More Pain Ahead? - WR4

MAG7 Struggles

Hi all,

Welcome back to the 4th edition of the Weekly Roundup!

We saw yet another rough week for the US markets, as many-high growth stocks continued their downward spiral following last week’s major drawdowns.

The indices were down this week, with QQQ 0.00%↑ being hit harder than others, owing to MAG7 weakness.

$SPY: -1.30%

$QQQ: -3.74%

Popular FinTwit Stocks % from ATH:

$TSLA: -38.93%

$HIMS: -34.41%

$PLTR: -31.87%

$HOOD: -23.25%

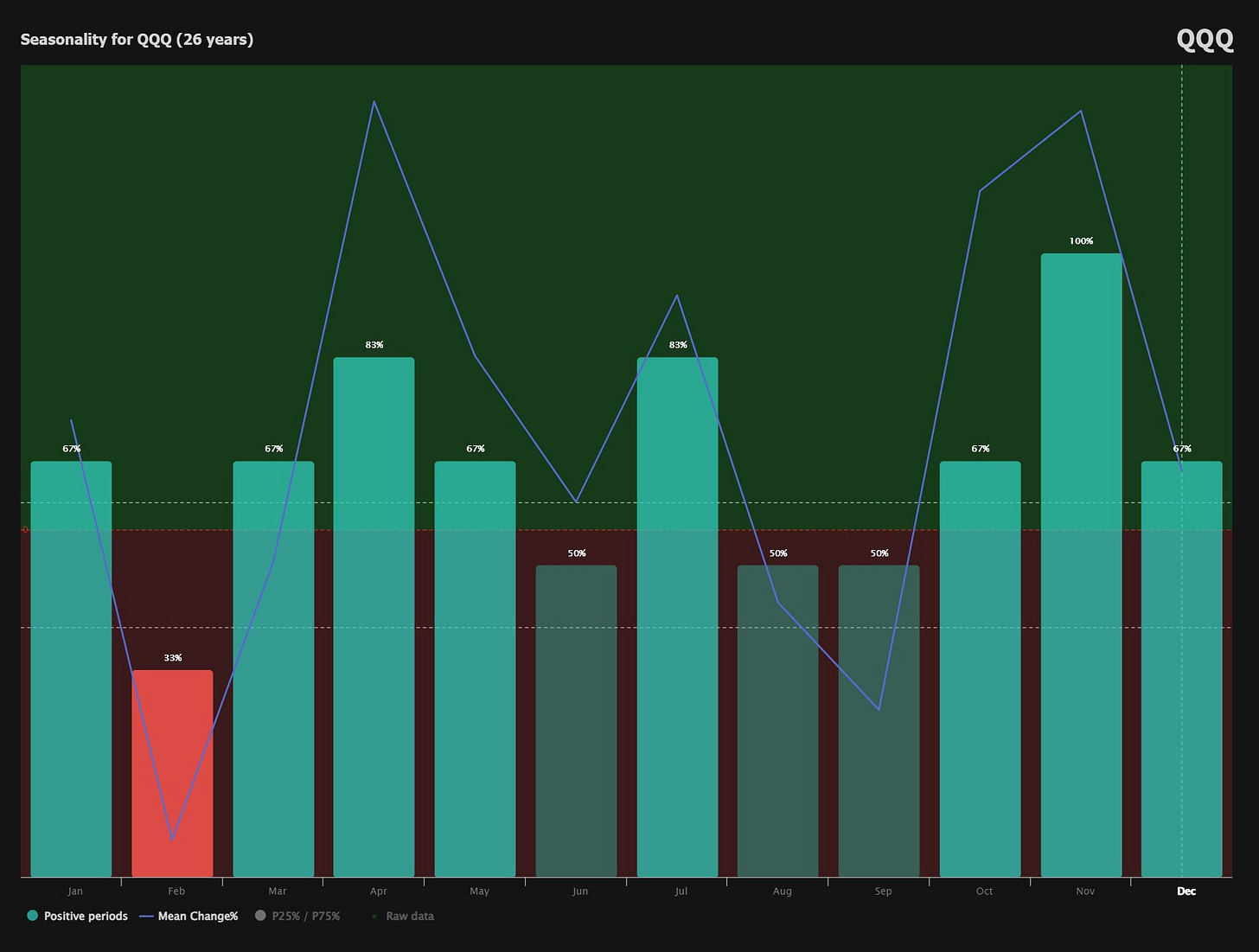

For those who are worried about the recent dip, this was not unexpected considering seasonality of stocks in post-election years. I expect a rebound in March.

Docket:

Sea Limited to Report Earnings!

MAG7 Struggles

Stocks on Watchlist

1) Sea Limited to Report Earnings!

Analysts expectations are rather high for Sea Limited, which is no surprise considering their recent earnings beats.

Earnings Expectations:

Revenue: $4.66B

EPS: $0.62

I expect a strong quarter from Sea yet again with metrics i’ve been tracking moving in the right direction.

Sea’s logistics business has been a huge under-rated factor by the market, with the scale of SPX now most likely having surpassed J&T Logistics, the leading logistics provider in the market.

If you have time, I would recommend reading Hayden Capital’s annual letter that details the logistics of Shopee and the competitive advantage they possess.

Some of you might have seen my post on X, but this is the chart of SeaMoney’s revenues from 2019 till today.

SeaMoney has often been overlooked, with Shopee usually in the spotlight. However, it has now overtaken Garena as the primary cash-generating segment and is poised to become a significant part of Sea Limited’s business in the years ahead.

2) MAG7 Struggles

MAG7, with the exception of META 0.00%↑ has struggled in 2025 so far, with the collective basket now down over 10% from ATHs.

The trend over time shows that the largest businesses will concentrate and make up a larger percent of the index, meaning an outperformance over time. However, one thing of note is that peaks in S&P concentration have tended to correlate with recessionary declines.

3) Stocks on Watchlist

With the recent market decline and with the majority of my stocks being up 100-500% from the troughs of 2022, I am actively on the look out for stocks that may have a better risk/reward scenario from here in comparison.

Here are the list of stocks on my watchlist:

DUOL

FOUR

MNDY

NU

ONON

CPNG

WING

I hope to share more about these businesses in the weeks to come!

That is all for this week’s weekly roundup. Thank you for reading and I hope it’s brought some value to you.

Until next time!

Disclaimer: The content presented is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.