Is the Bottom In? - WR5

Sea Limited SMASHES Earnings, Grab Acquires!

Hi all,

Welcome back to the 5th edition of the Weekly Roundup!

US markets fell further last week, with SPY and QQQ seeing a -3.36% and -3.84% decline respectively.

I have been buying consistently in the past few weeks and I do think we see a bottom relatively soon.

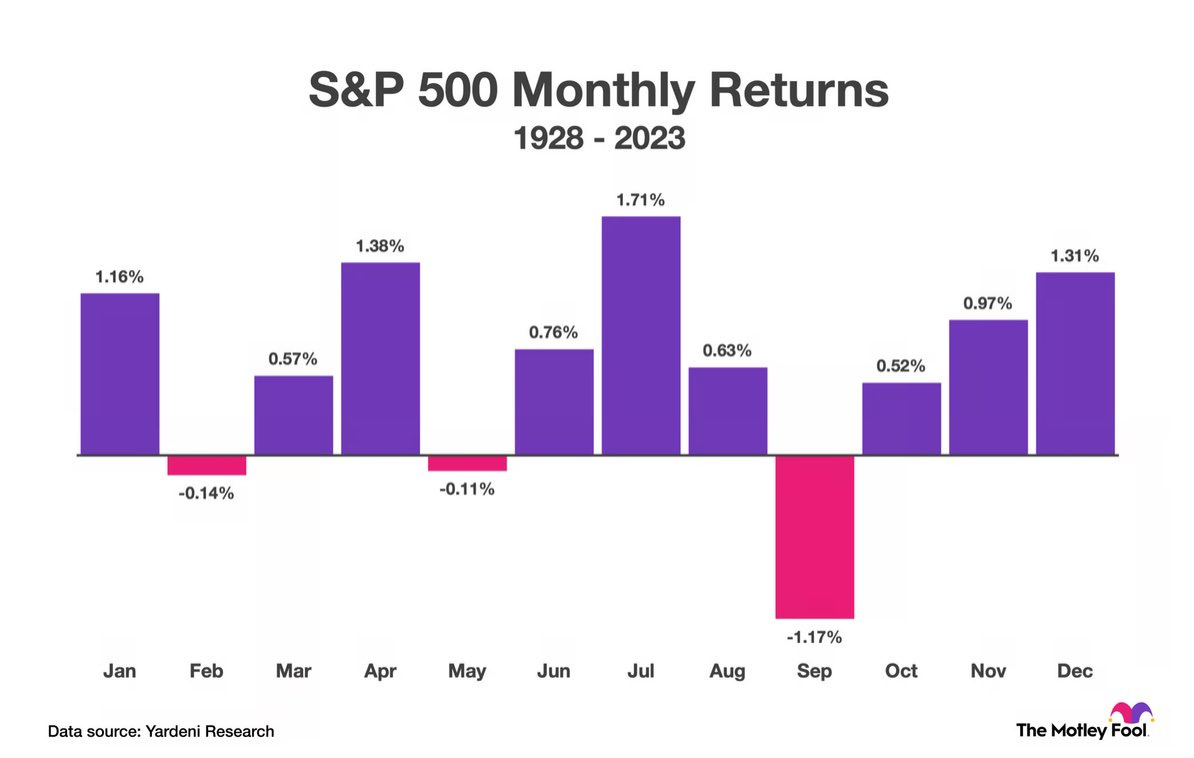

March should be a more favourable month than February and therefore I expect seasonality to be in the bulls’ favour.

Docket:

Sea Limited SMASHED Earnings!

Sea Limited’s MOATS are Growing

Grab Acquires 19 Everrise Supermarkets

1. Sea Limited SMASHED Earnings!

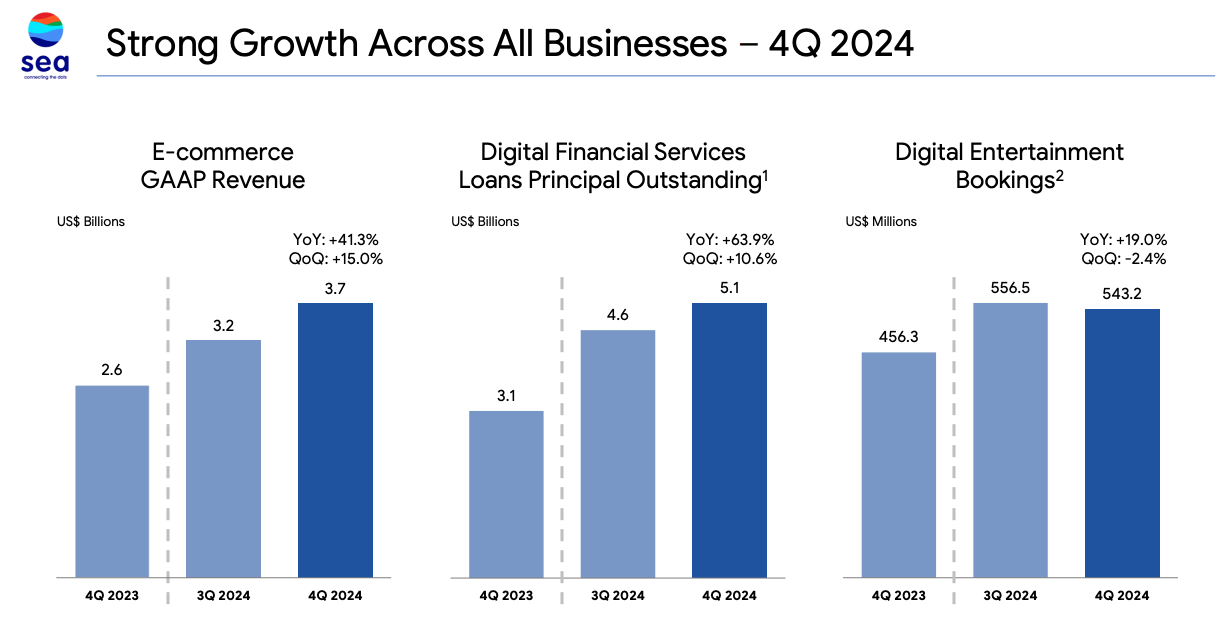

Sea Limited BEAT revenue estimates by 8% with the business now at a $20B run-rate!

The stock closed +7% that day amidst a weak overall market and followed it up with a +8% close the day after.

I made a detailed post covering Sea’s Earnings Report, feel free to check it out!

2. Sea Limited’s MOATS are Growing

Sea Limited’s strongest moat has arguably been network effects for many years. A larger supplier base leads to a larger consumer base, and a flywheel continues.

However, in recent years, Sea has built another extremely strong moat around the business: a logistics moat.

SPX, or Shopee Xpress, is the logistics arm of Sea Limited. SPX was launched to enhance Shopee’s delivery capabilities, offering efficient and reliable shipping services to its customers.

It was launched in 2020, and in the past 4.5 years of operation has grown into a behemoth logistics company, delivering 3.92 BILLION parcels in 2024. It is now the 2nd largest logistics business in Southeast Asia with 24.5% market share, just behind J&T Express with 28.6%.

Almost half of SPX Express orders in Asia delivered within 2 days of order placement in Q4 2024. Shopee’s logistics cost-per-order reduced by 5 cents YoY in Q4 2024.

Using peer estimations, I estimate that Shopee’s logistics cost per order is roughly $0.50 to $0.60. This means, it reduced cost-per-order by 10% in a year, which is an extremely impressive metric.

These go directly to the bottom line and likely explain the reason behind Shopee’s FY EBITDA profitability. If you want more details on this business, read this.

3. Grab Acquires 19 Everrise Supermarkets

Everrise is a supermarket chain in Sarawak, Malaysia. Grab acquired all its outlets for an undisclosed fee. This follows Grab’s purchase of a majority stake in Jaya Grocer, also a Malaysian supermarket chain just 2 years ago.

My Thoughts:

Grab purchased 75% of Jaya Grocer 2 years ago with the intention to vertically integrate their GrabMart business. At the time, 64% of SEA’s internet users had purchased groceries online at least once. Yet, just 2% of grocery transactions were made online.

Grab acquired Jaya Grocer, then digitised all 41 outlets and onboarded them onto the GrabMart platform, leading to a 10x growth in online sales as a proportion of total sales.

Today, roughly 22% of groceries are purchased online, although SEA likely has lower penetration rates. This entirely validates Grab’s approach and it makes sense to continue this strategy.

Leveraging the large supplier network of these retail supermarkets also helps to expand GrabMart’s product line at lower costs and in turn contributes to improved unit economics. This is particularly crucial in a business like GrabMart where margins are extremely low. Grab’s vertical-integration of the supply chain will create a strong moat around the business and ultimately crowd out any potential competitors.

Another aspect is that this strengthens Grab’s last mile delivery capabilities, essentially on a smaller scale but similar profile to Amazon’s purchase of Whole Foods. After all, Convenience and Time are the key selling points in the grocery business.

ALL of this plays into Grab’s ultimate goal, to be THE superapp. A one stop app for transportation, food delivery, payments and now groceries

That is all for this week’s weekly roundup. Thank you for reading and I hope it’s brought some value to you.

Until next time!

Disclaimer: The content presented is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.