Worst Week of 2025 Yet! - WR3

GRAB, China, MELI, Market Thoughts

Hi all,

Welcome back to the 3rd edition of the Weekly Roundup!

This week, we saw US markets down for the first time in awhile with a particularly large drop on Friday with supposedly mounting concerns on the economy and tariffs.

SPY: -1.61%

QQQ: -1.83%

However, Chinese markets were up big again this week with Alibaba reporting stellar earnings. BABA was up 13% this week and 69% YTD.

Docket:

Grab falls 10% on Earnings Report

China surges, best performing index of the year

Mercado Libre up 7% on Earnings Report

Market Thoughts

1) Grab falls 10% on Earnings Report

Revenue $764M vs. $757M est. ✅

EPS $0.00 vs. $0.00 est. ✅

Adj. EBITDA $97M vs. $98M est. 🔴

Group MTUs 43.9M (+17% YoY) :✅

Revenue Guidance $3.3-$3.4B vs. $3.39B est. 🟡

EBITDA Guidance $455M vs. $489M est. 🔴

I posted my Grab Q4 2024 Earnings Review a couple days ago, so I will not go too deep into this.

To put things simply, Grab had a good quarter. Expectations were high which led to inevitable disappointment. However, long-term Grab holders need not worry. The business is growing as expected and the trajectory is up and to the right.

My plan moving forward:

My average Grab cost basis is in the high $3 range, therefore I have no reason to add yet. I plan to add should there be a dip to $4.50.

My thesis for Grab remains intact; SEA is still in the early innings of growth. 70% of people underbanked/unbanked with 5%+ GDP growth possible for the coming decade.

2) China surges, best performing index of the year

Sales $38.6B vs Est. $38.2B (+8% YoY)

EPS $2.95 vs Est. $2.63 (+13% YoY)

EBITDA $8.5B vs Est. $8.3B (+4% YoY)

Alibaba reported strong earnings with the market focusing particularly on the cloud business which grew 13% YoY. This report lifted the entire Chinese market, unsurprisingly.

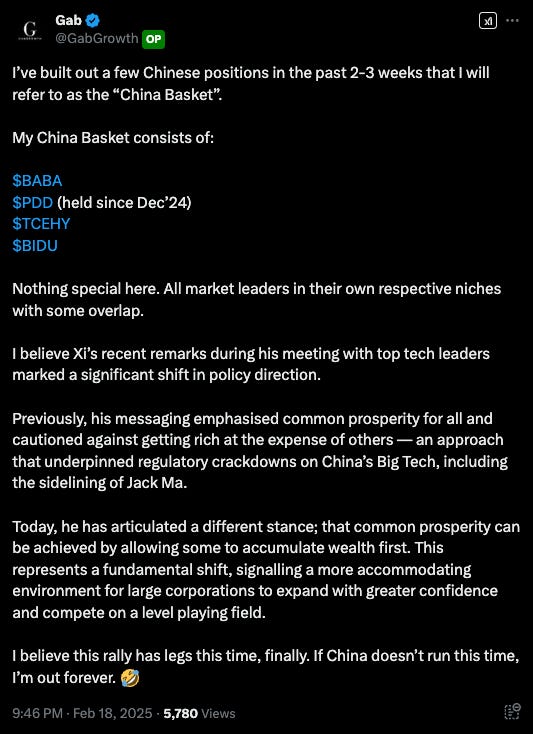

As mentioned earlier, I have built a China basket over the past 3 weeks:

I believe 2025 will continue to be a strong year for Chinese equities, with the key thesis being mean reversion and an accommodating environment.

3) Mercado Libre up 7% on Earnings Report

Mercado Libre reported earnings on Thursday, after the market close.

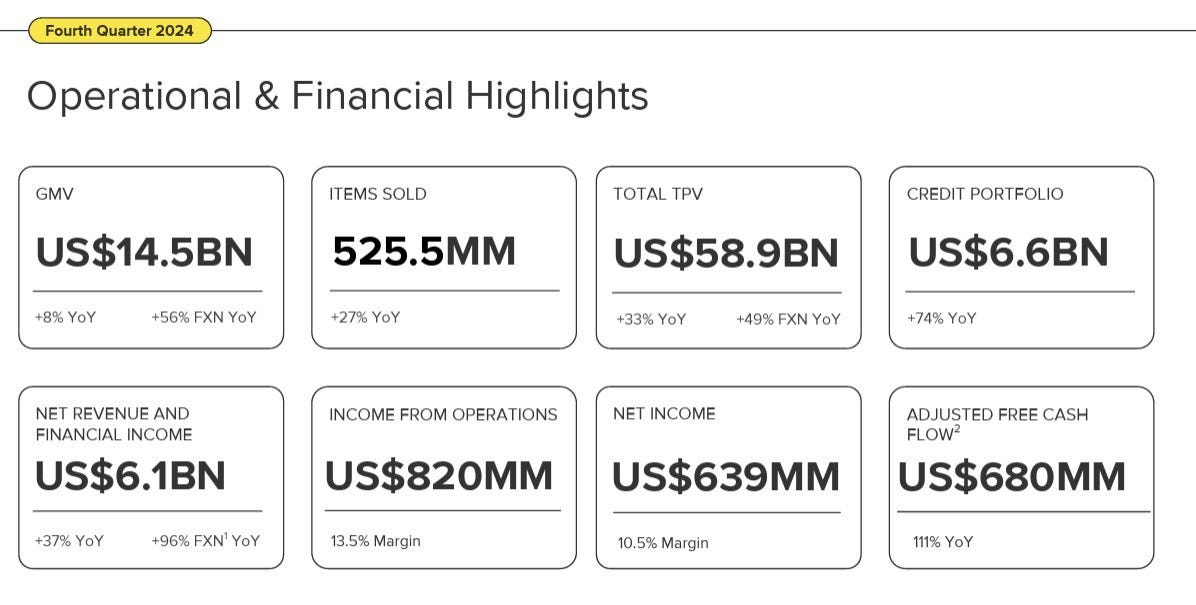

Revenue: $6.1B vs. est. $5.88B, +37% YoY ✅

Net Income: $639M vs est. $401.5M ✅

TPV: $58.9B, +33% YoY, 49% FX neutral ✅

GMV: $14.5B, +8% YoY, +56% FX neutral ✅

As usual, a stellar earnings report for the business. The most impressive part about Mercado Libre is the long-term focus by management.

This is a company that has been around for over 2 decades now and continues to grow revenue at 30+%. The tailwinds of the LatAm economy will ensure this business continues to grow at double-digit percentages for the coming decades.

With the post-earnings pop, MELI is now the 2nd largest holding in my portfolio. I am considering adding to it in the coming weeks, with my conviction in the business only growing.

4) Market Thoughts

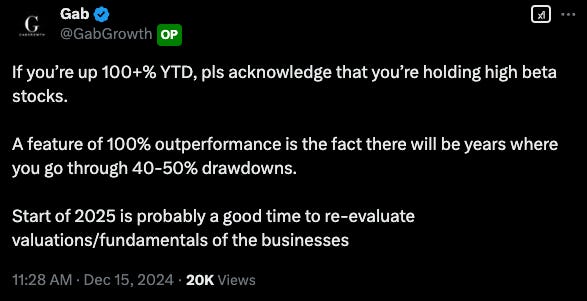

In December last year I made this post:

Since then, many investors are up 20-30% YTD with the run-up in stocks such as HIMS, PLTR, HOOD etc…

I feel even more strongly about my statement now than I did in December.

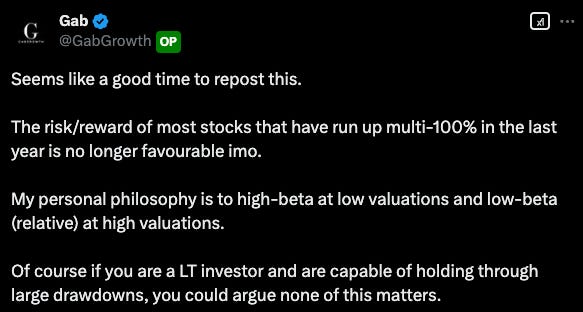

A few days ago, I came across this post by Amit on X:

I had a good long look at my portfolio and watchlist companies. I can confidently say that I am not confident that any of them are obvious doubles in the next 2-3 years. This is in stark contrast to 2022/2023 and even the start of last year where many stocks felt extremely undervalued and to me, were obvious multi-baggers.

As such, I have been raising cash and moving into lower-beta stocks. I also have to acknowledge that this could simply be because I am not doing enough research to find mis-understood or hidden gems.

However, I do think it is a much more difficult environment to find glaringly high reward to risk opportunities.

That is all for this week’s weekly roundup. Thank you for reading and I hope it’s brought some value to you.

Until next time!

Disclaimer: The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

I more and more like your contents. I am curious to know more about your statement around SEA…