Grab Valuation Model

Why I see much room for upside

Hi all,

I haven’t actually done a valuation model on Grab despite writing over 18 articles on the business over the past year. So I figured it was about time I put my thoughts into numbers and share a full model with you.

One recurring concern among investors is that Grab doesn’t screen “cheap” by traditional headline metrics like PE, EV/FCF, or even EV/EBITDA etc.

I think the right way to view Grab is as a sum of the parts, similar to how I recently valued Sea Limited.

Grab operates several segments but for the purpose of this valuation, I will focus on just 3:

Mobility: GrabCar, GrabBike, GrabTaxi

Deliveries: GrabFood, GrabMart, GrabExpress

FinTech: GrabFin

A SOTP model allows each segment to get the right multiple based on its maturity curve and margin structure, rather than forcing a blended multiple that distorts the picture.

Before we jump in, a few anchors from the latest quarter so the starting point is clear:

Q2 2025:

Revenue: $819M

Adjusted EBITDA: $109M

Net Profit: $20M

FY 2025 Guidance:

Revenue: $3.33-3.40B

Adjusted EBITDA: $460-480M

When valuing a company like Grab, the near-term numbers (1-2 years) are useful, but don’t tell the full story. Grab is in the mid-stages of its evolution, scaling its ecosystem, deepening penetration of ads and building out its FinTech business.

These are businesses with long investment cycles, and the real economics only become clear further down the road.

Hence, I’ve decided to build a model out to FY2030 to reflect how each segment matures, rather than being anchored to transitional results. This will, in my opinion, give each segment time to reach its full potential and allow us to apply appropriate multiples.

Mobility: GrabCar, GrabBike, GrabTaxi

FY 2024:

GMV: $6.64B (+22.5% YoY)

Segment EBITDA Margin: $569M (8.56% of GMV)

Assumptions:

GMV of $7.7B as the base year (FY 2025)

Assumes 16% growth rate, which I believe is consistent with the last 9 quarters.

GMV CAGR 2025→2030: 12%

EBITDA Margin as % of GMV: 9.5% by 2030

Management has guided for 9+% EBITDA margins long term. In Q2 2025, margins were already at 8.7%.

Output (FY 2030):

GMV: $13.57B (12% CAGR from FY 2025 to FY 2030)

EBITDA Margin: 9.5%

Segment Adjusted EBITDA: $1.29B

Deliveries: GrabFood, GrabMart, GrabExpress

FY 2024:

GMV: $11.724B (+13.1% YoY)

Segment EBITDA Margin: $196M (1.67% of GMV)

Assumptions:

GMV of $14.07B as the base year (FY 2025)

Assumes 20% growth rate, which I believe is conservative considering the trajectory over the past 10 quarters.

GMV CAGR 2025→2030: 15%

EBITDA Margin as % of GMV: 4% by 2030

Management has guided for 4%+ EBITDA margins long term. In Q2 2025, margins were at 1.8%, with management expecting significant upside, driven by the ad business.

For context, the ad business reached a $236M run rate as of Q2 2025, growing 45% YoY.

Output (FY 2030):

GMV: $28.3B (12% CAGR from FY 2025 to FY 2030)

EBITDA Margin: 4%

Segment Adjusted EBITDA: $1.132B

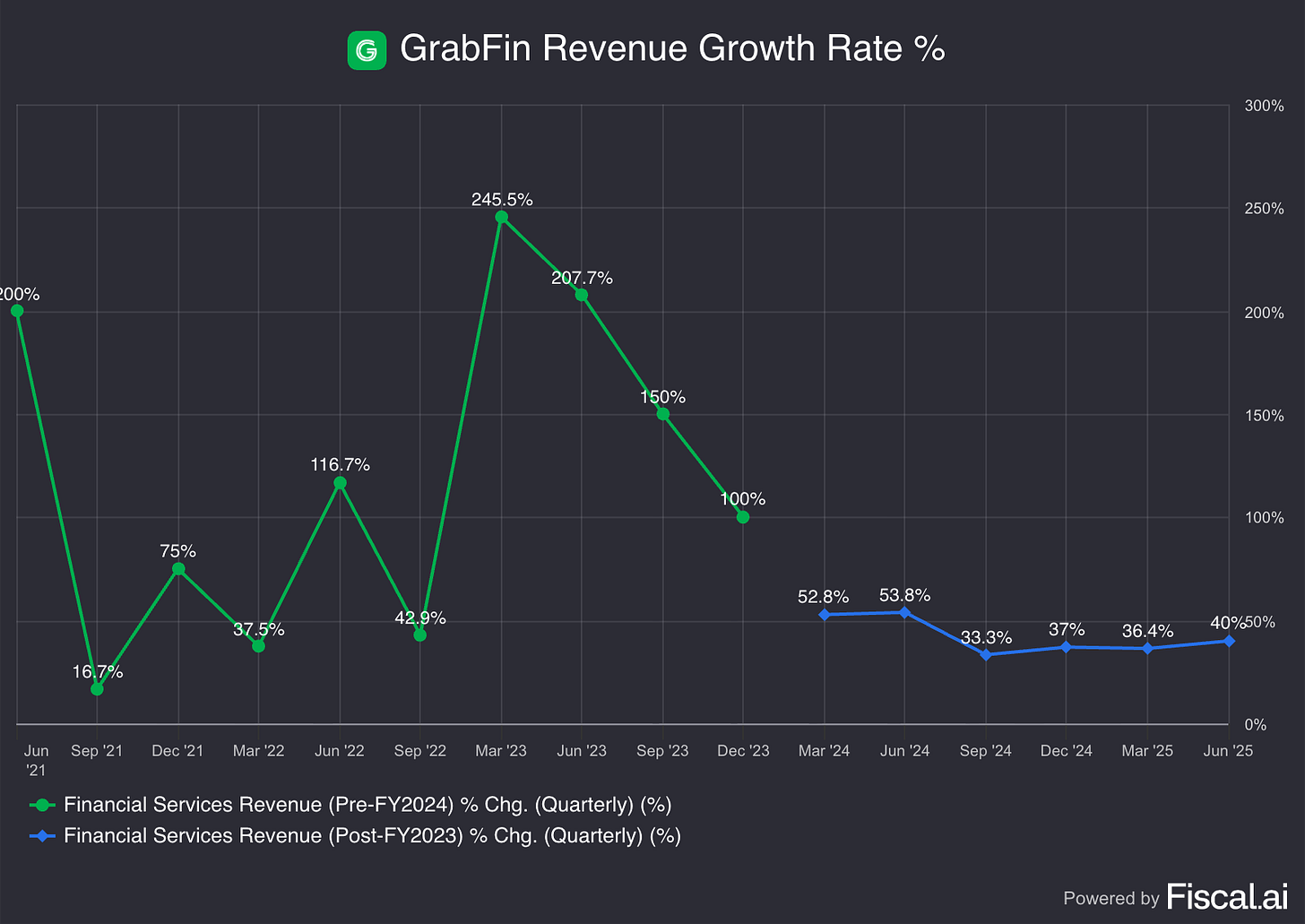

FinTech: GrabFin

FY 2024:

Revenue: $253M (+43% YoY)

Segment EBITDA Margin: -$105M (-41% of GMV)

Assumptions:

Revenue of $354M as the base year (FY 2025)

Assumes 40% growth rate, which I believe is conservative considering the trajectory over the past 4 quarters.

Revenue CAGR 2025→2030: 35%

FinTech is a nascent sector in SEA, where over 60% of the population are unbanked/underbanked. Grab can certainly grow at higher rates for much longer.

EBITDA Margin as % of Revenue: 4% by 2030

For reference, Sea Limited’s Monee which is a close comp to where GFin wants to be, has 27% EBIT margins at a $3B revenue.

Output (FY 2030):

GMV: $1.59B (35% CAGR from FY 2025 to FY 2030)

EBITDA Margin: 25%

Segment Adjusted EBITDA: $0.3975B

SOTP

In summary, if we look at the three segments, we see a FY 2030 Segment Adjusted EBITDA of:

Mobility: $1.29B (9% Margin growing 12%)

Deliveries: $1.132B (4% Margin growing 15%)

FinTech: $0.3975B (25% Margin growing 35%)

Mobility:

Multiples (EV/EBITDA):

Bear: 14x → EV $18.1B

Base: 18x → EV $23.2B

Bull: 24x → EV $31B

By 2030, Southeast Asia’s ride-hailing market should be a mature marketplace with durable contribution margins and reasonable growth. Currently Uber’s whole-company EV/EBITDA multiple is ~35-40x.

Using those as a ceiling and apply a region/scale discount puts mobility in the high-teens base and mid-20s bull once mature.

Deliveries:

Multiples (EV/EBITDA):

Bear: 15x → EV $16.98B

Base: 20x → EV $22.64B

Bull: 25x → EV $28.3B

Deliveries blends low-teens logistics economics with a fast-growing, high flow through retail media layer. I believe ads will continue to be a huge and growing sector well into the 2030s, as seen in Uber’s current growth rates at 60% per annum.

FinTech:

Multiples (EV/EBITDA):

Bear: 15x → EV $5.96B

Base: 20x → EV $7.95B

Bull: 25x → EV $9.94B

At GrabFin’s growth rate and margin profile in 2030, and with huge growth potential ahead, I think a 20x base case is very defensible. This is lower than Nu Holdings that is growing at just 15% and trades at over 20x EV/EBITDA.

Final Calculations:

Assuming we take the base case for each of these segments, we arrive at a FY 2030 EV for Grab of $53.79B.

Something that is of note here that most are likely to miss is that Grab has over $7B in cash on its balance sheet that can be used to acquire for growth and to wrestle market share, allowing for a more dominant market position, which could lead to higher multiples. However, this can arguably be counter-balanced by Grab’s $1.5B convertible note offering that is due in 2030.

Let’s assume in this case that Grab does nothing and merely grows its cash to $10B, which is only $600M per year (it already brought in over $660M in EBITDA in FY 2024).

This would bring us to a final FY 2030 market cap of $63.79B. Assuming a conservative 12% discount rate, we arrive at an present value of $36.2B or $8.87 today.

As of the time of writing, Grab trades at $5.02, implying a market cap of $20.44B. That means at the present value, there could be up to 77% upside today.

In terms of implied IRR from today’s $20.4B market cap to $63.8B in 2030, I believe Grab has the potential for ~25.6% CAGR returns, which is a very attractive proposition for me.

Final Thoughts

This is my personal base case for Grab and why I see it as a very interesting opportunity.

However, please note that these are all assumptions and valuation models are very subjective, and every investor will have a different set of variables.

Furthermore, this is a deliberately simplified valuation model. In my professional work I often build very detailed, granular models with dozens of assumptions, drivers, and sensitivities. But I’ve come to believe that level of complexity often gives a false sense of precision.

At the end of the day, all models are abstractions and simply frameworks for thinking. The real utility of a model isn’t in nailing down an exact fair value to the second decimal, but in helping us see what really matters; which I believe to be the long-term trajectory of each segment, the margin structure at scale, and the multiples the market might reasonably ascribe.

Consider formulating your own model to get a ballpark sense of what you personally believe the stock might be worth, as that would allow you to earn your own conviction.

Thank you for reading!

Thanks. What is the meaning of GMV?