Growth was particularly strong in MELI’s key markets: Argentina saw a GMV surge of 75% FXN, GMV in Mexico grew 32% FXN while Brazil grew 29% FXN YoY.

Two major talking points this quarter were related to shipping changes in Brazil. Mercado Libre lowered the free shipping threshold from 79 Brazilian Real (BRL) to 19 BRL for the 3rd time in 5 years and also reduced shipping charges for items between 79 BRL and 200 BRL.

MELI has long stated that this is part of its long term strategy to strengthen its value proposition and a crucial driver of conversion, retention and customer satisfaction. However, it must be noted that part of the reason could be the increasing threat of Shopee (Sea Limited’s e-commerce arm) and Temu (ultra-low pricing competitor owned by Pinduoduo) that has rapidly taken market share in Brazil.

The two businesses have put pressure on Mercado Libre with their focus on lower average selling price (ASP) items and free shipping. MELI’s decision-making on shipping changes are no doubt also a response to this.

In my view, Shopee in particular is a medium-sized threat to Mercado Libre as it has shown its prowess in Southeast Asia, going from nothing to displacing Alibaba’s Lazada and now possessing over 50% market share in the region. However, both can co-exist and Mercado Libre’s Envíos logistics network is a major moat that MELI can rely on. (More on this later)

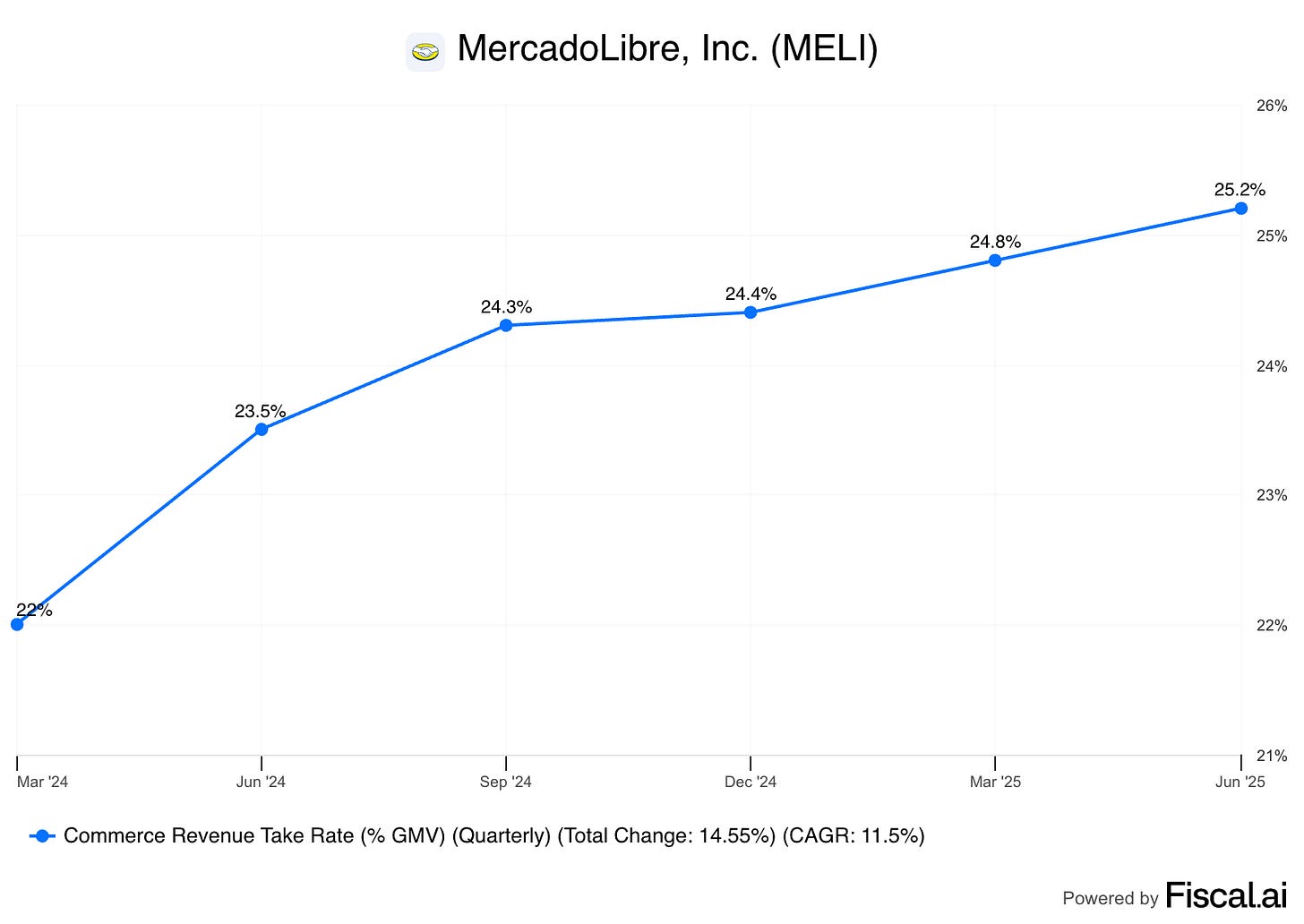

Despite the competitive pressure, it is clear that Mercado Libre has not suffered on profitability, with the business’ take rates at all-time highs of 25.2%.

3. Mercado Pago (FinTech)

Something to take note of is that Mercado Pago’s revenue has been accelerating in recent quarters, with the company growing in the low 20s in 2024 before accelerating to over 40% in 2025.

Now, let’s dive into the growth drivers of this.

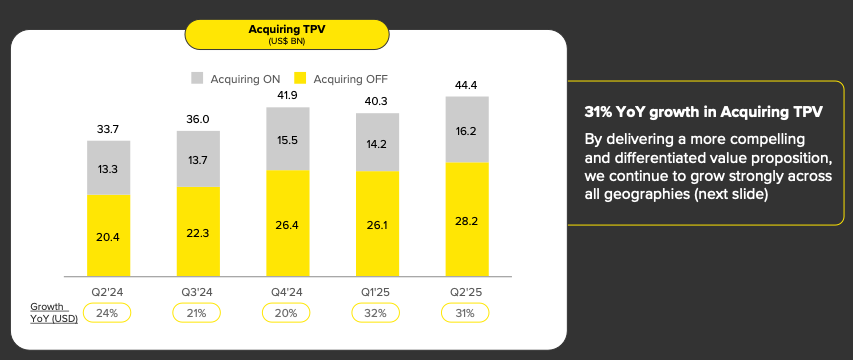

Mercado Pago’s total payment volume (TPV) rose 39% YoY in USD terms to $64.6B, with acquiring TPV (on and off platform payments) hitting $44.4B, up 31% YoY.

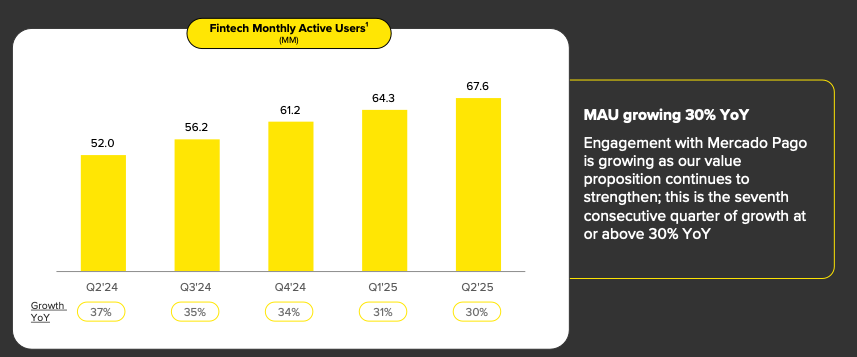

Monthly Active Users (MAUs) on the platform also climbed to 67.6M, up 30% YoY. This represented the 7th straight quarter of above 30% YoY growth which is frankly incredible for the size that Mercado Pago is at today.

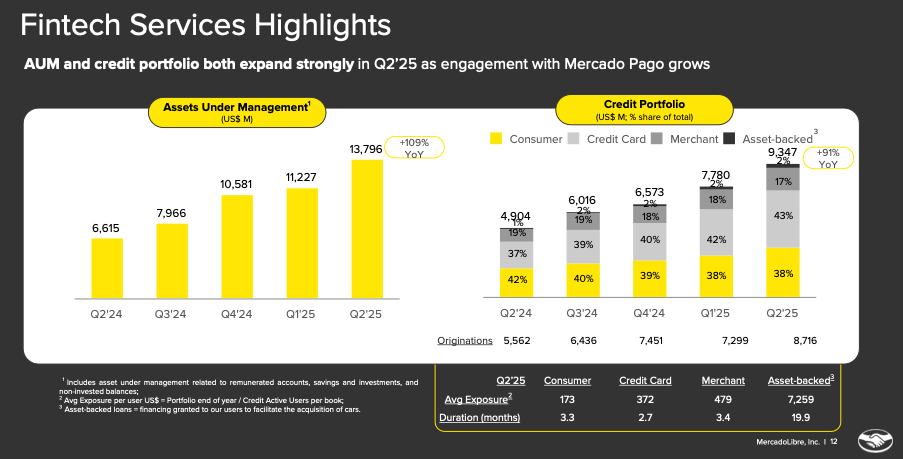

Assets under Management (AUM) more than doubled to $13.8B with the credit portfolio surging 91% YoY to $9.3B, including a 118% increase in the credit card segment to $4.0B (now ~43% of the credit book).

Credit quality also improved with the 15 to 90 day default rate falling to 6.7%, the lowest in 7 years. MELI attributed this to better asset quality and portfolio mix.

In all, the growth in Mercado Pago’s business is largely due to the growth in the credit portfolio which we will discuss more in section 6 of this article.

4. Mercado Ads (Advertising)

Mercado Ads functions as a sub-segment of Mercado Libre, in a similar fashion to every other major e-commerce business out there.

It continued its strong momentum in Q2 with revenue growth of 38% YoY and 59% YoY on a FXN basis. Growth was driven by increased ad penetration across categories, better targeting capabilities and integration with MELI’s broader commerce ecosystem.

In April, Mercado Ads’ launched an integration with Google Ad Manager that allows:

Mercado Libre’s first-party data to be used for programmatic ad buying beyond its own platform.

Advertisers to access off-platform placements powered by MELI’s rich consumer insights.

A bridge between brand marketing and performance marketing, improving ad efficiency for merchants and brands.

Ads is likely still a small driver of total revenue growth (management has not revealed exact revenue numbers), but it is a high-margin segment that could potentially contribute significantly to the bottom-line in future.

5. Mercado Envíos (Logistics)

Mercado Envíos is the key competitive advantage that separates Mercado Libre from its competitors, especially in a region with historically fragmented and unreliable logistics infrastructure.

57% of shipments were fulfilled via Mercado’s own network (rising to 75% in Mexico) via its 30 regional fulfilment centers, reflecting major investment in warehouse and last-mile infrastructure.

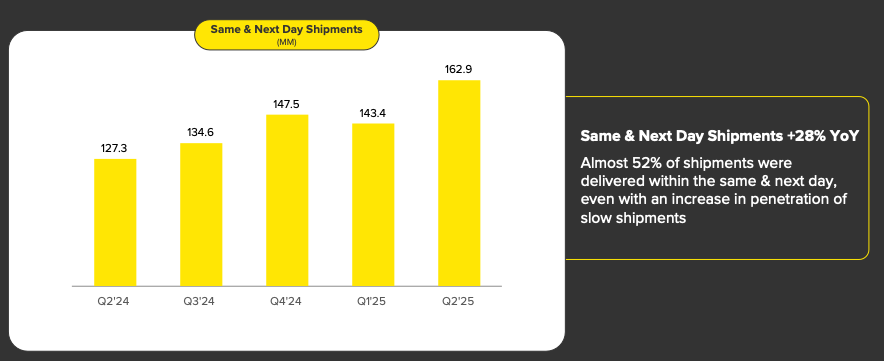

Same or next-day delivery rates increased by ~28% YoY, reinforcing its logistics moat. ~52% of shipments were delivered within the same or next-day despite an increase in penetration of slow shipments.

6. Mercado Crédito (Credit)

As discussed in the Mercado Pago section, Mercado Crédito is a key part of the business and the main driver of growth in recent quarters.

Mercado Crédito is MELI’s lending business, providing credit to:

Consumers (BNPL, Credit Cards)

Sellers (Working Capital Loans)

Merchants using Mercado Pago (Capital tied to transaction history)

It is deeply embedded within the broader MELI ecosystem, with the unique data advantage giving MELI superior underwriting capabilities.

The total credit portfolio grew to $9.3B, up 91% YoY. Credit cards are now $4.0B of the portfolio, up 118% YoY and accounts for ~43% of total credit.

Loan originations were up 54% YoY. Credit to consumers grew faster than merchant loans, showing rising adoption of wallet-linked credit.

Despite the rapid growth, MELI has been focused on tightening underwriting which has led to the 15-90 day delinquency rate dropping to 6.7%, the lowest in 7 years.

MELI uses machine learning models trained on transaction, payment, and behavioural data with no traditional credit scores required. This has arguably helped provisions for losses remain stable due to risk control, despite aggressive portfolio growth.

7. Financials

Overall, top-line growth was very strong at 34% YoY and 53% on a FXN basis.

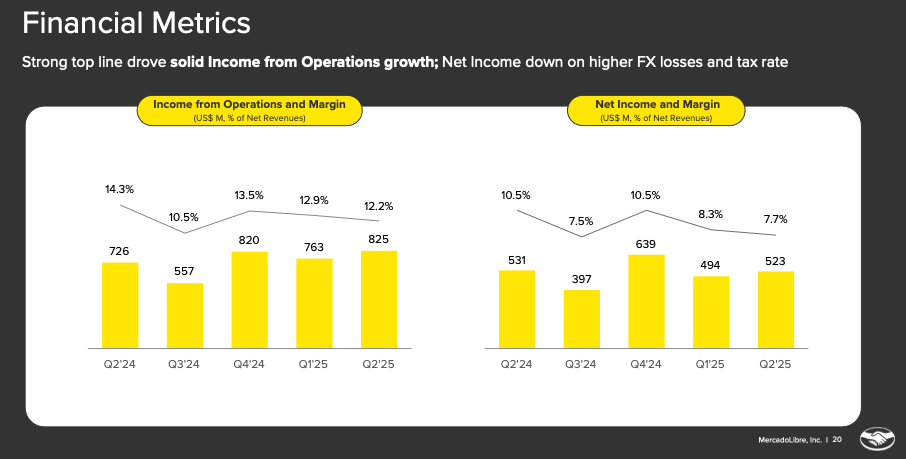

EBIT came in at $825M (12.2% margin), which is a new high but below the $869M forecast due to margin compression, likely from shipping changes.

Net income came in at $523M (7.7% margin), missing consensus of $596M.

The main reasons for the fall in operating income were the increased COGS from shipping subsidies, sales & marketing expenses as well as larger provision for bad debts as the credit portfolio continues to grow exponentially.

In my view, this is MELI trading short-term pain for long-term gain. The business understands innately that there is a huge opportunity for credit and is capitalising on it. In the e-commerce segment, lower shipping thresholds and charges make it harder for Shopee and Temu to challenge, owing to a lack of proprietary logistics at MELI’s scale.

This is part of MELI’s long-term strategy to accumulate market share and to dominate the field, which it has done particularly well for the past 2.5 decades.

8. Management Commentary

On Mercado Crédito:

“The overall credit portfolio grew at 91% year-on-year and the credit card specifically grew 118% year-on-year. As we mentioned earlier, because it's becoming a lot more profitable, and we are very satisfied with the results of our credit card.”

Martin de Los Santos, EVP & CFO

This was in response to one of the analysts’ questions regarding NPL ratio remaining elevated and picking up sequentially.

Management had no concerns with regards to NPLs and have been very happy with the way it has been evolving, hence the increased issuance in credit cards. In Q2 alone, MELI issued 1.5M new cards. It also mentioned that 1/2 the portfolio in Brazil is already NIMAL positive.

“If you recall, a couple of quarters ago at the end of the fourth quarter, early first quarter, we were a little bit more cautious, particularly in Brazil because we saw -- there were concerns about interest rates increasing and in general, in the market, NPLs increasing. And to some degree, we have seen something similar in the overall market in Argentina more recently. Nonetheless, we have continued to improve our models, and we felt comfortable increasing the speed of issuing cards in Brazil and in Mexico in both countries, but mostly in Brazil. And we continue to see that cohorts that are 2 years or older, all of them are -- have NIMAL positive. For example, all -- pretty much all of the 2023 cohorts are already NIMAL positives and some of the early 2024 cohorts also. So we continue to be bullish with how we are issuing credit.”

Osvaldo Gimenez, FinTech President

Management was clearly extremely bullish on the ability of its models to gauge default rates and hence is more aggressive in its issuing schedule of credit cards.

It is particularly impressive that the 2023 cohort is already largely NIMAL positive and means this is a segment that Mercado Crédito can definitely leverage to grow.

On Ads:

“We had a great quarter in ads. Revenues grew by 38% year-over-year in dollars and 59% year-over-year on FX neutral. Argentina is growing particularly well, I would say, as a result of both macro conditions and team execution. So lower inflation, more stocks on the hands of sellers and so on is kind of giving them the space and the oxygen to be able to invest as to promote sales.”

“On top of that, going back to ads performance in general, display and video has almost doubled year-over-year. I know we are starting from a low base, but still triple-digit growth is nice to see. Product ads is performing well across countries and sites and not only in Argentina, and this is on the back of improved UX and tools for sellers, such as a new question flow focused on benefits of advertising, smarter item selection, improved budget recommendation using AI and some of the things that I was mentioning before. So yes, overall, very positive on everything we are doing on ads. We see ads as a percentage of GMV accelerating this quarter. So good news, but still, the opportunity is huge ahead of us. So excited, but cautious. We need to continue executing.”

Ads is clearly a segment that management is extremely excited about and one that I as a shareholder am too. I think MELI is barely scratching the surface of Ads and will likely see this be a massive profit driver in future.

On NIMAL:

NIMAL refers to Net Interest Margin after losses and is a way to track how much is left after provisioning for bad debts.

“I think there are several effects working on at the same time. On the one hand, the most obvious ones with regards to credit card is that NIMAL for credit card is lower than for the other products and credit card is growing significantly faster than the credit book. So as Martin was saying, it's growing at over 100% year-over-year. And that's why even though the NIMAL for the credit card remains, I would say, rather flat for new segments and it has been improving for all the segments as the portfolio grows, that has an impact on the overall NIMAL.

And then the other factor I would mention is that is relevant is Argentina with inflation coming down so fast in Argentina, so how NIMAL last year was ridiculously high, I would say. But still, it's super profitable. And to counterbalance that to some degree, the other thing that is happening with Argentina is that the size of Argentina within all of the loan portfolio has increased. So even though the NIMAL has come down a little bit, overall, the impact continues to be relevant because of this increase in weight in the portfolio.”

Essentially, management explains that NIMAL is down because credit cards are booming at over 100% YoY growth and NIMAL on credit cards are much lower, hence contributing to a lower mix.

Argentina was also exceptionally profitable last year due to high inflation. With inflation falling rapidly, margins are reverting to the mean which affects NIMAL.

In my opinion, this is nothing to be concerned about and 23% NIMAL is still extremely strong.

On Free Shipping Threshold:

“We would not be a $50-plus billion GMV company today per year if it were not because of building our logistics infrastructure and launching our free shipping program back in 2017. And we think this is the same case now. We are convinced that the best way to serve our customers in Brazil is by offering more free shipping, and that's basically what we are doing.

We definitely expect the trend that we see in traffic increases, conversion rate increasing, more engagement, more frequency to continue in the future. And with that, we expect to see orders going up, order sizes going up and so on. So this is not a marketing investment that we are doing in order to generate transaction from one day to the other. This is a long-term play in which we think this is the best way to serve our customers.”

As discussed previously, I do agree with management’s view here and think that ultimately their logistics network is the core moat defending their market share

Reducing the free shipping threshold is a strategic move to drive greater engagement and accelerate the flywheel that underpins the entire business model.

9. Concluding Thoughts

Mercado Libre delivered another strong quarter with outstanding top-line performance, driven by resilient commerce growth and accelerating momentum in fintech and credit.

Their decision to lower shipping thresholds in Brazil and ramp up credit issuance has led to short-term margin compression and some concerns on the sustainability of its margins. However, I believe these moves are clearly designed to reinforce the company’s long-term flywheel and competitive advantage.

What stood out to me most this quarter was the re-acceleration of multiple core engines within its ecosystem. Commerce GMV grew 37% FXN while Mercado Pago saw TPV rise 39% and AUM more than double. Credit issuance re-accelerated sharply with the portfolio growing 91% YoY and credit card balances up 118%. Ads also showed signs of inflection with 59% FXN growth and stronger seller tool adoption.

I believe this was a great quarter for MELI and once again proves why it’s one of the best-run platforms in any emerging market globally.

While some may be concerned about Marcos Galperin stepping back, I’m confident in Mercado Libre’s leadership depth. Ariel Szarfsztejn brings strong experience to the role, and with Marcos staying on as Chairman, his strategic influence and guidance will still be very much present. The business remains in capable hands and I am as confident in the business as I have ever been.

I am highly considering adding to my position and will update subs should I do so. Note that none of this is financial advice and I am only sharing what I am personally doing.

Thank you for reading! If you enjoyed this read, do consider sharing it with a friend and dropping a like. Every bit helps, thank you!