Is it time to buy the dip on SE and MELI?

Sea Limited (SE) and Mercado Libre (MELI) both tumbled sharply yesterday, far underperforming the broader market.

Sea Limited (SE) plunged 9.56%

Mercado Libre (MELI) fell 5.07%

For context, SPY was up 0.44% and QQQ was up 0.71% on the day.

Both stocks are now well off their recent highs. Sea Limited is down about 18% from September highs of $199 while Mercado Libre is down roughly 22% from highs set in July.

Let’s break down what could have caused the sudden drop in each and whether the dip could present an opportunity for long-term investors.

Sea Limited (SE)

Sea’s nearly 10% plunge yesterday erased weeks of gains. Trading volume on the day spiked well above average, suggesting it was a strong wave of selling pressure.

Notably, there was no single, new negative catalyst from the company that was released. In fact, Sea’s fundamentals appear to be intact and the business seems to be operating from its greatest position of strength as seen over the past several quarters.

Wolf of Harcourt Street shared 2 possible reasons for the sell-off. I personally am of the view that the sell-off was an overreaction too.

Let’s begin by discussing the fundamentals of the business.

1. Fundamentals

During its last earnings report, Q2 2025, the business reported record metrics across the book:

Revenue grew 38.2% YoY to $5.26B, which was an acceleration over previous quarters. Earnings came in slightly weaker than consensus at $0.65 v $0.73, although that is to be expected as the business is not optimising for profitability yet.

All 3 segments performed incredibly well:

E-Commerce (Shopee)

Gross Orders: 3.3B (+28.6% YoY)

GMV: $29.8B (+28.2% YoY)

Revenue: $3.8B (+33.7%)

Adjusted EBITDA: $227.7M v -$9.2M (YoY)

Revenues came in at $3.8B for the quarter, bolstered by higher take-rates of 12.6%. A large reason for this has been Shopee’s breakout success in Brazil with average monthly active buyers growing over 30% YoY during the quarter.

Digital Financial Services (Monee)

Consumer & SME Loans Outstanding: $6.9B (+94% YoY)

Revenue: $882.8M (+70% YoY)

Adjusted EBITDA: $255.3M (+55% YoY)

Monee added over 4 million first-time borrowers in the quarter and now has over 30 million consumer and SME loans active users, representing over 45% YoY growth.

Despite the rapid growth, the NPL90+ ratio has remained stable at 1.0% for the quarter, reflecting sustainability of growth and prudence of management.

Digital Entertainment (Garena)

Bookings: $661.3M (+23.2% YoY)

Revenue: $559.1M (+28.4% YoY)

Adjusted EBITDA: $368.2M (+21.6% YoY)

Quarterly Active Users: 664.8M (+2.6% YoY)

Quarterly Paying Users: 61.8M (+17.8% YoY)

Garena’s QAUs saw yet another multi-year high at 664.8M and QPUs now firmly in the 9% range. Free Fire continues to be at the heart of Garena, with over 100 million average daily active users well into their 8th year.

Management also raised full-year guidance for Garena, expecting bookings to grow more than 30% in 2025, year-on-year.

2. Valuation

2 months ago, I published my valuation model on Sea Limited where I shared my personal view on the intrinsic value of the business.

I did a sum-of-the-parts model splitting the business into 3 distinct business units.

A peer comparison of Shopee’s core e-commerce and logistics business was done with Alibaba and Mercado Libre, and Shopee’s ads and VAS business with Amazon. Garena was comped with EA and Take-Two while Monee was comped to Adyen, Nu Holdings and PayPal.

Feel free to check out the full model if you are interested.

At 42x forward earnings with EPS expected to grow 172% this year and 49% next year, the multiple appears reasonable, especially given Sea’s accelerating fundamentals.

3. Technicals

Since breaking above the 200MA and staying above it in March 2024, SE has come back to retest it twice.

It appears it may want to test it again for the 3rd time. It is also key to note the $146 resistance-turned-support level.

I believe the $145-$150 level would be an ideal add should the opportunity arise.

Mercado Libre (MELI)

MELI has been on a downtrend over the past 3 months starting from a large intraday sell off on 1st July, coincidentally the day the stock set a new all-time high.

MELI’s sell off has not been without its reasons. In early October, news that Amazon was launching its most aggressive push ever in Brazil sent shockwaves through the market. Amazon announced it would waive logistics fees and commission fees for new Brazilian merchants using Fulfilment by Amazon through the holiday season.

This triggered loud alarm bells for MELI, which derives over half of its sales from Brazil.

In addition, Chinese entrants are pressuring MELI’s markets, in particular Shein and Temu. Sea has also expanded into Brazil and Mexico, targeting price-sensitive consumers with flash deals and gamified shopping.

In other words, competition fears are front and center.

My Take:

In my opinion, this is a classic overreaction in the face of short-term headwinds. MELI’s franchise in Latin America is arguably as valuable as ever.

It is the e-commerce leader in a region that is years behind the U.S. in online shopping penetration, and it has built a fintech/payment network that complements the business well. Its logistics business is second to none, which has given it a sustainable competitive advantage over rivals.

The bear case is not negligible, but I believe Mercado Libre deserves benefit of the doubt and some credit for their dominance in the region over the past 2 decades. I see no reason to believe that the dominance ends here.

1. Fundamentals

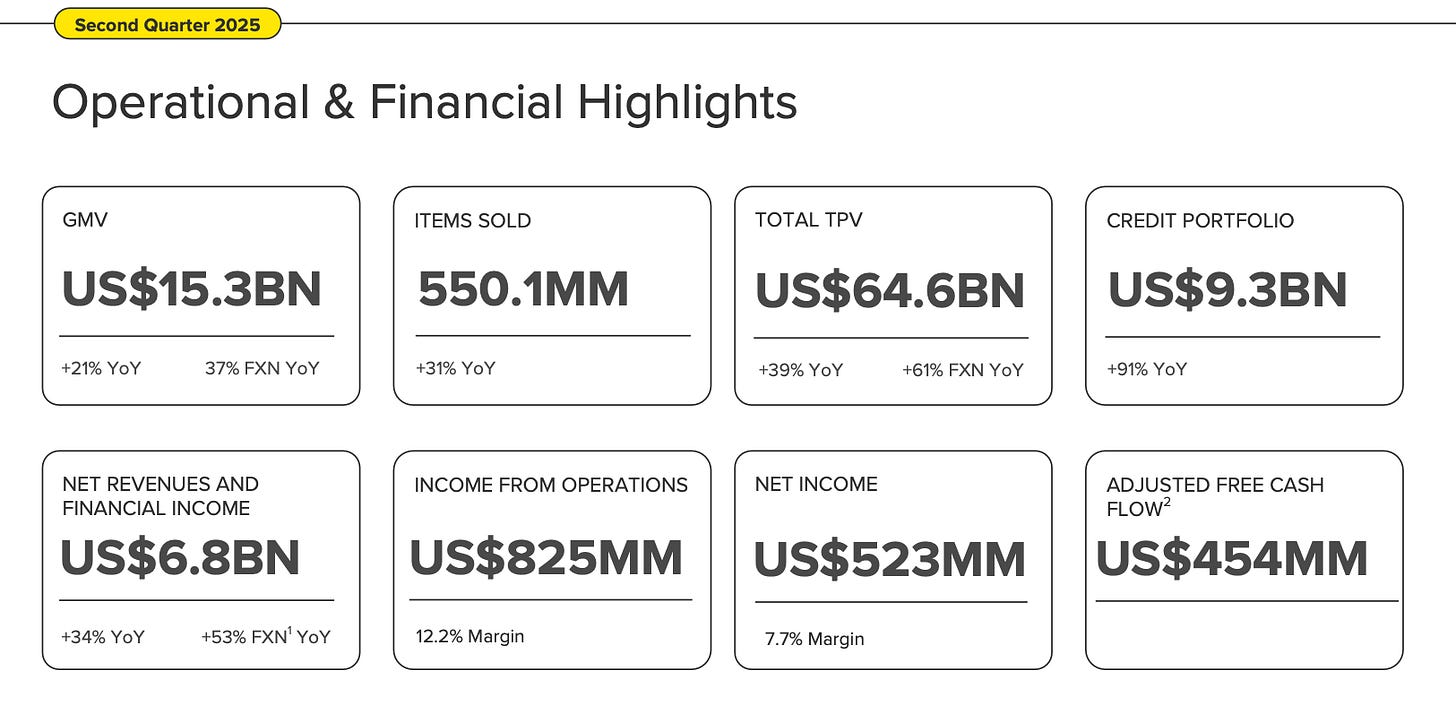

During its last earnings report, Q2 2025, the business reported stellar top-line metrics, although margins on the bottom-line were lighter than expected.

Revenue for the quarter was up 34% YoY (or 53% on a FXN basis).

Mercado Libre (Commerce)

MELI’s Commerce GMV totalled $15.3B, up 21% in USD terms and 37% on a FXN basis. Items sold rose by 31% YoY to ~550M units.

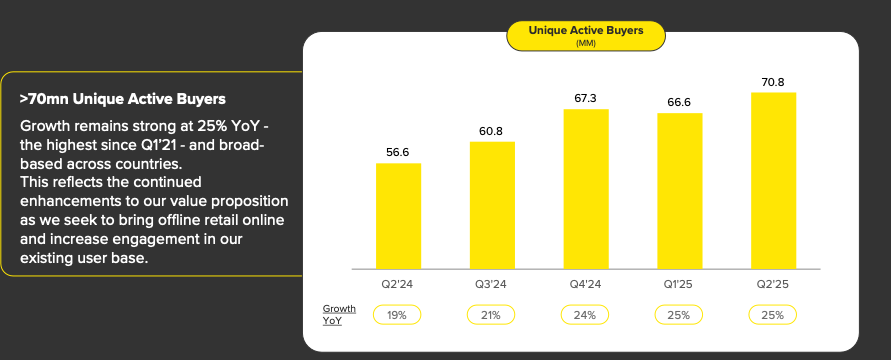

Unique buyers also soared 25% YoY to 70.8M. This was a continued acceleration and showed MELI’s increasing focus on attracting new buyers onto their platform. This is particularly amazing when you consider that Mercado Libre has been operating in the region for 25 years.

Despite the competitive pressure, it is clear that Mercado Libre has not suffered on profitability, with the business’ take rates at all-time highs of 25.2%.

Mercado Pago (FinTech)

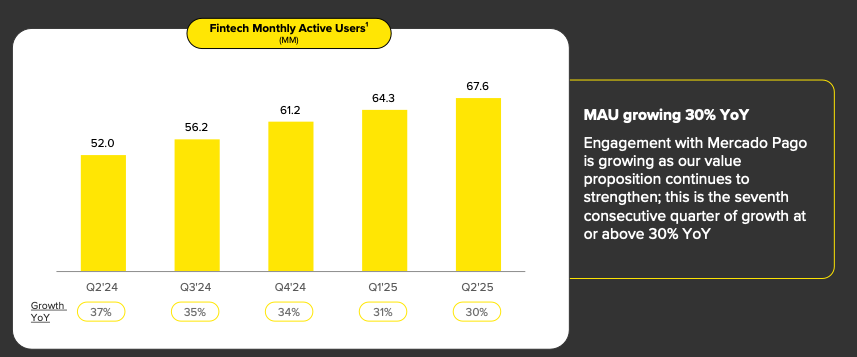

Something to take note of is that Mercado Pago’s revenue has been accelerating in recent quarters, with the company growing in the low 20s in 2024 before accelerating to over 40% in 2025.

Mercado Pago’s total payment volume (TPV) rose 39% YoY in USD terms to $64.6B, with acquiring TPV (on and off platform payments) hitting $44.4B, up 31% YoY.

Mercado Crédito (Credit)

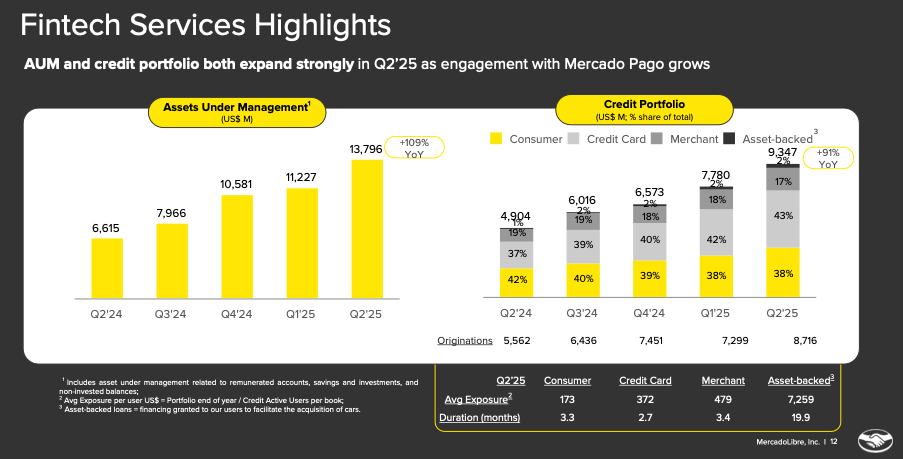

Assets under Management (AUM) more than doubled to $13.8B with the credit portfolio surging 91% YoY to $9.3B, including a 118% increase in the credit card segment to $4.0B (now ~43% of the credit book).

Loan originations were up 54% YoY. Credit to consumers grew faster than merchant loans, showing rising adoption of wallet-linked credit.

Despite the rapid growth, MELI has been focused on tightening underwriting which has led to the 15-90 day delinquency rate dropping to 6.7%, the lowest in 7 years.

Management Changes

One very notable point is the upcoming change in CEO. Marcos Galperin, the long-time founder and CEO of MELI is stepping back while Ariel Szarfsztejn is stepping up to fill the role.

Marcos will continue to stay as Chairman and I have no doubt that his strategic influence and guidance will still be present. The business remains in capable hands and I am as confident in the business as I have ever been.

Read this letter from Marcos Galperin.

2. Valuation

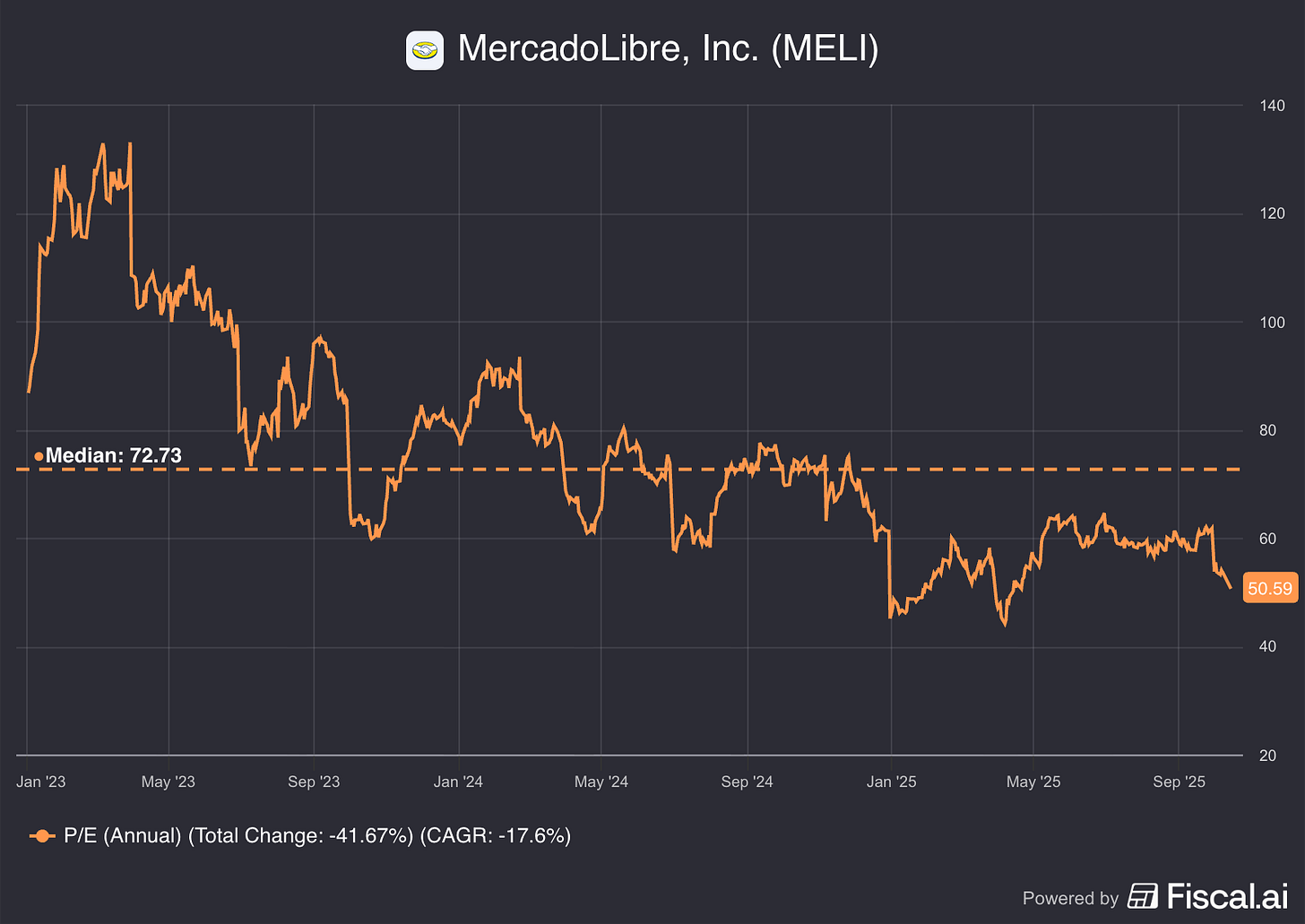

MELI currently trades at a 50x PE ratio with median analysts estimates for FY2026 EPS growth at 46.3%.

It is the lowest PE it has traded at since the April tariff tantrum.

This represents a PEG ratio of nearly 1, which in my opinion, is incredibly cheap for a business of Mercado Libre’s quality.

3. Technicals

MELI tends to overshoot below the 200MA frequently, with 4 instances since November 2023. However, it has rapidly rebounded each time.

It also sits today at a multi-year trendline that has held as support consistently.

I believe this is as good a time as any to add to the stock if you are confident in the businesses’ fundamentals.

Conclusion

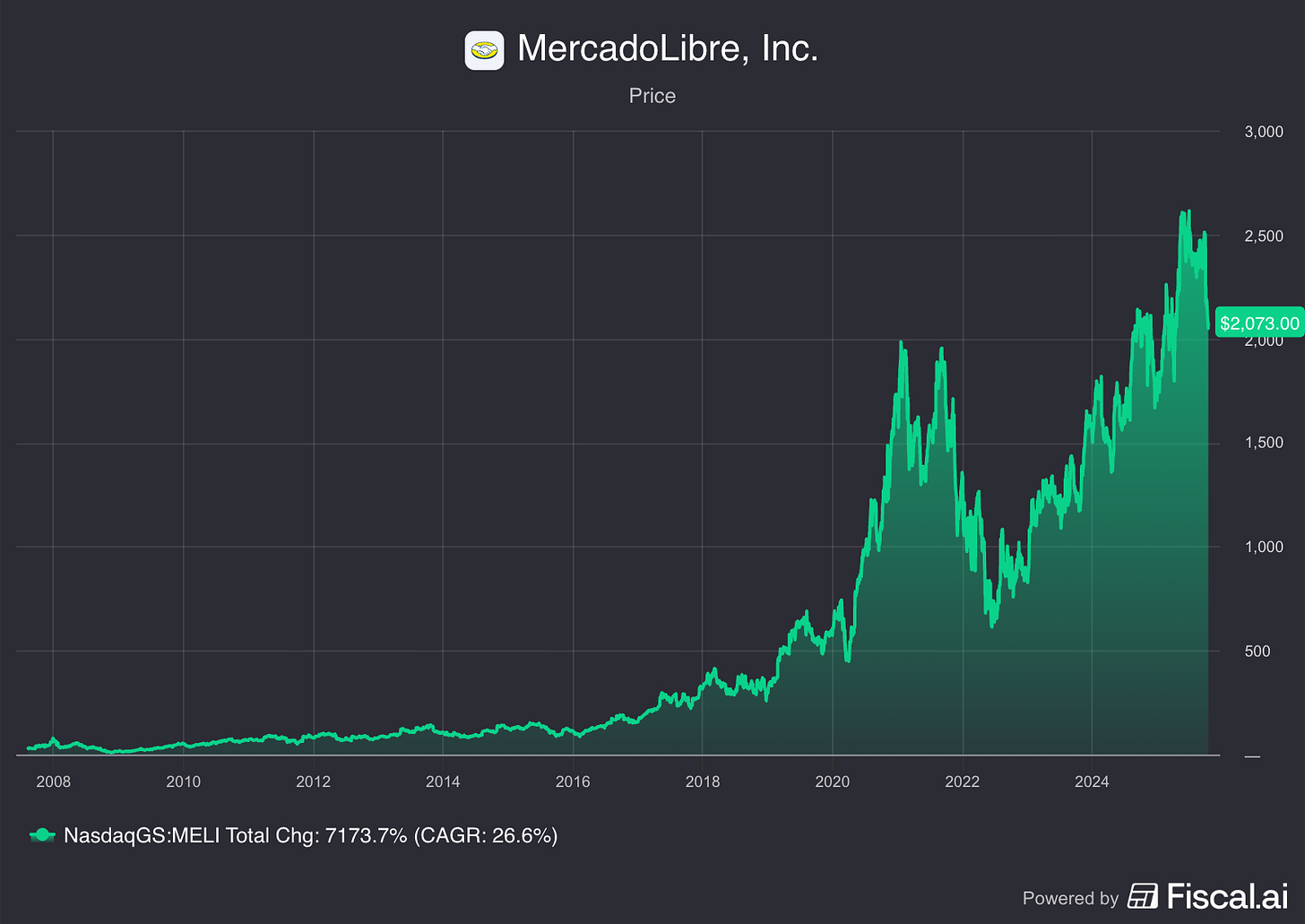

Sea Limited and Mercado Libre are two of the largest positions in my portfolio. This is certainly painful in the short term for shareholders, but it also key to note that these are stocks that have compounded shareholder value at north of 25% for many years.

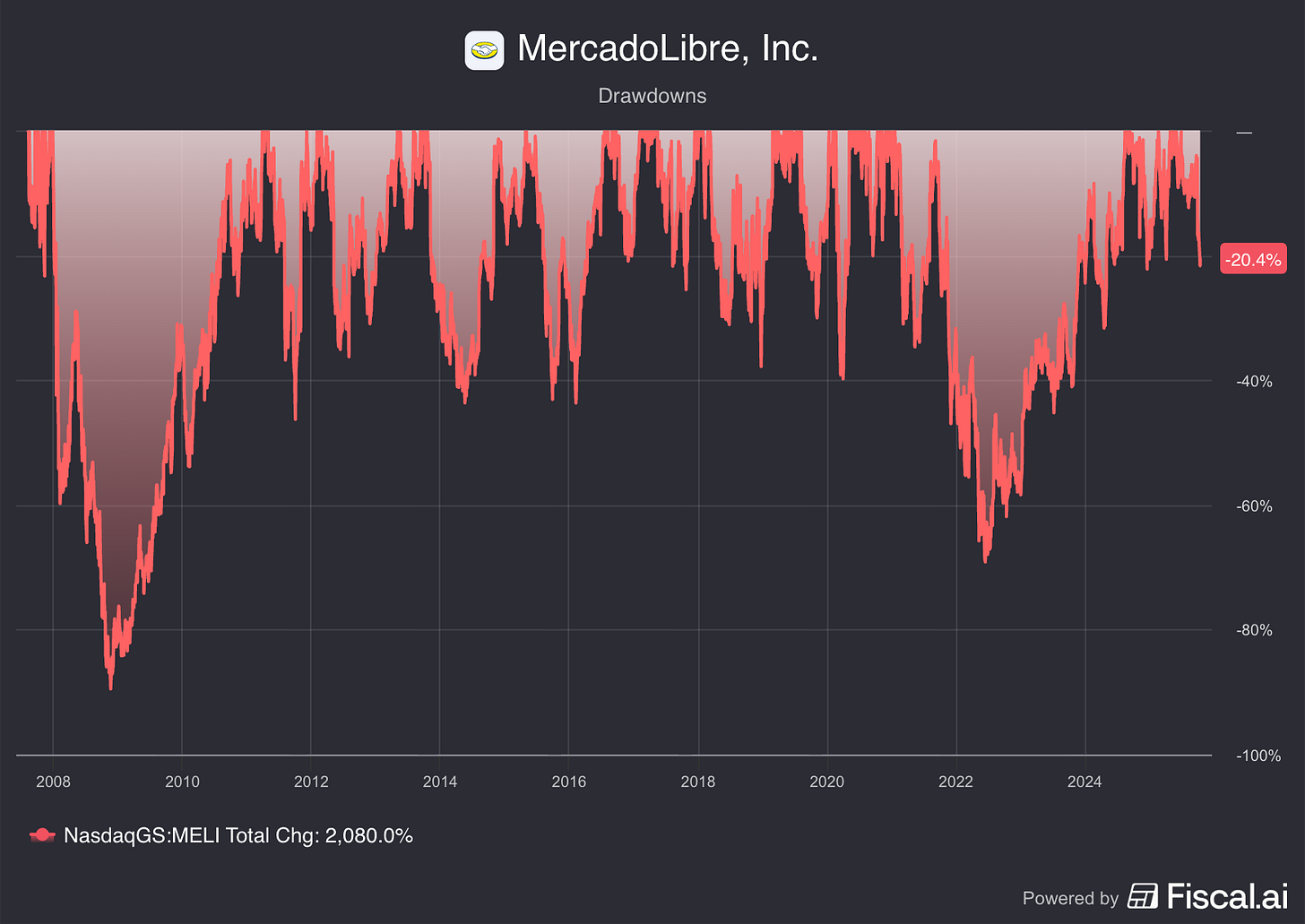

Yet, these businesses have not been without its drawdowns. Sea Limited has seen 5 drawdowns larger than 25% in the past 7 years, including a 90% drawdown that it has yet to recover from.

Mercado Libre has seen >30% drawdowns 9 times over the last 17 years.

Volatility is simply a feature of high returns. It is not easy to ride through them, but essential if you want to achieve truly great returns.

Fundamentally, Sea Limited and Mercado Libre’s long-term narratives remain compelling.

Southeast Asia’s rising middle class and Latin America’s e-commerce/fintech boom are multi-year trends that these companies are spearheading. Short-term stumbles aside, both firms have proven track records of innovation and market leadership.

If you believe in those secular trends, these dips, as painful as they are in the moment, may well turn out to be a golden opportunity to enter or add to positions at more reasonable valuations.

P.S. If you have yet to watch Sea Limited CEO Forrest Li’s most recent interview, I would highly recommend it. It is extremely rare that he does a sit-down interview, and for over 40 minutes at that.

Disclaimer: I am long Sea Limited and Mercado Libre. The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

Great article!

Awesome write-up!