Takeaways from the definitive SEA report

Breaking down the structural shifts and what they mean for SEA equities

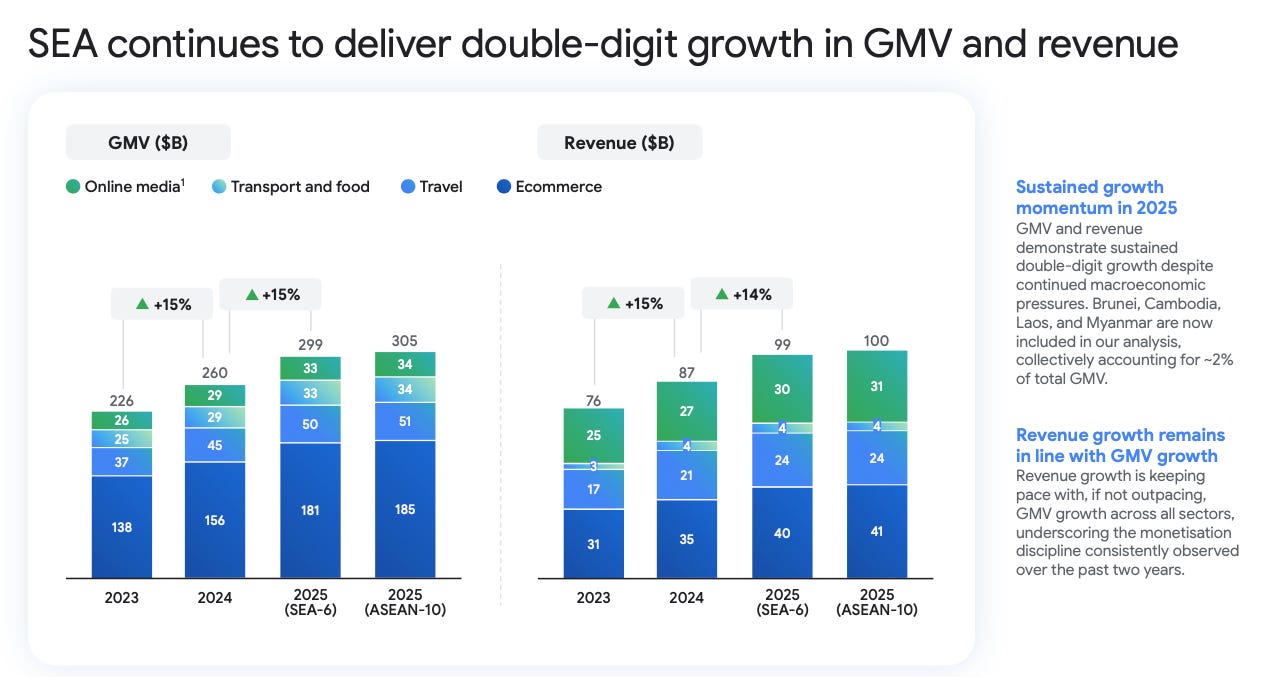

Southeast Asia’s digital economy crossed US$300B in GMV in 2025, nearly 50% higher than what the very first e-Conomy SEA report projected 10 years ago.

A short introduction to the e-Conomy SEA report: this is a landmark annual study of Southeast Asia, particularly focused on the digital economy. It was first launched by Temasek and Google in 2016, with Bain & Company joining as lead research partner in 2019. It tracks and analyses the digital economy of Southeast Asia across several sectors: e-commerce, travel, food & transport, online media & digital financial services.

In my opinion, it is mandatory reading for all SEA investors as it provides an independent, data-driven view of the region’s digital economy. Particularly, how large the opportunity is, trends, investment flows, and challenges.

The e-Conomy SEA 2025 report is 81 pages and covers four major themes. To make the insights more usable for investors, I am breaking it into two parts.

Part 1 focuses on the fundamentals of the digital economy today. It examines the 9 core sectors that currently drive GMV and revenue in Southeast Asia:

e-commerce, food delivery, transport, online travel, online media, payments, lending, wealth and insurance.

In other words, this is the “current state of play”. Who/what is growing, why they are growing and which monetisation strategies are working right now.

Specifically, I will breakdown:

the structural shifts reshaping Southeast Asia’s digital economy

the new monetisation engines driving platform profitability

the AI disruption that will reshape demand and intent

the Digital Financial Services battleground

most importantly for many of us, how each of these forces directly affects Sea Limited and Grab.

Table of Contents

Introduction

Lesson #1: Consolidation is now the main driver of profitability

Lesson #2: Monetisation matters more than GMV growth

Lesson #3: AI is a double-edged sword

Lesson #4: Ecosystem lock-in is key

Lesson #5: Digital financial services are becoming the core monetisation engine

Lesson #6: Cost discipline is structural, not temporary

Lesson #7: Platforms are more important than Meta and Google in SEA

Concluding Thoughts

Introduction

It’s clear to see that the Southeast Asian digital economy has shifted drastically in the past 2-3 years.

The first decade of SEA’s digital economy was largely about:

user growth

convenience

adoption

The companies that performed best in this era were those that could onboard users rapidly, subsidise usage (which required enormous amounts of capital), expand across geographies, and remove friction from previously offline transactions.

That operating environment has clearly changed. Today, nearly everyone who will meaningfully participate in the digital economy is already online. Penetration is high across e-commerce, food delivery, payments, and mobility. Incremental new users are no longer moving the needle, and investors are demanding profits over growth.

Hence, I believe the next decade is about:

monetisation

profitability

AI-driven conversion

regulatory navigation

The companies that can layer multiple monetisation lines on top of their existing and incoming user base will compound faster than those dependent on incremental GMV. Companies that cannot self-fund growth will no longer gain market share through subsidies like before. Profitability discipline has now become a competitive requirement rather than an optional milestone.