Grab Q4 2025 Earnings Review

Short-Term Weakness, Long-Term Strength

Grab reported Q4 2025 Earnings after the market close on 11th February 2025.

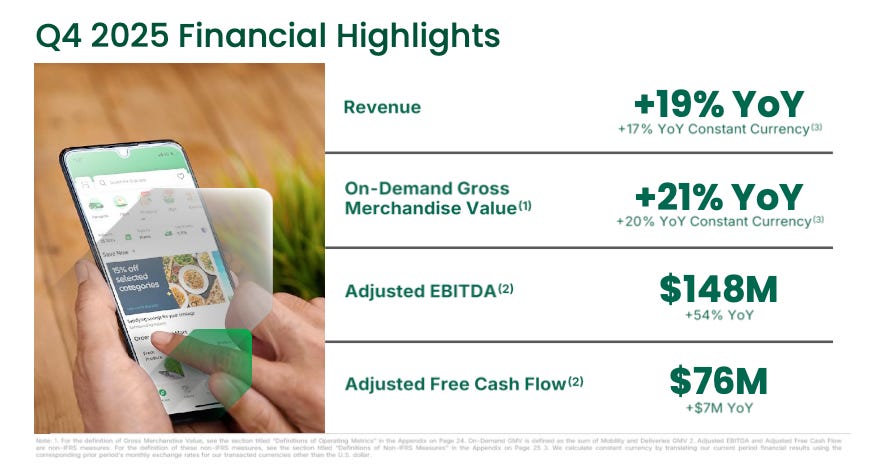

Revenue: $906M v $941M est. (+19% YoY, 17% Constant Currency)

EPS: $0.00 v $0.01 est.

Selected Key Metrics

On-Demand GMV: $6,077M (+21% YoY)

On-Demand GMV per MTU: $131 (+4% YoY)

Group MTUs: 50.5M (+15% YoY)

Loan Portfolio: $1,180M (+120% YoY)

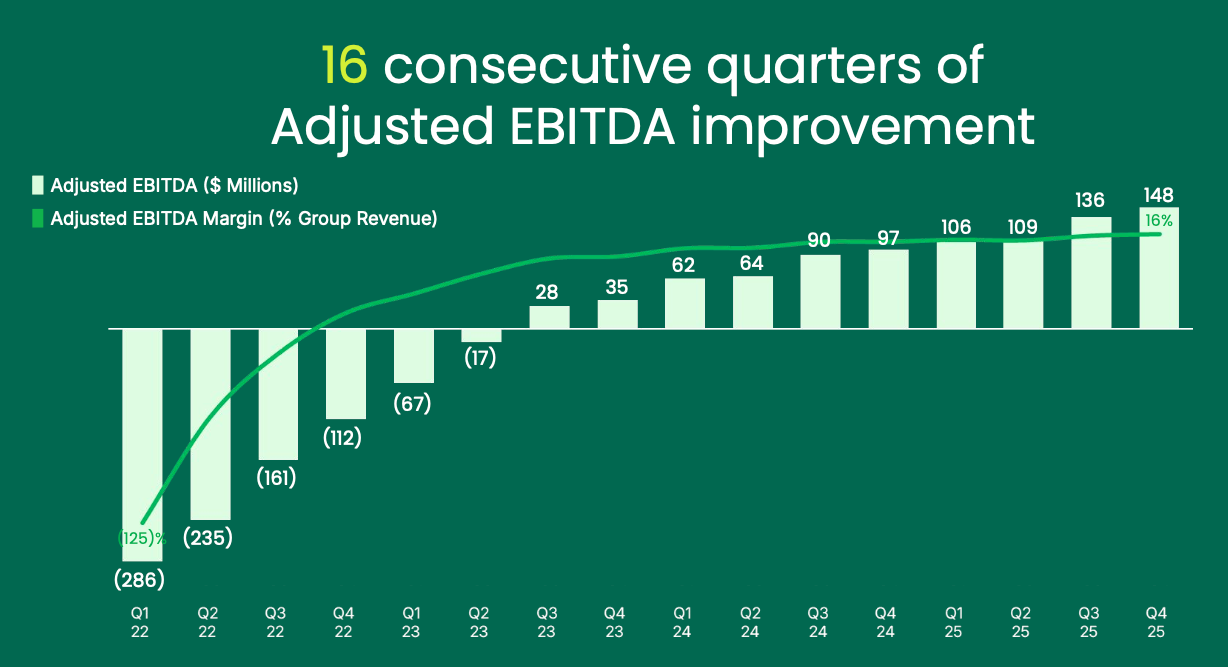

Adjusted EBITDA: $148M (+54% YoY)

Adjusted Free Cash Flow: $76M (+10% YoY)

Grab’s earnings for the quarter missed expectations by about 4%. However, much of it can be explained by their affordability strategy which I will dive into later.

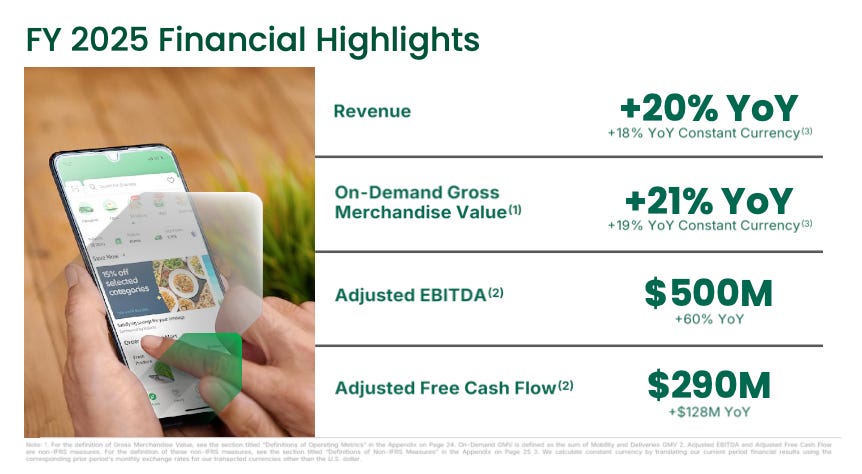

That said, FY2025 numbers as a whole were still very strong. Group Adjusted EBITDA margin expanded from 12.7% to 16.4%.

Segment Adjusted EBITDA for each of the 3 segments improved.

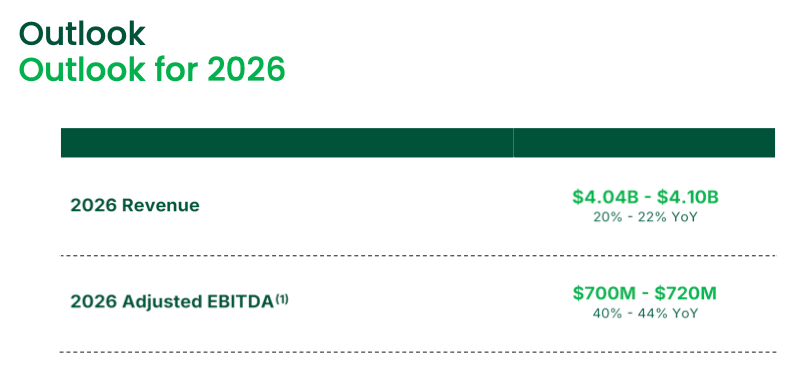

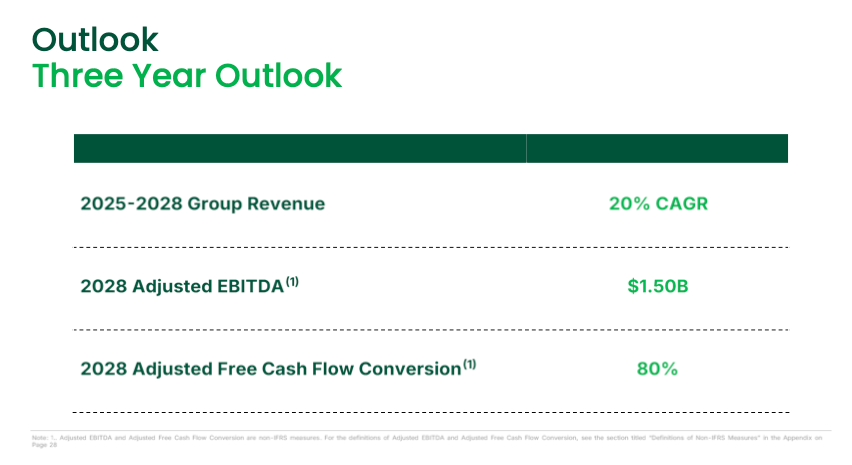

Management also gave their outlook for FY2026 and 3-year outlook (the first one since September 2022).

They guided for 20% revenue CAGR over the next 3 years and a 200% increase in Adj. EBITDA, along with an increase in Adj. FCF conversion from 52% in 2024, 56% in 2025 to 80% in 2028.

One last thing to note, management reiterated their 3 key pillars for growth:

Affordability to widen TAM of audience

Product led and ecosystem focused execution to increase LTV

Leveraging technology in AI to unlock efficiency

In this piece, I will break down the earnings in full, highlight key points on management commentary during the call and discuss my personal thoughts in the last section.

Table of Contents

Deliveries & Mobility

GFin, Financial Services

Key Call Commentary

Positives & Negatives

Conclusion

1. Deliveries & Mobility

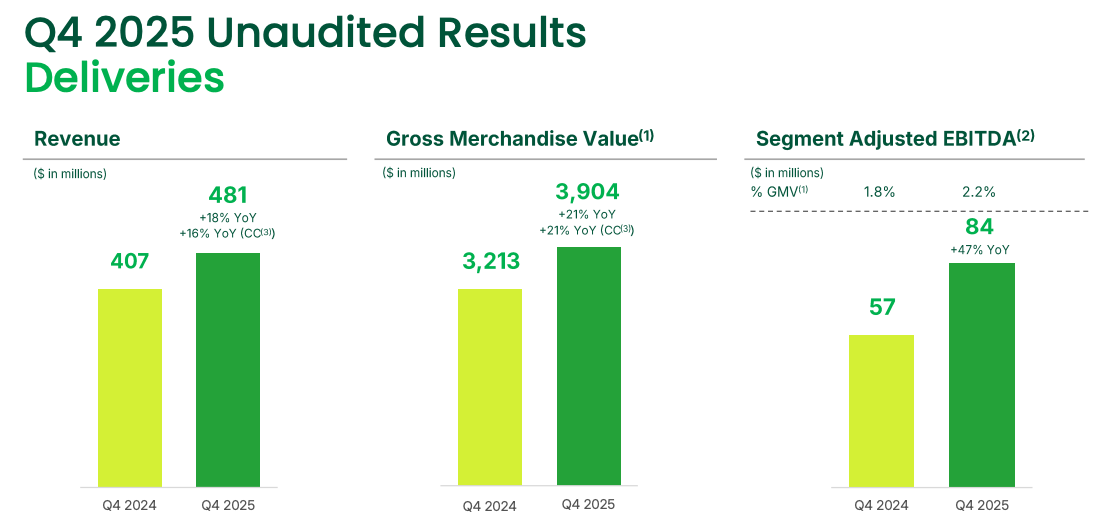

Deliveries is Grab’s largest segment by GMV and Revenue.

GMV grew 21% YoY (also 21% on a constant currency basis). Adj. EBITDA margin also grew from 1.8% to 2.2%, tracking closer towards management’s long-term target of 4+% margins.

This growth has been attributed to higher contributions from advertising and gains in operating leverage. On a FY basis, deliveries segment Adj. EBITDA margin grew 35bps to 2.0%.

Of note, the total number of quarterly active advertisers joining Grab’s self-serve platform increased 21% YoY to 228,000 while average spend increased 23% YoY.

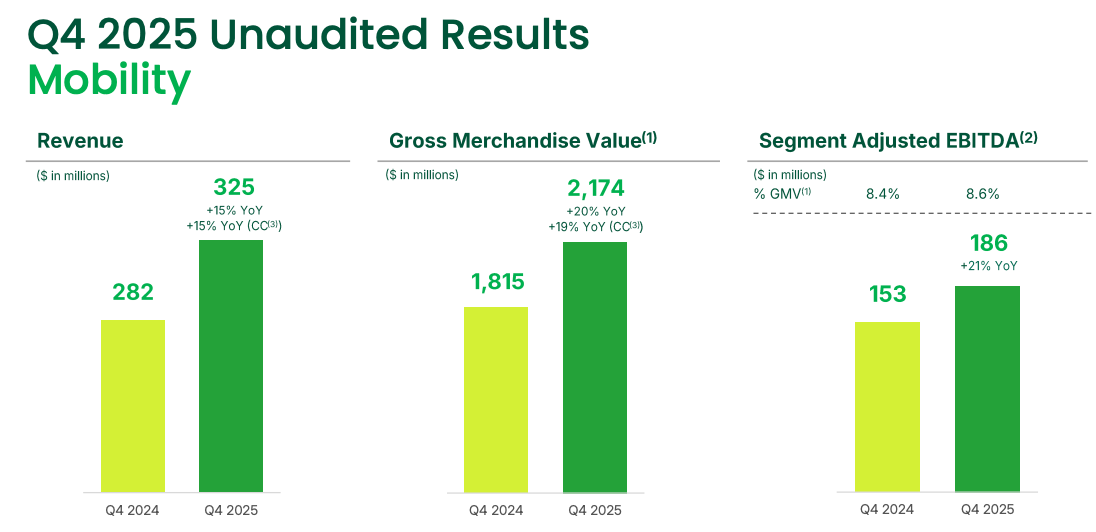

Mobility GMV grew 19% YoY on a constant currency basis. However, revenue growth was lower at just 15% YoY due to the focus on affordability.

Yet, segment Adj. EBITDA margin still expanded YoY from 8.4% to 8.6%.

As a reminder, Grab’s long-term steady state margin target for this segment is 9+%.

2. GFin, Financial Services

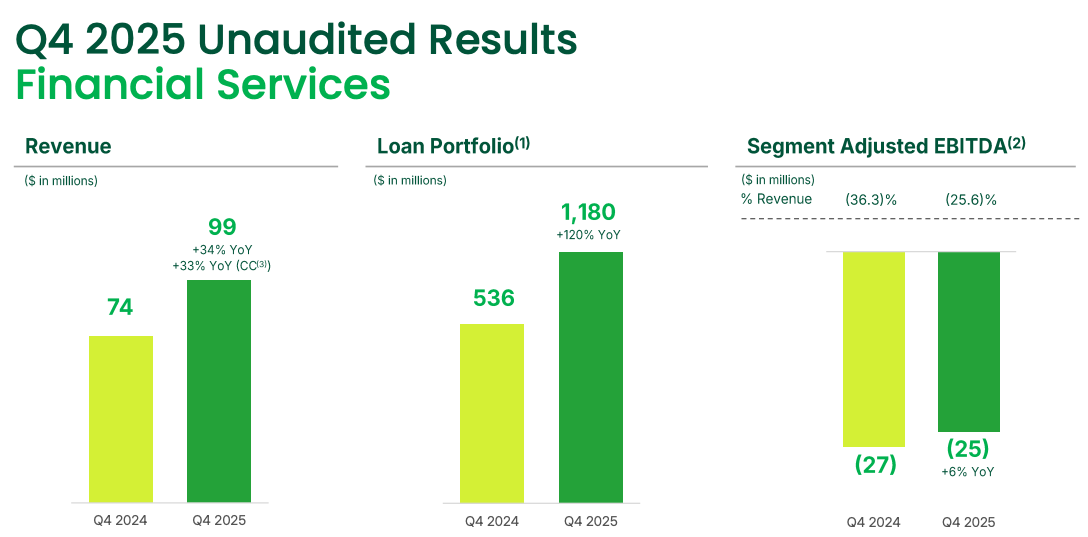

This was a phenomenal quarter for GFin. The net loan portfolio reached $1.18B, up from $821M just last quarter. That represents 43% QOQ growth and 120% YoY growth.

Management’s year end target was for $1B which has been achieved easily. Segment Adj. EBITDA margin improved from -36.3% to -25.6%. Grab tracks closer towards profitability, which it expects in the 2nd half of this year.

Customer deposits across GXS Singapore and GXBank Malaysia grew to an all-time high of $1.6 billion as of the end of the fourth quarter, compared to $1.2 billion in the prior year period, driven by customer growth, with the majority of depositors also being Grab users.

3. Key Call Commentary

Before I begin, I want to acknowledge that Grab did their first live video earnings call with an IR head taking charge of questions.

It was a much smoother experience and I thought the questions and answers were of higher quality than usual.

On Rumours of Indonesia’s Proposal to Lower Ride-Hailing Commissions

“So we can confirm that the government have not proposed any changes in commission caps. We’re in close consultation with them. And we’re aligned and committed to their ultimate goal, which is improving the welfare of drivers in Indonesia.”

On Superbank IPO

“The highlight was, of course, the IPO of Superbank in December, which came out now, I think, with a $1.8 billion market cap and was incredibly successful, 300x oversubscribed with over 1 million shareholders.

And I believe at this point, we’ve got more shareholders in Superbank than any other stock on the IDX. So that’s just an indication of the potential of the market for Financial Services, and we’re just getting going now with an increase in velocity to be expected in 2026.”

On Grab’s AV Strategy

“You may actually have seen us make, as you talked about just now, small minority investments. Now these position us in Southeast Asia in a way where we can have a geopolitical and technological hedge because we can partner global leaders across both U.S. and China ecosystems.

Now this agnostic approach allows us to leverage this unique position we are in with the ability to take the best technology from the world to adapt it to specific nuances of Southeast Asian infra.”

Singapore as the Blueprint for AV Strategy

“Over the next 3 years, you asked, we see actually Singapore as our blueprint. You look at Ai.R. Ai.R is our first public AV shuttle service in Singapore’s Punggol district.

That’s a great example. Ai.R has covered over 25,000 kilometers with zero safety critical incidents or near misses. This is the highest mileage recorded and the most data collected by any AV operator in Southeast Asia.”

Grab’s Product Strategy Bearing Fruit

“The product strategy is working. We will continue. We updated the new product initiatives in Deliveries when we last updated at the half year, contributed to about 1/3 of our GMV. On a full-year basis, I can tell you that now is represented by almost half, so 46% year-on-year GMV growth from our new products, so a massive contribution.

Just to summarize what the product strategy has been and what we will continue to focus on, so the ladder pricing strategy is working. Affordability drives a lot better frequency. So Saver gives us 1.5x higher frequency than the average. And the high-value customers are here in Southeast Asia as well, less price sensitive, looking for limo rides to airports, et cetera. So we’ll continue to grow at the top end of the ladder also, allowing us to manage the margin mix very nicely, as you saw in the overall results.”

On the Stash Acquisition

“One is it’s got a very strong IP. It’s got a strong talent pool and a platform that we don’t have today.

If you look at Financial Services as a business, what do we have? We have a very strong payments, we have a strong lending business, which is continuing to scale, we have a big deposit base over 7 million customers on the deposit side on the banking side of the house.

What’s missing? We don’t have an investing platform today. And that’s really critical for us as we continue to complete the full picture of Financial Services in Southeast Asia or also in other parts of the market where Stash operates today.

Now it is a positive EBITDA business today. It is generating free cash flow positive, and we see this business generating $60 million in EBITDA in 2028. So it’s an accretive business that we see. But really, it’s important that we also serve our user base today, not only in extending loans, but also teaching them how to save. It’s critical in terms of our mission for the underserved, especially on Financial Services.

We expect to close this transaction sometime in Q3 or Q4. It’s a great team. We already have over 1 million customers that we are continuing to serve that they have continued to prove that, that product works. And as they continue to build that product set out, they’re going to continue to penetrate the U.S. market, but also over time, we’ll introduce the product here in Southeast Asia.”

4. Positives & Negatives

Positives:

Headline number was misleading

Top-line missed by 4% but this could be explained by Grab’s strategy to sacrifice short-term numbers for longer-term engagement and organic growth.

Partner incentives were up 40% this Q, while Consumer incentives were only up 14%. This is targeted to drive up TAM expansion and adoption, which they alluded to during the call, and eventually leads to stronger organic growth through repeat customers.

These higher incentives act as contra revenue, mechanically depressing reported revenue growth (with part of it also flowing through cost of revenue).

If Grab had increased partner incentives in line with consumer incentives instead, roughly $53M of contra revenue would have been “saved,” which more than covers the revenue shortfall versus estimates.

The larger picture is very much on track

This is a very impressive graphic, especially considering seasonality effects didn’t disrupt the trajectory.

Going from -125% Adj. EBITDA margin to 16% Adj. EBITDA margin in 4 years is a major feat that Grab doesn’t get enough credit for.

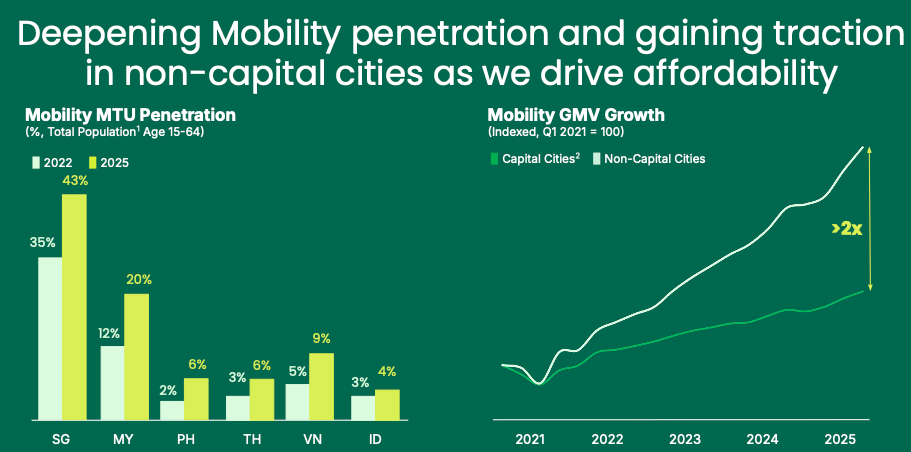

Southeast Asia remains very underpenetrated

Despite Grab now having over 50 million monthly transacting users, there is still tons of room for growth.

Indonesia, a country with 200 million users, only have 4% of users as MTUs. This is a massive growth area and Grab is well positioned to benefit. This is precisely why they are focusing on the 3 pillars of growth and I believe double-digit growth can be hit for the coming decade.

GrabMart is a huge growth driver

Mart is growing 1.7x faster in GMV compared to Food, with 1.6x the AOV. During the call, COO Alex Hungate also highlighted the opportunity:

“In ASEAN, the modern retail penetration is less than 40% of the overall grocery market. And then online grocery penetration is even lower at less than 3% in the majority of our markets. That compares with much higher numbers in U.S., China, U.K. of 15%, 20%, even 30% in some of those markets.”

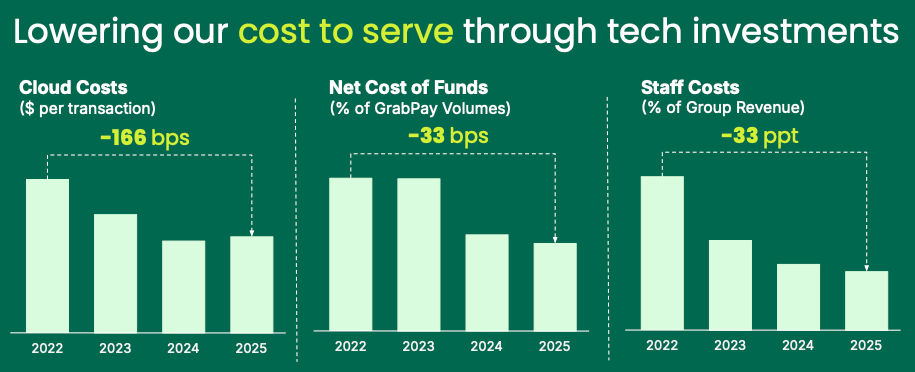

Cost to serve is down massively

Negatives:

Top-line miss

It’s not great that Grab has missed top-line estimates for the 2nd consecutive quarter (although last one was a very near miss <1%).

Management will need to spur growth through new product types which they are trying.

Capital Allocation

The $500M buyback and $425M acquisition of Stash is generally a net positive, utilising the massive net cash Grab has.

At these prices, I believe Grab is very cheap, and it would be a great idea for management to repurchase shares. The acquisition is relatively reasonably priced in my view.

However, the question remains around where they intend to deploy the other $5B. If the GoTo acquisition is unlikely to happen, I believe management should look elsewhere to allocate capital, including authorising much larger share buyback programs, considering Grab is now very healthily FCF positive.

5. Conclusion

My initial view of the quarter was negative, unsurprisingly, due to the top and bottom-line misses.

However, upon further review. I believe this was generally an above average quarter. I’ll give it a B-.

In 2 months, we are likely to see Grab’s Product Day event which was a massive success in 2025 with those new products contributing heavily to spurring growth and increasing efficiency throughout the organisation. I am looking forward to it.

I remain optimistic in Grab, especially at these prices. I’ve detailed my thoughts on Grab as an investment for the year in this piece that you might want to consider reading:

Thanks for reading! If you enjoyed this piece, please give it a like and consider subscribing to a tier of your choice.

As a reminder, paid subscribers receive 6-8 articles a month covering:

Earnings Reviews (Grab, Sea Limited, dLocal, Mercado Libre and more)

1-2 Deep Dives (always happy to receive suggestions)

Portfolio Review (sharing all my positions & changes)

Great write up!

Did you watch the call live? I can't get it on Quartr or Fiscal.AI, and they haven't uploaded the transcript to their IR page yet either.