Portfolio Performance

Dear Reader,

In this section, I will share the performance of my personal portfolio. Majority of the stocks that I write about are personal holdings of mine. However, I will also, from time to time, write about businesses that are not in my personal portfolio.

I will continually update the performance of the portfolio here on a quarterly basis. I will share the return of the portfolio since inception, specifically the Time Weighted Return.

Quarter to Date and Year to Date returns will be shared with paid subscribers. The inception date of this portfolio is October 27, 2023. It is a relatively short period as I do not have accurate data prior due to a change in brokerage (from TDAmeritrade to Interactive Brokers). Therefore, I do not believe the returns reflect the true performance of the portfolio, as I measure my holdings on a holding period of at least 5 years.

That said, I do understand that subscribers gravitate towards Substack’s with performance to back up the thesis and therefore have decided to share my returns transparently.

If you would like to gain access to my Full Investment Cases, My Portfolio Holdings, Performance on a QTD and YTD basis, along with Monthly Southeast Asia Updates surrounding particularly Grab and Sea, do consider upgrading to a Paid sub.

Portfolio Performance

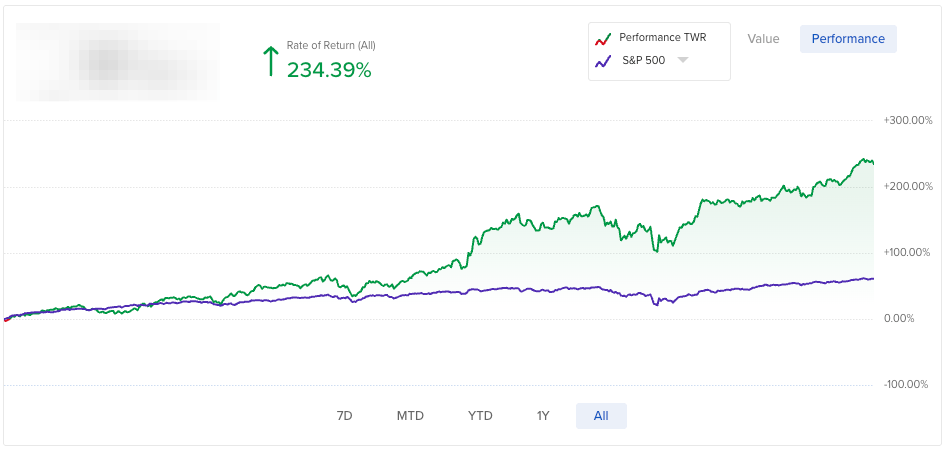

Updated as of 30th Sept 2025 (Performance since October 27, 2023)

The portfolio has returned 234.39% since October 27, 2023.

Since inception, the S&P 500 has returned 61.01%, implying a 173.88% outperformance during the period.

Since inception, the NASDAQ has returned 82.05%, implying a 152.34% outperformance during the period.

Firstly, these are unrealistic numbers, and impossible to achieve on a consistent basis over a long period of time, and I understand that.

However, I believe outperforming the index is very possible, if you buy fantastic businesses at a fair price.

-GabGrowth