Robinhood Q2 2025 Earnings Review

Robinhood announced their Q2 2025 earnings on 30th July after market close.

Once again, as we’ve become accustomed to in the past year and a half, it was a stellar report, beating expectations on the top and bottom line.

Revenue: $989M v $913M est. (+45% YoY)

EPS: $0.42 v $0.31 est.

However, Robinhood stock ended the subsequent day down 2.87%, why did this happen and was it warranted?

Before we get started, I would like to remind newer readers that I am long HOOD and have been since $8.

Please feel free to check out my Deep Dive on the business that I posted late last year (I have removed the paywall temporarily for all to view):

Table of Contents

Financials

Key Highlighted Metrics

Risks & Challenges

Forward Outlook

Personal View on Robinhood Stock

1. Financials

Revenue and Revenue Growth

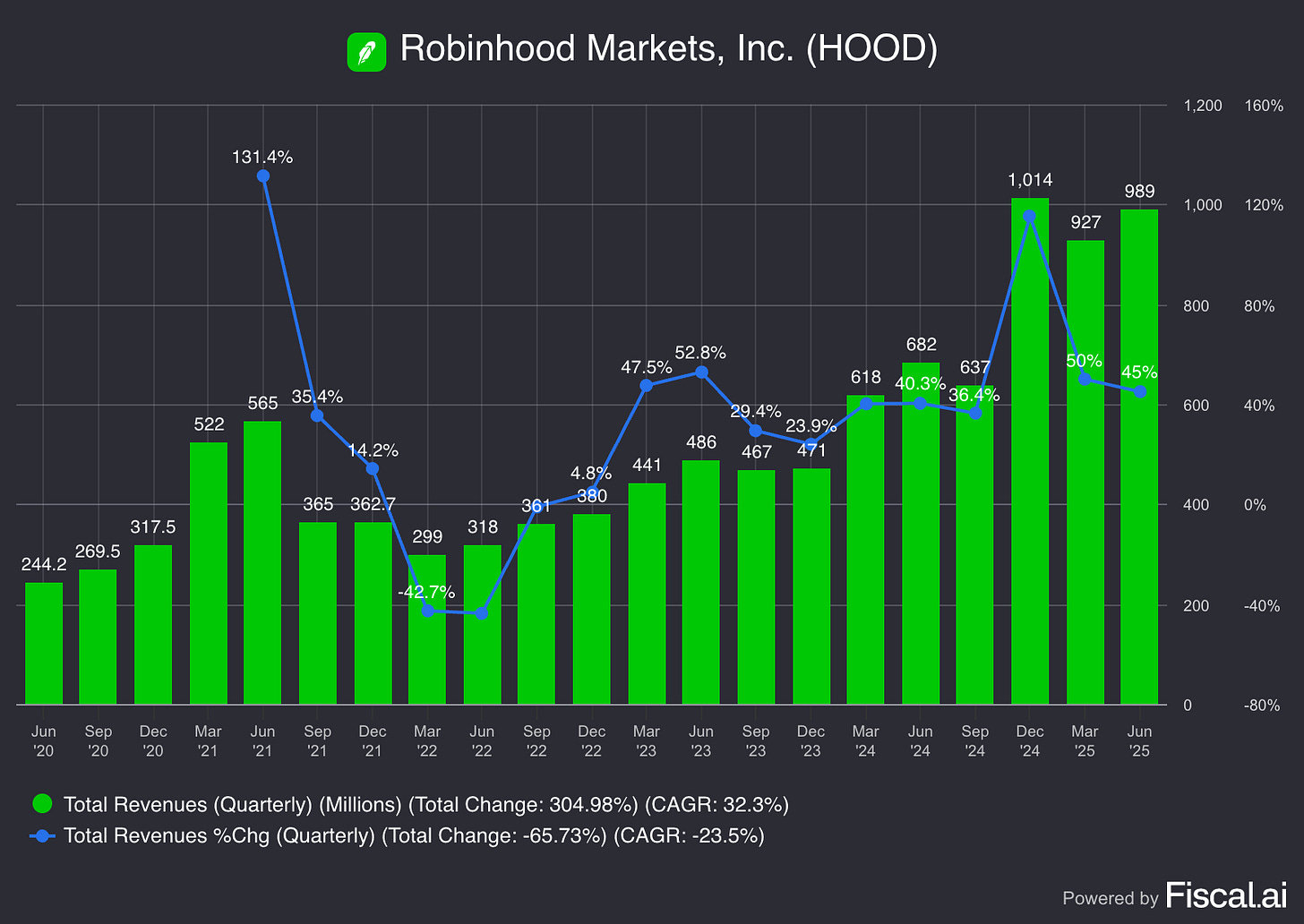

Robinhood was, and continues to be a cyclical business. It’s clear to see from the revenue chart that revenue growth rates oscillate wildly from negative growth to mid-double digits, and even up to triple digits when the craze occurs.

This is innate in the business, and exacerbated by the fact that Crypto remains a large part of the business’ revenue stream. Crypto has been governed by four year cycles, starting with hope and ending with a sort of euphoria hardly seen in any other asset.

That leads to extremely wild swings in Crypto transaction revenues for Robinhood as its customers’ activity tracks almost identically to Crypto prices.

In Q2 2025, revenue growth has come down slightly to 45% YoY, which is still a remarkable figure considering the comps to last year are not easy at all.

Transaction Revenue Streams

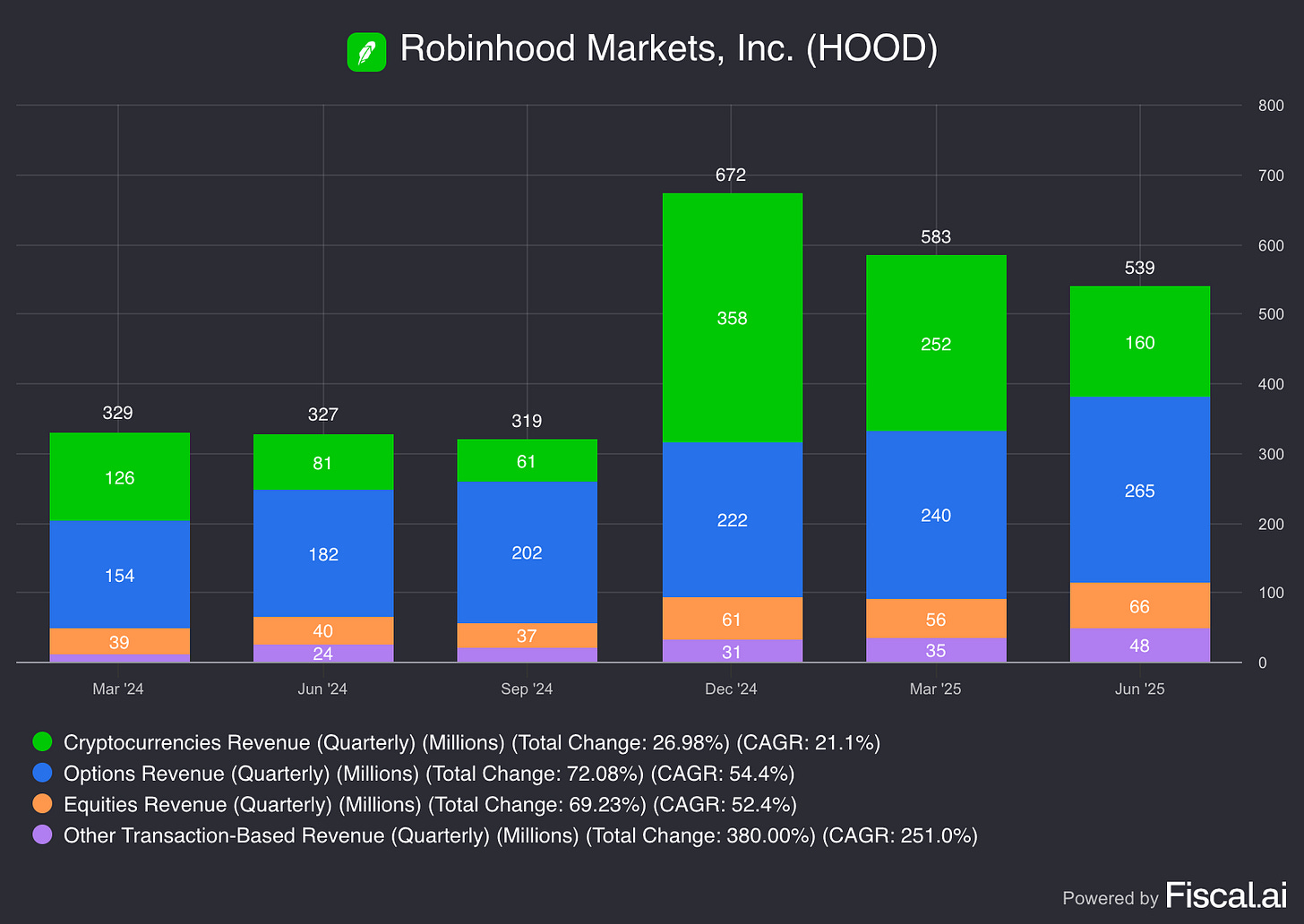

It is clear to see that there has been a steady decline in transaction revenues over the past 2 quarters, and on closer inspection, it is almost entirely due to Cryptocurrencies revenue.

In just 6 months, Crypto revenues have fallen over 50%, showing exactly how volatile these revenues are.

Net Interest & Other Revenue

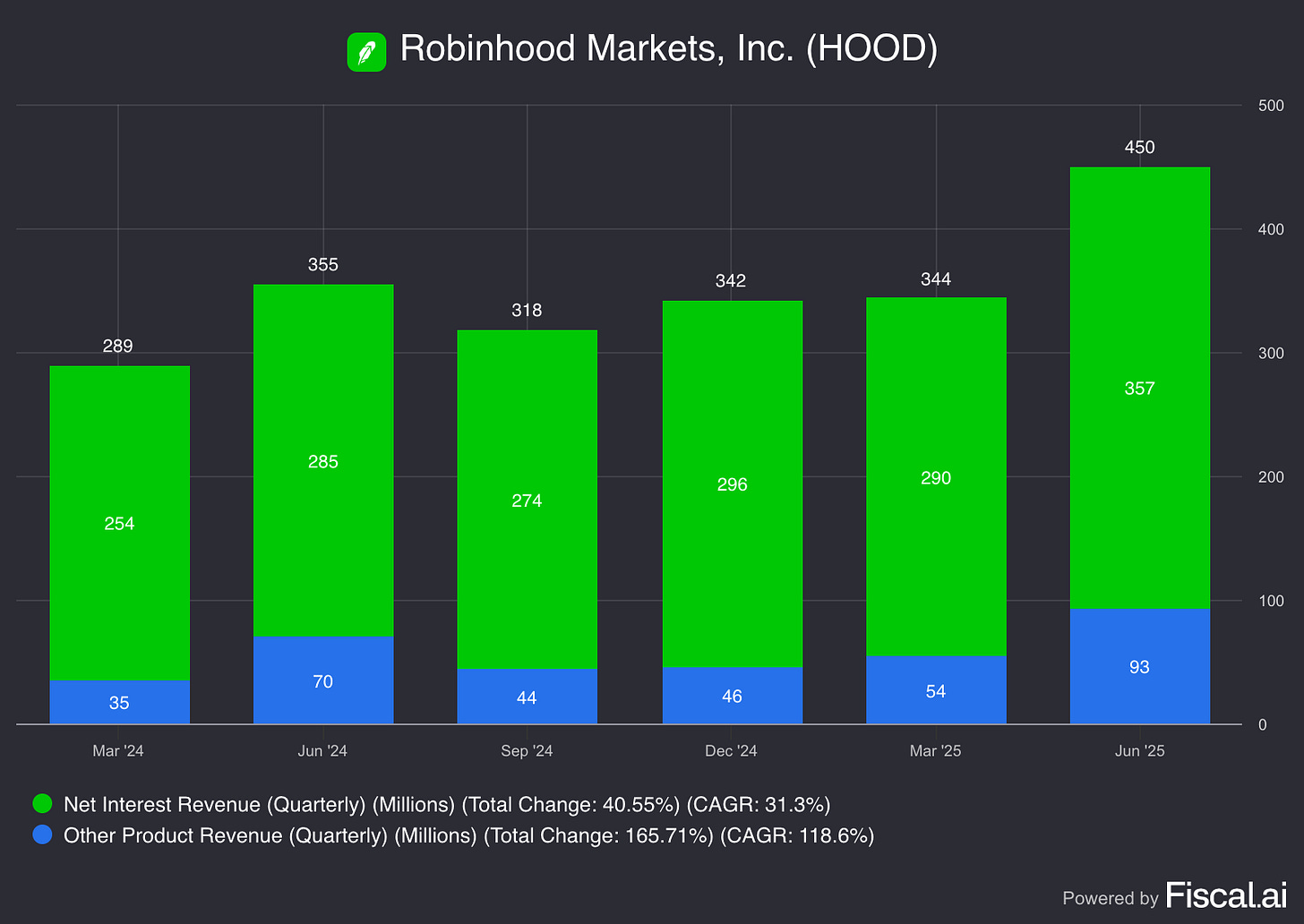

Meanwhile, Net Interest Revenue and Other Product Revenue (largely Robinhood Gold subscription) has helped to support the fall in transaction related revenues.

These are two vastly different income streams. Net Interest Revenue is mostly reliant on higher interest rates, which have held for the past 2 years. In my opinion, this is one of the key areas of concern for Robinhood shareholders, as rates will inevitably come down in the next few quarters to years.

However, Other Product Revenue, which is mostly supported by Robinhood Gold is a very promising area of growth and one that Robinhood has to tap into strongly to ensure sustainable recurring high-margin revenue.

Overall, I think there are some valid concerns to be had about the quality and sustainability of revenue.

2. Key Highlighted Metrics

These are some metrics I picked out specifically:

Robinhood Retirement AUC:

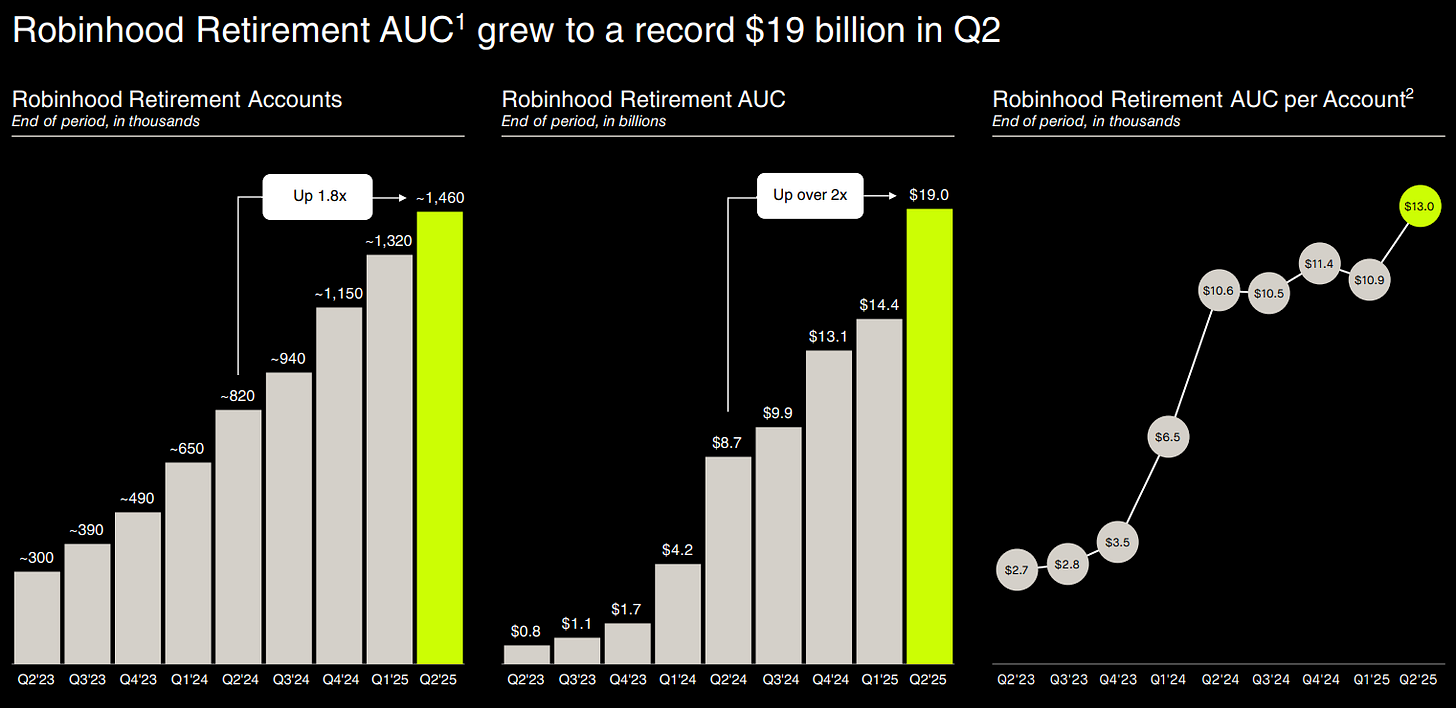

- Increased 118% YoY to a record $19B

This is a metric I track closely as I believe one of the largest long-term bull cases for Robinhood is the transfer of wealth from legacy platforms.

Retirement AUC is a key indicator that even the older, more wealthy individuals view Robinhood as a credible and trusted platform.

Share Repurchases:

- In the last Q, $124M was repurchased (Average: $41.52)

- Over the past 12M, $703M was repurchased (Average: $34.24)

The average buyback price ($41.52) in the last Q was particularly impressive. If you check out the chart in the last Q, this was almost the low in April during the Trump tariffs.

Prices are now nearly 2.5x higher (!)

This gives me confidence that the management team is great at being greedy when others are fearful which is key in efficient capital allocation.

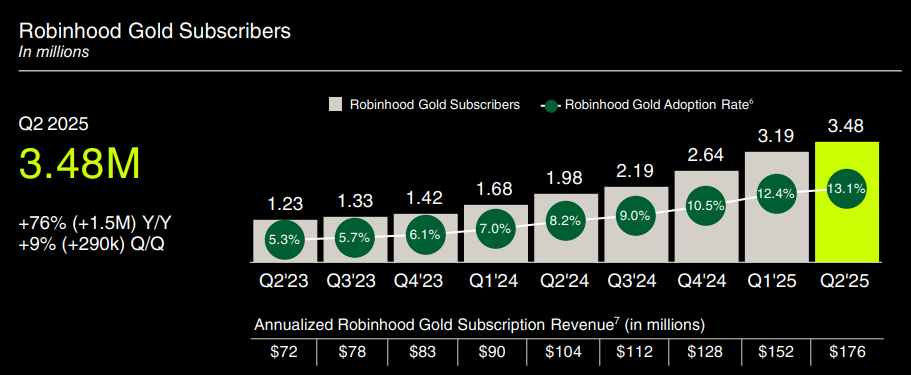

Robinhood Gold:

- Record 3.5M subscribers in Q2 with an adoption rate of over 13%

These are some incredible numbers and not to be scoffed at.

I think a large reason for this is that the sheer value of offerings that Robinhood provides through Gold makes it a no-brainer subscription for many users.

There is also something to the fact that users are investors, and hence understand ROI well innately. I believe Gold adoption can surpass 30% in the long-run and will prove to be a dependable source of income for Robinhood. (This is backed by recent adoption of over 35% among new customers that joined in the recent quarter)

3. Risks & Challenges

Crypto Revenue Softness

As discussed previously, this is a key segment to watch. Despite the broader crypto rally, volumes and revenue have dropped sequentially which is a slight concern.

In my view, we should see a slight uptick in the next 2 quarters. However, in my view with my belief that Crypto tops in Q4 2025, I expect to see a larger decline in Crypto revenues early next year which will likely lead to a significant drawdown in overall revenues.

This, combined with the tough comps set this year will prove to be an uphill battle for Robinhood.

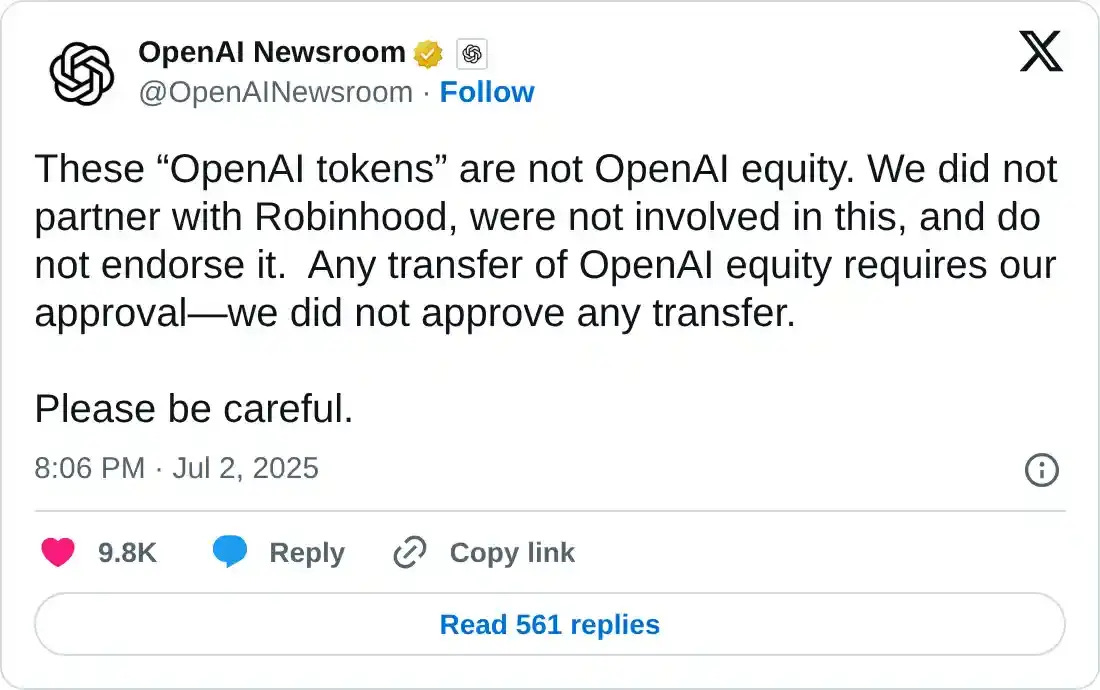

Tokenisation Uncertainty

Robinhood’s “To Catch a Token” event was highly controversial as the business rolled out its push into tokenising private companies like OpenAI and SpaceX.

This could put Robinhood in a spot of legal ambiguity. OpenAI was quick to publicly disclaim any involvement and there could be risks around transparency, liquidity and enforceability.

The main issue I see with tokenisation is the sheer lack of liquidity that could lead to adverse outcomes. For e.g., the demand for OpenAI stock is likely to be extremely high due to the fact that regular retail investors have no access to these businesses.

This could lead to a situation where the tokenised price of these “stocks” are bid extremely high due to a misalignment in demand and supply and a subsequent conundrum when the business eventually goes public.

Robinhood will have to carefully tackle this situation as reputation is one of the key characteristics of a brokerage that investors focus on keenly.

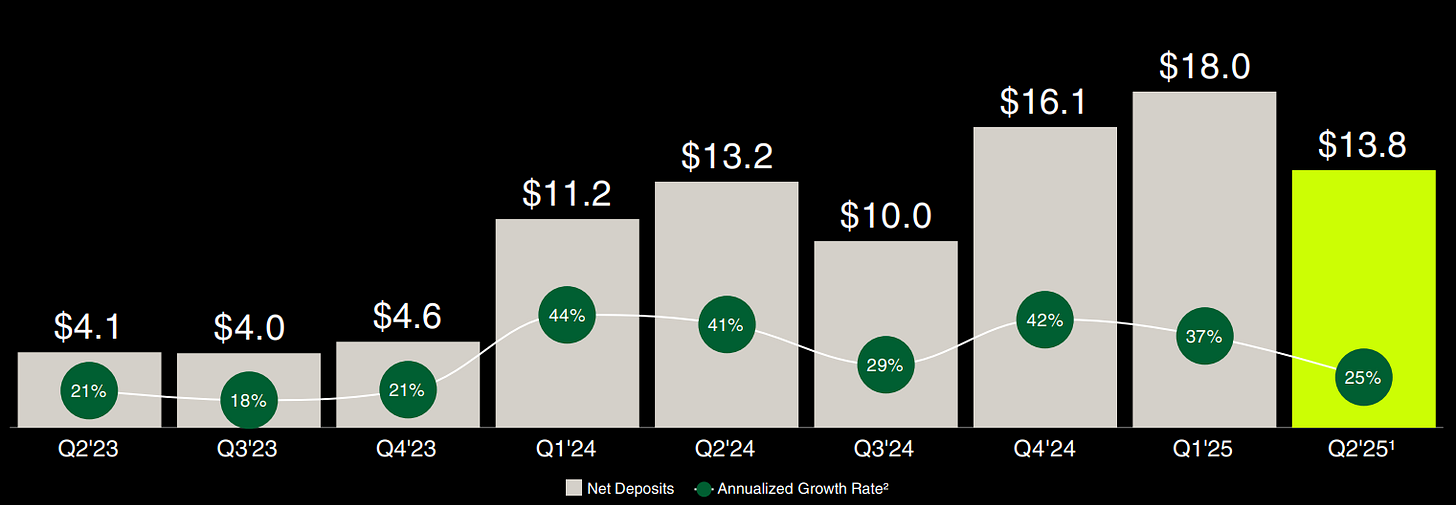

4. Forward Outlook

Robinhood appears to have gotten off to a great start in Q3 2025 with customers accelerating net deposits to ~$6B in July alone. This is roughly in line with Q1 2025’s results which was a record $18B.

Bitcoin prices have also traded to a new all-time high in July, closely followed by Ethereum that has traded to ~$4,000 — a sign of bullish sentiment and overall a boon for trading activity, that is essential to Robinhood’s revenue.

I expect a strong Q3 2025 that should fuel Robinhood stock’s continued rise.

5. Personal View on Robinhood Stock

As I’ve shared with paid subscribers in my portfolio reviews: