Portfolio Review - 3rd June 2025

Performance & Allocation

Hi all,

Many have asked for my Portfolio Allocation & Performance in the past few months.

Today, I’ll be sharing my allocation, performance, as well as my rationale behind holding each stock.

I run a concentrated book, holding no more than 12 positions at any one time, and I tend to concentrate my positions when the market corrects, often to between 6-8 high conviction stocks.

I like to let my winners run, hence my top 5 stocks make up ~78% of my portfolio.

Portfolio Performance (YTD 2025) as of 1st June 2025

Portfolio: 17.72%

S&P 500: 0.81% (Outperformance: 16.91%)

NASDAQ: 1.74% (Outperformance: 15.98%)

I am personally relatively pleased with how I have deployed my capital in the past 6 months.

In early January, I trimmed my holdings in stocks that went parabolic: HOOD 0.00%↑ HIMS 0.00%↑ TSLA 0.00%↑ and re-invested most of into SE 0.00%↑ GRAB 0.00%↑ MELI 0.00%↑

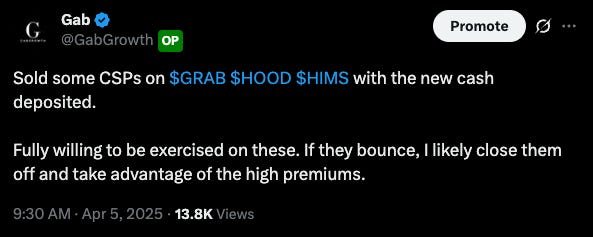

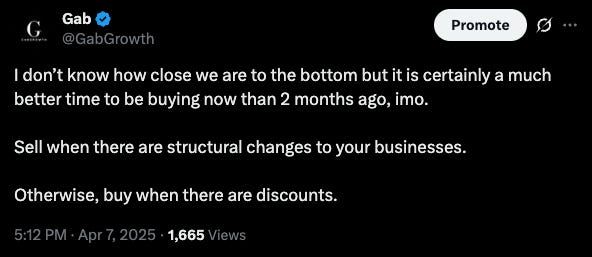

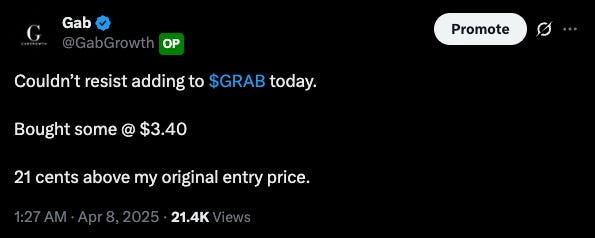

On the week of capitulation from Trump’s Liberation Day Tariffs, I deposited more cash into the account and added to my holdings while the market was panicking. Also sold some Cash-Secured Puts.

Proof below for transparency:

That said, my portfolio was still down ~25% from peak to trough, which is something I will be looking to improve.

Portfolio Allocation

In recent months, I have spoken about my plan to raise cash as it appears we are in a period where euphoria is taking hold and fundamentals are starting to be overlooked in favour of pre-revenue businesses and speculative sectors.

From ~1% cash at the April trough, I have now raised my cash levels to ~11%. That said, I generally prefer to stay >95% invested and will be looking for more investment ideas to deploy that capital.

This is my current allocation: