Rubrik Valuation Model

2 weeks ago, I published my latest deep dive. The business was Rubrik, a cybersecurity business operating in the backup/data-resilience niche.

It was the first unprofitable business i’ve covered in my deep dives. Despite being unprofitable now, it is a high quality business with a clear path to profitability.

In that deep dive, I touched on valuation very slightly, and promised to write more in-depth on valuation shortly.

Today, I will run through the numbers and give my definitive take on Rubrik’s valuation at this point in time.

While there are several ways to value a business, my personal belief is that the method varies for each business, depending on the core drivers of the specific business, life cycle and margins.

While I typically run a DCF, I don’t think it’s the most useful way to value a company like Rubrik at this stage.

Rubrik has only just turned cash flow positive, which means the bulk of cash generation lies many years ahead. A DCF ends up discounting those long-dated cash flows so heavily that the model looks artificially conservative and doesn’t fully capture the earnings power of the business.

This is why SaaS growth businesses are typically comped by the market on EV/Revenue or EV/FCF multiples. In subscription-based, recurring revenue business models like Rubrik, revenue itself has intrinsic value because it is highly predictable and scales efficiently as margins expand.

Hence, this model is less of an intrinsic valuation model and more of a prediction pricing model of where I believe the market might value Rubrik at different stages of its journey. This is an inherently impossible task, but one that I will try anyway.

Table of Contents

Current Snapshot

Key Assumptions

Projections

Valuation Output

Final Implied Share Prices & Thoughts

1. Current Snapshot

Before we set our key assumptions, let’s take a look at Rubrik’s latest financial metrics.

Q2 2026 Key Metrics

These are the six highlighted metrics by Rubrik. Subscription ARR is top of funnel for Rubrik. This feeds directly into their Subscription Revenue, with the key profitability metrics being Gross Margin, Free Cash Flow and Subscription ARR Contribution Margin.

Today, Rubrik remains unprofitable, with a large part of their revenue going towards stock-based compensation (SBC). Hence, a P/E ratio comparison would not be feasible.

Q2 2026 Financials

Revenue: $309.9M (+51.2% YoY)

Gross Margin: 79.5%

Operating Margin: -30.5% (attributable to SBC and R&D)

Net Income: -$95.9M

Free Cash Flow: $57.5M

FCF Margin: 18.5%

Trailing Twelve Months (TTM) Financials

Revenue: $1,082.6M (+47.7% YoY)

Gross Margin: 78%

Operating Margin: -39.6% (attributable to SBC and R&D)

Net Income: -$443.8M

Free Cash Flow: $181.6M

FCF Margin: 16.8%

It is key to note that the latest quarter is only the 4th quarter since Rubrik turned free cash flow positive.

Over the TTM, Rubrik’s FCF margin came in at 16.8%. This is still quite far away from peers such as CrowdStrike, Zscaler, and Palo Alto Networks who have FCF margins of 25%, 30% and 38% respectively.

2. Key Assumptions

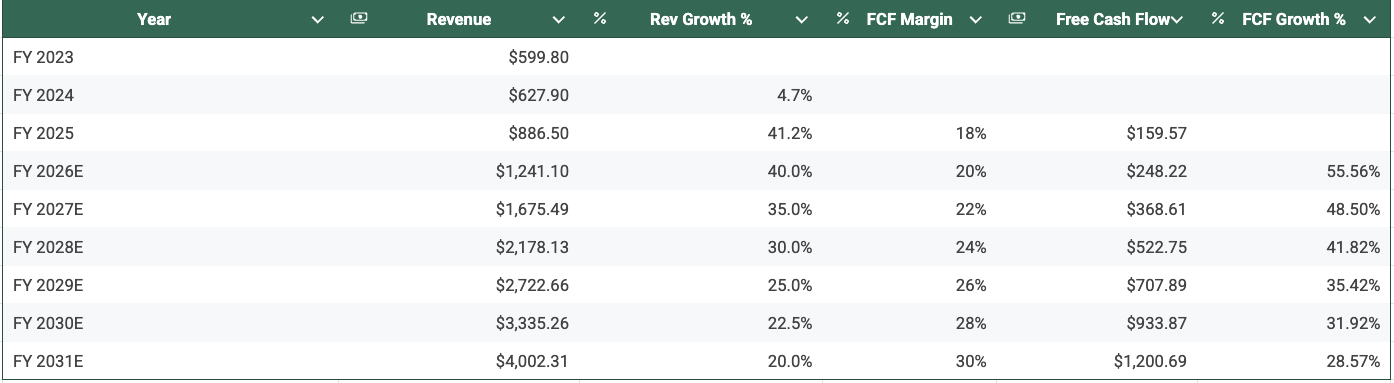

Before beginning, I would like to preface this by noting that Rubrik’s financial year begins on May 1st and ends on April 30th. Hence, FY2026E really means FY2025E in the typical reporting cycle of most businesses.

Therefore, my EV/Revenue and EV/FCF approach will be built out to FY2031E, which is ~5 years out.

Revenue Growth:

FY2026E:

Over the TTM, Rubrik has grown revenues at 47.7%.

Management has guided for FY2026E revenues of $1.227B to $1.237B. This implies revenue growth of between 38.5% to 39.5%.

One key point to note here is that Rubrik’s management is extremely conservative and loves sandbagging.

Across all 6 quarters that Rubrik has reported since going public, management has raised guidance consistently.

In Q1 2025, revenue guidance for FY2025 was $810-824M, eventually coming in at $886.5M.

In Q4 2025, revenue guidance for FY2026 began at $1,145-1,161M, which means over a 7% bump in expectations.

I believe FY2026E revenues are likely going to come in at a minimum of 40% YoY growth.

As revenues get larger and Rubrik picks off the low-hanging fruit (Commvault, Dell EMC, Veritas), growth will surely slow down.

I will hence forecast a slowdown in growth from 40% to 25% in FY2031E.

Free Cash Flow Margin:

Over the TTM, Rubrik’s FCF margin came in at 16.8%. Despite the stark improvement, it is still far away from peers such as CrowdStrike, Zscaler and Palo Alto Networks.

The three peers have FCF margins of 25%, 30% and 38% respectively. At the moment, these 3 businesses are larger than Rubrik, but I would argue Rubrik in 5 years are likely in a similar position to where they are today.

For instance:

CrowdStrike’s TTM Revenues are $4.34B and growing at 23%

Zscaler’s TTM Revenues are $2.67B and growing at 23%

Palo Alto Networks’ TTM Revenues are $9.22B and growing at 15%.

In FY2021, PANW’s TTM Revenues were $4.26B and growing at 24.9%. Its FCF margin was 32.6%

If we compare all 3 of these, I think it is fair to make an assumption that Rubrik will likely be able to achieve the 30% FCF margin target in 5 years (FY2021E).

Hence, I have decided to assume a steady growth of FCF margins to 30%.

Shares Outstanding:

Rubrik’s shares outstanding has been growing at ~9.3% CAGR from April 2024 to the latest July 2025 quarter.

Like many young SaaS businesses, SBC is a meaningful expense, and over time translates into dilution. This affects the equity value per share, which is what ultimately matters for investors, hence this is definitely of concern to us.

I do not expect Rubrik’s shares outstanding to continue growing at 9.3% CAGR, but I do expect continued share dilution to the tune of ~5%.

As of the latest quarter, Rubrik has 197.4M shares outstanding.

Management has guided to 200M shares outstanding in Q3 FY2026 and 197M shares outstanding in FY2026. To be conservative, I will go with the 200M number for FY2026E.

Benchmarks:

For a multiple approach, the most important consideration is the peer comparison. For this, I will be using Jamin Ball’s Clouded Judgement Substack that runs through the numbers for the entire universe of SaaS businesses.

I must note that this method, overall, is very dependent on the overall SaaS and market environment. At times, we have seen SaaS get overblown, and I believe we are seeing pockets of that.

However, it still remains the best method, in my opinion, to measure the relative valuation of Rubrik.

3. Projections

Revenue Growth:

40% in 2026E, laddered down to 20% in FY2031E

FCF Margin:

18% in 2026E, climbing up to 30% in FY2031E

In FY2031E, we arrive at $4B in Revenue and $1.2B in Free Cash Flow, which I believe is very doable for a business like Rubrik.

In my deep dive, I discussed the addressable market for Rubrik. At $1B in ARR, Rubrik has addressed <2% of the TAM. At $4B in FY2031E, Rubrik would be addressing ~8% of the TAM. However, the future TAM is likely to expand significantly. Hence, I believe those numbers are extremely achievable for Rubrik.

The remaining information is reserved for paid subscribers.

If you are keen on accessing the rest of the valuation model along with more additional content, considering upgrading to the paid tier, where you will gain access to:

Full Deep Dive Articles (Min. 1 per month)

Access to Portfolio Performance & Holdings (Once a month)

Full Archive of Articles (60+ and counting)

Private Chat