Why I’m Not Worried About $SE Sea Limited’s 38% Drawdown

Sea Limited is in a 38% drawdown from its most recent high in September 2025.

This drawdown has understandably raised investor concerns and prompted questions around what is driving the correction.

In this piece, I’ll break down the key factors behind the sell-off and assess whether they genuinely warrant concern for long-term investors.

Reason 1: Shopee's Margins

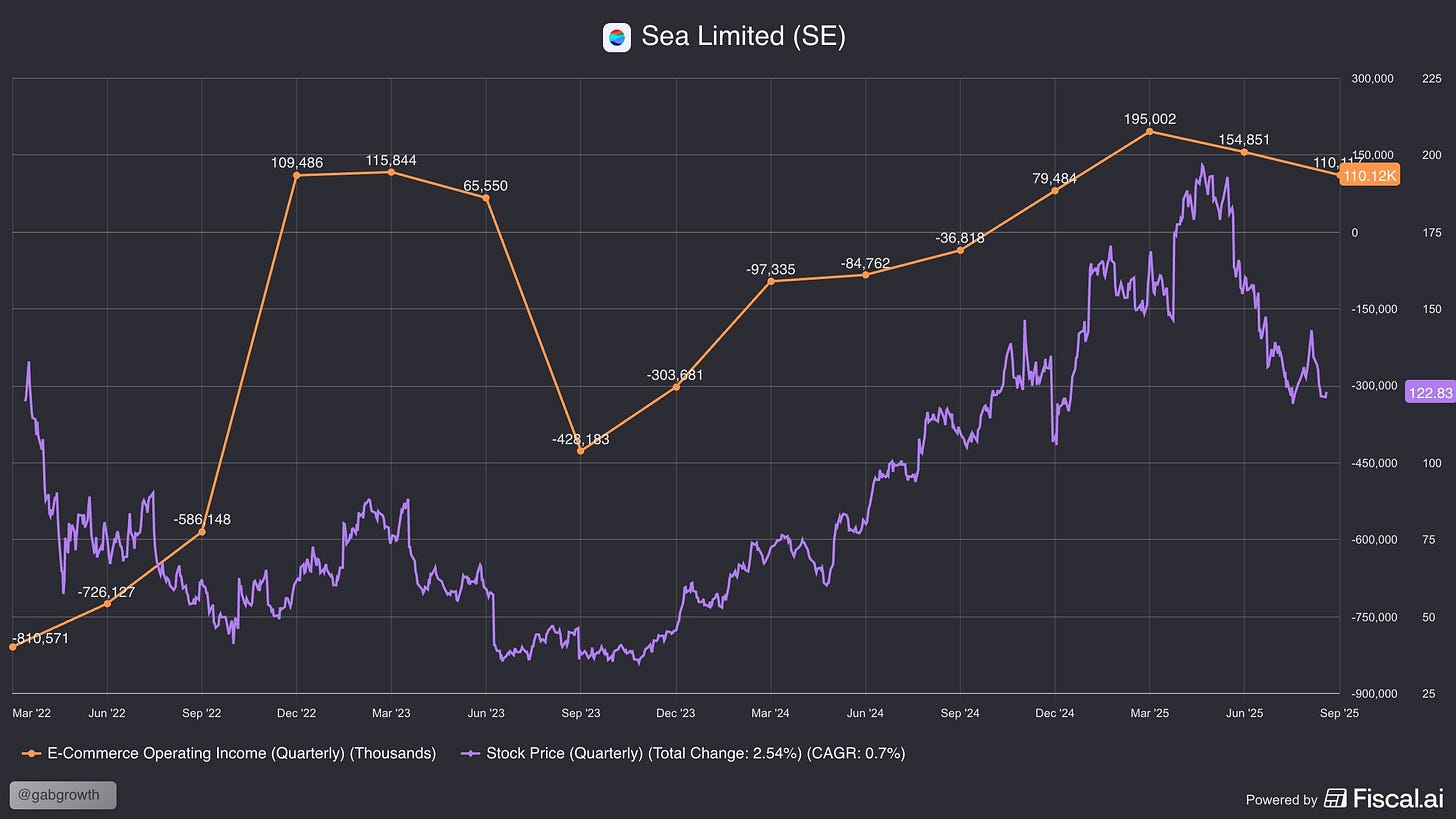

When we chart Shopee’s operating profits to Sea’s stock price, we see a relatively clear correlation. For years, Shopee has been the key focus for investors in Sea Limited. After all, it makes up 72% of revenues and potentially a large majority of future profits.

Shopee’s operating income has fallen in consecutive quarters for the first time since Q2 2023. This begs the question(s): Is 2025 a repeat of 2023? Are we about to see Shopee’s operating profits crater?

The short answer (in my view) is “No”.

The longer answer is explained by the situation Sea found themselves in then and now. During COVID, Sea Limited benefitted from a once-in-a generation demand shock.

E-commerce adoption compressed 5-7 years into ~18 months

Gaming engagement exploded as people stayed home

Digital payments penetration surged

This created artificially elevated baselines across GMV, user growth, engagement and margins.

In 2022-2023, when the world reopened, offline retail came back, gaming hours normalised and inflation crushed discretionary spend.

Sea Limited had to pivot from growth at all costs to proving it could turn profitable.

Hence, Q1 2022 to Q4 2022 was a period where Sea rapidly moved towards proving its model could be profitable. It had to shrink to get to profitability, cutting marketing spend massively and sacrificing growth.

Once it proved it in Q4 2022, it started to find a way to re-balance growth and profitability which led to unprofitability again in subsequent quarters.

In Q4 2024, Shopee finally turned profitable again, and this time it has proven to be sustainable, with growth re-inflecting and accelerating.

This slight dip in profitability for Shopee over the past 2 quarters comes from completely different circumstances.

Today, Shopee is no longer coming off an artificial COVID peak. Demand has normalised and its cost structures have already been reset. Unit economics have already been proven in a post-COVID, high-inflation world.

In 2025, operating profits dipped because Shopee is re-accelerating from a position of strength. Management has chosen to re-invest in the business by expanding its Brazil business, spending more on marketing, re-investing in logistics, fulfilment and seller incentives, and working on its Shopee VIP program.

Importantly, this is not speculation. Here are management’s comments from the latest earnings call:

On if the current investment cycle is similar to 2 years ago:

“I think the short answer is probably not. What we are doing now is a continuous investment into our business to strengthen our competitive moat. Now we are extending logistics to the fulfilment network too. It’s not completely new... but we feel now is a good time to scale it even more.”

On the Competitive Landscape:

“What we see is a relatively stable competitive landscape. I think as you can probably observe as well from your own sources, we didn’t see any particular market behaving differently from another. The trends in competitive intensity and behaviour have been fairly consistent across Southeast Asia.”

Reason 2: TikTok Shop

Here’s the elephant in the room. TikTok Shop is rapidly growing and personally, I’ve also ordered from them in recent months. The incentives they offer for new users and on certain products are incredible and reminds me of Shopee back in the day.

In fact, Momentum Works (MW) shared just a couple days ago that TikTok Shop appears to have doubled its GMV in Southeast Asia in 2025. This was evident from J&T Express’ average daily parcel volume growing 73% YoY to 26.5 million in Q4 2025. For context, J&T is TikTok’s main delivery partner and now drives the majority of orders for them.

Currently, TikTok Shop is still behind Shopee in GMV in absolute terms in 2025. Calculations by MW also suggest that Shopee remained ahead in order and parcel volumes. However, the gap is clearly narrowing across the region.

So here, the question really is: What is Shopee’s competitive advantage and how will it defend against TikTok Shop?

Fundamentally, I believe Shopee’s advantage over TikTok Shop boils down to deliberate, search intent-based purchases, logistics and fulfilment advantages, and broader product categories.

1. Search Intent-based Purchases

Shopee is a purpose-built e-commerce platform, designed from the ground up for online shopping, whereas TikTok Shop is built on a social media app that added commerce later.

This means Shopee’s core experience caters more to deliberate, search-based buying rather than impulse purchases.

Why is this important?

Repeat behaviour is the true moat of an e-commerce business. Impulse buys require constant attention and novelty. However, repeat behaviour means re-buying of the same SKUs monthly and defaulting to Shopee for price discovery.

Basically, people open TikTok Shop for entertainment, and Shopee to shop.

Another underrated aspect is that Shopee has built trust, which typically leads to higher value orders being placed on platform.

2. Logistics and Fulfilment Advantages

Shopee has invested heavily in localised logistics networks and fulfilment services through SPX Express. It is the 2nd largest logistics player in the region. TikTok Shop relies primarily on J&T Express.

This matters because logistics at Shopee is not just a vendor relationship but a strategic control layer embedded into the marketplace. By owning SPX Express end-to-end, Shopee can prioritise parcels during peak campaigns, smooth delivery bottlenecks, stabilise costs during high-volume periods, and tightly integrate fulfilment with seller tools and buyer guarantees.

Over time, this control allows Shopee to optimise unit economics, defend GMV during competitive cycles, and turn logistics from a pure cost centre into a durable operational moat rather than a commoditised service.

3. Broader Product Categories

Shopee has broader product categories because it was designed from day one as a general-purpose marketplace. Meanwhile, TikTok Shop focuses on content-driven, impulse-led categories.

This naturally favours categories that are visually obvious and easy to explain without specifications or comparison. Categories like beauty, personal care, snacks, cheap gadgets, fashion accessories etc.

Because discovery happens passively, TikTok Shop prioritises low AOV, fast-moving SKUs over complex or high-ticket items, and campaign spikes over steady, repeat purchasing. I think this model is extremely powerful, but there are limitations by design.

This model struggles with categories that require trust, research, warranties, compatibility checks, or after-sales support, such as electronics, appliances, or household staples.

Whether this is sustainable comes down to behaviour rather than features. TikTok Shop can add more categories, but changing user intent is far harder as mentioned above.

Over time, this gives Shopee a defensible advantage in categories that form the bulk of long-term e-commerce GMV. TikTok Shop can coexist and even dominate certain verticals. However, displacing Shopee as the default destination for broad, everyday commerce would require a fundamental shift in how users mentally categorise the app, which is a much slower and more uncertain transition.

When can we expect Shopee to launch an entry into the Intent/Impulse-based category?

I think we can expect the numbers and evidence to come in soon. Shopee has already begun collaborating with YouTube, launching a Shopping Affiliate Program in multiple Southeast Asian countries.

TikTok is a behemoth in the digital space, but if there is one competitor they are behind, it is YouTube.

Shopee also partnered with Meta to launch new tools allowing users to discover products on Facebook/Instagram and buy them directly through Shopee.

In essence, we have Shopee+YouTube+Meta vs TikTok. It isn’t as easy a battle as it seems, but I do think Shopee has the advantage.

Conclusion

I believe the current drawdown in Sea is driven far more by sentiment than by any meaningful deterioration in fundamentals.

When we break down the drivers behind this sell-off, I think it is pretty clear to see. The first concern is not a replay of 2022/2023. The second concern is real but is also being misunderstood.

Crucially, this is not a winner-takes-all market. TikTok Shop can coexist and thrive in specific verticals without structurally displacing Shopee as the default marketplace for everyday commerce in Southeast Asia.

Shopee, in parallel, is not standing still. Its partnerships with YouTube and Meta show a clear strategy to layer discovery and social commerce on top of an already dominant transactional platform.

I think things will become much clearer in the coming quarters.

Paid Subscription Upgrade

If you’d like to support the work I do, consider becoming a paid subscriber. Your support will allow me to spend more time finding asymmetric opportunities in the market, writing and analysing various businesses.

As a reminder, paid subscribers get access to:

Monthly Portfolio Updates (+98% in 2024, +26% in 2025)

Earnings Reviews on Portfolio Companies (SE, GRAB, DLO, MELI etc)

Archive of Deep Dives and Posts (13 Deep Dives and counting)

Southeast Asian coverage of industries and companies

Disclaimer: I am LONG Sea Limited and this is NFA.

I am just starting a position

Great post, Gab!