Portfolio Review (September 2025)

+43% YTD, +234% Since Inception

September 2025 Markets Review

S&P 500: +4.05%

NASDAQ: +6.14%

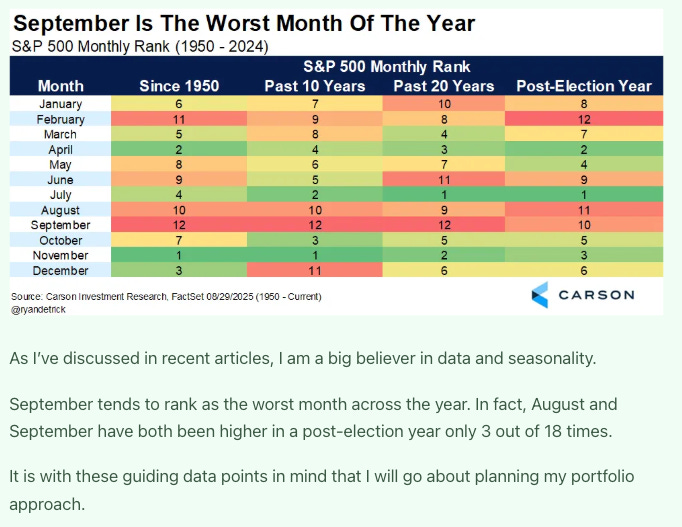

September is typically one of the weakest months of the year, and I highlighted my concerns in my previous portfolio review:

Despite these concerns, September has largely been an “up-only” market for the indexes. The S&P 500 posted its fifth consecutive monthly gain while both the S&P 500 and NASDAQ reached all-time highs again.

Chinese equities continued to see strong inflows and performance, with Alibaba leading the charge (+25% in the past month). Gold also saw one of the strongest months on record with a +10% gain into all-time highs.

Markets are clearly in a risk-on environment, like we’ve not seen since late 2021. We know what happened in the subsequent year, though that is merely an observation.

These trends do not worry me at all, as it is typical for markets to go up. However, there are certainly some concerns for me in specific sectors of the market, with many pre-revenue or meme stocks going up exponentially in the past few months.

The quantum sector in particular has been extremely hot, with several of these stocks up over 300% YTD and 100% in the past month alone (RGTI, QBTS, IONQ etc…). I would not touch any of these with a 10-foot pole.

More on my positioning later in this update.

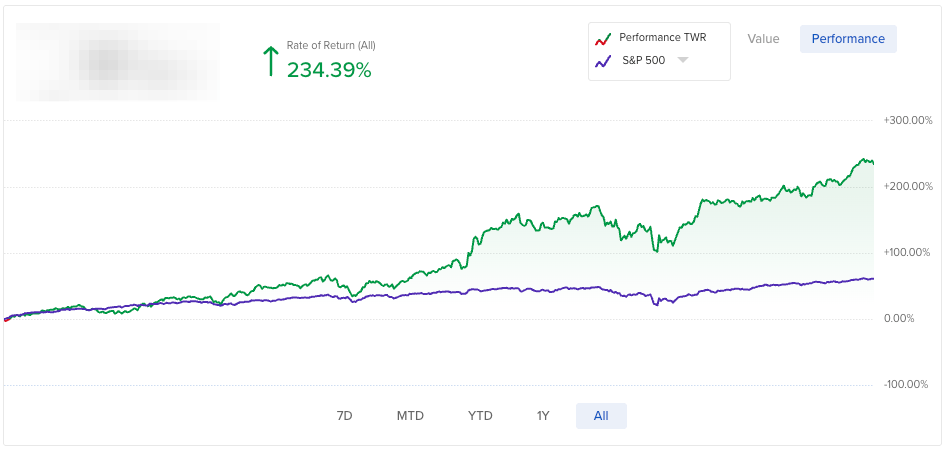

Portfolio Performance (Since Inception)

(Portfolio Inception Date: 27th October 2023)

Portfolio: +234.39%

S&P 500: +61.01% (Outperformance: +173.38%)

NASDAQ: +82.05% (Outperformance: +152.34%)

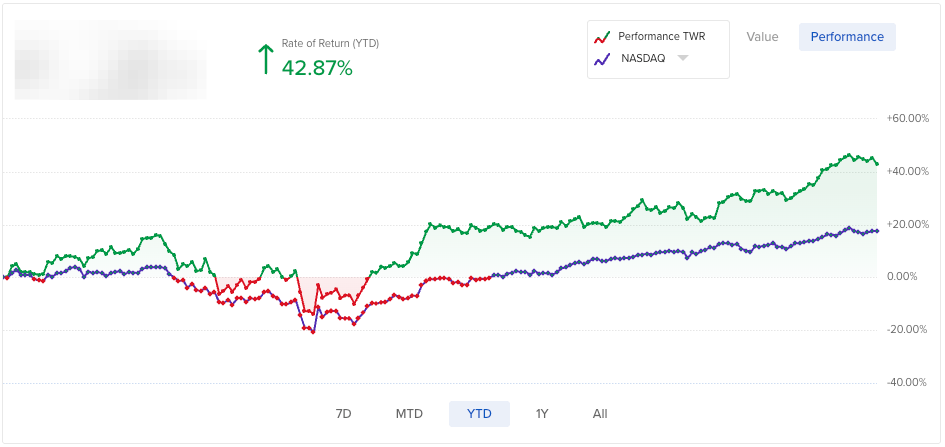

Portfolio Performance (YTD)

Portfolio: +42.87%

S&P 500: +13.25% (Outperformance: +29.62%)

NASDAQ: +17.60% (Outperformance: +25.27%)

Portfolio reviews are exclusively for paid subscribers. If you would like to gain access to my portfolio holdings, deep dives, and tons of other articles, do consider subscribing.

I post several articles per month, ranging from extensive 50-60 pager deep dives on the most interesting businesses I can find, to shorter articles on valuations, market musings and specific verticals/geographies.

In the past month, I have shared two deep dives with subscribers (INTR, RBRK) and a free article that you might find interesting:

In the next few segments, I discuss my general thoughts on the market, performance, portfolio allocation and portfolio changes.