Taiwan Semiconductor (Deep Dive)

The Foundry that runs the World

When people think of chips, they often think Nvidia, Intel, or AMD.

Yet, the most important company in the chip world is none other than an unassuming business located halfway around the world from the major players.

That business is Taiwan Semiconductor, or TSMC for short.

From iPhones to Data Centers to AI Clusters, the digital era runs on silicon crafted by TSMC.

This will be a shorter than usual thesis, as I believe it is a relatively simple business for investors to understand, should they take the time.

Enjoy!

Table of Contents

What does TSMC do?

TSMC is the dominant player

Founder & Culture

Bull Thesis

Why Now?

The Risks and the Bear Case

GabGrowth Quality Score

Valuation

Concluding Thoughts

1. What does TSMC do?

Apple, Nvidia, AMD, Qualcomm, Broadcom design chips.

TSMC manufactures them.

And it is the best in the world at it. By far. How do we determine it?

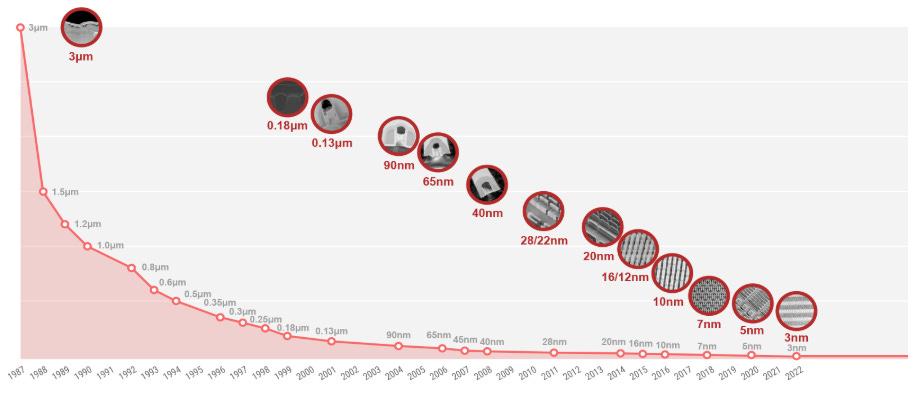

First, we need to understand that the chip world is fundamentally ruled by “Moore’s Law”.

“Moore's Law is the observation that the number of transistors on a microchip doubles roughly every two years. This trend has been a driving force in the exponential growth of computing power and efficiency, leading to the development of smaller, faster, and more affordable devices.”

This has become a sort of rule of thumb in the tech world. For decades, this has been true, and is the key reason why computers and phones have gotten faster and cheaper over time.

In order to facilitate that, TSMC and others (Samsung, Intel) have worked to create smaller chips (7nm, 5nm, 3nm etc)…

At a fundamental level, smaller chips (or more accurately, smaller transistors) allow you to:

Pack more transistors onto the same chip area

Increase computing power (more logic units = more operations)

Reduce power consumption and heat

Lower costs per transistor (in theory, though this is now hitting limits)

This explains why chips are key, and why TSMC is a foundational player.

2. TSMC is the dominant player

As of Q4 2024, TSMC had a 67.1% market share as its rivals continue to struggle in keeping up.

For context, its largest rival Samsung had a mere 8.1% market share.

How does TSMC do this?

Technology Leadership:

TSMC has been the first to mass-produce cutting-edge nodes (7nm, 5nm, 3nm, and soon 2nm).

It consistently beats Intel and Samsung on yield, performance, and energy efficiency.

Its proprietary manufacturing techniques (like EUV lithography and CoWoS packaging) are years ahead in reliability and cost.

Scale and Execution:

TSMC produces 67% of the world’s chips and nearly 90% of the most advanced chips.

Massive CAPEX spend to the tune of $36B allows them to build and scale fabs faster than anyone else.

Trust and Customer Alignment:

TSMC is a pure-play foundry. It doesn’t compete with its clients.

Designers like Apple, Nvidia, AMD trust TSMC with their most sensitive IP.

This enables them to co-develop process technologies years in advance.

Advanced Packaging and Vertical Integration:

Beyond wafer production, TSMC leads in chiplet integration, 3D stacking, and advanced packaging (CoWoS, SoIC).

These are key enablers for AI chips and next-gen server processors (e.g., Nvidia, AMD, Amazon).

3. Founder & Culture

TSMC was founded in 1987 by Morris Chang. Morris’ history is one of the most interesting of any founder i’ve come across. He was 55 when TSMC was founded, an age where most would have retired (as he planned to). I will not delve too deep into the details here but Acquired’s episode on TSMC and interview with Morris Chang are a great resource.

Morris Chang fundamentally reshaped the semiconductor industry by pioneering the pure-play foundry model. Unlike vertically integrated chipmakers like Intel, TSMC focused solely on manufacturing chips designed by others, a decision that proved transformative.

Under current CEO C.C. Wei, TSMC continues to lead the industry with a disciplined, execution-first mindset. There are no shortcuts, only roadmap-driven innovation, long-term thinking, and deep alignment with global chip designers. C.C. Wei has been the CEO for the last 7 years and an employee at TSMC for the past 27 years.

4. Bull Thesis

My bull thesis revolves largely around TSMC being an indispensable part of modern computing and possibly the biggest winner of the AI era.

TSMC is the only scalable producer of 3nm chips, with 2nm on deck

The major tech conglomerates are locked in for half a decade to come, and are dependent on advanced node production.

i.e., Apple, Qualcomm, Nvidia, AMD

AI demand continues to surge, and TSMC is the picks-and-shovels provider:

LLM Race: OpenAI (ChatGPT), Anthropic (Claude), xAI (Grok), Google (Gemini), Meta (Llama), Perplexity etc…

Inference & Training Race: Nvidia, AMD, Intel, Cerebras, Groq etc…

Custom Silicon Race: Nvidia, Google, Amazon, Meta, Microsoft, Apple etc…

AI Cloud Infrastructure Race: AWS, Azure, Google Cloud, Oracle, CoreWeave, Lambda Labs

5. Why Now?

TSMC has emerged from its cyclical downturn and growth is inflecting.

Revenue grew by 35% in Q1 2025.

It is expected to grow between 37-41% in Q2 2025, signalling an acceleration.

The market fundamentally believes that this is a cyclical business, I believe this is the new normal.

6. The Risks and the Bear Case

The obvious elephant in the room is in the name of the business.

Taiwan Semiconductor Manufacturing, more specifically, the first word.

Taiwan is a key geographical area of geopolitical tension between China and the West due to issues of sovereignty. Taiwan was initially a part of China, prior to the Kuomintang’s (CCP’s rival) relocation to the peninsula.

A potential invasion or blockade by China would indeed pose an existential threat to TSMC’s operations, global chip supply chains, and global markets at large. I personally treat this as a low-probability risk, but it does remain a persistent overhang on the company’s long-term investment case and is a potential reason for its relative undervaluation.

Beyond geopolitics, there are 2 key risks to consider:

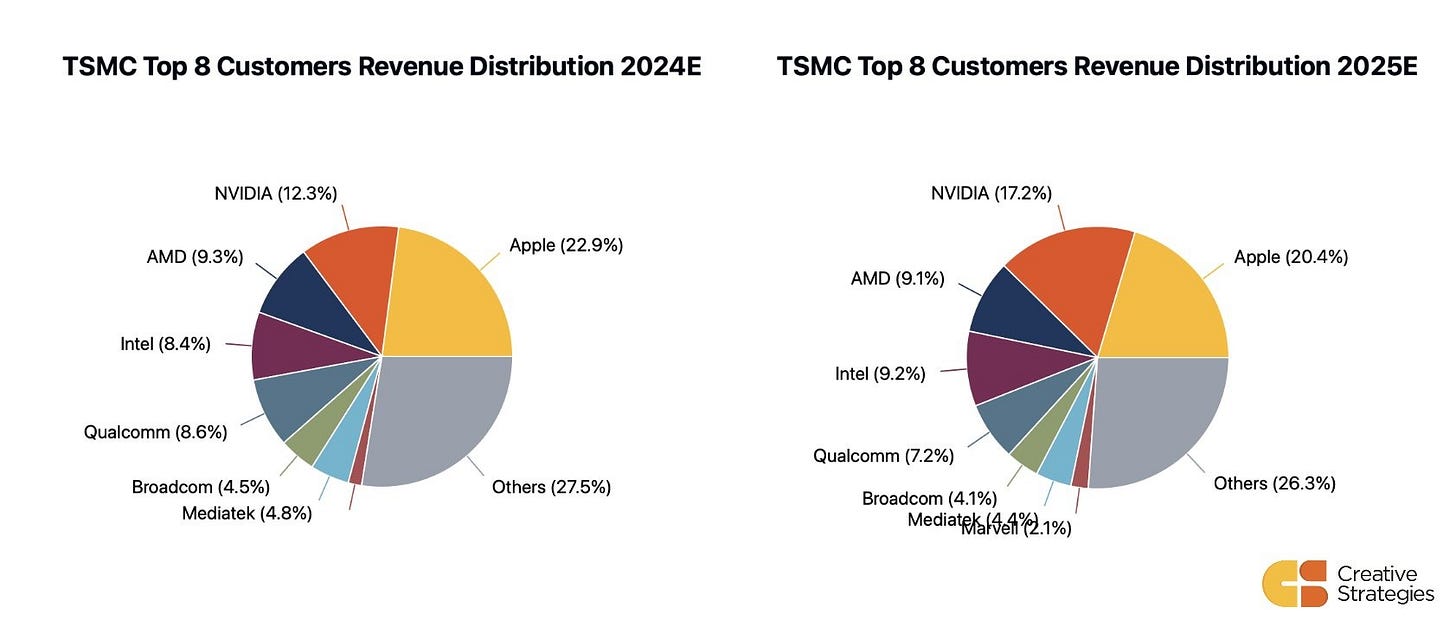

Customer Concentration: Apple and Nvidia specifically represent significant portions of TSMC’s revenue. A loss or weakening of these relationships would severely impact financial performance.

CAPEX and Cyclicality: TSMC runs a highly capital-intensive business, with over $30B of investments annually in cutting-edge fabs to maintain its lead. While this helps it to build an unassailable moat, it also exposes the company to demand cyclicality in semis and declining returns on incremental fabs if overcapacity arises.

7. GabGrowth Quality Score

TSMC scores a 15.5/20 on my Quality Score, deeming it a “High Conviction” pick. I will detail my scoring in a separate post later for brevity of this article.

The key points that TSM lost out on were:

Skin in the Game: While C.C. Wei is an extraordinary operator and a CEO I deem to be a visionary, I much prefer founders being in charge, therefore deducted half a point here.

Asset Light Model: TSM loses points on being a relatively CAPEX heavy business.

Optionality/Multi-Product Potential: TSM runs a fantastic business, but there are certainly questions to be had in terms of optionality of the business. It is singularly focused on the mission of providing the best chips in the world, and so it should.

Regulatory/Geopolitical Risk & Customer Concentration Risk:

As detailed in the risk section, these are ultimately the biggest concerns for a business like TSMC.

8. Valuation

TSMC trades at a forward P/E of just 21.6x while it is expected to grow its earnings at ~33%.

I believe this is extremely modest given its dominant position in an industry with decades of secular growth ahead.

My simple DCF calculation gives me a bull/base/bear 5Y target of $899, $353, $200 respectively. Giving each an equal weightage leads me to arrive at $484 which implies a 19% p.a. return from the current price of $202.

Ultimately, my thesis around valuation is that TSMC is a relatively cheap/fairly priced business that the market doesn’t yet realise is a key driver and indispensable part of the coming AI/Computing wave.

9. Concluding Thoughts

TSMC plays a crucial and foundational role in the global semiconductor industry, which I view to be the most important industry in the coming decade or two.

It is the key manufacturing partner behind the world’s leading chip designers and has an absolutely dominant position in advanced nodes and a strong multi-decade track record of execution.

While there are risks to the business, I believe they are priced into the stock.

For those reasons, I believe TSMC offers an opportunity for investors to own a structurally important business with durable cash flows, and solid compounding potential.

Disclaimer: I am long Taiwan Semiconductor Manufacturing Company Limited. The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

Great analysis! Only company more important in this space is Asml.

Excellent analysis on TSMC's moat! The geopolitical risk is real, but what strikes me is how TSMC's manufacturing excelence at 3nm and below creates a decade-long window before competitors can catch up. The capital intensity alone (facilities cost $10B+) is a massive barrier.