Mercado Libre (Deep Dive)

The Most Important Business in Latin America

Most investors describe Mercado Libre (MELI) as the Amazon of Latin America.

I think that’s an incredibly lazy comparison.

Amazon entered a market with working logistics, reliable payments, predictable inflation, and a consumer base already comfortable with commerce.

Mercado Libre had none of those luxuries. It had to build each of those foundations itself, before it could dominate the region.

It started off as an e-commerce website, then built its own payment system to serve the millions of unbanked or underbanked consumers who couldn’t use credit cards or trust traditional banks. It then invested heavily in logistics networks from the ground up, building warehouses, delivery fleets, and even air cargo operations in regions where roads were unreliable and last-mile delivery was a nightmare.

Over the last 25 years, MELI has quietly become the backbone of how millions of people buy, sell, pay, borrow, advertise, and run their businesses.

It is the infrastructure layer for commerce and finance across an entire continent, stitched together through a level of execution that is rarely seen in emerging markets.

However, there is increasing competition and some risks that the business has arguably never seen before. In this piece, I will evaluate the competitive landscape, market positioning, bull/bear cases and valuation of the business among other factors.

Table of Contents

Company History

Value Proposition

Business Model

Product Offerings

Moats & Differentiation

Market Context & Industry Positioning

Competitive Landscape

Financials

Ownership & Management

Valuation

Catalysts & Outlook

Bull and Bear Case

GabGrowth Quality Score

Concluding Thoughts (What I am personally doing)

1. Company History

Origins and Early Growth (1999-2007)

Mercado Libre (or “Free Market” in Spanish) was founded on August 2, 1999 in Buenos Aires, Argentina by Marcos Galperin. Then an MBA student at Stanford, he drew inspiration from eBay’s success in the US.

He envisioned replicating an online auction and marketplace model tailored to Latin America’s emerging internet landscape, where penetration was extremely low (around 3% in Argentina at the time) and trust in online transactions was minimal.

In the early days, Mercado Libre facilitated auctions and C2C sales online. This caught the attention of eBay itself, which in 2001 purchased a 19.5% stake in MELI. This partnership helped Mercado Libre survive the dot-com bust and learn from eBay’s playbook. As part of the deal, eBay also agreed not to compete in the region for at least 5 years.

By the mid-2000s, Mercado Libre was expanding beyond Argentina into Brazil, Mexico and several other Latin countries, often by acquiring or outcompeting local rivals.

For example, Mercado Libre acquired iBazar in Brazil in 2001, DeRemate, a leading regional competitor in 2008, which cemented its dominance in markets like Argentina and Chile. It also acquired Classified Media Group, which ran real estate and automotive classified sites like tucarro.com (for cars) and tuinmueble.com (for property) to enter the autos and real estate listing business. These early moves established Mercado Libre as the leading e-commerce platform in Latin America.

In 2004, it also launched Mercado Pago (“Market Pay”) as an integrated payments solution to facilitate transactions on the marketplace. This was born out of an early insight that Latin America lacked reliable payments infrastructure and it turned out to be a crucial innovation in a region where credit card usage was limited and cash was king.

IPO and Regional Expansion (2007-2011)

In August 2007, Mercado Libre became the first Latin American tech company to IPO on the Nasdaq, under the ticker MELI. The IPO provided capital for further expansion. Around this time, e-commerce was still nascent in Latin America. Internet penetration was growing, but trust in online shopping and electronic payments was low. MELI focused on adapting to local needs, setting up operations in nearly every Spanish-speaking country in the region and Brazil, tailoring its site to local languages and currencies.

It was precisely this hyper-localisation that helped MELI to win the market, and create a dominant platform that was well-loved by millions in the region.

Around 2010, Mercado Pago began expanding beyond the Mercado Libre platform, offering a way for online merchants on other platforms/websites to accept payments. Mercado Libre’s marketplace continued to grow rapidly, acquiring competitors where possible, but in many countries, it simply out-executed them.

A major milestone came in 2011 when the company migrated to an open-source platform and opened its API to third-party developers, encouraging the creation of a whole ecosystem of apps and services around Mercado Libre. By 2012, Mercado Libre was firmly established as the e-commerce leader in its key markets (Argentina, Brazil, Mexico), though it still faced competition from local players in certain countries.

Ecosystem Expansion (2012-2016)

As Mercado Libre grew, it steadily transformed from an auction site into a full-fledged e-commerce ecosystem. It launched Mercado Shops in 2012, enabling small businesses to create their own branded online storefronts integrated with Mercado Libre’s platform.

It also started building Mercado Envíos, its proprietary logistics program, to handle shipments for sellers (initially via partnerships with carriers). During this period, the company’s management clearly saw that to overcome Latin America’s trust and infrastructure barriers, Mercado Libre had to provide end-to-end solutions: payments, shipping, financing, and even advertising. In 2015, it acquired Metros Cúbicos and Portal Inmobiliario (real estate portals) to bolster its classifieds business.

Around this time, more eyes were set on the region. Local e-commerce players like B2W and Magazine Luiza were investing heavily while Amazon launched marketplace operations in Brazil and Mexico in the mid-2010s. Mercado Libre responded by accelerating investment in fulfilment centers and faster shipping to maintain its lead. However, bigger changes were on the horizon as the company prepared to double down on logistics and FinTech.

By 2016, Mercado Libre was investing heavily in Brazil (its largest market) including opening a new 17,000 m² tech headquarters in São Paulo called “Melicidade” and expanding R&D centers.

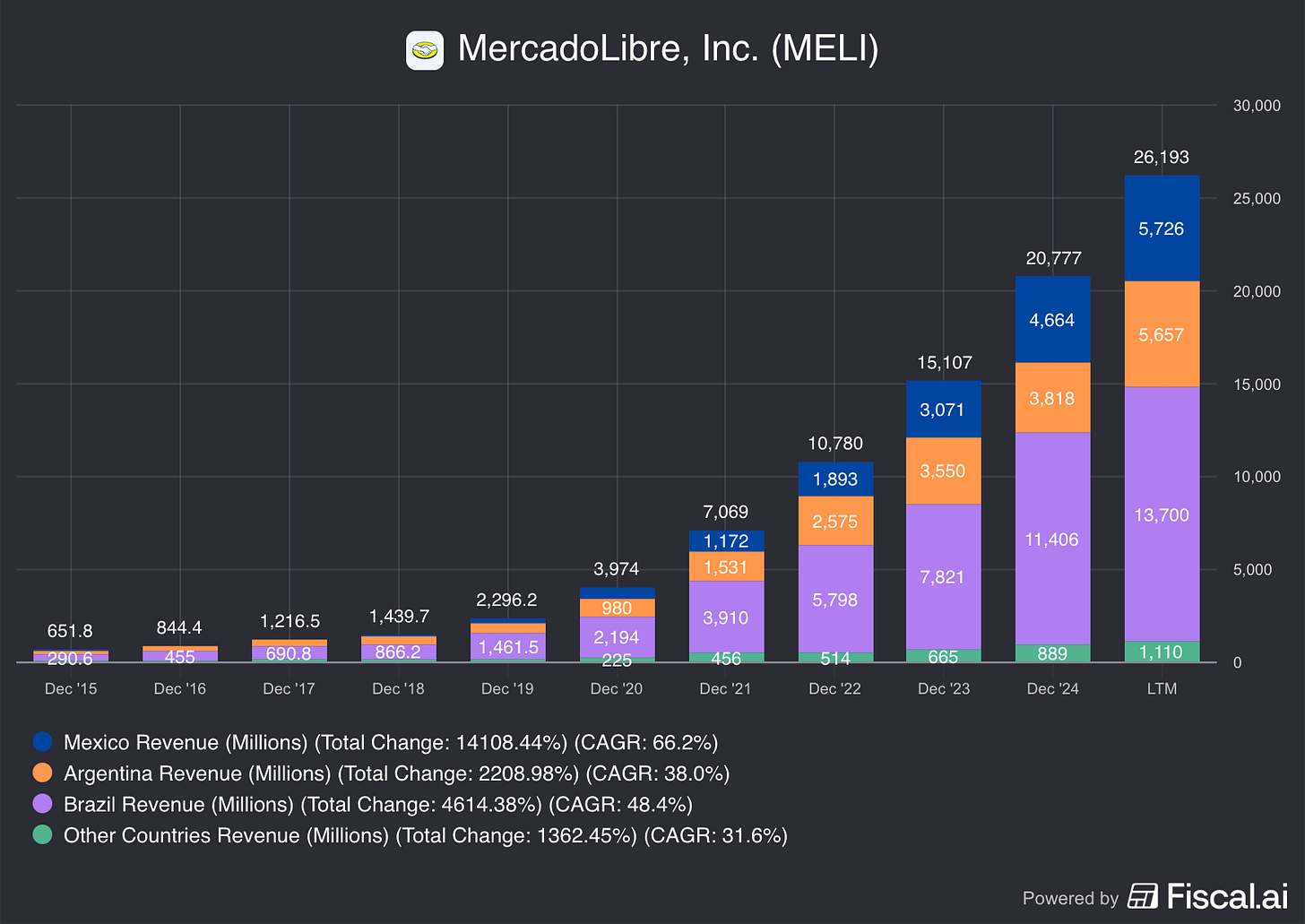

During this period, MELI’s financial performance showed resilience despite competitive pressures. Revenues grew from $374M in 2013 to $844M in 2016, though operating profit stayed relatively flat as the company strategically re-invested in growing its moat.

Notably, eBay exited its investment in 2016, selling off its stake, a sign that MELI had matured and could stand on its own. The 2 companies continued to maintain a partnership that allowed eBay sellers to list on Mercado Libre.

Logistics & FinTech Focus (2017-2019)

In 2017, Mercado Libre joined the Nasdaq-100 index, reflecting its growth into a sizeable tech player. This period saw the company aggressively build out Mercado Envíos (its logistics network) and Mercado Crédito (consumer and merchant lending).

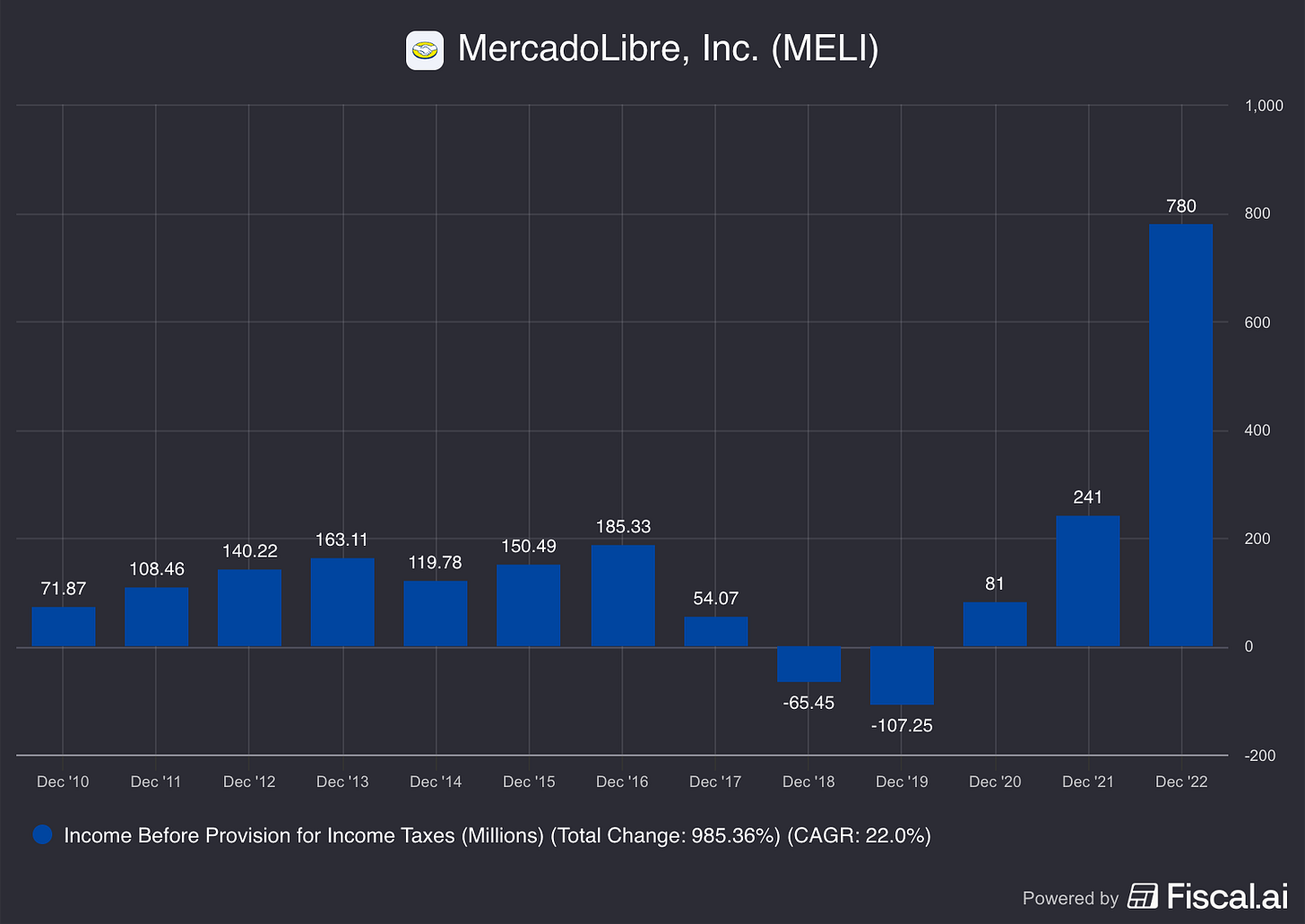

In 2017-2018, Mercado Libre started operating its own fulfilment centers. By 2019 it opened its first large distribution centers in Argentina, Brazil, and Mexico. This was a pivotal shift from being a pure marketplace to a hybrid model more similar to Amazon’s FBA (Fulfilled by Amazon), where Mercado Libre could store sellers’ goods and offer faster delivery. The investment was costly, which led to operating income turning negative in 2018-2019, as it spent on warehouses, shipping subsidies, and promotions to drive user adoption.

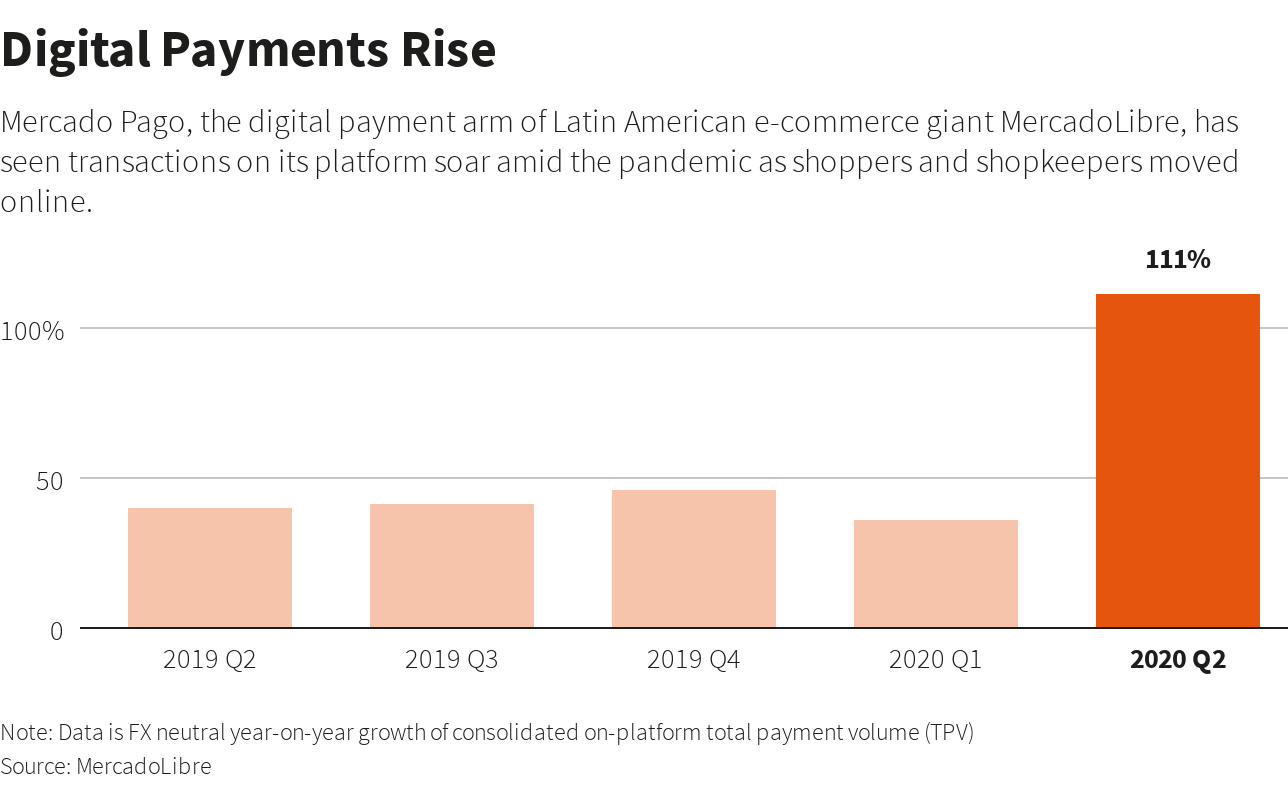

Meanwhile, Mercado Pago was booming beyond the marketplace. It became one of the leading digital payment platforms in LatAm, facilitating online checkouts for third-party websites and mobile point-of-sale payments in physical stores. In 2018, Mercado Libre introduced in-app QR code payments and mobile wallet features, foreshadowing its ambitions in FinTech.

It also started extending credit to merchants and buyers on the platform, leveraging its rich data to underwrite loans. By 2019, Mercado Libre’s revenue had jumped to $2.3B, albeit with an operating loss.

Pandemic Surge and Profitability (2020-2022)

The COVID-19 pandemic was an inflection point for Mercado Libre. Lockdowns drove huge numbers of consumers and small businesses online for the first time. In 2020, Mercado Libre’s revenue soared 73% to $3.97B, and then another 78% in 2021 to $7.06B.

The company scaled rapidly to meet demand, opening new distribution centers in Chile and Colombia in 2020, expanding last-mile delivery capabilities (including a fleet of “Meli Air” cargo planes in Mexico), and hiring thousands of workers. By 2021, it operated over 90 logistics centers across LatAm, enabling same-day or next-day deliveries in major cities. This gave Mercado Libre a delivery speed edge over most competitors.

Mercado Pago usage also skyrocketed as people avoided cash (due to perceived health risk during COVID). The platform added features like utility bill payments, investments (Mercado Fondo offered users a way to earn interest on balances), and insurance products. By 2021, Mercado Libre had firmly achieved profitability at scale again, operating income was $240M in 2021 and $780M in 2022, after several break-even years.

Importantly, the post-2018 investments in logistics paid off as Mercado Libre could offer faster and more reliable delivery than competitors during the pandemic, winning over customers. In Brazil, it launched same-day and next-day deliveries, leveraging its warehouses and fleet, achieving the region’s fastest shipping times.

Also in this period, the company started Mercado Ads, monetising its first-party data via an advertising platform for sellers and brands. By 2022, Mercado Libre was the undisputed leader in e-commerce across its core markets, and Mercado Pago had grown into one of LatAm’s largest FinTech platforms. However, competition was ever-present (Amazon, Sea Limited’s Shopee, and local rivals were vying for share), so Mercado Libre kept the pedal down on growth.

Consolidation and New Initiatives (2023-Now)

In recent years, Mercado Libre has been expanding its empire further and layering on new services. In 2023, the company crossed $10B in annual revenue and continued to grow ~40% YoY despite tough macro conditions.

The key focus area has been credit cards. Mercado Pago rolled out its own credit card (in partnership with Visa) in Brazil, Mexico and just launched in Argentina, tapping into the huge unbanked population (over 60% of adults in Argentina lack a credit card, a gap Mercado Pago is seizing).

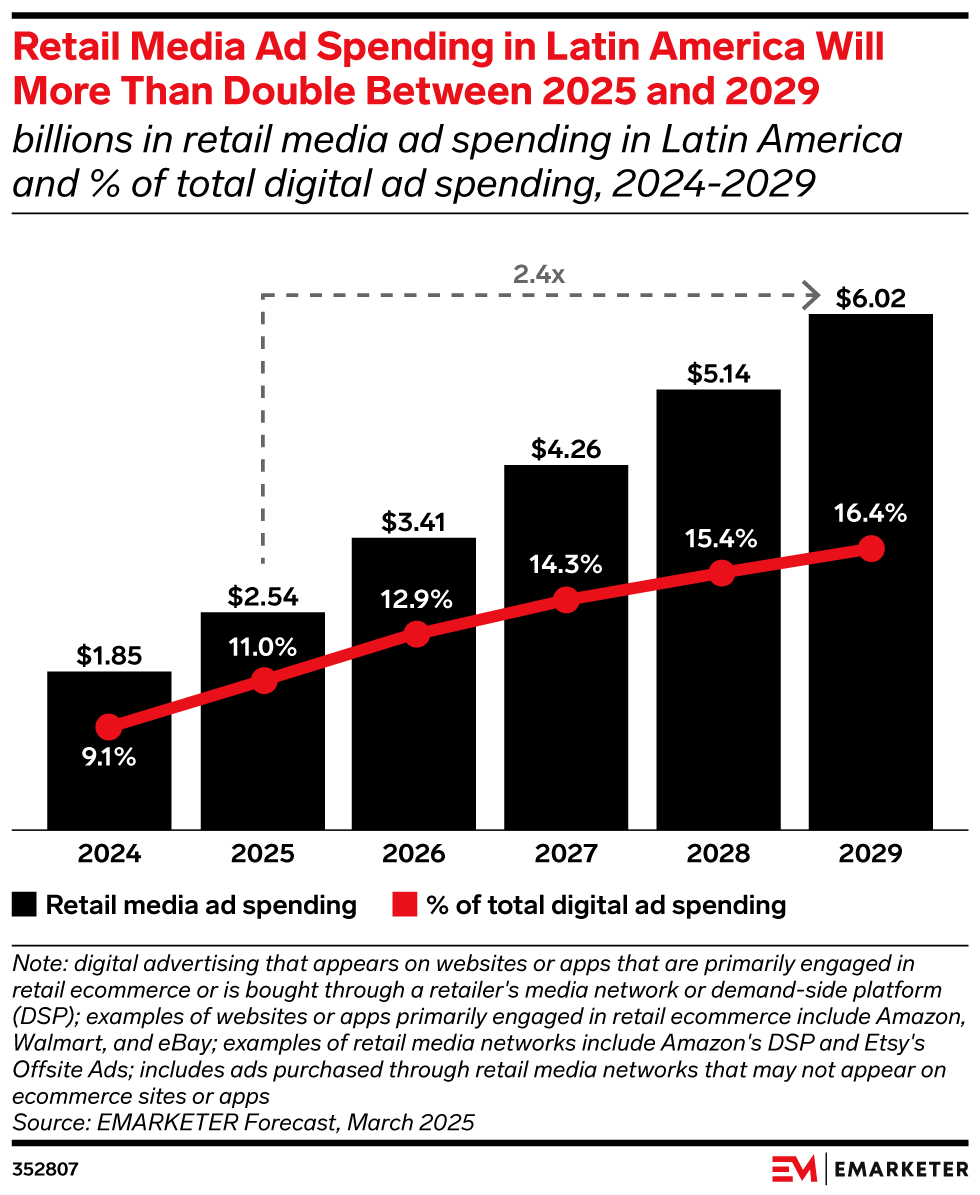

By Q3 2025, Mercado Libre had issued over 5 million credit cards in Brazil and was rapidly expanding in Mexico. Mercado Ads is becoming a meaningful revenue stream, growing 56% YoY in USD in Q3 2025 (63% FX-neutral) and forming a big part of the company’s long-term monetisation strategy.

While Mercado Libre already serves 18 countries, it has started to deepen presence in smaller markets (e.g. Central America via cross-border programs) and even opened a fulfilment center in Texas in 2025 to help U.S. sellers ship into Latin America.

Mercado Libre is also piloting robotics and automation in its warehouses (including testing humanoid robots for moving goods) to boost efficiency. With labour being one of the key bottlenecks and higher expense items for e-commerce, a move towards automation could materially improve margins.

As of Q3 2025, Mercado Libre’s growth remains extraordinary, net revenue grew 39% YoY to $7.4B for the quarter, and it continues to capture market share in both e-commerce and FinTech. The history of Mercado Libre is one of relentless expansion and reinvention, from an auction website to a diversified commerce + FinTech platform that has helped modernise retail and banking across Latin America.

I write all this, not for colour or nostalgia, but because I believe the company’s past decisions explain why the business looks the way it does today, and why many of its advantages may be hard to replicate.

Mercado Libre’s moat was built over decades, with each layer added in response to real constraints in the region. I believe understanding when and why Mercado Pago, Mercado Envíos, and Mercado Crédito were created, is key in understanding the durability of the model.

2. Business Model

At a high level, Mercado Libre generates revenue through two main segments: Commerce (Mercado Libre) and FinTech (Mercado Pago). The Commerce segment includes the online marketplace and related services (like shipping and advertising), while FinTech covers payments, credit, and other financial services.

The synergy between these segments is a key strength of Mercado Libre’s business model. Let’s break down how the company makes money and the strategic approach behind it.

Marketplace Transaction Revenue (Commerce):

Mercado Libre’s marketplace primarily earns revenue through take-rates on transactions. When sellers make a sale, MELI collects a commission (which varies by category and country). In addition, sellers pay fees for optional services like shipping (through Mercado Envíos) and promotions/ads if they choose to advertise their listings via Mercado Ads.

In some cases, buyers pay nominal fees too if they choose faster shipping options or cash-on-delivery service, though many of these are subsidised or free to encourage volume.

While most sales are third-party, Mercado Libre selectively runs first-party inventory (buying inventory to sell directly) to ensure availability in key categories. Revenues scale with GMV, which reached $16.5B in Q3 2025. Over time, take rates have risen as more value-added services are layered onto each transaction. (More on this later)

FinTech (Payments & Credit):

Mercado Pago, the payments arm, generates revenue from payment processing fees and interest income. Whenever someone uses Mercado Pago to pay on Mercado Libre or on an external merchant, MELI earns a fee.

Crucially, it is now far larger off-platform than on-platform: Q3 2025 TPV was $71.2B, over 4x marketplace GMV. In addition to payment fees, Mercado Libre makes interest income and credit revenues through Mercado Crédito. It now has a $11B loan book by Q3 2025, making interest income a material contributor to profits.

The FinTech segment also includes other financial services revenue, such as fees from its asset management segment (Mercado Fondo), insurance referrals and other transactions.

Advertising:

Mercado Ads is a fast-growing, high-margin business driven by high-intent shopper data. Advertising revenue grew 56% YoY in Q3 2025, and Mercado Libre controls an estimated 55%+ of LatAm’s digital retail media market (as of 2024), giving it a monetisation lever similar to Amazon Ads.

Value-Added Services:

Beyond core marketplace and FinTech revenues, Mercado Libre monetises its ecosystem through several value-added services. Sellers using Mercado Envíos Fulfilment pay storage and handling fees, similar to Amazon FBA.

Certain verticals such as real estate, autos and services operate on paid listing models. Mercado Libre also runs loyalty and subscription products, Mercado Punots and MELI+ (Amazon Prime-equivalent), which bundle free shipping and digital perks to increase engagement and retention rather than near-term profit. While smaller than commerce and FinTech today, these services improve monetisation density, raise switching costs and strengthen the overall ecosystem economics.

What makes MELI’s model particularly powerful?

Cross-Subsidy & User Lifestyle Monetisation

Mercado Libre isn’t solely focused on maximising profit per transaction. Instead, it cross-subsidises across products to fuel growth. It periodically offers free or discounted shipping, which reduces marketplace revenue but increases order volume and attracts new customers.

This leads to greater lifetime value and more FinTech transactions. Over a user’s lifetime, Mercado Libre might earn relatively low margins on the first few purchases (due to incentives), but as the user grows comfortable and uses Mercado Pago and perhaps takes a loan or uses the MELI credit card, the company’s revenue per user multiplies.

This approach is easy in theory, but requires a long-term minded management team that is willing to play the long game. And as we will see later, MELI has a truly exceptional and long-tenured executive team.

Multi-Year Horizon & Heavy Reinvestment

Much like other great tech companies, Mercado Libre takes a long-term view. It continuously reinvests a large portion of its cash flows back into the business, be it through building logistics warehouses, developing new FinTech products, or customer acquisition.

A vivid example was the 2018-2019 period when Mercado Libre raised $1.85B (including a notable $750M investment from PayPal) and ploughed funds into warehousing, shipping fleet, and subsidising faster delivery. This depressed short-term earnings but set the stage for huge pandemic-era gains.

Network Effects & Ecosystem Lock-In

The integration of services creates natural switching costs for users. A seller using Mercado Libre not only relies on the sales, but might also use Mercado Envíos for all logistics and have a Mercado Crédito loan for inventory. This makes it hard for them to switch to a rival platform without losing those benefits.

Similarly, a consumer with money in their Mercado Pago account, a Mercado Pago credit card in hand, and a history of positive experiences on Mercado Libre has little incentive to try a competing site or payment app.

This “ecosystem lock-in” means Mercado Libre can retain customers and gradually increase monetisation (for instance, introducing a subscription like MELI+ with free shipping and video streaming adds even more stickiness, akin to Amazon Prime). The business model, therefore, isn’t about one-off transactions but about capturing a user’s entire digital commerce journey and keeping them within Mercado Libre’s network of services.

Scale Economies

As Mercado Libre scales, its unit economics improve. More volume in Mercado Envíos lowers per-package delivery cost (Brazil’s unit shipping cost fell 8% QoQ in Q3 2025 thanks to scale).

More TPV in Mercado Pago spreads the fixed platform cost and attracts more merchants, and larger data pools improve credit scoring (leading to stable credit default rates even as the loan book grows.

3. Value Proposition

MELI’s key value proposition I believe lies on making commerce and payments easier, safer and more accessible for hundreds of millions in Latin America.

For Consumers:

MELI offers shoppers an unparalleled selection of products with the convenience of online ordering and delivery, crucial in a region where brick-and-mortar retail can be underdeveloped outside major cities.

The platform provides trust and safety through buyer protection programs, escrow via Mercado Pago, and a robust review/rating system. This is critical in Latin America, where trust in online transactions was historically low. MELI has built that trust over decades.

Consumers also benefit from Mercado Libre’s fast delivery options (same-day and next-day in many areas) and the integration of Mercado Pago which allows various payment methods including instalments.

Beyond e-commerce, Mercado Pago provides enormous value in the financial realm. For millions of unbanked or underbanked individuals, Mercado Pago is often their first entry into the formal financial system.

It offers a free digital wallet where users can store money, pay bills, transfer funds, and pay online or in-store via QR codes, all from a smartphone. In countries like Argentina with high inflation, Mercado Pago even lets users invest their wallet balance in a money market fund (Mercado Fondo) to earn a return, protecting against inflation.

Mercado Pago’s Visa credit card has also given millions of users their first credit card experience. In Brazil, the Mercado Pago credit card has become the most used credit card on MELI’s marketplace. Importantly, over 50% of its usage in Brazil is off-platform, which indicates people are using it in their daily life outside the platform too.

For Sellers and Businesses:

MELI empowers millions of SMBs and entrepreneurs by providing them a ready-made online storefront and access to a huge customer base (over 250 million monthly visits in Brazil alone).

Nearly 10 million entrepreneurs and SMEs in LatAm are part of MELI’s ecosystem. For many of them, Mercado Libre is their main source of income, accounting for the majority of their sales.

Through Mercado Envíos, even a tiny business can offer fast, nationwide shipping with MELI handling the heavy lifting of delivery, warehousing and fulfilment.

Then we have Mercado Pago, where sellers automatically gain access to its infrastructure to accept credit/debit, instalments etc. Sellers can even access working capital loans from Mercado Crédito to grow their business or tide them through tough times. In fact, more than 60% of SMEs on Mercado Libre obtained their first-ever access to credit through Mercado Pago’s lending program.

Sellers also benefit from Mercado Ads where they can promote their listings, utilise data/analytics tools to improve sales.

In summary, Mercado Libre provides a win-win ecosystem. Consumers get convenience and trust, sellers get reach and tools while everyday people gain access to modern financial services. The network effects between these groups reinforce the value proposition.

This democratisation of commerce and finance has had a real economic impact. A study showed MELI’s ecosystem sales represented 3.2% of Brazil’s GDP and nearly 10% of Argentina’s GDP. These are mind-blowing numbers and underlines just how vital it is for local businesses.

4. Product Offerings

MELI’s products span six core areas: Marketplace, Payments, Logistics, Credit, Advertising, and Seller Tools.

Marketplace:

The core e-commerce platform where individuals and businesses sell across all major categories (electronics, apparel, home goods, auto parts, you name it). It now features over 3,000 official brand stores, has a sophisticated search and recommendation engine, frequent sales events, loyalty rewards (Mercado Puntos), and tight integration with shipping and payments.

Payments (Mercado Pago):

A full digital wallet and payments platform used both on and off Mercado Libre. It supports online checkout, QR and in-store payments, P2P transfers, merchant POS devices, a money market fund (Mercado Fondo), insurance services, and a widely adopted credit card. Mercado Pago has become one of Latin America’s largest FinTech platforms, rivaling local banks in usage.

Logistics (Mercado Envíos):

An end-to-end logistics network including fulfilment centers, last-mile delivery, cross-border shipping and fast delivery options (same-day and next-day). Scale has driven major cost efficiencies, allowing Mercado Libre to offer faster and cheaper delivery than most competitors, often subsidised to boost conversion.

Credit (Mercado Crédito):

Provides instalment payments, personal loans, merchant working capital loans and credit cards. Lending is powered by proprietary marketplace and payments data, keeping credit quality stable while the loan book scales. Credit boosts purchasing power, seller growth and user stickiness.

Advertising (Mercado Ads):

A high-margin retail media platform offering sponsored listings, display ads and increasingly off-platform ads using Mercado Libre’s first-party data. Ads are growing rapidly and now dominate Latin America’s retail media market, similar to Amazon Ads in the US.

Seller Tools & Other Services:

Includes Mercado Shops (similar to Shopify where merchants can have a standalone presence but have access to payments, logistics etc.), paid listings in autos and real estate, loyalty and subscription bundles (MELI+), and engagement features like Mercado Play. These are smaller today but increase retention and ecosystem lock-in.

5. Moats & Differentiation

I believe MELI possesses the strongest moat within e-commerce in Latin America, and that has been established over a 25+ year history. This helps to protect its market position from competitors and can attributed to several key factors:

Integrated Ecosystem & Switching Costs:

Mercado Libre’s strongest moat is its tightly integrated ecosystem spanning marketplace, payments, logistics, credit and advertising. Buyers often shop, pay, hold balances, earn rewards and borrow within one system. Sellers rely on Mercado Libre not just for demand, but also for fulfilment, financing and ads. Leaving the platform means replacing multiple critical services at once, which creates high switching costs.

It’s reminiscent of how Apple’s ecosystem (iPhone + iOS + iCloud + App Store) makes customers very loyal. Few competitors in LatAm offer a comparable end-to-end solution. Most rivals are more siloed, Amazon has a strong e-commerce platform but weak payments penetration, local FinTech giants like Nubank have a strong payments presence but no retail platform.

Network Effects (Multi-Layered):

The marketplace benefits from classic buyer-seller network effects, compounded over two decades. Mercado Pago adds another layer, where more users of its wallets attract more merchants and vice versa. There is also a data network effect where transaction and behaviour data improves search, recommendations, fraud detection and credit underwriting, making the platform better as it scales. These effects also spill across services, strengthening ads, payments and lending simultaneously.

Logistics & Infrastructure Advantage:

Mercado Libre operates the most advanced e-commerce logistics network in Latin America, a region where delivery is structurally difficult. Years of investment in fulfilment centers, last-mile delivery, air freight and software have created a major barrier to entry. Scale has driven falling unit shipping costs, allowing Mercado Libre to offer fast and often subsidised delivery sustainably, something smaller rivals struggle to match.

Fintech Integration & Financial Float:

Through Mercado Pago and Mercado Crédito, Mercado Libre captures payments, float and interest income around transactions. This vertical approach into FinTech boosts margins and deepens user dependence. For many SMEs, Mercado Pago is their first access to credit, making the relationship highly sticky. Replicating both a scaled marketplace and a profitable FinTech stack is extremely difficult for any single competitor.

Brand Trust & Local Expertise:

Mercado Libre is a trusted household name across Latin America, built over 25+ years. Its deep understanding of local payment methods, regulations, languages and economic volatility gives it an edge over global entrants. In many markets, Mercado Libre is synonymous with online shopping. Its brand strength and dominance is especially pronounced in markets like Argentina, Chile and Colombia where market share is north of 65%.

Scale & Capital Advantage:

With large cash flows and access to capital, Mercado Libre can invest aggressively in logistics, subsidise shipping, and expand FinTech without straining its balance sheet. This allows it to outspend and outlast smaller competitors during periods of competition or investment cycles.

Breadth of Offering (“Super-App” Effect):

Mercado Libre is the only platform in LatAm that combines shopping, payments, credit, logistics, advertising and merchant tools under one login. This convenience encourages users to centralise their digital commerce activity within MELI, increasing retention and lifetime value.

6. Market Context & Industry Positioning

Mercado Libre sits at the centre of two huge growth markets in Latin America: e-commerce and fintech. The region is still early in both, which creates long runway, but it is also volatile and competitive.

E-commerce in LatAm is big, growing, and still under-penetrated.

Online retail has expanded quickly, but e-commerce penetration is still meaningfully below more mature markets. That means growth can come both from more people shopping online and from existing shoppers shifting more spend online over time.

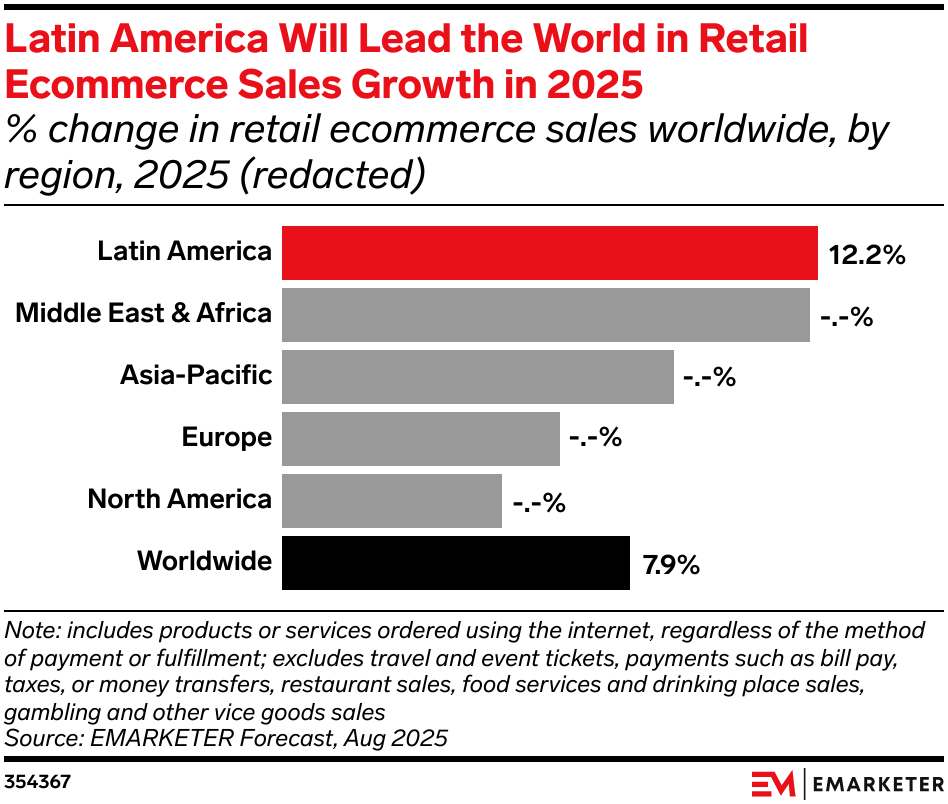

Retail e-commerce sales in LatAm are expected to reach around $191 billion in 2025 (up ~12% from 2024). Yet, online penetration of total retail remains relatively low, with projections for it to rise to 16% only in 2028. In other words, there is plenty of runway for growth as more shoppers come online and existing shoppers shift more of their spending to e-commerce.

In fact, it is the fastest-growing retail e-commerce market in the world and it is expected to hold that lead through 2027, before Middle East and Africa (MENA) overtake it the following year. Argentina, Brazil and Mexico are the 3 key markets, accounting for 84.5% of regional retail e-commerce sales in 2025.

The growth is largely driven by the region’s demographics: a young population, rising internet usage and smartphone penetration. Importantly, consumer behaviour is catching up. Latin Americans have historically loved shopping malls and cash transactions, but convenience and better pricing are driving them online. The pandemic was a huge accelerator for adoption and many of those users have continued to shop online post-pandemic.

The market is fragmented, country-by-country.

Latin America is not one unified market like the US or China. Each country has its own consumer behaviour, competitors and infrastructure challenges. This makes execution harder, but it also creates an opportunity for a regional winner to consolidate share.

For instance, Brazil has MELI, Magazine Luiza, Americanas, Shopee, Carrefour, while Mexico has MELI, Amazon, Walmart, Coppel. Argentina is largely dominated by MELI and Frávega.

Mercado Libre is one of the few players with real scale across multiple countries (~27% share in Brazil, ~68% in Argentina, ~14% in Mexico). However, this fragmentation means it cannot be complacent, and must execute country-by-country strategies. This also means there is a huge opportunity for consolidation of share.

FinTech tailwinds are structural, driven by financial inclusion.

A large portion of the population has historically been underbanked, creating demand for digital wallets, digital acquiring, credit, and savings products.

Companies like Nubank, PagSeguro, and traditional banks’ digital arms are all vying to bring financial services to the masses. Mercado Pago is positioned uniquely because it started from e-commerce and expanded outward.

There is still enormous headroom here. In Argentina, over 60% of adults have no credit card (hence Mercado Pago launching a credit card there in 2025 directly targeting that gap). In Mexico, credit card penetration and digital payments usage are on the rise but still far from saturated.

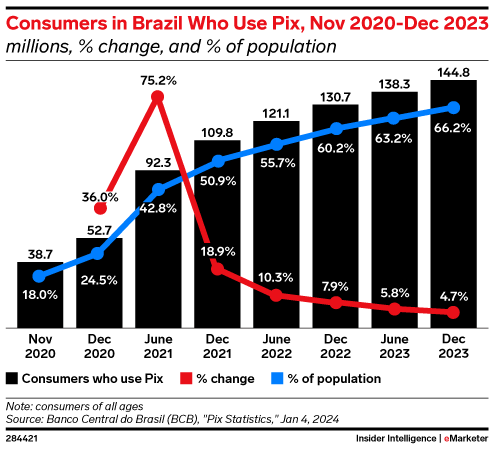

Pix in Brazil has also been a huge driver for payments growth. Pix is an instant bank-to-bank system launched by the Brazilian Central Bank in 2020, and is now widely used. Initially, one might think Pix could undermine wallets like Mercado Pago, but Mercado Libre cleverly integrated Pix into its platform. The presence of Pix has actually accelerated the digitisation of cash, which in many ways benefits Mercado Pago by familiarising people with digital money. Moreover, Mercado Libre’s credit and investment features provide differentiation beyond what Pix offers.

Regulation and macro volatility are constant constraints.

Latin America’s macro environment is a mixed bag. High inflation, currency fluctuations, and political shifts are common. For example, Argentina’s inflation peaked at nearly 300% in 2024, and its currency devaluations can drastically reduce MELI’s reported USD revenue from that country.

Politically, policies on data, taxation of digital services, or financial regulation can impact how Mercado Libre operates. For example, there’s often talk in various countries about taxing digital platforms or requiring local data storage, which MELI, as a large player, has to navigate. At the same time, Mercado Libre has navigated these cycles for decades and often positions itself as a partner for SME digitisation and financial inclusion, which can help with regulators.