Inter & Co (Deep Dive)

LatAm FinTech Super App Trading at 15x PE Growing 40% YoY

I’ve covered several emerging market stories over the past year: Sea Limited, Grab Holdings, dLocal and Mercado Libre. Each of the first three have their own dedicated deep dives that you can find on my page.

The company I’ll be covering today belongs in a similar category.

Inter & Co, listed on the NASDAQ as INTR, is a Brazilian financial Super-App that offers a one-stop platform for banking, investments, insurance, credit and even e-commerce to millions of customers.

Below you will find a ~12,000 word deep dive into Inter & Co, covering its history, business model, industry dynamics, competitive landscape, bull thesis, risks, financials, valuation, and what I’m personally doing with the stock.

Table of Contents

Introduction

Company History

Company Overview

Industry and Market Analysis

Competitive Landscape

Competitive Advantage

Bull Thesis

GabGrowth Quality Score

Risks

Financials

International Expansion

Ownership & Management

Valuation

Concluding Thoughts (What I am personally doing)

1. Introduction

Inter & Co is one of the pioneering digital banking super-apps in Brazil. It has over 40 million customers and growing, standing out by offering a fee-free banking experience, seamlessly integrated via a single intuitive app.

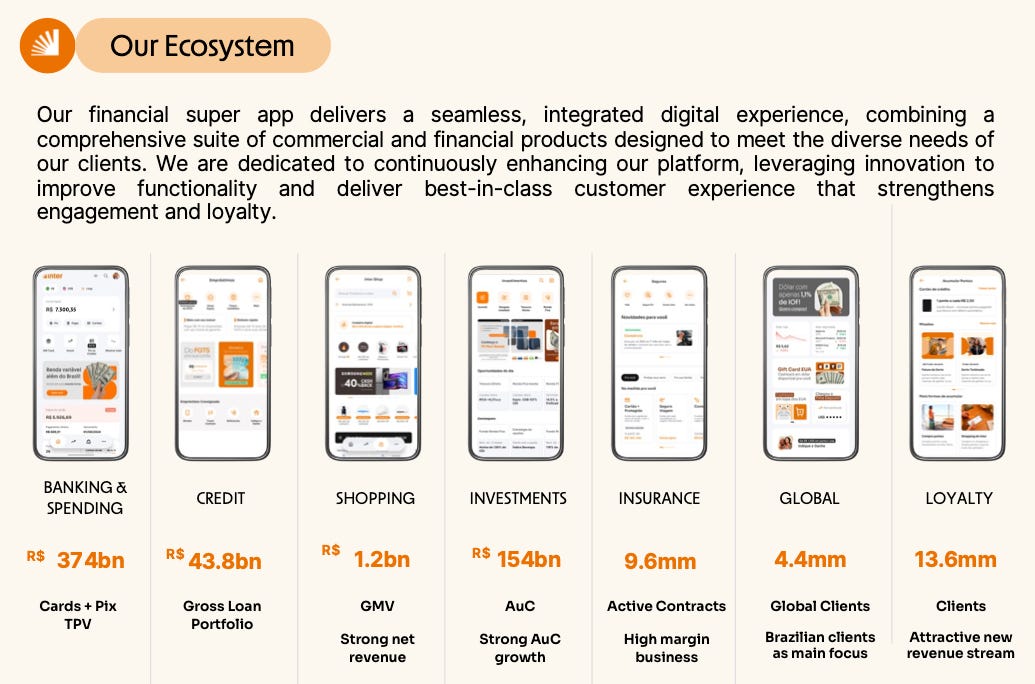

Inter has split its business into 7 verticals: namely Banking, Credit, Investments, Insurance, Shopping, Global and Loyalty.

Unlike traditional banks that charge for services, Inter monetises in the background through lending, interchange, investment fees, insurance commissions, and its embedded marketplace.

2. Company History

1994-2014: Origins as Intermedium

Inter’s origin dates back to 1994 in Belo Horizonte, Brazil. It was co-founded by Brazilian real estate mogul Rubens Menin who owned MRV Engenharia.

In its early years, Intermedium was a niche financial institution focused on credit. First providing SMB loans from 1999 and payroll loans from 2001, before later expanding into real estate financing in 2007.

In 2008, Intermedium obtained a multiple bank license from the Central Bank of Brazil, allowing it to operate as a full-fledged bank. By the early 2010s, the company had added insurance (Inter Seguros in 2012) and a brokerage arm (Inter DTVM) to its offerings. At this point, Intermedium remained relatively small and traditional in its approach. However, this was all about to change dramatically.

2015: The Digital Banking Revolution

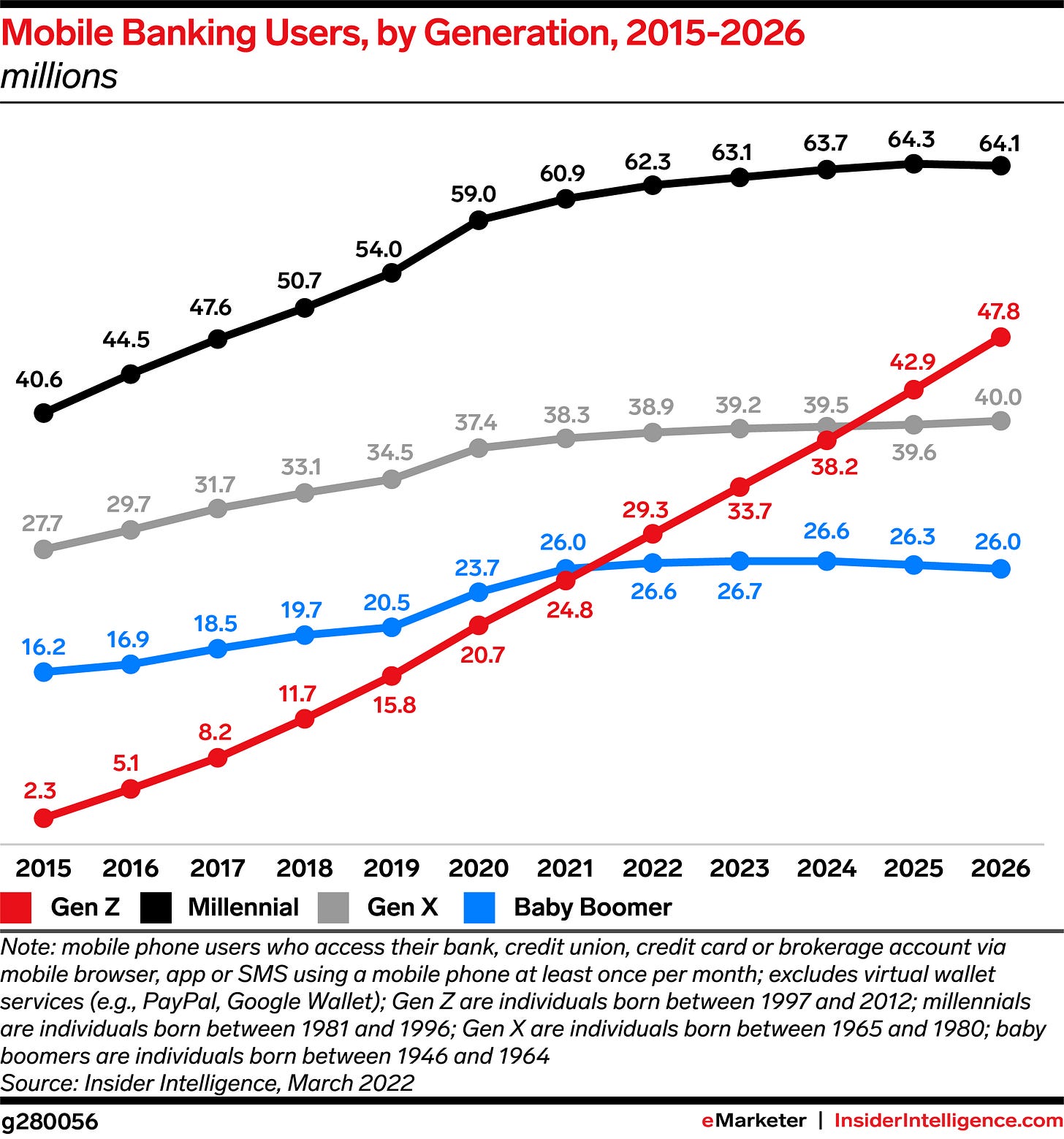

In the mid-2010s, there was a sudden rise in FinTech and mobile banking globally due in part to rising mobile and internet penetration rates. Brazil’s banking sector was ripe for disruption. Traditional banks in Brazil were notorious for bureaucracy and high fees, which excluded large swathes of the population. Nearly half of Brazilian adults were unbanked.

Sensing an opportunity, Intermedium’s management, led by CEO João Vitor Menin, whose family controlled the bank, decided to radically pivot the business.

In 2015, Intermedium launched the country’s first 100% digital checking account, a product that was completely free of fees. This was a bold move at the time, and was essentially a banking revolution. This also marked the bank’s entry into retail banking, expanding from its roots of lending into everyday financial services.

2016-2017: Rebrand & Early Growth

Intermedium quickly gained traction with its new digital banking business. By 2016, the bank launched its first mobile app and a Mastercard debit card, reaching 8,000 digital customers.

Sensing it was onto something big, the company rebranded from Intermedium to Banco Inter, reflecting its modern, simplified approach to banking. By the end of 2017, Banco Inter had over 370,000 customers using its digital platform. While still small, it was rapidly growing and proved that Brazilians were eager for an alternative to legacy banks.

2018: IPO & Pioneering Achievements

In April 2018, Banco Inter became the first digital bank in Brazil to complete an IPO, listing on Brazil’s B3 stock exchange. Moving from a family-owned operation to a public company brought new capital and scrutiny, but also validated its business model.

Around this time, Inter migrated its entire tech stack to the cloud (AWS), becoming the first bank in Latin America to fully operate on cloud infrastructure, a move that enabled greater scalability.

By the end of 2018, Inter’s customer base had swelled to 1.4 million as its user-friendly app and zero-fee promise attracted millions of Brazilians hungry for better and cheaper banking.

2019-2020: From Digital Banking to Super App

Armed with IPO capital, Inter accelerated its expansion. In 2019, it raised over R$1.2B (~USD$220M) in a follow-on offering to invest in growth. Inter aggressively rolled out new features that went beyond banking.

By late 2019, it had transformed into a one-stop hub for not only financial services but also shopping and more. Inter introduced a marketplace within the app for both financial and non-financial products. Customers could shop for retail products, earn cashback, and access services like travel booking via Inter’s platform.

This drove higher engagement rates, app loyalty as the app became a daily-use platform.

2020 was a breakout year for solidifying the super-app vision. Despite the pandemic, Inter achieved several milestones. It acquired an asset management firm (DLM Invista, rebranded as Inter Asset) and launched new services like Inter Travel (Hotel & Flight Booking) and Inter Protect (Insurance Marketplace).

By the end of 2020, Inter had 8.5 million customers and firmly branded itself as a super-app. In just 5 years, Inter had gone from a tiny lender with no retail presence into one of Brazil’s fastest growing consumer platforms.

2021: Rapid Expansion and M&A

Inter’s growth only accelerated in 2021. Customer accounts more than doubled from the prior year, reaching 16 million by end of 2021. It continued adding products and partnerships at a dizzying pace. It acquired controlling stakes in FinTech startups (e.g., 60% of Meu Acerto, a Brazilian credit solutions firm, and 45% of Granito, a merchant payments acquirer).

Inter also struck partnerships to bolster key verticals. For instance, teaming up with Sompo (a large insurer) and partnering with Banco ABC to support corporate lending.

Perhaps most notably, 2021 saw Inter set the stage for international expansion. In the second half of the year, Inter announced the acquisition of USEND, a US-based FinTech specialising in cross-border payments and remittances, as part of a plan to serve Brazilian customers in the US, and eventually Americans too.

To fund these moves, Inter raised another R$5.5B (~USD$1B) in June 2021 via a major follow-on offering with participation from global investors, including SoftBank.

2022: US Listing and Going Global

All the pieces came together in 2022. Inter executed a corporate restructuring and officially listed on the NASDAQ under the name Inter & Co (ticker INTR) in June 2022. The decision to list in the US was driven by its aims to access a broader investor base and position Inter as an international tech player.

By the end of 2022, Inter’s customer base had grown to 24 million, up 50% YoY. Alongside the US listing, Inter rolled out products to support its “international nation” of users. It launched a global account feature allowing Brazilian users to hold and send US dollars easily through the app.

This enabled simple remittances and purchases abroad, a highly requested feature for customers with international needs.

2023-2025: Scaling Profitably and Big Ambitions

In 2023, Inter turned its focus towards scaling profitably and articulating a grand vision for the future. At its Investor Day in January 2023, management unveiled the “60-30-30 Plan”, an ambitious roadmap for 2027. The aim:

60 million clients

30% cost-to-income efficiency ratio

30% return on equity

Hitting these targets would imply massive growth and best-in-class profitability. For context, a 30% ROE would far exceed any large Brazilian bank. Importantly, Inter was already profitable by this point and gaining operating leverage. In 2024, Inter achieved its highest ever net income of R$973M (~ USD$190M), up nearly 200% YoY.

The customer base reached 36 million by end 2024, with active clients of ~21 million.

So far, 2025 has seen Inter continue its upward trajectory. In Q1 2025, Inter delivered 57% YoY net income growth (R$287M, ~USD$51M quarterly profit) and surpassed 37.7 million total customers. By Q2 2025, client count hit 40 million. Notably, the credit portfolio is expanding rapidly while non-performing loans remain in check at 4.6%.

Inter is also gaining recognition. It was recently named the 7th most powerful brand in Brazil and the no.1 banking brand among Gen Z in a national survey. This speaks to the strong affinity it has built with the new generation of consumers.

3. Company Overview

Value Proposition

Inter’s core value proposition is providing a one-stop, all-in-one platform for a customer’s financial (and increasing non-financial) life. It is often dubbed a “super-app” akin to a financial Amazon, where users can bank, invest, borrow, insure and shop on one seamless app interface.

For customers, the appeal is clear. With a single Inter account, you get a free digital checking account, a debit/credit card, the ability to pay bills or send money instantly via Pix (Brazil’s instant payment service), access to personal loans and mortgages, the ability to invest in stocks/funds/crypto, insurance products, and even an “Inter Shop” marketplace that offers e-commerce deals with cashback rewards.

Importantly, Inter’s app is free to use and many of its core services are zero-fee too (zero fee checking account, free transfers, free ATM withdrawals to a limit). This was revolutionary in a market like Brazil that traditionally gouged customers with fees. Inter instead monetises through other means (more on that later).

By removing fees and adding tons of value-added services, Inter attracts a broad demographic, from first-time banking users to affluent customers seeking convenience, thus driving higher engagement.

From a business standpoint, the super-app model creates a flywheel effect. Each new product or service increases the app’s utility, which attracts more customers and encourages existing ones to stay active, which in turn provides more cross-selling opportunities for Inter.

For example, a user might start by opening an Inter bank account for free. Then they see a good cashback deal on the Inter Shop and buy something, earning rewards. With that positive experience, they decide to try investing via Inter’s platform or take a loan pre-approved in the app. As they use more products, Inter garners more data, enabling them to personalise offers and increase ARPAC (average revenue per active customer). The endgame here is to maximise ARPAC by capturing multiple revenue streams per user, but doing so in a way that feels organic and helpful to the customer.

How Inter Works: Products & Services

Inter’s product ecosystem spans a wide range of financial verticals. Here’s a quick overview of its main offerings on the retail side:

Digital Banking (Accounts & Cards)

This is the entry point for most users. Inter provides a digital checking account with no maintenance fees, offering features like free Pix instant transfers, bill payments, a Mastercard debit card, and optional credit card.

There are also niche account types like Kids Accounts and Global Dollar Accounts. The digital account is the backbone for cross-selling other services, and its zero fee nature drives mass adoption. Inter’s user base skews towards cost-conscious customers who love avoiding fees.

Payments & Money Transfer

Inter has fully integrated Brazil’s most popular instant payment system Pix into its app, enabling 24/7 free transfers to anyone by phone number or QR code. It also offers mobile top-ups and QR payments. The ubiquity of Pix (used by ~80% of Brazilians as of 2024) has been a boon for Inter as it has accustomed people to cashless payments and made Inter’s no-fee transfers especially attractive. (More on Pix later)

Lending

Originating credit is a legacy strength for Inter (it started in loans). Today, Inter offers a full spectrum of credit products. On the secured side, Real Estate Credit and Payroll Loans are core offerings. These products have relatively low risk, collateralised or with repayment at source, and cater to long-term needs like home buying.

Inter has also recently expanded into unsecured credit to drive everyday engagement. This includes personal loans, credit cards, overdraft lines, BNPL and Pix Financing (essentially micro-credit via the Pix system).

Management’s approach has been to start users on smaller credit products (like a BNPL or Pix installment) and graduate them to larger products

as their credit history builds.

Investments (Inter Invest & PAI)

Inter operates a robust investment platform, allowing customers to invest in fixed income, stocks, funds and even crypto all through the app. In 2020, Inter acquired a money management firm which offers its own funds and wealth management for high net worth clients.

For retail investors, Inter’s PAI (Plataforma Aberta Inter) provides access to a wide array of third-party investment products too. By integrating investing, Inter keeps users with growing wealth from “graduating” to other platforms.

Insurance (Inter Seguros)

Inter has an insurance brokerage arm that sells dozens of insurance products via the app, from standard life, auto, home insurance to more niche covers like pet insurance and even Pix insurance.

Insurance is a high-margin add-on and drives additional stickiness. The integration of insurance into the super-app also differentiates Inter.

Marketplace & Non-Financial Services

Through Inter Shop, users can buy products from hundreds of partner retailers (from apparel to electronics) and get cashback on purchases. Inter essentially acts as an affiliate/referral platform, earning commissions from merchants while giving a cut back to users.

This not only generates extra revenue but also increases daily engagement. Additionally, Inter has services like Inter Travel, gift card purchases, and even an Inter Tickets feature for events.

These may seem tangential, but are part of the lifestyle aspect of the super-app, keeping users in the ecosystem for as many needs as possible.

On the business side, Inter also offers banking services for SMBs like digital business accounts, working capital loans, acquiring/merchant services via its Granito subsidiary etc. However, the vast majority of Inter’s 40 million clients are individual, hence this deep dive will focus on the consumer side.

How Inter Makes Money

Given the breadth of services, Inter has multiple revenue streams:

Net Interest Income

Like any bank, Inter earns interest on loans and on its portfolio of securities, funded by customer deposits. As a digital bank with a low cost of funds through cheap deposits, Inter’s lending margins contribute significantly to revenue.

It focuses on secured loans (mortgages, payroll) that have relatively lower yield but also lower loss rates, and supplements with higher-yield unsecured loans.

Inter’s cost of funding is a competitive advantage against traditional banks with no branches and a digital model, it can gather deposits at scale without paying higher interest. This low funding cost allows healthy spreads on loans.

Fees and Commissions

Inter generates fee income from a variety of sources: interchange fees on card transactions, commissions from insurance sales, investment product fees (trail commissions from funds, brokerage fees), and marketplace commissions from Inter Shop sales.

Importantly, these fees come without directly charging customers for basis services. For example, every time a user uses their Inter credit card, Inter gets an interchange fee paid by the merchant; when a user buys a fund through Inter’s platform, the fund manager shares a fee with Inter.

Float and Other Financial Income

Since Inter has 40M users, it holds a large amount of customer deposits (over R$50B in total assets by 2024). A lot of these funds are kept in very short-term investments or central-bank deposits.

With Brazil’s interest rates being relatively high in recent years, the interest on float and short-term investments have been a meaningful source of income. Additionally, Inter also earns some FX fees on its global account or currency conversion.

Adjacent Offerings

As Inter’s ecosystem grows, it has begun exploring new monetisation angles such as advertising. Management has hinted at leveraging the app’s high user engagement for ads or promotions. This is still nascent but could become a notable revenue stream, effectively monetising user attention in the app beyond just transactions.

Crucially, Inter’s strategy has been to keep customer-facing costs low and monetise in the background. This is a very similar strategy to Robinhood.

Inter’s low cost to serve gives it an edge. It only costs Inter a fraction of what big banks spend to service an account, thanks to full automation and no branch overhead. In Q4 2024, Inter’s cost per active customer was just R$8.30 monthly, compared to R$20-$30 for traditional Brazilian banks.

This efficiency means that even modest fees per user translate into a healthy profit. Inter’s banking efficiency ratio (cost-to-income) has been improving, down to ~47% in mid-2025 from well above 60% a couple years prior, on track towards its 30% goal for 2027.

A Typical Inter User’s Value Path

I thought this would be helpful to understand how Inter makes its money through a typical value chain of an average customer.

Imagine a customer who joined for the free checking account. They might hold a few thousand Brazilian Reals (Inter earns float interest), swipe their debit card for daily purchases (Inter earns interchange fees), use Pix regularly (Inter doesn’t earn but this drives engagement), perhaps take a small personal loan or finance a smartphone (Inter earns interest), buy an insurance policy for their car (Inter earns commissions), and do some shopping via Inter’s marketplace with cashback (Inter earns merchant commission).

Individually, each of these activities’ revenue might be small, but in aggregate over 40 million users, it adds up tremendously and gives Inter scale. This feeds directly into Inter’s long-term thesis that scale + cross-selling = profits.

4. Industry and Market Analysis

To understand Inter & Co, we must first zoom out to the broader Brazilian financial landscape, one of the most dynamic FinTech markets in the world. Few countries combine the same mix of massive population scale, digital adoption, progressive regulation, and entrenched incumbent banks as Brazil.

On the demand side, Brazil is a nation of more than 200 million people, most of whom are mobile-first, with smartphone penetration exceeding 85%. Consumers are highly engaged digitally, but have historically faced high fees, poor service, and limited access from legacy banks.

On the supply side, regulators have been unusually proactive. The Central Bank of Brazil has launched Pix, the world’s most successful instant payments system, and rolled out Open Finance, a framework enabling consumers to share financial data across institutions. These initiatives have lowered barriers to switching, accelerated digital adoption, and reshaped how financial services are distributed.

The result is a market in flux. Legacy banks are seeing their fee pools eroded, FinTechs are scaling faster than anywhere else in the region, and digital payments are already leapfrogging traditional rails. For Inter, this environment is both an opportunity and a challenge. There is massive growth potential, but also intense competition in a market that is evolving at breakneck speed.

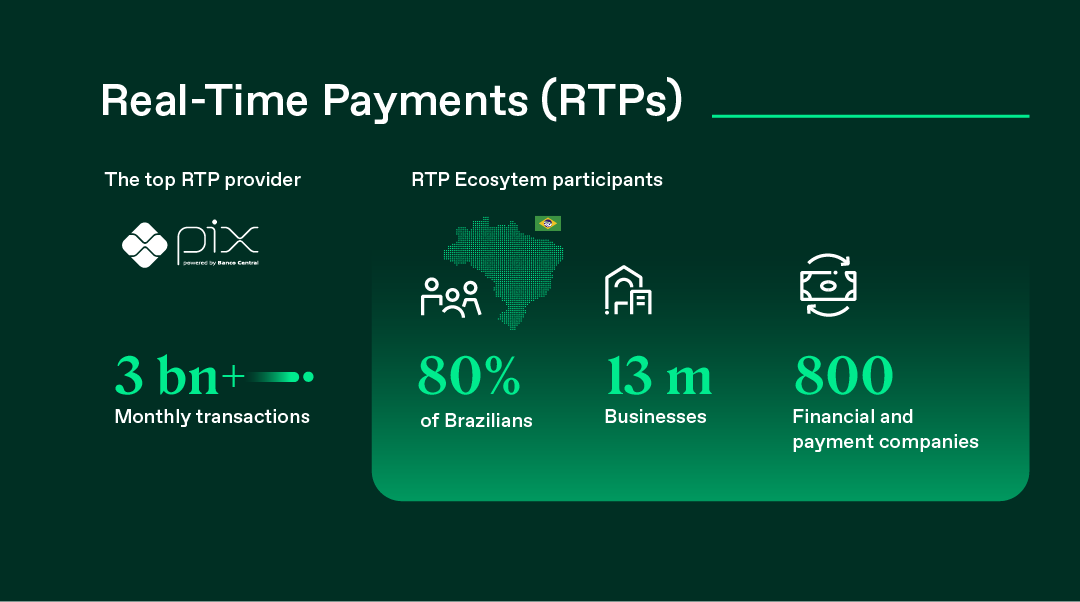

Payments Revolution: Pix as the Core Rail

It is vitally important to understand Pix as it has become the dominant payment method in Brazil in record time.

It was introduced in November 2020 by the Brazilian central bank and now processes trillions annually, overtaking credit/debit cards in volume.

Pix enables instantaneous payments and transfers in Brazilian Real 24 hours a day and without interruptions, even outside banking hours, during holidays or weekends, with no fees.

Its near-zero cost and instant settlement have made it ubiquitous across P2P, P2B, and e-commerce.

In 2024, Pix processed 68.7 billion transactions, a 52% jump from 2023, moving nearly $5 trillion in value. That’s more than Brazil’s entire GDP.

New features like Pix Automático (recurring debits) and Pix Parcelado (instalments) are broadening its role, eating into traditional credit card fee pools.

Many banks have adopted Pix within their platforms as it is both a user-acquisition funnel through daily engagement, and a cross-sell enabler for lending, cards, and marketplace spending. Inter is no different.

Open Finance & Regulatory Tailwinds

Brazil’s Open Finance initiative allows consumers to share financial data across providers, lowering switching costs and intensifying competition. This data portability is bullish for a business like Inter that is considered a smaller player in the space, especially in comparison to the large traditional banks.

Expansion beyond banking into insurance and investments enables platforms like Inter to aggregate more of a customer’s financial life.

With a broad product suite already in place, Inter can leverage open APIs to underwrite better, personalise offers, and increase cross-sell depth.

Credit Cycle & Macroeconomic Context

Brazil’s Selic (benchmark policy) rate remains elevated, which pressures unsecured lending but supports deposit gathering.

Rising household leverage has regulators cautious, with signs of stress in low-income segments.

Profitability is cushioned by fee income streams (marketplace, insurance, investments), but growth in credit products must be carefully managed to maintain ROE targets.

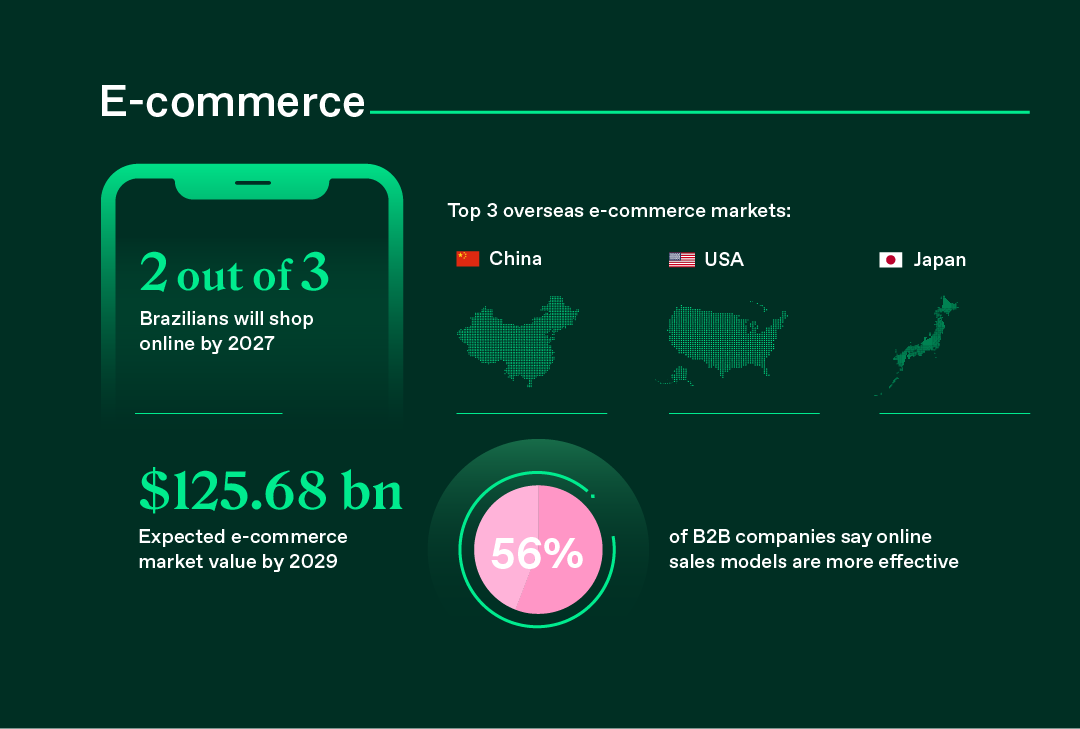

E-Commerce & Lifestyle Integration

Online buyers in Brazil continue to grow at double-digit rates, with Pix accelerating checkout conversion. As commerce shifts online, Inter’s marketplace and affiliate channels create non-financial revenue streams tied to daily banking usage.

Differentiation lies in bundling lifestyle services with finance, driving engagement beyond traditional banking.

Competitive Landscape

Neobank Scale: Nubank leads with over 100M clients, while Inter (~40M) positions as the multi-product alternative.

Legacy Banks: Itaú, Bradesco, Santander are digitising aggressively, leveraging scale and balance sheet strength.

Specialists: XP and BTG dominate investments; StoneCo, PagBank, and Cielo lead in acquiring and merchant services.

Implication for Inter: Success depends on its ability to be the all-in-one platform, while peers remain more siloed (cards, investments, or payments).

Insurance, Investments & Remittances

Insurance Penetration: At ~6% of GDP, Brazil is under-insured versus developed peers, creating growth headroom for digital distribution.

Investments & Wealth: Open Finance migration from low-yield savings to funds/brokerage supports cross-sell for Inter’s investing arm.

Cross-Border Remittances: With millions of Brazilians abroad, remittance flows (~US$5B annually) create optionality for Inter’s Global Account.

Key Items To Watch (2025-2026)

Uptake of Pix Automático & Parcelado and impact on card economics.

Effectiveness of Open Finance monetisation in driving cross-sell.

Asset-quality trends as long rates remain high.

Competitive responses from Nubank, Mercado Pago, and incumbents.

Early traction of international expansion via the US Global Account.

5. Competitive Landscape

The FinTech and banking space in Brazil is fiercely competitive. Inter faces multiple categories of competitors, from nimble startups to giant incumbents. Each presents different challenges. However, Inter also enjoys some competitive advantages stemming from its head start and holistic model.

I believe there are 4 major groups of competition for Inter here:

1. Other Digital Banks / Neobanks

The most direct competitors are other branchless, app-based banks targeting similar customers. The standout here is Nubank (NU), which is not only Brazil’s but Latin America’s largest digital bank with over 80 million customers. This is also a crowd favourite of retail investors and has prominent investors such as Warren Buffett on the cap table.

Nubank started with credit cards and later expanded into bank accounts, loans, insurance, and investments, quite parallel to Inter’s trajectory. Nubank is worth roughly 20x of Inter ($75B v $3.85B) despite Nubank only having 2x the customers of Inter. Some of that premium is due to Nubank’s international footprint (Mexico, Colombia, etc.) and scale, but it highlights that Inter appears undervalued in comparison.

Beyond Nubank, there are several other digital banks/wallets: C6 Bank (backed by JPMorgan, ~30 million users), Banco Pan (backed by BTG Pactual, ~31 million users), Neon (~23 million users), PicPay (~70 million users), Mercado Pago (part of Mercado Libre, ~64 million users), etc.

However, none of them have the full suite that Inter possesses. Instead, each compete on specific fronts. For example:

C6 Bank offers investments, rewards and has tried to lure higher-end clients

Banco Pan has a marketplace and loans focus

Neon focuses on working-class users with tools for micro-entrepreneurs

PicPay started as a digital wallet and remains centred on payments

Mercado Pago focuses on e-commerce integration and merchant payments

2. Traditional Large Banks

The big Brazilian banks (Itaú, Bradesco, Santander, Caixa, Banco do Brasil) are still the titans in terms of assets and revenue. They have vast resources, recognised brands, and decades-long customer relationships. Over the past few years, these incumbents have belatedly improved their digital offerings, launching slick banking apps, reducing fees and even creating separate digital brands.

That said, there is still very much the fundamental innovator's dilemma for incumbents that truly embracing the FinTech model will cannibalise their high-fee, high-margin business. For instance, they can’t easily match the zero-fee model without losing easy low-hanging fruit revenue from existing clients.

In terms of competitive threat, a bank like Itaú could certainly outspend Inter in marketing or copy specific features. But Inter’s brand among young consumers is strong (#1 banking brand for Gen Z). Trust is a huge factor in banking, and Inter has built credibility as an innovator while incumbents are often viewed as stale or even predatory. Moreover, Inter’s cost structure is much better due to the lack of physical branches. This means Inter can profitably serve customers that big banks find unprofitable.

In essence, big banks will slowly lose share in the retail segment to agile players like Inter. However, they still pose strong competition in areas like credit due to their massive balance sheets and wealth management as rich clients still prefer large private banks. Hence, Inter has at times approached this through a partnership (notably with Banco ABC for corporate lending capacity).

3. Niche FinTech

Another competitive front comes from fintechs specialising in one vertical, as well as Big Tech companies potentially encroaching. For example, XP Inc. and Modal are competitors in investments, while StoneCo and PagSeguro are competitors in payments/SME acquisition.

These are typically not direct competitors to the entire Inter platform, but they do compete on certain aspects. For instance, XP is Brazil’s largest brokerage and might attract affluent investors that Inter are attempting to secure for its wealth segment. Inter’s competitive edge here is its integrated model. Inter offers a variety of services across all needs which provides value in convenience and consistency.

In this way, it is very similar to how WeChat in China beat dozens of single-purpose apps by bundling services. Also, Inter is now of a scale that it can enter partnerships rather than always compete directly. This allows it to compete at scale with specialised competitors.

4. Big Tech

A wildcard competitor is increasingly Big Tech companies such as Apple, Amazon and Google. So far, big tech has not deeply penetrated Brazilian banking beyond offering payments (Apple Pay, Google Pay). Regulatory barriers and the complexity of local financial systems have kept them at bay. It’s unlikely Apple or Google is going to start offering Brazilian Real savings accounts or loans directly.

Instead, Big Tech often partners with local financial institutions. Thus, I don’t see Big Tech as an immediate competitor to Inter’s core banking, though if one of them did launch a comprehensive financial app, it could quickly gain traction given their user bases.

![r/dataisbeautiful - [OC] Brazil's biggest banks hold a total of $1.5 trillion in assets — almost twice as much as LatAm’s next 10 banks combined. r/dataisbeautiful - [OC] Brazil's biggest banks hold a total of $1.5 trillion in assets — almost twice as much as LatAm’s next 10 banks combined.](https://substackcdn.com/image/fetch/$s_!sAm_!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F6ea4d275-48cb-47a2-9d55-baef0a14b831_640x640.png)