The Case for Investing in Emerging Markets

Why the Next Decade of Growth Belongs to Emerging Markets

Emerging markets are often overlooked by investors due to perceived risk and volatility, information asymmetry and general benchmark and institutional bias.

This has led to many investors underweighting them in portfolios. Yet today’s macroeconomic landscape tells a different story from the general narrative. Emerging markets today are no longer just “developing”. Many of these countries are powering global growth with youthful demographics, rising middle class and rapid digital adoption.

In this piece, I will attempt to make the case for why now is the time to take a fresh look at emerging market investments. I will also attempt to tackle common biases held by investors and unpack the risks that keep many investors on the sidelines.

Firstly, What Are Emerging Markets?

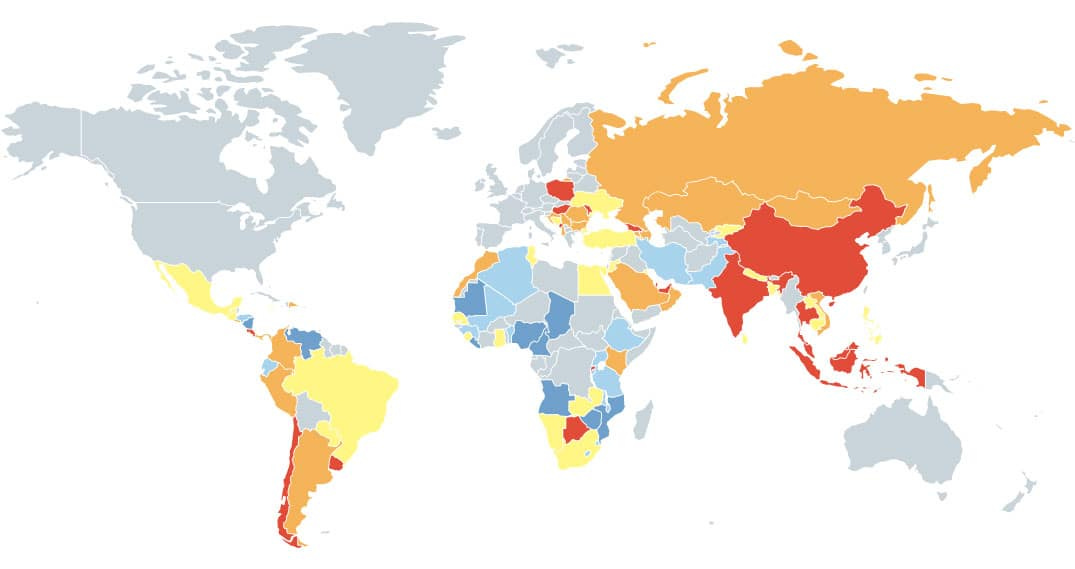

Emerging markets (EMs) are countries that are in between developing and developed status. Their economies are growing quickly, often industrialising, urbanising, and becoming more connected to global trade and capital flows, but they haven’t yet reached the income levels, financial stability, or institutional maturity of developed economies like the US, Japan, or Western Europe.

Examples of Emerging Markets:

Asia: China, India, Indonesia, Vietnam, Philippines, Thailand

Latin America: Brazil, Mexico, Argentina, Colombia, Chile

Africa: South Africa, Nigeria, Kenya, Egypt

Eastern Europe: Turkey, Poland, Hungary

These are often classified by:

World Bank: by income levels (low, middle, high).

MSCI & FTSE Russell: by market accessibility, size, and liquidity of listed companies.

For instance, MSCI “Emerging Markets Index” includes ~24 countries such as China, India, Brazil, South Africa, and more.

The Emergence of Emerging Markets

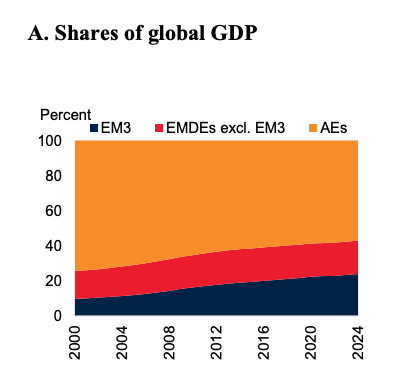

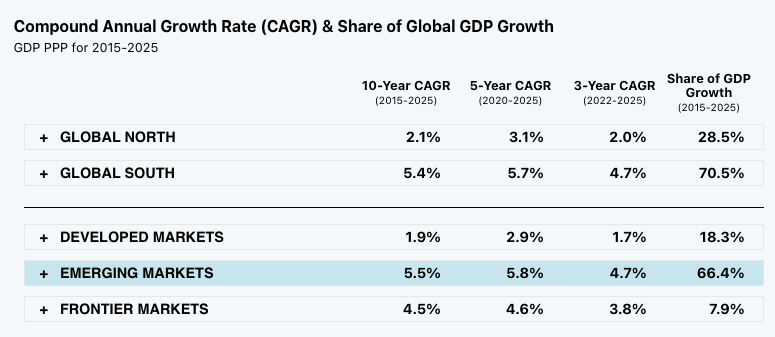

Over the past two decades, EMs have transitioned from the periphery of the world economy to the primary growth engine. In the past decade, EM countries have accounted for two-thirds of global growth.

These economies collectively produce output on par with the developed world.

About 35% of global trade was attributable to EMDEs in 2023 vs. 20% in 2000, while EMDEs received about 20% of global capital inflows in 2019-2023 vs. 6% in 2000-2004.

Structural Tailwinds

There are several structural tailwinds that set emerging markets apart from developed markets:

Demographics and the Rising Middle Class

Many EM countries enjoy younger, faster-growing populations compared to the aging, stagnant demographics of developed nations. For example, India’s median age is only 28, versus 43 in Europe.

A younger populace means a growing labor force and consumer base, with fewer retirees to support. Across South Asia, Africa, and parts of Latin America, a huge cohort of young workers is entering its prime productive and consuming years.

These demographics form the foundation for the next few decades of growth and are often referred to as the “demographic dividend”.

In 2020, the global middle class was about 3.5 billion strong. By 2030 it will approach 5 billion, with the majority of new entrants in Asia and Africa. More households entering the middle class means more spending on everything from appliances and automobiles to education, travel, and financial services. This is a massive tailwind for domestic demand in emerging markets.

Technological Adoption and Innovation

Technology is another major driver. With little legacy infrastructure holding them back, many EMs have leapfrogged straight into the digital age. Smartphone penetration already tops 70-80% in much of Asia and Latin America and is climbing quickly in Africa.

This shift has allowed billions of people to go straight to mobile banking, e-commerce, and online services, bypassing the slower build-out of landlines and traditional banks. It has also created homegrown tech champions like Grab, Sea, dLocal, and Mercado Libre (that I have covered on my Substack).

The stereotype of EM as commodity exporters or low-tech manufacturers is outdated. Today’s emerging economies host some of the world’s most dynamic tech ecosystems. The net effect is that technology is turbocharging emerging market growth and enabling these countries to climb the value chain faster than ever before.

Infrastructure and Urbanisation on the Rise

At the same time, trillions of dollars are being invested in physical infrastructure. Roads, ports, power grids, airports, and railways are being built at a scale never seen before. Urbanisation is also accelerating, with cities like Jakarta, Lagos, and Mumbai adding hundreds of thousands of new residents each year.

This urbanisation trend concentrates economic activity and creates huge demand for housing, infrastructure, and urban services. It also contributes to the rising middle class as urban jobs generally pay better and offer more upward mobility. For investors, infrastructure and urbanisation mean opportunities in industries like construction, cement, transportation, utilities, real estate development, and consumer goods tailored to urban lifestyles.

By 2030, most of the world’s largest cities will be in emerging markets. This shift concentrates economic activity, grows the middle class further, and drives demand for housing, transport, utilities, and consumer goods. Together, these trends are laying the foundation for faster long-term growth and opening up enormous investment opportunities across the developing world.

Why Now?

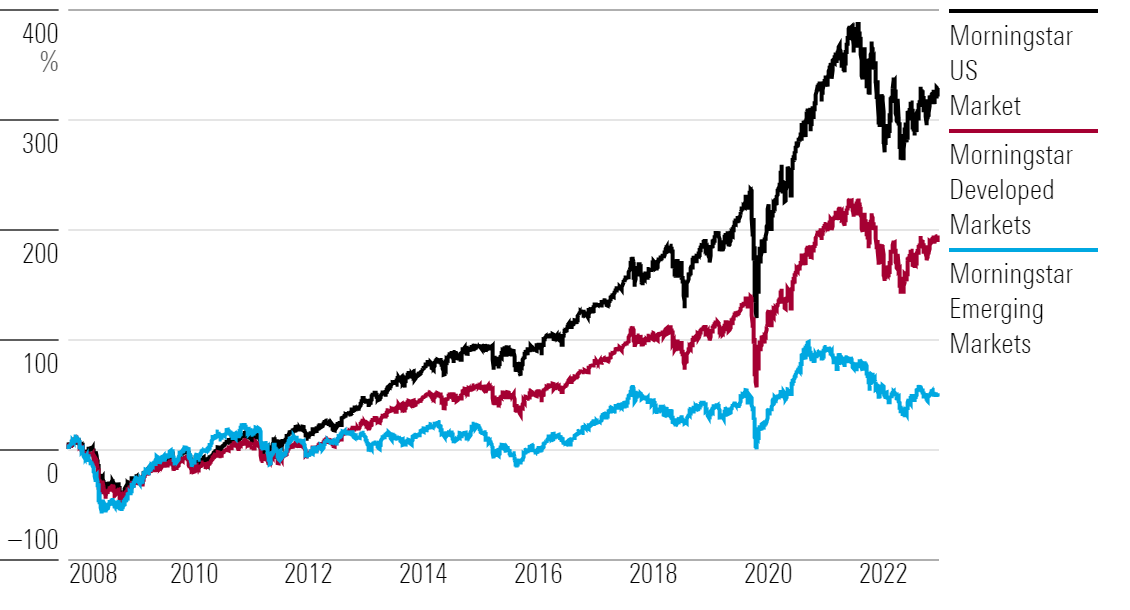

Emerging market equities have underperformed in the past 15+ years. From 2007 to 2023, EM Equities ex-China went sideways with huge volatility, capped by resistance around the 1,450 mark. Multiple attempts in 2011, 2015, 2018 and 2022 failed to break through.

However, since 2024, that ceiling has finally been broken, suggesting a technical breakout after years of stagnation. We could be primed for a decade of strong performance.

During the 2007-2023 period where EM equities struggled, DMs and US markets performed particularly well.

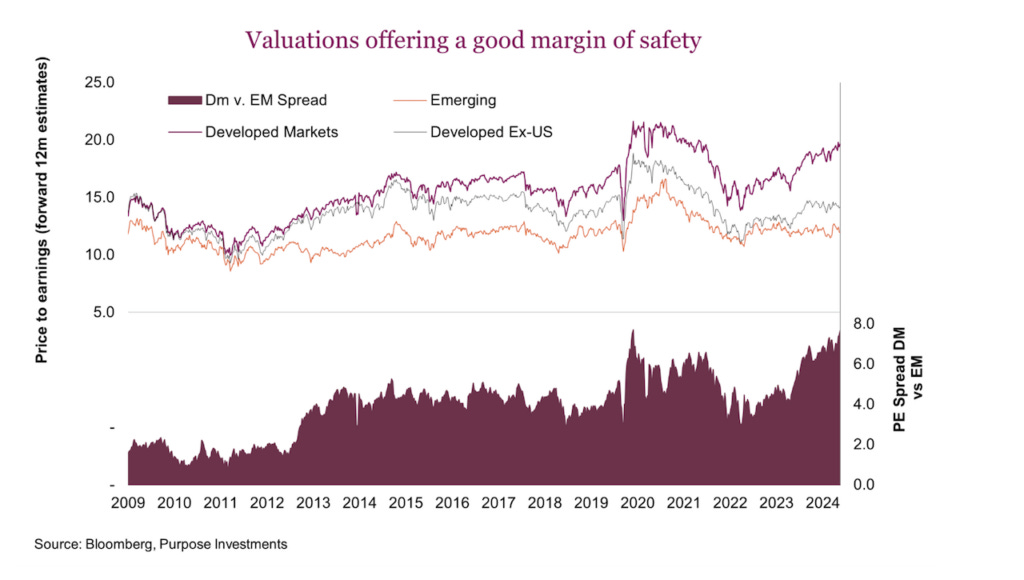

This has created one of the widest valuation spreads in history.

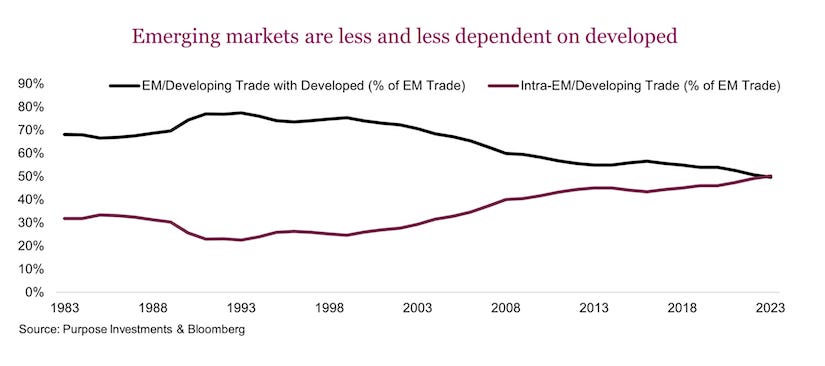

On the fundamentals side, emerging markets are less and less dependent on developed markets.

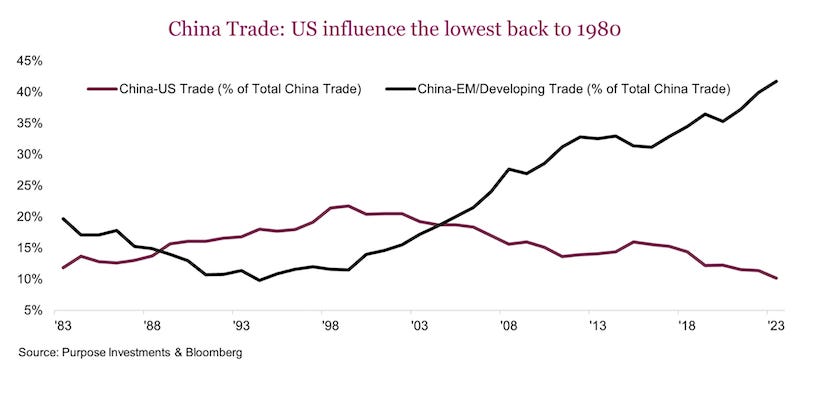

US influence on trade is also the lowest that it has ever been since the 1980s. China instead has soared ahead on influence and with the partnerships it has with EMs around the world, it could be argued that EMs stand to benefit most from this shift.

India, Indonesia, and much of Africa have young, expanding workforces vs. aging populations in the West

Fintech, e-commerce, and super-apps (e.g., Grab, Nubank, Mercado Libre) are scaling faster than in developed markets

EMs now account for 60%+ of global GDP growth, outpacing developed economies

Supply-chain shifts are redirecting investment into EM manufacturing hubs.

China → Vietnam, Mexico, India

Risks and Realities of Investing in EMs

Investing in EMs come with its own set of risks and here are some I can think of:

Currency Volatility

One of the most significant risks in EM investing is currency fluctuation. If you invest in an emerging market stock like Mercado Libre (MELI) that earns in local currencies like the Brazilian real, Argentine peso, and Mexican peso, but reports in US dollars, the perception of growth in USD falls if the emerging market currencies depreciate relative to USD.

That mismatch between perception and reality can drag on the stock, at least until investors re-focus on constant-currency growth. Over the long haul, if MELI compounds its business strongly in local terms, it can outpace the FX headwinds. Also, currencies are cyclical, a weak peso or real today could strengthen later, turning into a tailwind for USD returns.

Political and Regulatory Instability

This is one of the primary concerns that are heard from investors in the West when considering investing in businesses like Grab that operates miles away in SEA.

Politics can be unpredictable anywhere, but the uncertainty is often higher in emerging markets where institutions may be less mature. Changes in government, policy U-turns, geopolitical conflicts, or even nationalisations can occur and rattle investments.

The risk of corruption or weaker rule of law in certain markets is another consideration; corporate governance standards may lag those in developed markets, potentially leading to minority shareholders being at a disadvantage.

Market Volatility and Liquidity

Emerging market stocks and bonds typically exhibit higher volatility than those in developed markets. Sudden sentiment shifts can lead to larger swings in EM asset prices. Part of this is due to the factors above, and part due to liquidity.

Some EM markets have lower trading volumes and fewer institutional investors, meaning that in a risk-off scenario, prices can gap down as buyers disappear. Similarly, EM debt markets can become less liquid in times of stress, leading to wider bid-ask spreads. For the retail investor, this might mean experiencing larger drawdowns in EM investments.

Lastly, the notion of “Western biases” deserves a mention. There’s a psychological aspect where investors from developed countries might have an ingrained bias that EM are uniformly risky or “not worth it.”

I’m personally not sure where this stems from, but perhaps it is a lack of knowledge or memories of past crises (the 1997 Asian financial crisis, or hyperinflations in the past in countries like Venezuela etc).

My Personal Approach & Advice

As most readers will know, I cover emerging markets often as I am relatively familiar with them having studied them for nearly a decade now. I also live in Singapore which is situated very near to many emerging markets in Southeast Asia, a region that has gone from being overlooked to becoming one of the most dynamic parts of the global economy.

When I travel to countries like Indonesia, Vietnam, Malaysia and Thailand, I see how quickly things are changing on the ground. A rising middle class, booming cities and endless opportunities for entrepreneurs.

That’s why I’m drawn to investing here. Emerging markets are messy and volatile, no doubt, but the opportunity is too big to ignore. The combination of young populations, rapid urbanisation, and tech adoption creates a growth runway that’s hard to match in developed markets. And because I live here, I get to see it with my own eyes.

On this Substack, I’ve covered Sea Limited and Grab extensively. I’ve held Mercado Libre stock for years, and one of my most recent deep dives was into dLocal. These case studies are just a few among many examples of businesses that have been hugely successful in the past few decades, largely operating highly-localised operations.

Emerging markets are producing world-class companies that in my view, are evolving into the next Amazon, Uber, PayPal and more.

Ultimately, investing in emerging markets is about recognising where the world’s momentum is building. I believe it is a huge opportunity to own the next trillion dollar businesses at an early stage where the competitive landscape is often favourable for first-movers and elite businesses.

I would urge readers to consider taking incremental steps to increase your emerging market exposure, or at the very least, increase your knowledge exposure to these markets.

The emerging markets of today are simply the developed markets of tomorrow. While the likes of Nvidia, Google, Microsoft and Amazon will continue to be big winners, I think emerging markets continue to be overlooked and may provide better reward-to-risk scenarios.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment, financial, legal, or tax advice. The views expressed are my own and should not be relied upon as a recommendation to buy or sell any securities or financial instruments. Investing in emerging markets involves risks, including but not limited to currency fluctuations, political and regulatory instability, and market volatility. Past performance is not indicative of future results. Please do your own research and consult with a licensed financial advisor before making any investment decisions.

I like the rationale behind this but I'm surprised you're willing to allocate such large portions of your portfolio to EM stocks but I like your conviction!

Also, i'm curious, are you on the lookout for other companies in EM outside or e-commerce/financial? To me it feels like a little to much concentration on the same themes across these EMs? I know that's where the tailwinds are but wondering if youre looking at other themes as well?

Great article, a few questions:

Outside of the technical breakout, haven't the emerging market trends or what makes them appealing been true for the past decade? I.e nothing necessarily new?

For the political risks, how would you address those? I.e does it make sense that these stocks should be valued lower because of these particular risks, specially vs the U.S? Do you forsee any of these countries potentially shifting towards a China type of strategy/economy in the future?