My Top 3 Stocks for 2026

In this piece, I highlight three stocks I currently own that I am most excited about heading into 2026.

These are not necessarily the largest positions in my portfolio, but they are names where I believe the probability-weighted outcomes are meaningfully skewed in my favour.

I think they reflect situations where fundamentals appear to be lining up with the narrative at the right time, and therefore providing the potential for outsized performance over the year ahead.

I will layout the bull case for each, discuss catalysts, risks and valuation.

Specifically, I’m looking for asymmetric risk-adjusted returns, not simply high-beta stocks that can go up 2-3x higher than the market, if the market performs strongly.

As it stands today (25th December 2025), it is almost certain that we will finish the year at a strong gain for the index (SPY), for the 3rd year running:

2023: 24.23%

2024: 23.31%

2025 (YTD): 18.09%

The last 3-year streak was from 2019-2021, followed by a -19.44% return in 2022.

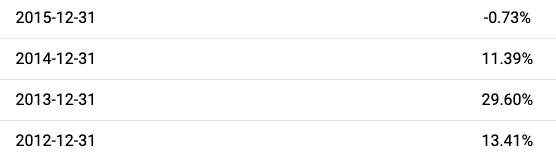

Going further back, the last time we saw a minimum 3-year streak was from 2012-2014, which was followed by a flat year in 2015 of -0.73% returns.

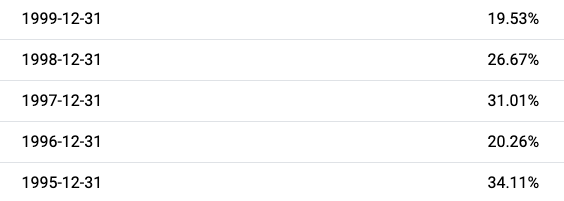

Going even further back, the closest corollary that we see to these 3 years of market returns, is probably 1995-1997. And what followed was 2 stellar years in 1998 & 1999.

What followed after, was of course not so pretty…

So what is the point of me sharing all this?

It is not to make a prediction that 2026 must be a poor year, nor to argue that history repeats in a neat, mechanical way. If it were that easy, we would all be rich.

Rather, the point is to frame where we are in the cycle, and how that should shape expectations, positioning and risk management.

Extended streaks of strong index-level returns are rare. When they happen, they tend to coincide with:

Elevated starting valuations

Compressed forward returns at the index level

A widening gap between index performance and individual stock outcomes

That is why I believe the risk is not that everything collapses tomorrow, but that index beta becomes a poor source of returns, while dispersion across stocks increases materially.

If we think about it, this is the perfect “stock pickers” market. And for us stock picking participants, this is ideal.

In fact, dispersion has already started happening. The COR30D which represents the market’s expected average pairwise correlation among the largest (top 50 by market cap, value-weighted) stocks in the S&P 500 over the next 3 months, is near all-time lows despite the S&P being at all-time highs.

This indicates that the market expects S&P500 stocks, particularly the largest 50, to move more independently of each other over the next 3 months, rather than in lockstep. This creates dispersion in returns: some stocks can significantly outperform while others lag, even if the overall market is flat or up modestly.

In 2026, I believe “owning the index” may not be enough, and while returns may still be fantastic, they are likely to be more idiosyncratic, more dependent on fundamentals rather than liquidity and more asymmetric, in both ways.

This is why I’m focusing heavily on picking the right stocks to back, and ensuring that my portfolio is well positioned for the year ahead.