Shopee v TikTok Shop

The Battle of 2 Giants for SEA E-Commerce Dominance

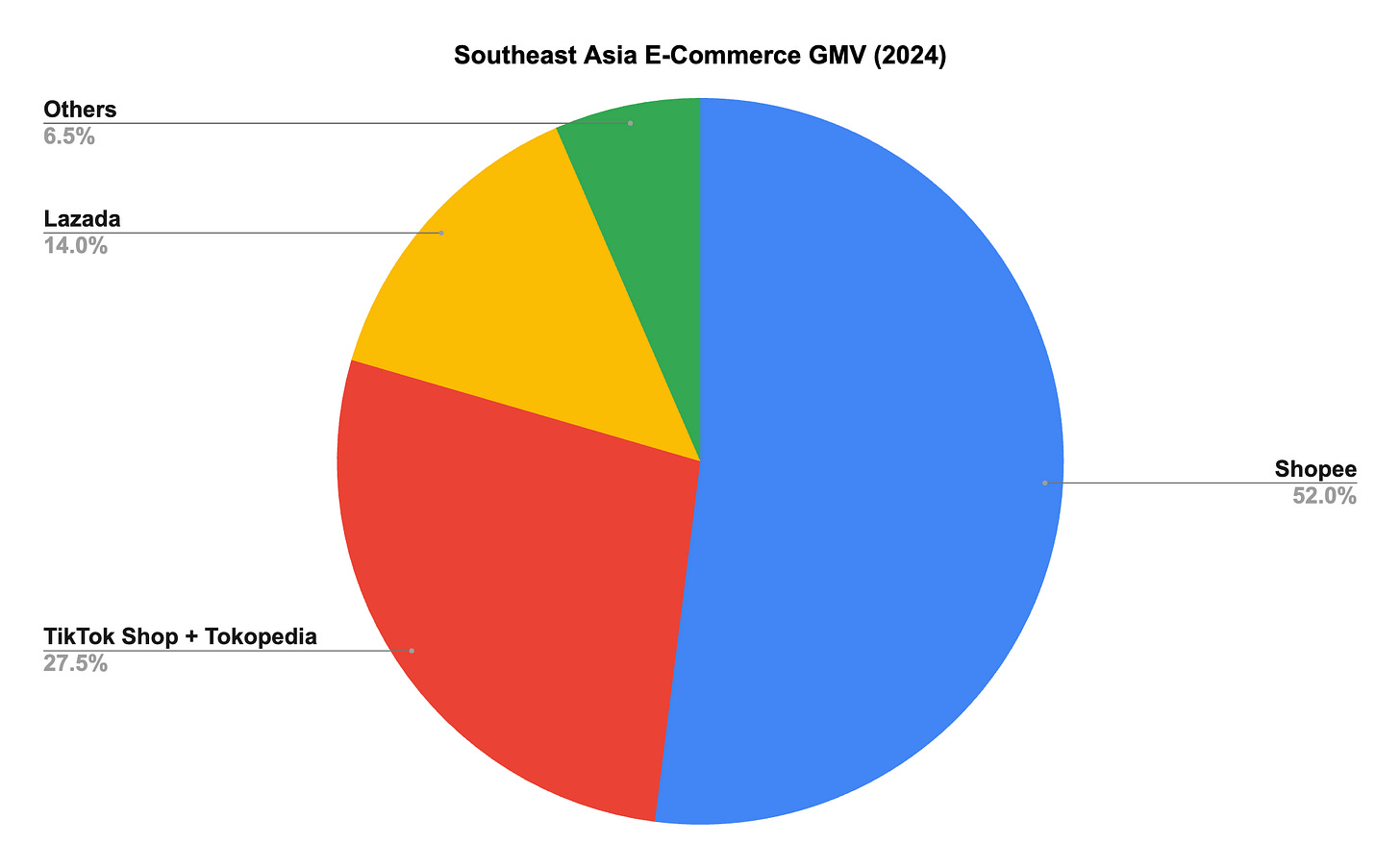

Market Share Dynamics

E-Commerce in Southeast Asia is a huge and growing pie. As per 2024 numbers from Momentum Works, GMV in 2024 was $128.4B.

Incredibly, e-commerce GMV in the region has continued to grow at double-digits despite the law of large numbers. At a similar cadence, we can expect this to be a $200B market by 2028/2029.

Of the current e-commerce pie, the largest player continues to be Sea Limited, increasing its market share to 52%, from 48% in 2023.

TikTok Shop meanwhile surged from 4th to 2nd place, gaining considerable market share, currently owning ~17.6% of the market.

In 3rd place, we have Lazada, which continues to stagnate with its 3rd consecutive yearly decrease in overall GMV numbers. Its market share declined to just 14%.

In 4th place, we have Tokopedia, the local Indonesian champion that had 75% of its shares acquired by TikTok Shop in December 2023.

It is pretty clear to see that TikTok Shop is actually relatively far ahead in 2nd place, when we consider its ownership of Tokopedia.

Adding up their GMV’s, we arrive at a total of $35.4B for 2024, totalling 27.5% market share.

In essence, we now have the big 3:

Shopee: 52%

TikTok Shop+Tokopedia: 27.5%

Lazada: 14%

Judging by the trajectory of both businesses and the increasing importance in social/video-commerce, it is quite likely that we see a two-horse race at the top.

For context, Video Commerce now makes up >20% of SEA’s e-commerce GMV, a four-fold increase from 2022. The rise of Gen Z also plays a crucial factor: 8 in 10 Gen Z consumers in SEA prefer shopping that includes entertainment.

The question is: which of Shopee or TikTok Shop will come out as winners?

That is what I will attempt to uncover today.

Two Vastly Different Commerce Engines

Traffic Model:

Shopee is the incumbent here of the two with search, ads and mega-sale events dominating traffic flow, supplemented by in-app games and vouchers.

TikTok Shop on the other hand drives traffic through its content algorithm, pushing products inside an entertainment feed; discovery is video-first and influencer-led (60% of GMV already comes via creators; data from the US).

Logistics:

Shopee has its proprietary shipping business, SPX Express that handles about 10 million parcels a day, and over 50% of its total orders in Southeast Asia. The remaining orders are handled by third-party logistics (3PL) partners.

TikTok Shop has no proprietary shipping network, relying solely on 3PL partners, reducing its margins and meaning less reliability around order fulfilment.

Traffic Partners:

Shopee has struck a YouTube Shopping tie-up since 2024. Today, users from 6 countries in Southeast Asia have the ability to purchase straight from video links.

That partnership has been wildly successful. Some stats from the Shopee-YouTube partnership:

YouTube users are 98% more likely to trust creators' product recommendations than those on other social platforms

Purchase intent is 3.8x higher on YouTube than other social platforms

Southeast Asia now accounts for 2/3 of YouTube Shopping's global rollout

In 2024 alone, video-based sales accounted for 20% of the region's e-commerce GMV

TikTok Shop, of course, relies solely on its dominant sister network to garner traffic.

Competitive Pressure Points

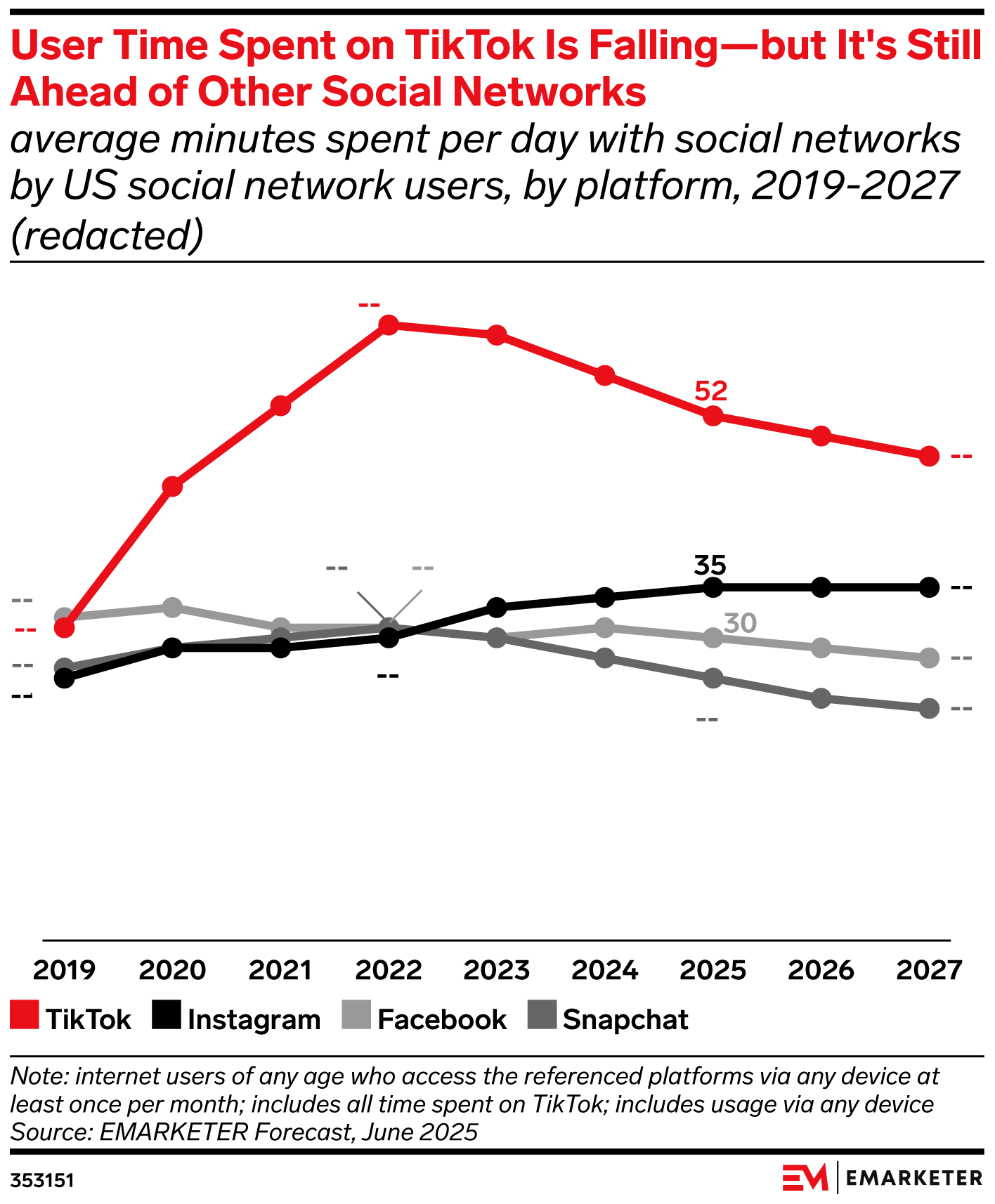

Consumer Time Spent:

TikTok already owns more daily minutes than every shopping app out there. Every incremental hour of scrolling is a chance to convert impulse into checkout, eroding Shopee’s top-of-funnel advantage.

However, what is key here is that time spent does not equal to buyer conversion.

Users of TikTok are there for entertainment, with purchases largely driven by impulse-buying. Shopee however, is driven by intent buying. Users of Shopee open the app for 2 main reasons:

They have something in mind that they need to buy

They want to shop and intend to buy something

In both cases, their end goal is a purchase.

This means that while TikTok may garner 4-5x the amount of consumer time spent, Shopee could very well be converting >10x the number of users. In aggregate, that leads to a win for intent-driven purchasing (Shopee).

Fulfilment Reliability

The SPX Express network is a major differentiator for Shopee. As of 2024, it was the 2nd largest player in Southeast Asia with ~24% market share. The leader was J&T Express, with ~26% market share. It is inevitable that SPX Express continues to grow its market share, with a high likelihood that it becomes the largest player and handles 100% of its own orders.

TikTok however, leans on Tokopedia and external couriers. Hence, delivery speed could be a critical differentiator as consumers grow less tolerant of slow shipments.

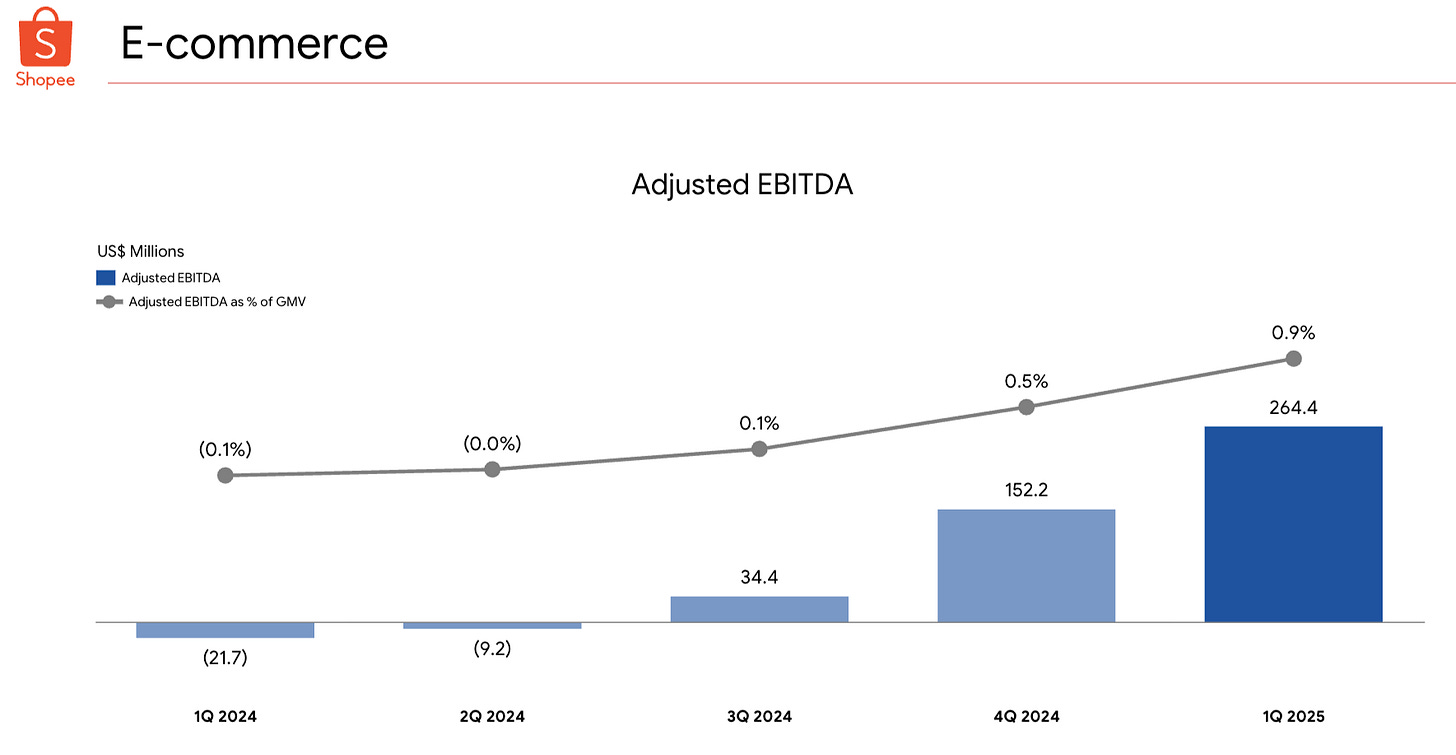

Path to Profit

Shopee turned its first-full year of adjusted EBITDA profit in 2024 and its take rates have continued to climb despite signs of competition not backing down. That is certainly a positive sign for Sea Limited shareholders.

TikTok Shop is currently still in land-grab mode and heavily subsidised by ByteDance cash flows, a not-too-different position from Shopee of yesteryear (relying on Garena).

Strategic Outlook

Shopee is likely to push deeper into video-commerce to defend attention share, leveraging its YouTube partnership and in-house streamers. We are likely to see continued fee hikes as Shopee leverages its superior network and market share.

TikTok Shop will have to focus on building its proprietary logistics networks, although it is uncertain if they will decide to considering its focus on being primarily a tech business.

Brands are likely to continue “dual-homing”, treating TikTok as its platform for discovery and Shopee for dependable fulfilment and high-velocity mega sales. However, allocation of ad dollars will follow the platform that proves the lowest blended cost per order.

My personal view is that Shopee will keep the largest share of the market; particularly the habitual “planned” purchases, while TikTok captures an outsized slice of impulse and new-product sales. It is likely that both businesses gain at the expense of Lazada, leading to a potential 70-30 split in the long-run.

What I’m personally watching

I am observing this battle closely (especially since Sea Limited is my largest position), and doing channel checks on the success of Shopee’s YouTube partnership in particular.

I believe the key items to watch out for moving forward are:

Ad-Take Rates of both platforms

Fee Changes of both platforms

Logistics Moves

Regulatory Implications

Not to worry, I will update subs should any significant changes happen.

If you missed my recent deep dive on Sea Limited, I would highly recommend checking it out:

If you enjoyed this piece, please share it with a friend or two, and drop a like.

Thank you!

Thanks for the analysis, just wondering if you have the stats for the differences between delivery lead time of Shoppe and TikTok Shop?