Sea Limited Q3 2025 Earnings Review

Yet another stellar top-line beat... but some profitability concerns?

Revenue: $5.99B v $5.62B (+38.3% YoY) 🟢

EPS: $0.63 v $0.74 (+142% YoY) 🔴

Selected Key Metrics

Total Gross Profit: $2.6B (+39.7% YoY)

Total Net Income: $374.99M (+144.6% YoY)

Total Adjusted EBITDA: $874.25M (+67% YoY)

Cash & Cash Equivalents: $10.5B

E-Commerce (Shopee)

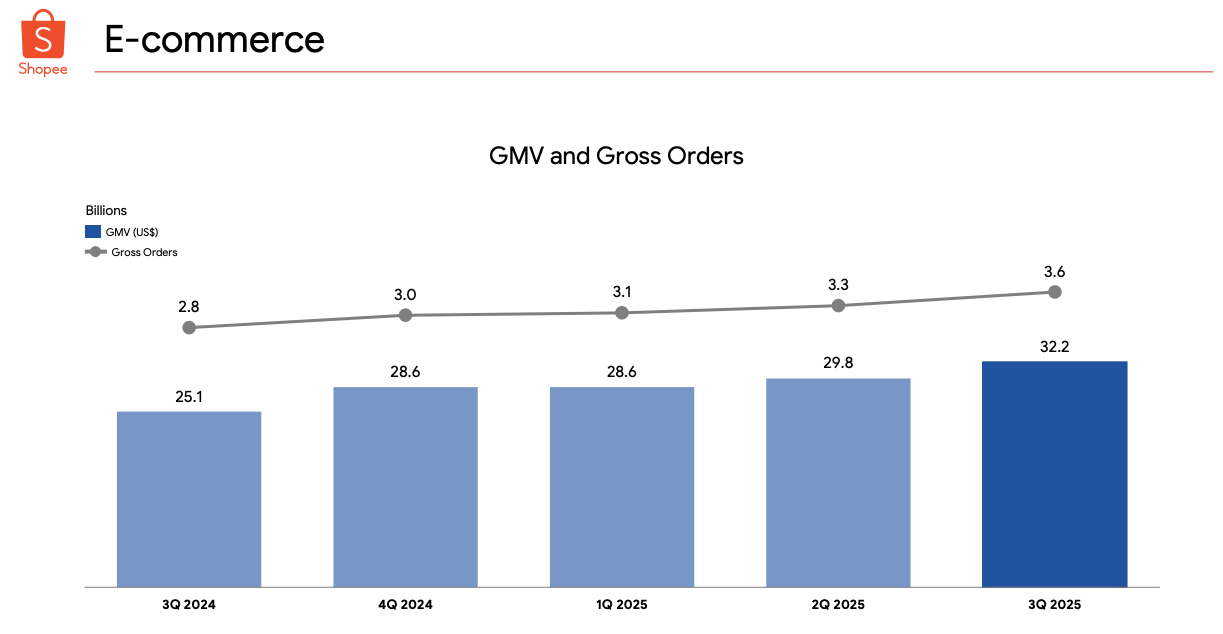

Gross Orders: 3.6B (+28.4% YoY)

GMV: $32.2B (+28.4% YoY)

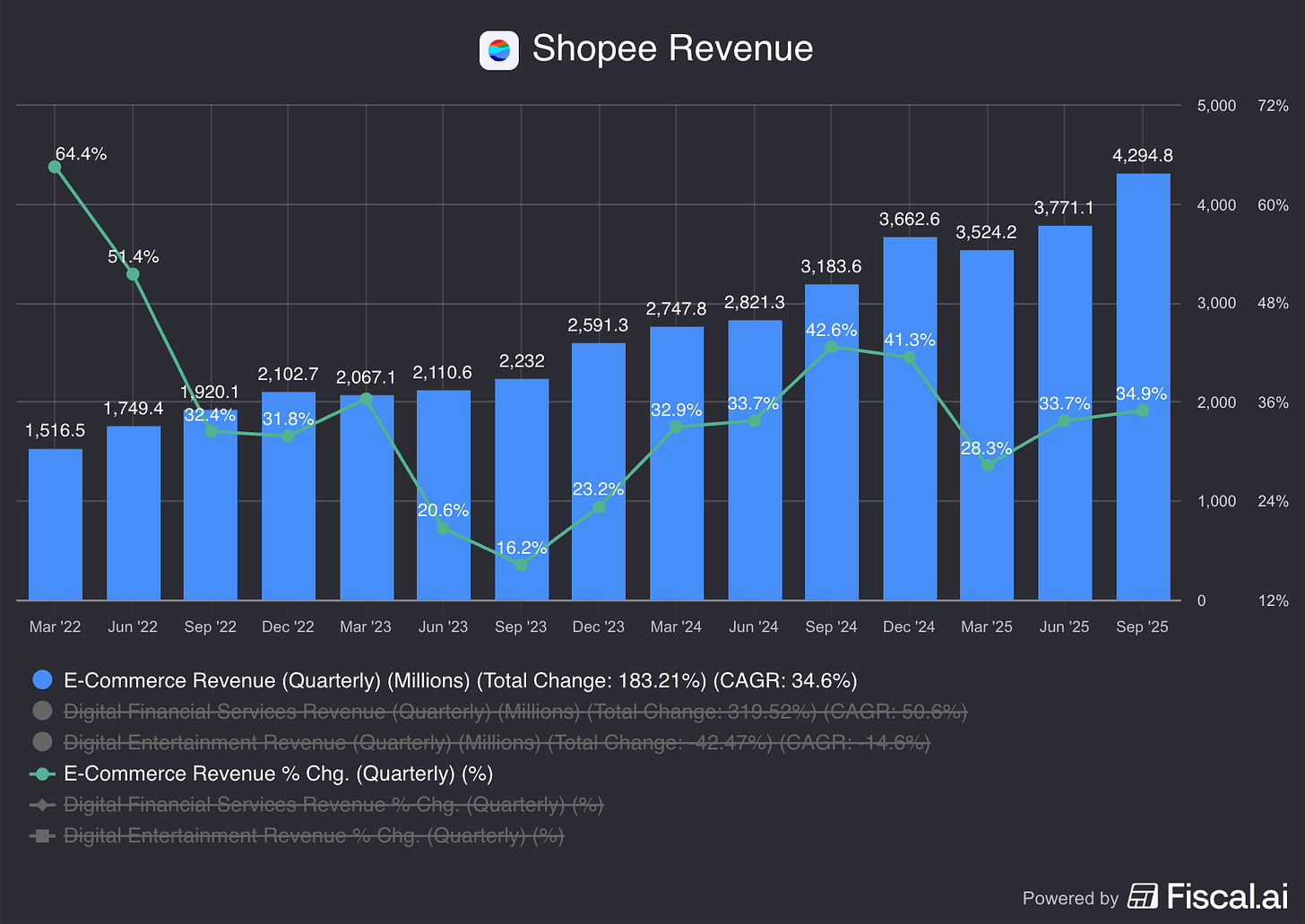

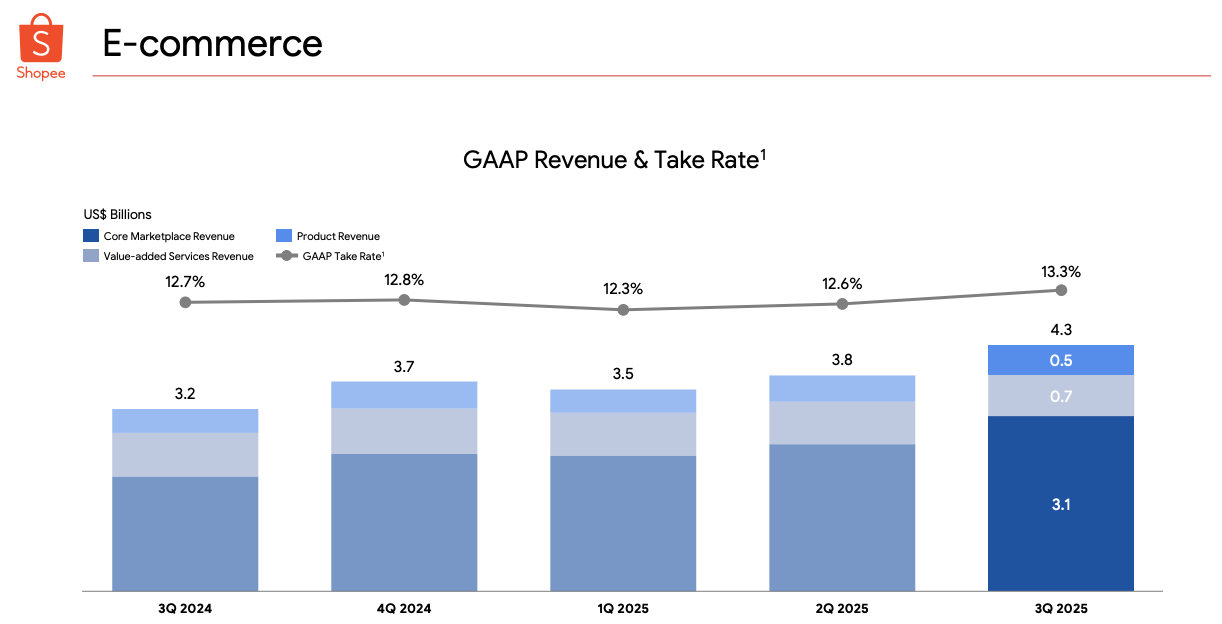

Revenue: $4.3B (+34.9% YoY)

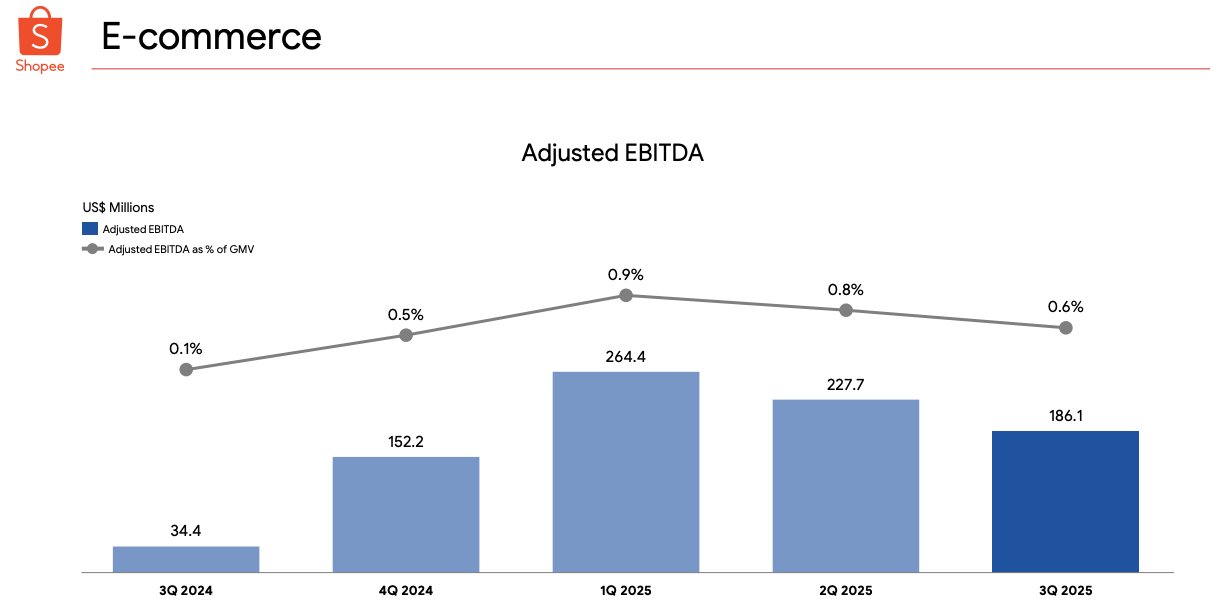

Adjusted EBITDA: $186.1M v $34.4M (+441% YoY)

Digital Financial Services (Monee)

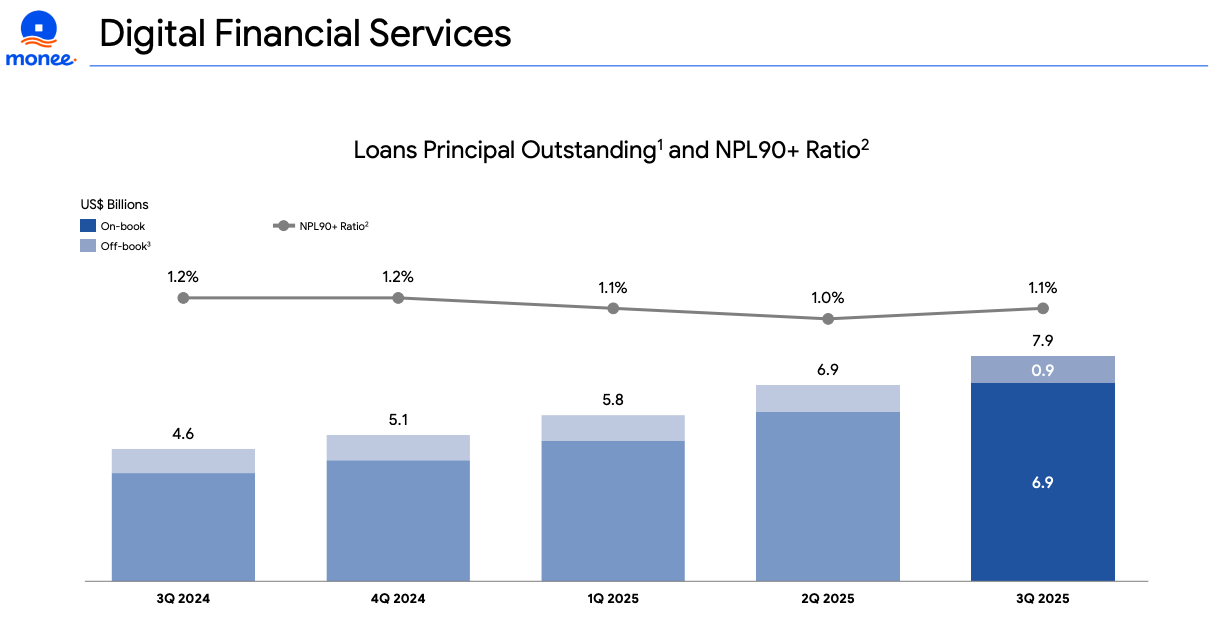

Consumer & SME Loans Outstanding: $7.9B (+69.8% YoY)

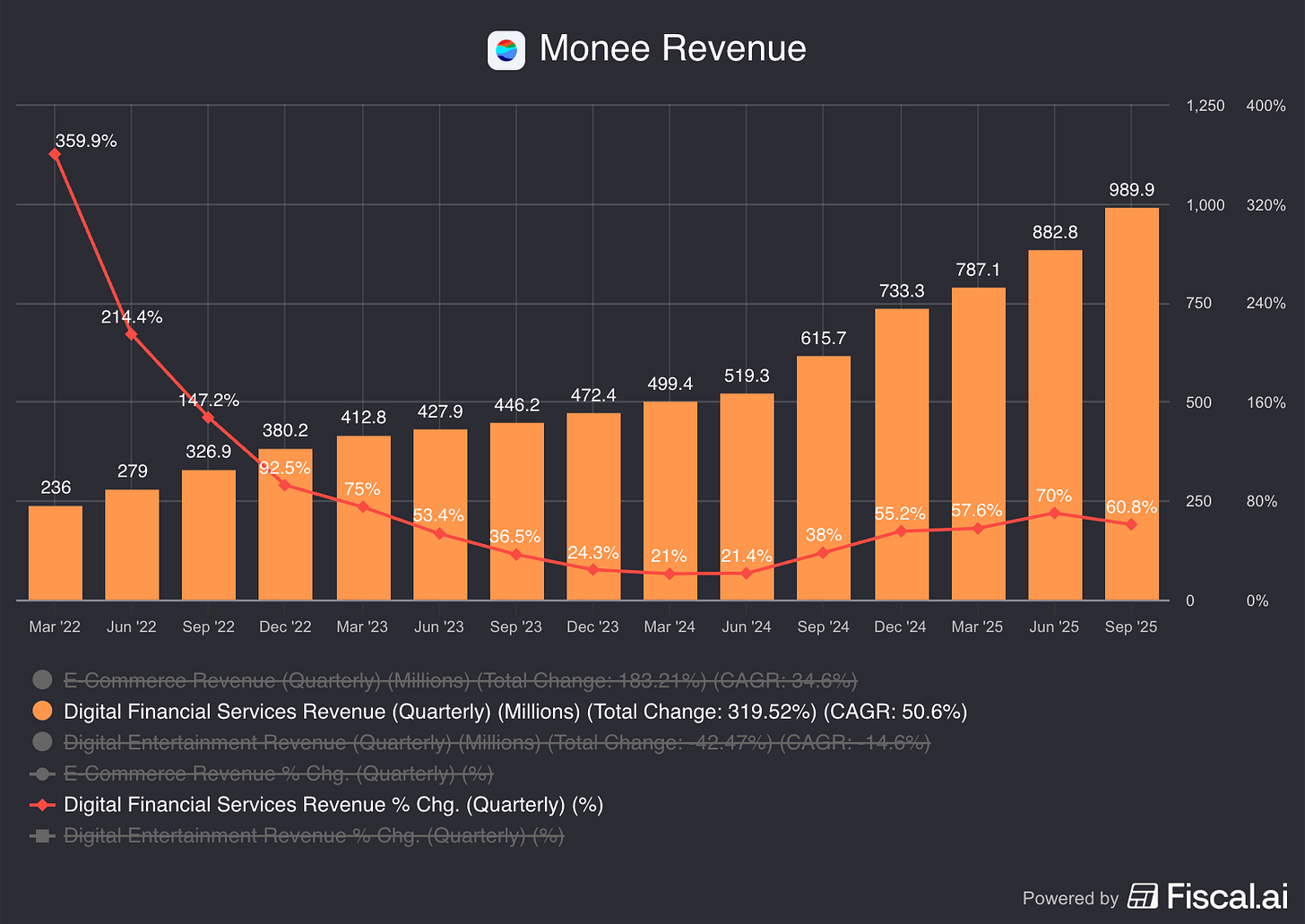

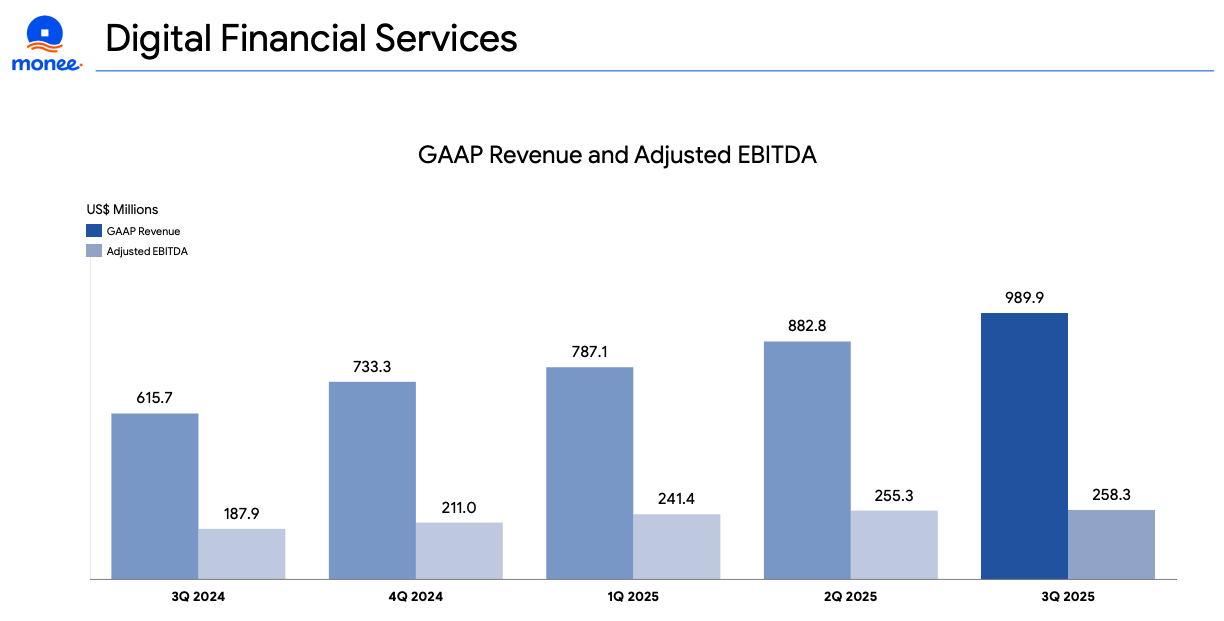

Revenue: $989.9M (+60.8% YoY)

Adjusted EBITDA: $258.3M (+37.5% YoY)

Digital Entertainment (Garena)

Bookings: $840.7M (+51.1% YoY)

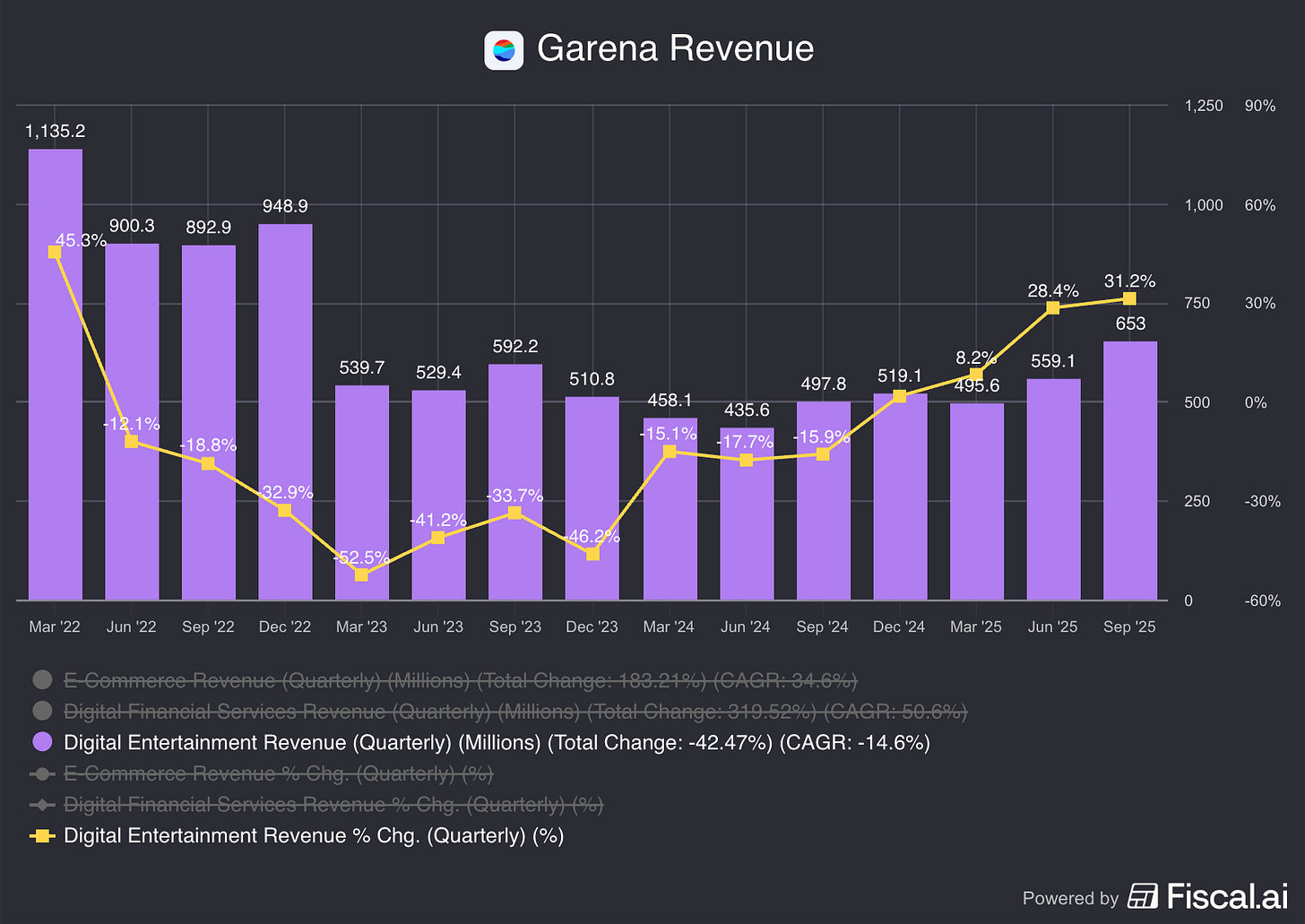

Revenue: $653.0M (+31.2% YoY)

Adjusted EBITDA: $465.9M (+48.2% YoY)

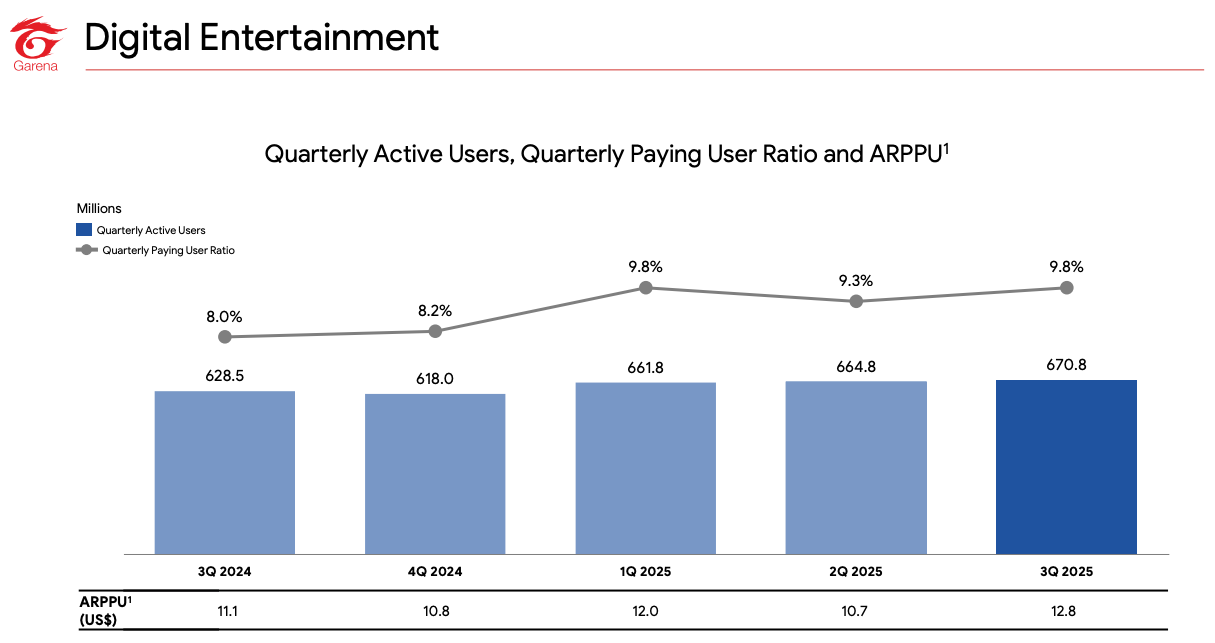

Quarterly Active Users: 670.8M (+6.7% YoY)

Quarterly Paying Users: 65.9M (+31.2% YoY)

This was one of the strongest quarters I’ve seen for Sea Limited. All 3 segments performed well, with Shopee and Garena seeing acceleration in revenues despite operating at massive size.

As I’ve discussed often, my base case is >20% growth for the decade to come. Growth is certainly not slowing, in fact it is accelerating. I believe the market continues to not price in that durability of growth.

In this piece, I will break down the full report, earnings call and discuss my personal thoughts on the quarter.

Table of Contents

Shopee (E-Commerce)

Monee (Digital Financial Services)

Garena (Digital Entertainment)

Management Commentary

Concluding Thoughts

1. Shopee (E-Commerce)

Shopee’s GMV continued climbing to record highs, with GMV now at an annualised $128.8B run-rate. Sequentially, GMV grew 8% QoQ, compared to 4% QoQ in Q2 2025, signalling yet more acceleration in the business.

Adding up the first 3 quarters, GMV for the 9 months of 2025 is now $90.6B.

Management’s expectations at the start of the year was for 20% growth in Shopee GMV for FY2025. FY2024 GMV was $100.5B, which meant $120.6B expected GMV for FY2025. To match that, Shopee would need to achieve just $30B in GMV for Q4, the seasonally strongest quarter for the business.

Management has hence raised guidance for Shopee’s full year GMV growth to be more than 25%. To be precise, that would mean Q4 GMV of at least $35B.

Revenues came in at $4.3B for the quarter, lifted by record take rates of 13.3%. This was good to see considering the QoQ fall in Q1 this year. As I discussed in the previous earnings review, I was expecting higher take-rates in Q3 and expect it again in Q4.

There was certainly some concern by the market regarding the reduction in Adj. EBTIDA for Shopee to 0.6% judging by the 6% fall during pre-market.

While I believe these concerns are valid, I am personally not surprised. I believe Shopee’s margins are likely to range between 0.5% to 1.5% for the foreseeable year as long as growth remains strong.

It is to the benefit of long-term shareholders of the business that management continually re-invests to attain more market share if the opportunity presents itself. Management did comment on this, with them stating their intention to invest in more fulfilment to create a wider competitive moat and to reduce cost to serve.

Logistics (SPX Express)

This quarter reiterated my belief that SPX Express is becoming the structural advantage that others cannot replicate.

““We deliver by truck, plane, boat, motorbike… even across rivers, rice fields, and homes without addresses.”

“SPX Express is now a clear leader in scale, coverage and cost in our Asia markets.”

A few proof points shared by management:

Taiwan automated lockers scaled to 2,500 locations in under 3 years

They now handle 70% of deliveries

They run at 30% lower cost-per-order vs traditional pick-up points

Also double as last-mile hubs for home delivery

Meanwhile, its localised delivery strategy in Indonesia drove

+35% YoY orders for instant delivery in Jakarta (upper mid-market)

+45% YoY rural orders outside Java (lower mid-market)

Shopee is tackling each segment with a specialised approach that only comes with truly understanding its customer base.

As its logistics business scales, Shopee is now focused on enhancing its fulfilment capability, which unlocks higher consistency, higher seller lock-in, higher margins, lower delivery friction and more volume per merchant.

Shopee VIP

Management also shared more about the Shopee VIP program that is beginning to show strong results as it ramps up.

“VIP members spend 40% more after subscribing… buy 3x more frequently and spend 5x more than non-subscribers.”

Across Indonesia, Thailand and Vietnam, VIP members surpassed 3.5 million members, up more than 75% from the previous quarter (!)

Shopee - YouTube Partnership

Sea also shared that their partnership with YouTube continues to gain strong traction, with Shopee orders driven by YouTube content across Southeast Asian markets growing more than 30% QoQ.

They have since expanded their partnership to Brazil.

Shopee Brazil

“Brazil GMV continues to outpace the market, while maintaining positive EBITDA”

Management attributed this to its wide product assortment, highly competitive pricing and structural cost leadership that is enabling them to scale rapidly and profitably.

Shopee continues to invest in sustainable competitive advantages through improvements in delivery speeds and have also expanded into more upmarket product categories. This was reflected by the GMV for ShopeeMall more than doubling year-on-year in Brazil.

Management also mentioned delivery speeds improving sequentially in Q3 with average delivery time improving by about 2 days compared to a year ago. In the Greater São Paulo area, one in three parcels were delivered the next day and nearly half within two days.

Ad Monetisation

Shopee saw ad revenues increase over 70% and ad take-rates increasing by more than 80bps YoY. There was also a large increase in sellers using Shopee’s ad products, at >25% and average ad spend increasing over 40% YoY.

2. Monee (Digital Financial Services)

Monee saw yet another record quarter in loans principal outstanding, albeit with slower sequential growth. Its loan book grew ~70% YoY to $7.9B while the NPL ratio held steady at 1.1%.

Management shared that Monee added over 5 million new first-time borrowers, largely as a result of shifting from a whitelist approach to an “all can apply” approach. This is exactly what Monee is set out to do, enabling the underbanked and 77underserved. Active borrowers are now up to 34M people, growing 45% YoY.

Most importantly, new users are <10% of total disbursements, with management reiterating their intention to scale only when incremental loans are profitable, to ensure tight underwriting discipline instead of a growth at all cost model.

Adjusted EBITDA margin for Monee fell QoQ which isn’t too surprising considering we are seeing interest rate declines in certain markets such as Malaysia and Thailand, which reduces the yield on lending. I am not particularly concerned, unless we see a few quarters of consistent margin pressure.

Beyond the Shopee app, Off-Shopee SPayLater is taking off in quite an impressive manner. There was over 300% YoY growth and 40% QoQ growth, while this was still <10% of the total loan book, implying huge runway. I believe this is likely to be the next growth catalyst for Monee and Sea as a whole.

Sea is clearly pushing for this strongly with the standalone ShopeePay app now live in 4 markets and over 20% of users transacting outside of Shopee. Thailand’s loan book surpassed $2B at the end of September while the loan book grew over 3x YoY in Brazil.

3. Garena (Digital Entertainment)

Garena had its best quarter since 2021. Yep, you read that right. Despite us being out of the pandemic, and people fully out of their homes, Garena saw a record quarter.

QAUs grew to 670.8M with a rebound in QPU ratio to 9.8% after the slight dip last quarter. Average bookings per QPU increased significantly to $12.80.

Bookings grew 51% YoY to $841M while EBITDA grew 48% YoY to $466M. Management reiterated guidance for 30% YoY growth in bookings for 2025, which surely looks easy now.

Garena has continued to focus on attracting new and retaining old users through new content. While I’m personally not a big fan of these, it is clear to see that users are loving the switch-up in relatable content, from Squid Game to Naruto. These have increased engagement significantly.

Sea shared that the Red Light, Green Light challenge, incorporated from the Netflix blockbuster TV Series led to over 300 million plays in Q3 alone. Gamers resonate heavily with this, and shows Sea’s understanding of its user base. After all, Garena was the original business, and the one that Forrest and team understand best.

Beyond Free Fire, Garena also expanded its publishing portfolio with the launch of EA Sports FC Mobile in Vietnam last month through its long-standing partnership with Electronic Arts. The game became the country’s most downloaded game in October.

4. Management Commentary

This section focuses mainly on questions during the earnings call, with key highlights of what I believe are important points to takeaway. I may adjust a few words here and there for clarity purposes, (English is not the first language for the majority of Sea’s management team) but I will not change the meaning of these quotes.

On Shopee’s EBITDA margins:

“If you look at the previous year versus this year, we do see consistent improvement of margin. If you look on a year to year basis as we shared before, we will obviously see quarter to quarter fluctuation sometimes for seasonality reasons or some of the investment cycle initiatives and /or a particular market status in terms of where we are pushing some of these initiatives.

I think if you look at the sort of year to year trend going forward, we believe that we are able to deliver the 2-3% EBITDA margin as we shared before and also see an improvement year on year.”

On the Taiwanese Market:

”In Taiwan, we are growing double digits, faster than the overall market. We are pretty confident that we are the largest e-commerce platform, with the largest assortment, the best pricing and best delivery infrastructure.

We are able to defend our market share well, and grow even faster, with our infrastructure much better built than in previous years.”

On if the current investment cycle is similar to 2 years ago:

“I think the short answer is probably not. What we are doing now is a continuous investment into our business to strengthen our competitive moat. Now we are extending logistics to the fulfilment network too. It’s not completely new... but we feel now is a good time to scale it even more.”

On winding down its operations in Chile & Colombia while expanding to Argentina:

“The reason we look at Argentina is essentially expansion of our capabilities that we have built in Brazil, leveraging on our existing cross-border infrastructure and the operational experience we have already built in Brazil.

The objective is to capture the operational synergies across the adjacent regions and to open additional channels for our sellers, with minimum increase in mental investment.

We decided to wind down our cross-border operations in Chile and Colombia as part of our ongoing review of our global business priorities to ensure our resources are in line with our long-term strategy in the region.”

On the Competitive Landscape:

“What we see is a relatively stable competitive landscape. I think as you can probably observe as well from your own sources, we didn’t see any particular market behaving differently from another. The trends in competitive intensity and behaviour have been fairly consistent across Southeast Asia.”

On the Shopee VIP program:

“One thing that we monitor very closely is the retention rate. We would like to make sure that the users we bring to the program have good retention rates. In these early days, we have observed that retention rates have almost doubled quarter to quarter, which is a big breakthrough for us given that in our market, credit cards are not a common payment method.

In many other markets, platforms use credit cards to ensure continuous payment. We are working on multiple ways to ensure that the retention goes well with the program, especially together with our digital finance side through SPayLater.”

5. Concluding Thoughts

Sea delivered one of its strongest quarters ever, and I’ve followed the company for several years now. How the market reacts to this is up to them.

For me, as a long-term shareholder who has no intention of selling anytime soon, I am inclined to ignore the short-term movements, except to purchase more stock during irrational dips. And I have. I increased my position in Sea Limited today during pre-market after it fell 6% post-earnings.

The only real negative this quarter was the drop in Shopee’s EBITDA margins from 0.8% to 0.6% quarter over quarter. This would normally be concerning if Shopee were focused on profitability. But I am not concerned for two reasons:

At the pace Shopee is growing, 35% YoY revenue growth, there is no need to worry about the magnitude of profitability. Management should focus on attaining as much market share as possible while the opportunity is there.

Management shared that it was investing heavily in fulfilment to build a larger moat around the business. For long-term shareholders, this is great news, and will be instrumental in Shopee retaining its lead at the top in SEA.

Overall, I thought this was a great quarter, and my long-term thesis of over 20% revenue growth for a decade remains intact. At $85B today, I believe the market is still undervaluing the sheer duration and quality of Sea Limited’s growth.

Thank you for reading! If you enjoyed, consider sharing it with a friend, thank you.

What do you think about the trend of their EPS in the next few quarters? They mentioned that they want to grow with profitability, but I'm wondering how it would improve given the stiff competition

Great take, thanks