SEA Economy Tailwinds

2030 and Beyond

The primary reason for my strong optimism about SE 0.00%↑ and GRAB 0.00%↑ in the medium to long term lies in the demographics of the regions they serve, particularly Southeast Asia.

The tailwinds of the SEA economy into 2030 and beyond are huge.

SE 0.00%↑ and GRAB 0.00%↑ operate predominantly in Southeast Asia, a region that remains under-appreciated and often misunderstood by many US based investors.

This unfamiliarity has likely contributed to the significant undervaluation of these companies in recent years, especially following the post-COVID market correction.

Southeast Asia is frequently, and incorrectly, lumped together with China in analyses by Western observers. However, the two regions are fundamentally distinct. China is a largely homogenous nation under centralised authoritarian governance. In contrast, Southeast Asia is a diverse collection of over a dozen countries, each with unique languages, cultures, and political systems.

This diversity has posed challenges for Chinese companies attempting to expand into the region. For instance, Lazada, backed by BABA 0.00%↑ acquired Rocket Internet, a SEA startup e-commerce platform but struggled to maintain its market position. By prioritising a top-down management style and deploying Chinese execs, Lazada saw its market share erode significantly, losing ground to SE 0.00%↑ Shopee.

Shopee, on the other hand, demonstrated a keen understanding of the region’s nuances by empowering local leadership to guide operations in each market. This approach transformed Shopee from a rising competitor to the clear market leader within just five years.

Southeast Asia’s diversity also extends to its governance. Countries in the region operate under vastly different systems: Thailand combines nominal democracy with significant military influence, Vietnam is a socialist one-party state, and Singapore functions as a parliamentary democracy with a long history of single-party dominance. This heterogeneity makes it an exceptionally challenging market for executives unfamiliar with its complexities.

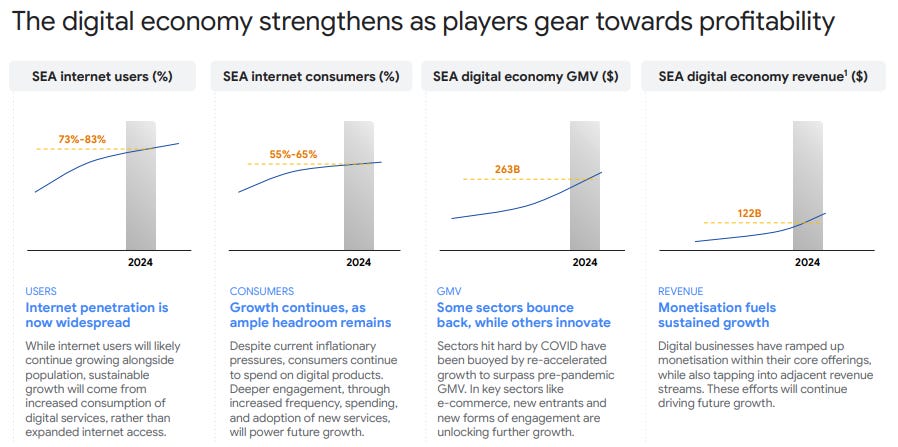

Despite these challenges, the economic potential of Southeast Asia is undeniable. Its digital economy, in particular, is poised to become a dominant force within the broader economic landscape.

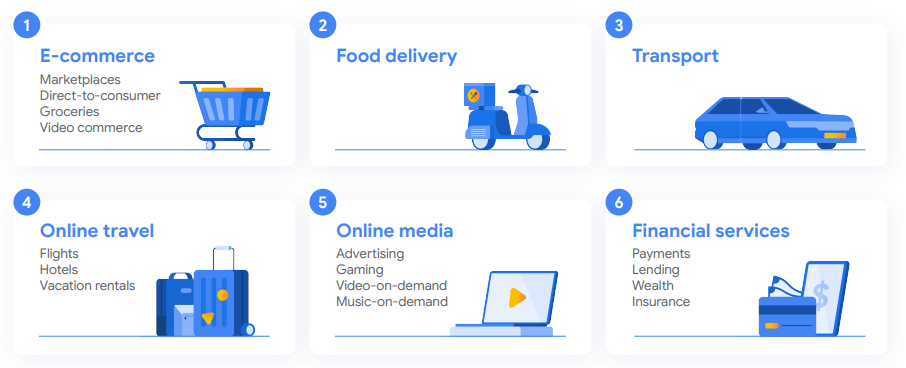

Digital Economy Sectors:

The six leading sectors of this digital economy: e-commerce, food delivery, transport, online travel, online media, and financial services, represent a rapidly growing share of regional GDP.

The structural tailwinds in these sectors, driven by a young, tech-savvy population and increasing internet penetration, are set to provide significant opportunities for companies that can navigate the region’s complexities effectively.

SE 0.00%↑ and GRAB 0.00%↑ are uniquely positioned to capitalise on these opportunities and deliver sustained growth in the years ahead.

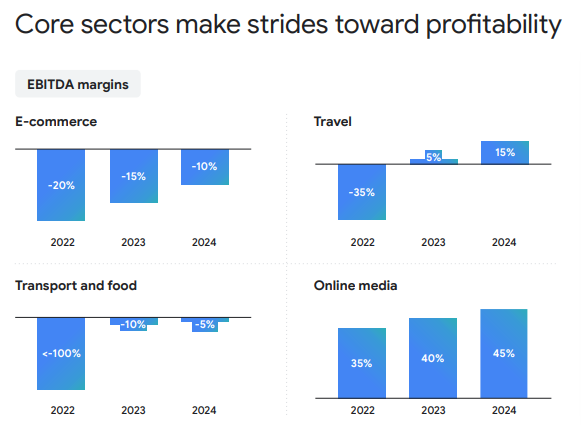

Profitability:

There have also been huge strides made toward profitability in recent years in e-commerce, food delivery, transport, travel and online media.

Demographics and Urbanisation:

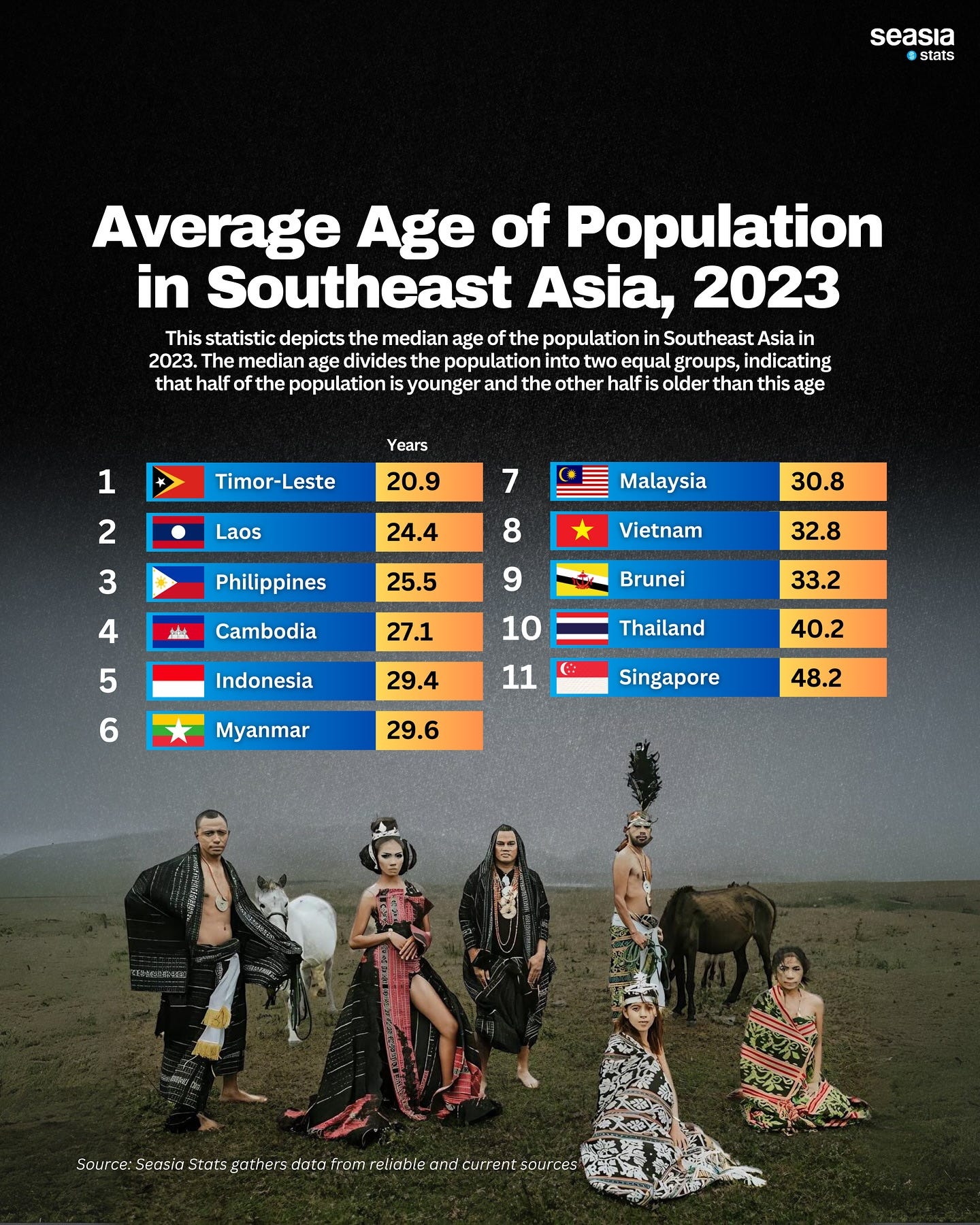

SEA is home to ~700M people with a median age of ~30 years old. This is significantly younger than regions like Europe (~44 years) or North America (~39 years).

The urban population is expected to grow from 50% in 2023 to 60% by 2030, adding ~68M urban residents. Urbanisation fuels e-commerce, fintech adoption and digital adoption. Smartphone penetration already exceeds 75% and is expected to exceed 85% by 2030. These are pillars of SE 0.00%↑ and GRAB 0.00%↑ success.

Fertility Rates:

While fertility rates have declined, key economies like Indonesia (2.1) and the Philippines (2.7) maintain above-replacement levels compared to aging regions like Japan (1.26) or Europe (1.46).

Continuous population growth ensures a steady expansion of the consumer base. Unlike aging regions, SEA's labor pool is expanding, offering a long-term competitive advantage in manufacturing and services.

Urban Growth Trends:

Urbanisation rate in SEA was 50% in 2023, projected to reach 60% by 2030, adding 68 million urban residents.

Cities like Jakarta, Manila, Ho Chi Minh City, and Bangkok are becoming megacities, driving infrastructure and retail investments.

Rising Middle Class:

190 million people in SEA were classified as middle-class consumers in 2023, expected to grow to 350 million by 2030.

By 2030, SEA's middle class will collectively spend over $2 trillion annually, up from $1.1 trillion in 2023.

Consumer Spending:

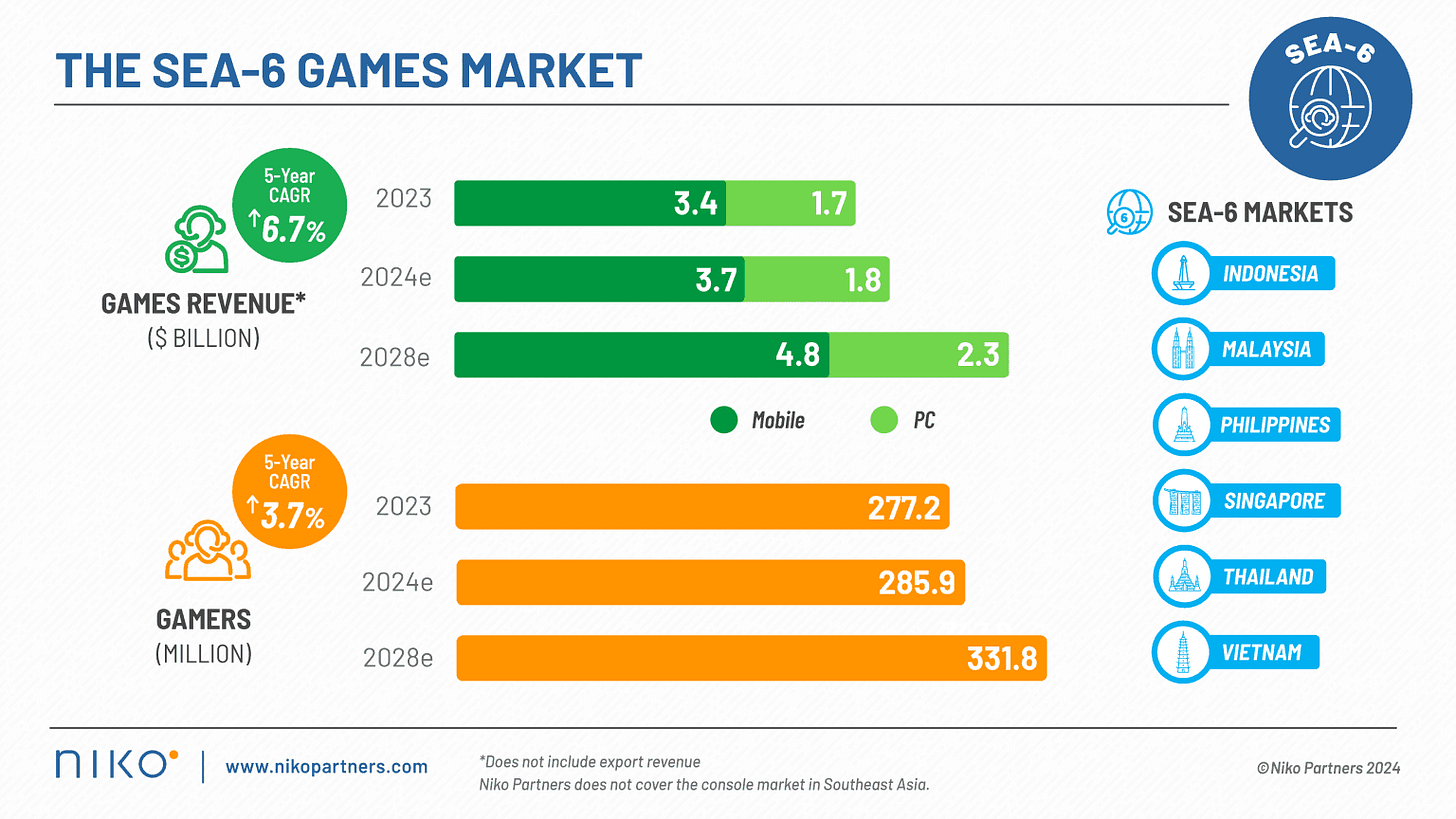

Millennials and Gen Z drive discretionary spending, particularly in:

- E-commerce: SEA’s online shopping GMV was $131 billion in 2023, projected to grow to $280 billion by 2030.

- Gaming: Mobile gaming revenues expected to grow from $6 billion in 2023 to $10 billion by 2030.

- Travel: SEA’s tourism receipts were $115 billion in 2023, set to reach $200 billion by 2030.

With a thriving middle class, urbanisation, and a young tech-driven consumer base, SEA will represent 15% of global economic growth by 2030.

This demographic dividend will drive consumption, innovation, and productivity, making SEA one of the most dynamic and attractive regions for investment into 2030 and beyond.

SE 0.00%↑ and GRAB 0.00%↑ are major players in the SEA digital economy, with each of them being involved in 4/6 key sectors.

SE 0.00%↑ operates the leading e-commerce marketplace, Shopee, the leading gaming platform, Garena, the leading digitial financial services platform, SeaMoney, and also operates in the food delivery space.

GRAB 0.00%↑ operates the leading food delivery and ride hailing platform, while also venturing into the e-commerce space. GRAB 0.00%↑ also operates in the Financial Services space with GXSBank, GXBank and its stake in the soon to be public-Super Bank.

It is inevitable that these 2 major players will be key beneficiaries of these demographic shifts.