Portfolio Review (July 2025)

A busy month with a few key additions to the portfolio

July has been another strong month for the market with the NASDAQ returning over 4%, boosted by the incredible reports by MSFT and META just yesterday.

As discussed in previous posts and announcements, portfolio reviews are exclusively for paid subscribers. If you would like to gain access to my portfolio, deep dives, and various articles, do consider subscribing.

I post 8-10 articles per month, of which 2-3 will be extensive 50-60 pager deep dives on the most interesting businesses.

Portfolio Performance (Since Inception)

(Portfolio Inception Date: 27th October 2023)

Portfolio: +201.29%

S&P 500: +53.99% (Outperformance: +147.30%)

NASDAQ: +69.78% (Outperformance: +131.51%)

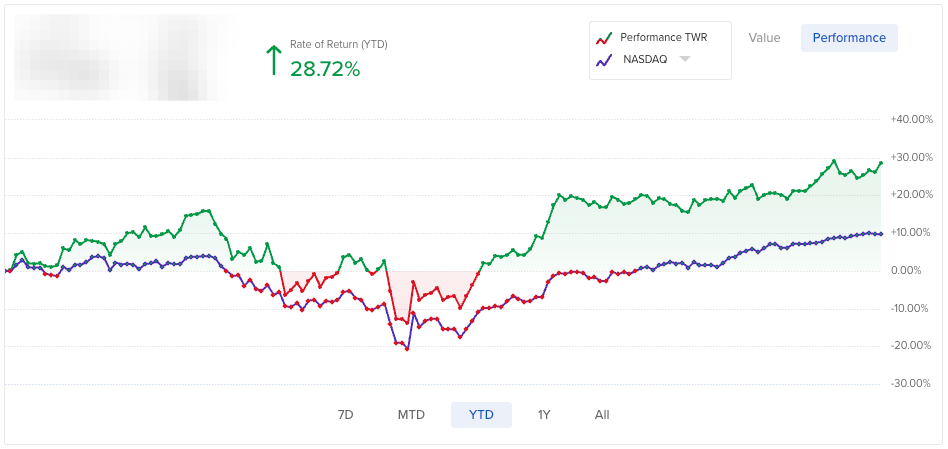

Portfolio Performance (YTD)

Portfolio: +28.72%

S&P 500: +8.32% (Outperformance: +20.40%)

NASDAQ: +9.68% (Outperformance: +19.04%)

General Thoughts on Portfolio Performance

The past 2.5 years have been one of the strongest bull markets with the market seeing back to back 20+% years and seemingly on track again this year for a double-digit positive return.

I’m relatively pleased with my performance thus far, especially with regards to the stocks I own, which I believe are not as high-beta as the performance would suggest.

Rather than the outperformance on the positive side, i’m most proud with how I handled the drawdown in April, with the portfolio never underperforming the NASDAQ despite a heavy tilt towards growth which got hit hard by the tariff scare.

I attribute that to a trim in the portfolio between January and March which I shared on my X account in real-time and the subsequent heavy dip buys in April.

Overall, this performance is not sustainable, but I will continue to stick to my approach and purchase great businesses at fair prices and believe that they will allow me to outperform in the long run.