Nike: Value Buy or Value Trap?

Is it time to buy?

Nike is down 23.7% in the past five years despite revenues growing by 27% in that same time-frame.

The business currently trades at a 21x P/E, 4.5x EV/GP ratio.

That begs the question: Is this a generational opportunity to buy the stock? Or is this a value trap?

My belief is that Nike is a value trap, and in this article I lay out my reasons for it.

1. Fashion is a weak MOAT

While Nike is often perceived as having a strong branding MOAT, the reality is that fashion and consumer trends are inherently fickle.

Nike’s historical success was built on it being at the forefront of culture and sport. Signature athlete deals are no longer the draw they once were, and Nike hasn’t found the next Jordan.

The Air Jordan line created a business model where the athlete became the brand, and Nike the ultimate platform.

Today, consumers, especially GenZ’s don’t idolise athletes the same way previous generations did. Cultural influence is fragmented across athletes, musicians, influencers, streamers, and niche creators.

Young consumers are more likely to wear what they see on TikTok or Instagram than what their favourite NBA player wears on court.

Unlike network effects or high barriers to entry, fashion brands can fall out of favour quickly, and Nike is not immune.

In an era of TikTok virality and micro-brand loyalty, Nike is competing in a game where cultural momentum can shift overnight.

2. Brand Relevance is rapidly fading

Younger consumers are increasingly less loyal to legacy brands and more drawn to niche, authentic, or viral labels.

Nike, once seen as the ultimate symbol of innovation and swagger, is now viewed by many as a default or safe choice. Still relevant, but no longer defining the culture.

They’re gravitating towards:

New Balance for retro authenticity

Hoka/On Running for performance-meets-fashion

Smaller streetwear brands attracting niche audiences and a loyal group

Gen Z and Millennials are drawn to products that feel authentic, exclusive or niche, viral or community-driven. Nike, which once dominated these dynamics, now feels corporate, mainstream, and mass-produced. Still a “good” brand, but no longer an aspirational one for the most trend-forward segments.

3. China: From Growth Engine to Structural Headwind

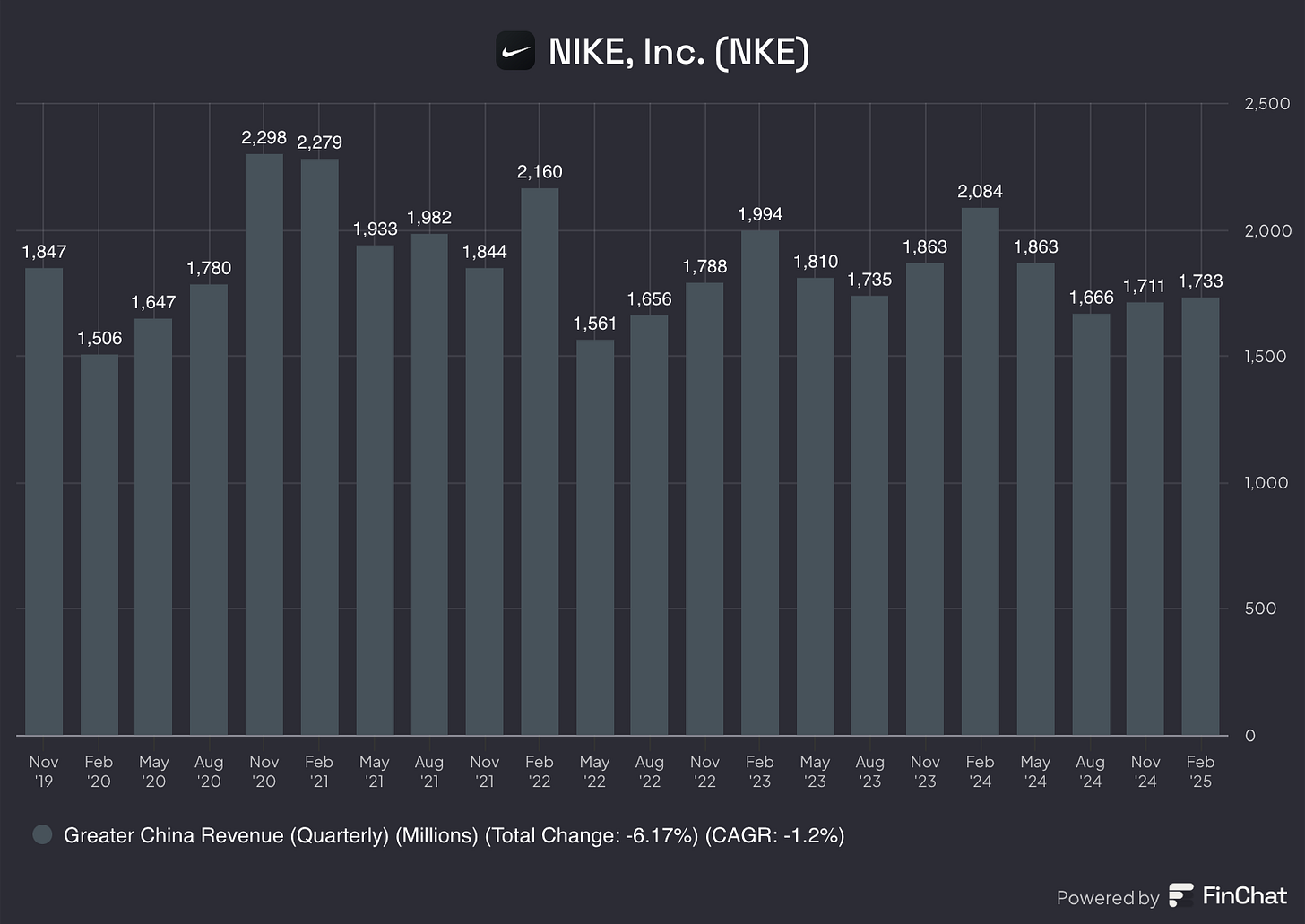

Once Nike’s fastest-growing and most profitable region, China is now a source of uncertainty. Nike once viewed China as a high-margin, high-growth engine; double-digit growth, rising middle class, and premium brand positioning. However, those days are over.

Revenue from Greater China has now declined or stagnated in recent quarters and Nike is now losing share in a market that used to drive global upside.

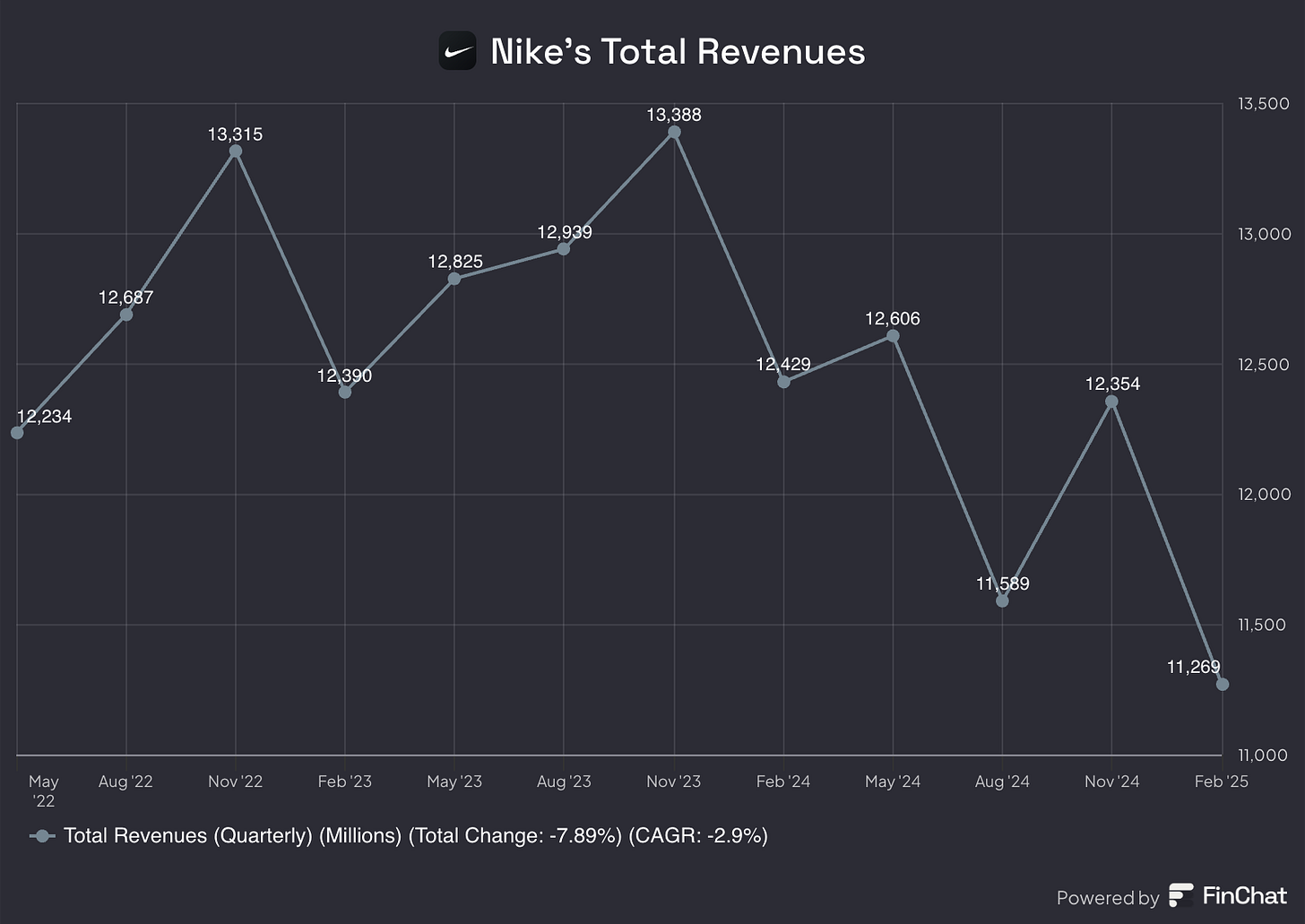

4. Financial Metrics Decline

Nike looks attractive at first glance: a storied brand, strong global presence, and a long track record of success.

But digging deeper, I find a company grappling with slowing growth, squeezed margins, increased competition, and a fading brand edge.

a. Revenue Stagnation

Top-line growth has stalled, especially in Greater China where sales were once growing at double-digits, but are now flat or down YoY.

Even in North America, where Nike dominates, growth is minimal and largely driven by pricing or DTC mix shift, not volume.

b. Margin Compression

Strong brands with moats are supposed to grow margins over time as they brand power provides pricing power.

However, Nike’s gross margins have consistently declined from a peak of 46% to a low of 43-44% today. Operating margins have dropped to the low-teens (10-12%), a steep decline from pre-COVID levels (15-16%)

The DTC strategy was supposed to drive operating leverage, but instead has raised fixed costs (distribution centers, retail operations, digital investments) without the expected payoff.

c. Inventory Bloat & Working Capital Drag

Inventory levels were up ~40% YoY at one point in 2022 and remain elevated compared to pre-COVID levels.

Despite efforts to clean up inventory, working capital remains a drag on cash flow, and the reliance on discounting is hurting both brand equity and margins.

Conclusion:

Nike still has brand recognition and global scale, but it’s become a legacy giant in a fast-evolving market. The stock may look like a bargain, but the business is fundamentally weaker than the valuation implies.

IMO, this is a definition of a value trap.

Sure, the stock may rebound in the short-term, but I believe the business as it is today is structurally broken and would require drastic changes to turnaround.