Robinhood: Beyond Trades (Deep Dive)

From Brokerage to FinTech Titan

Contents

Introduction

Company Overview

Industry and Market Analysis

Bull Thesis

Bear Thesis

Bear Thesis Debunked

Moats

Financials

Risks

Valuation

Ownership

Concluding Thoughts

Introduction

Robinhood has had a turbulent history to say the least. From media darling to disaster, from retail saviour to betrayer.

There have been controversies surrounding Robinhood since its founding, and yet the company currently finds itself in the strongest position in its history.

For all of Robinhood’s faults, there is no denying that it has transformed the brokerage industry, once dominated by legacy incumbents.

In this article, I will detail the reasons behind my belief that Robinhood will dominate the FinTech landscape in the decades to come and how best to position for it.

Company Overview

Robinhood is a U.S. -based financial services company that operates a web and mobile platform, primarily for commission-free trading of stocks, ETFs, options, and cryptocurrencies.

Founded in 2013 by Vlad Tenev and Baiju Bhatt, Robinhood’s mission is to democratise finance for all.

Robinhood went public in July 2021 under the ticker symbol HOOD 0.00%↑ on the NASDAQ.

Key Products & Services

Robinhood App:

The platform’s flagship product that allows users to trade a wide variety of financial assets. Its zero-commission model attracted millions of users, particularly young investors, helping drive down trading fees across the industry.

Crypto Trading:

Robinhood added support for cryptocurrency trading in 2018, allowing users to buy, sell, and hold popular cryptocurrencies such as Bitcoin and Ethereum. This has become a significant part of their revenue mix.

Robinhood Gold:

This is Robinhood’s premium membership that offers margin trading, larger instant deposits, and professional research.

Cash Management:

Tied to a debit card, it allows users to earn interest on uninvested cash. This positions Robinhood as more than just a brokerage, leaning into banking-like services.

Retirement Accounts:

One of the newer features, Robinhood launched retirement accounts with the option to invest in IRAs with a matching bonus, further diversifying its offerings to appeal to long-term investors.

Robinhood Wallet:

A self-custodial crypto wallet that acts as a portal to Web3, enabling users to control their private keys and interact with the broader cryptocurrency ecosystem.

Business Model

Payment for Order Flow:

Robinhood receives payments from market makers for routing customer trades, which has been a significant revenue driver and a source of controversy.

Interest on Cash Balances and Margin Loans:

Like traditional brokerages, Robinhood earns interests on users’ uninvested cash and margin loans extended to users.

Robinhood Gold Membership:

Monthly subscription fees from users.

Transaction Fees for Cryptocurrency Trading:

Robinhood charges a spread for cryptocurrency trades, generating revenue from crypto transactions without an explicit commission.

Industry and Market Analysis

Robinhood operates its equity brokerage services predominantly in the United States but has recently expanded to the UK. It also operates cryptocurrency trading in the EU. There are plans for expansion to Canada and Europe.

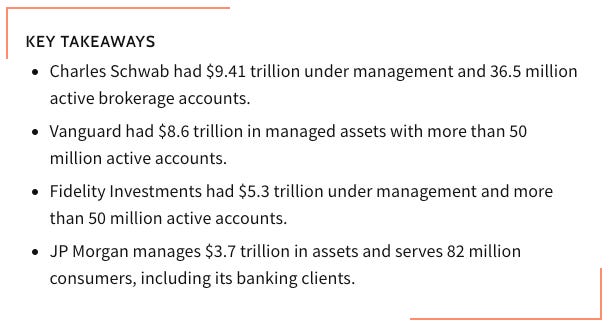

The brokerage space has been dominated by incumbent players with deep pockets. The likes of Fidelity, Charles Schwab, Interactive Brokers, and Vanguard have trillions of dollars in Assets under Management (AUM).

The addressable market of the financial asset space is massive. Robinhood’s constant innovation proves it is not just interested in the brokerage space but all things finance.

Bull Thesis

Robinhood is the no.1 innovator in the FinTech space. Since its inception, it has consistently produced new features and products to the space. Being a pioneer of 1 or 2 innovations in a decade is considered a remarkable feat for most, yet Robinhood has managed to pioneer arguably 7 huge innovations in less than a decade. There is no reason to believe this pace of iteration will not continue.

Commission-Free Trading

Fractional Share Trading

Gamification of UI/UX

Instant Deposits and Trades

Extended Trading Hours

IPO Access for Retail Investors

Prediction Markets

Robinhood’s goal is not merely to be a leading brokerage, but rather to expand into becoming a full-scale financial ecosystem. In the past few years alone, it has had 4 key features. Retirement Accounts, Gold Card, Crypto Offerings, Robinhood Legend. Each of these are extensions of Robinhood’s identity and will eventually form a segment of their own.

Robinhood gives a 1% contribution match that incentivises users to consolidate their assets - creating a long-term relationship and driving asset growth.

The Gold Card offers 1% cash back on ALL purchases that can be reinvested into Robinhood accounts, driving more engagement.

Robinhood has prioritised Crypto with the acquisition of BitStamp earlier this year and their simplified approach to buying, selling and storing digital assets.

The long awaited trading platform was finally launched with advanced charting tools and features, ensuring Robinhood’s competitiveness with established brokerages.

Robinhood has managed to cultivate a large, young and financially engaged user base. Nearly 70% of $HOOD’s users fall between the ages of 18-40. This demographic tends to have higher earning potential over time and are the heirs of the baby boomer generation.

The risky phase of Robinhood’s business trajectory is over. Free Cash Flows are likely to be positive from here on out, there is a very healthy cash balance and net debt is low. Robinhood has taken steps to improve operational efficiencies, controlling cost to reduce cash burn and improving margins, especially as it leverages new revenue streams.

Robinhood’s data on its user base is extremely underrated. The aggregated data allows Robinhood to understand what their users like and enables them to curate personalised recommendations that suit their needs.

Robinhood currently only operates its brokerage services in US and UK, where the market is largest but so is the competition. Speaking from experience, brokerages in Asia are extremely limited and many still charge exorbitant commissions on trades. An expansion to Asia and beyond is a matter of time for Robinhood and would secure its position as the leading brokerage in the world.

Bear Thesis

Reliance on Payment for Order Flow Revenue

Robinhood’s revenue heavily depends on payment for order flow (PFOF), where it earns fees by routing users’ trades to market makers. Regulatory scrutiny around this practice has increased, especially given concerns that it may not prioritize users' best interests.

If regulators ban or significantly restrict PFOF, Robinhood’s primary revenue source would be impacted. Although Robinhood is diversifying, its reliance on PFOF remains a major vulnerability.

Volatility in Retail Trading Activity

Retail trading volumes tend to spike in times of market enthusiasm but drop during market downturns. Since Robinhood’s active usership and trading frequency correlate with periods of speculative market excitement, a bear market or prolonged downturn could significantly reduce engagement and revenue.

Intense Competition and Lack of Differentiation

Robinhood faces fierce competition from both traditional brokerage firms like Charles Schwab, Fidelity, and Vanguard, which have introduced commission-free trading, and fintech players like Cash App, SoFi, and Webull, which offer similar features and broader financial services.

With limited switching costs, Robinhood’s users can easily migrate to other platforms if they offer better pricing, services, or features, posing a risk to its user retention and long-term growth.

User Demographics and Financial Vulnerability

Robinhood’s core user demographic is young, new to investing, and often engages in high-risk trading. This can result in high churn rates as users either "graduate" to more comprehensive platforms or exit due to losses.

Many of Robinhood's users have smaller account balances, limiting the potential for substantial revenue growth per user compared to platforms that target wealthier or institutional clients.

Bear Thesis Debunked

While PFOF is a significant revenue source, Robinhood is actively diversifying its income streams. Products like cryptocurrency trading, cash management, margin lending, and IPO access are already contributing to its revenue mix. Furthermore, with products like Robinhood Gold, the company has opportunities to increase its revenue from subscriptions. Robinhood has proactively positioned itself to adapt to regulatory changes. If PFOF is banned or restricted, Robinhood can shift toward other monetisation models, such as subscription services or a small commission model, similar to what other fintech platforms have done in regulated environments.

Robinhood is positioning itself as a broader financial platform rather than a simple trading app. By offering recurring investments, crypto, and soon even lending products, Robinhood is targeting more consistent, everyday financial needs. This diversification can smooth revenue during periods of low trading activity.

Robinhood’s brand is highly recognised, particularly among younger investors. It has a reputation for democratizing finance and is often the first platform people associate with commission-free trading. While competitors offer similar services, Robinhood’s focus on simplicity, intuitive design, and accessibility keeps it distinct in a crowded market. A quick look at growth rates and churn from rival brokerages paints a clear picture of the position Robinhood is in.

While Robinhood’s user base skews younger, this demographic has high earning potential over time. As these users build wealth, Robinhood can benefit from increased account balances and potentially higher engagement in long-term financial products, such as retirement and lending services. Additionally, Robinhood is already attracting a more diverse set of users, including those with larger portfolios through IRA matching and ACAT incentives.

Moats

This segment will focus on the 5 key moats, aka competitive advantages. I will give a scoring on each segment and an overall score. The aim of this is to determine if the company in question has a sustainable competitive advantage over its rivals.

I believe Robinhood is somewhat of an outlier in Moat comparison as it appears to not have a substantial moat in the traditional sense. Instead, its moat appears to lie in the ability to execute quickly or what I like to call “operational agility”.

Robinhood’s competitive advantage ultimately lies in being the preference for most investors under the age of 40 as a result of superior UI/UX and product ecosystem expansion. Brand loyalty will be built up over time, allowing the new innovations that are born to flourish.

Intangible Asset (2/5)

Robinhood possesses strong brand recognition among millennials and Gen Z. Brand reputation is mixed, however, following the 2021 GameStop trading restrictions.

Cost Advantages (2/5)

Low overhead due to digital-only operation, automated customer service, efficient customer acquisition through viral/referral marketing.

Network Effects (3/5)

At the moment, Robinhood does not have a strong network effect economy. There are near zero social features on their platform, with the only network effect being users sharing with friends/family about the usability and strength of the platform.

Switching Costs (2/5)

ACAT transfers are extremely simple, which is working well for Robinhood now as they are aggressively capturing users from incumbents such as Fidelity, Interactive Brokers, etc.

However, this would also be an issue in future should there be a competitor that is better positioned than Robinhood with funds to offer incentives.

Efficient Scale (4/5)

Technology infrastructure at a company like Robinhood scales very efficiently. The marginal cost of adding new users is minimal. Additionally, the market is large enough to support multiple players.

Overall Score (2.6/5)

Robinhood’s strongest moat is its efficient scale. However, as mentioned previously, I believe Robinhood’s speed of iteration enables them to have a competitive advantage as they execute quicker than any of their competitors, allowing them to always be a step ahead.

Financials

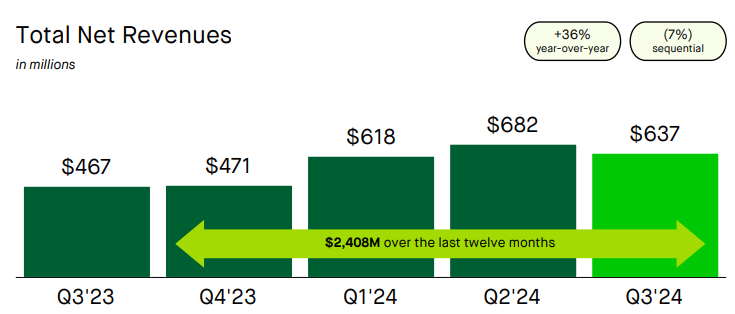

In the last Q2 2024 earnings, HOOD 0.00%↑ grew revenues 36% YOY.

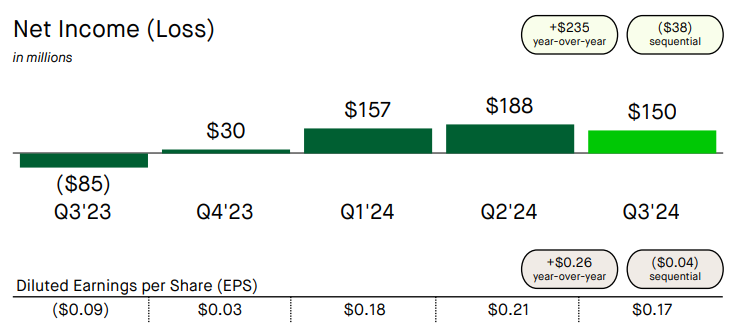

The company saw its 4th straight quarter of positive net income. Diluted EPS has jumped from -$0.09 in Q3’23 to $0.17 in Q3’24.

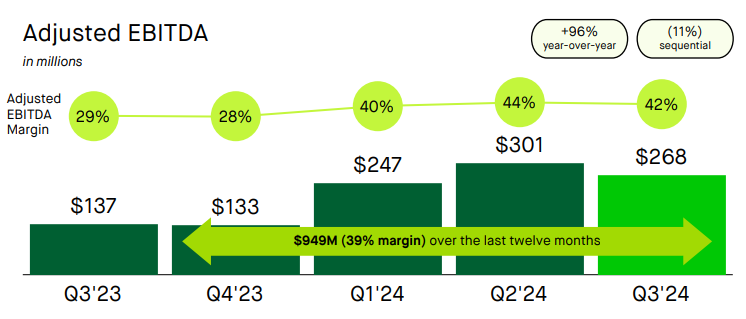

Adjusted EBITDA has also grown substantially, 96% year-over-year, from $137M the same quarter a year ago to $268M this quarter.

All profitability metrics for Robinhood are trending in the right direction and I believe the company is merely at the beginning of its parabolic profitability phase.

Risks

I believe Robinhood has one major risk, of which they have had for much of the company’s history. That is, the business is rather cyclical and performs as well as the stock market does.

In the 2020 Covid bull run, Robinhood saw the quickest growth in user numbers, engagement, etc. The company looked to be unstoppable. Until, the tech crash began in 2022.

Operating Revenues fell from $1.402B in 2021 to $814M in 2022, a substantial decrease. These numbers have yet to recover fully with the TTM Operating Revenues currently hovering around $1.04B.

Currently, the US stock market is at an all-time high, Crypto is near all-time highs, all of which are strong tailwinds for Robinhood. However, it remains to be seen if this momentum can be kept up should there be a change in the landscape of equities and crypto.

To be a truly successful company, Robinhood will have to ensure its operations and revenues are less subject to volatility in the markets, and instead highly dependent on being a superior product and leveraging new products/features to accelerate growth.

Valuation

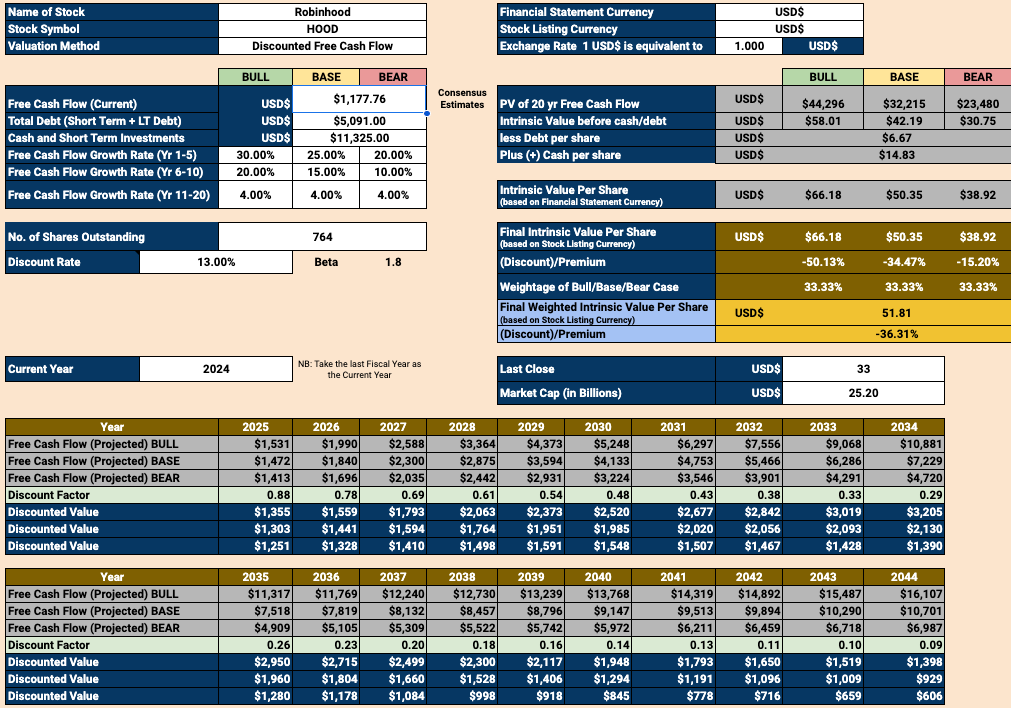

For $HOOD, despite it being at an inflection point, I will still attempt to value it using a discounted cash flow method to show the relative undervaluation of the business.

I have taken the consensus estimates for 2025E and discounted it to the base case growth rate, giving me a FCF of $1.177B for the current year.

I have given an equal weightage to bull/bear/base case scenarios for the business with staggered growth projections between 20-30% for the first 5 years and between 10-20% for the next 5 years.

The intrinsic value of HOOD 0.00%↑ given here is $51.81 which provides a ~36% margin of safety on the stock.

Ownership

On ownership, Vlad Tenev and Baiju Bhatt are the co-founders and currently act as President and CEO of Robinhood respectively.

Baiju owns 7.4% while Vlad owns 6.4% of the outstanding shares, showing significant skin in the game.

Concluding Thoughts

Robinhood stands at a pivotal moment in its journey, having transformed from a controversial startup to a mature fintech leader showing consistent profitability. The company has successfully weathered its growing pains, including the GameStop controversy and the crypto winter, emerging stronger with a diversified revenue stream and an expanding product ecosystem.

I believe the firm’s greatest strength lies in its operational agility and commitment to innovation, having pioneered seven major industry innovations in less than a decade. While traditional moats may be modest, with an overall score of 2.6/5, Robinhood's ability to execute quickly and its strong connection with younger investors creates a different kind of competitive advantage. The company's focus on the 18-40 demographic positions it perfectly to capture the greatest wealth transfer in history as millennials and Gen Z inherit baby boomer assets.

Looking ahead, Robinhood's expansion plans into Asia and broader international markets, coupled with its growing suite of financial products beyond basic trading features, suggest significant growth potential. The company's improving financials, with four consecutive quarters of positive net income and 96% year-over-year EBITDA growth, indicate that the business model is not only sustainable but scalable. At the current valuation of $51.81, representing a 36% margin of safety, I believe Robinhood presents an attractive opportunity for investors.

While risks remain, particularly around market cyclicality and regulatory scrutiny of payment for order flow, Robinhood's efforts to diversify revenue streams and build a comprehensive financial ecosystem should help mitigate these concerns. With strong founder ownership, a clear vision for democratising finance, and a track record of consistent innovation, Robinhood appears well-positioned to dominate the fintech landscape in the decades to come.

Disclaimer: I am long Robinhood. The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.