Grab-GoTo Merger Talks?! - WR1

Stock Coverage: GRAB, SE, AMZN, NVDA

Hi all, my Substack page has strictly been deep dives and earnings reviews so far but I intend to ramp up activity.

As of today, I’m launching a weekly newsletter that will cover stocks that are in my portfolio or in the watchlist. I may also chime in with my views on the larger business/economic news stories from time to time.

Docket:

Grab and GoTo Merger Talks

Sea Limited announces opening of Sea Building and Sea Connect at NUS

Amazon Earnings Review

Nvidia: The MAG7 Winner?

1. Grab and GoTo Merger Talks

It’s been an eventful week for GRAB 0.00%↑ as rumours circulated on Monday 3rd Feb regarding a potential merger with GoTo, it’s largest competitor in ride-hailing and food delivery.

I shared my thoughts on X as the news came out and will be reiterating them here.

It was not a major shock to see the news come out as Grab and GoTo (Gojek + Tokopedia) have had merger talks in the past. In December 2020, it was reported that Grab had informed staff of their intention to acquire Gojek. In late 2022 and early 2023, rumours resurfaced about a potential Grab-GoTo merger. Both companies denied serious negotiations.

It certainly makes sense for a merger to happen considering the competitive position and financial situation of GoTo in particular.

GoTo is down roughly 79% from IPO with the company seemingly far from profitability. While they have denied rumours of merger talks, pressure has definitely been put on management.

It would not surprise me to see more rumour talks in the months to come.

Personally, I would favour a merger as it accelerates the route towards improved margins for the combined entity. A virtual monopoly would allow for less competitive discounting and therefore higher margins.

Yet, in my eyes, Grab will inevitably be the sole winner of the ride-hailing and food-delivery battle, regardless of the outcome of these merger talks.

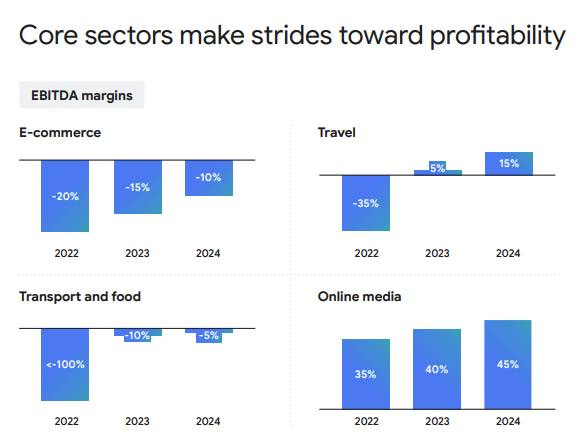

Transport and Food sectors have made leap and bounds improvement in terms of EBITDA margin. Grab is already profitable in both segments and on track to achieve optimal profitability.

2. Sea Limited announces opening of Sea Building and Sea Connect at NUS

Those who are unfamiliar with Singapore are likely unaware of NUS. NUS is the National University of Singapore, the most prestigious university in the country and regularly ranks in the top 20 universities in the world.

In 2021, Sea Group gave NUS their largest corporate gift ever of $50M that was used to fund scholarships, fellowships, and grants that will enhance the School’s ability to attract talent and pursue advanced research.

This will support the next wave of innovation. The talent, ideas, and breakthroughs in key technology areas that will result from this partnership will certainly enhance Singapore's already vibrant tech sector.

“We are deeply appreciative of the generous gift from Sea in 2021, which has been instrumental in expanding the resources at the NUS Computing to foster innovation, enhance education, and support cutting-edge research in AI, computing, and related fields. The Sea Building and Sea Connect have enabled us to expand considerably our learning and teaching facilities, research labs as well as collaborative and leisure spaces for students within and beyond the School. We are excited to fully leverage the gift and our longstanding partnership with Sea to build human capital, harness the power of technology and drive meaningful impact.”

NUS President Professor Tan Eng Chye

This is one example that I believe shows the far-sightedness of Sea’s management and their willingness to play the long game.

Sea Building and Sea Connect are home to 12 research labs, including NUS AI Institute, Health Informatics Research Lab, Information Systems & Analytics Research Lab, and more. Research conducted in these labs will undoubtedly foster start-ups and innovations that will make a positive and transformative impact on the industry and society.

Top students will be trained and taught at these institutes with a path towards working at Sea Limited. This is not just an investment in Singapore’s labour force, it is a potential investment into their future labour force. And at a minute $50M “investment”, I don’t see any downside.

3. Amazon Earnings Review

Amazon’s earnings report was great.

EPS of $1.86 beat est. of $1.48Revenue of $187.8b beat est. of $187.2b

So why was the stock down -4%?

Simple: Overblown expectations.

The stock is up 40% in the past 6M, gaining a whopping $700B in market cap.

This was a great earnings report on all segments. Personally, I’ve taken the opportunity to add in this dip.

4. Nvidia: The MAG7 Winner?

The MAG7 are projected to spend a total of $325B in CAPEX in 2025!

Amazon: $105B

Microsoft: $80B

Google: $75B

Meta: $65B

This does not include the likes of Tesla, XAi, OpenAI, Anthropic and many more…

I think it goes without saying that the biggest winner of the MAG7 earnings reports this week has been Nvidia. I have no position at the moment but am carefully considering it.

That is all for this week’s roundup. I hope it’s brought some value to you.

Until next time!

Disclaimer: The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

I like this transition and newsletter format. Quick and easy here, deeper dives in other posts. Thanks for the great work.

Didn’t even know you had a Substack! Excellent read my friend!