Grab Q3 2025 Earnings Review

Another Steady Quarter, High-Margin Business Accelerating

Grab reported Q3 2025 Earnings after the market close on 3rd November 2025.

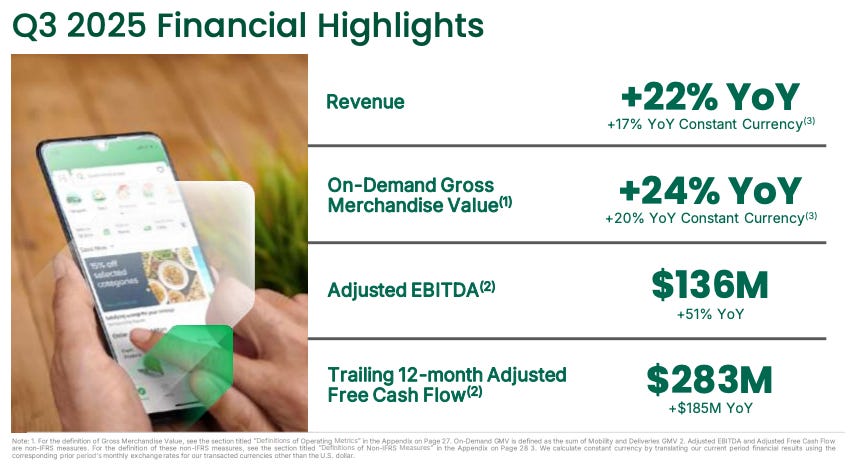

Revenue: $873M v $876M est. (+22% YoY, 17% Constant Currency)

EPS: $0.01 v $0.02 est.

Selected Key Metrics

On-Demand GMV: $5,774M (+24% YoY)

On-Demand GMV per MTU: $133 (+7% YoY)

Group MTUs: 47.7M (+14% YoY)

Loan Portfolio: $821M (+65% YoY)

Adjusted EBITDA: $136M (+51% YoY)

Adjusted Free Cash Flow: $203M (+37% YoY)

Grab reported another set of strong earnings numbers this quarter, largely in-line with estimates. As usual, GMV and MTUs are the key metrics I track in the business and both saw sequential improvements.

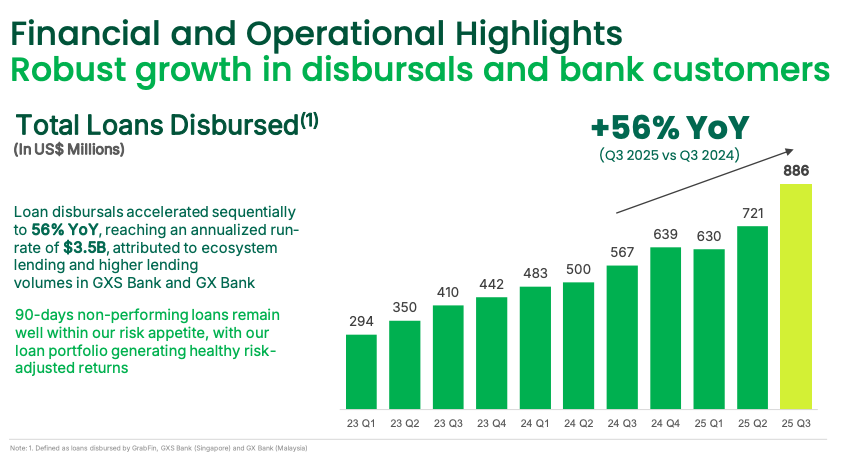

Loan book growth continued growing strongly to $821M this quarter, a 65% YoY growth. Total loans disbursed accelerated sequentially to 56% YoY, reaching an annualised run-rate of $3.5B during Q3.

Management raised guidance on both revenue and adjusted EBITDA, in line with what I shared in my Q2 earnings review:

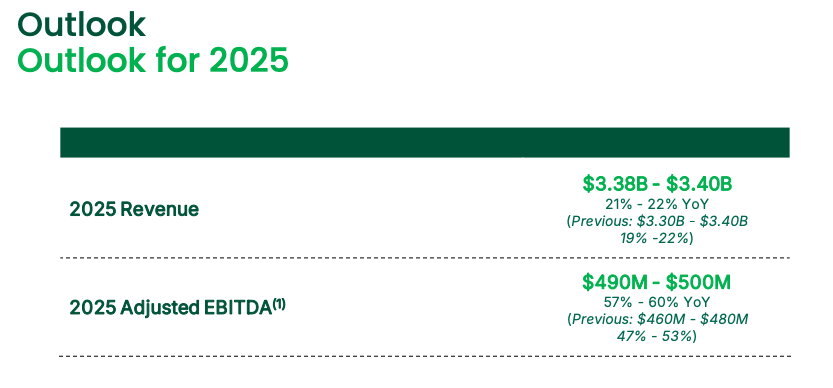

Management raised FY Revenue guidance from $3.30B-$3.40B to $3.38B-$3.40B and Adjusted EBITDA guidance from $460M-$480M to $490M-$500M.

This would imply a midpoint guide of 21.5% revenue growth and 58.5% adj. EBITDA growth.

In this piece, I will break down the earnings in full, highlight key points on management commentary during the call and discuss my personal thoughts in the last section.

Table of Contents

Deliveries & Mobility

GFin, Financial Services

GrabMart

GrabAds

Key Call Commentary

Positives & Negatives

Conclusion

1. Deliveries & Mobility

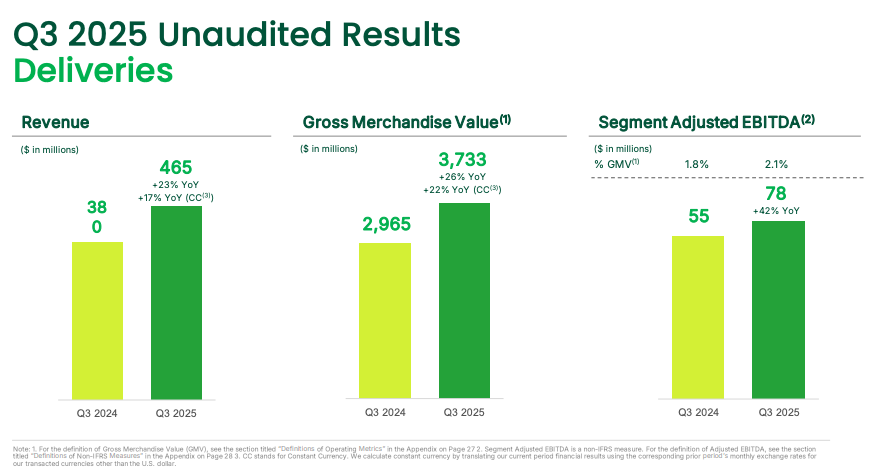

Deliveries is Grab’s largest segment by GMV and Revenue.

GMV grew 26% YoY (or 22% on a constant currency basis), this was a third consecutive quarter of acceleration, with Grab attributing growth to its product-led strategy that delivered all-time high Deliveries MTUs.

Adj. EBITDA margin also grew from 1.8% to 2.1%, tracking closer towards management’s long-term target of 4+% margins.

Grab has been pushing the affordability-focused products that has allowed for deeper penetration within its user base and more frequent usage. These products include Saver Deliveries and Group Orders.

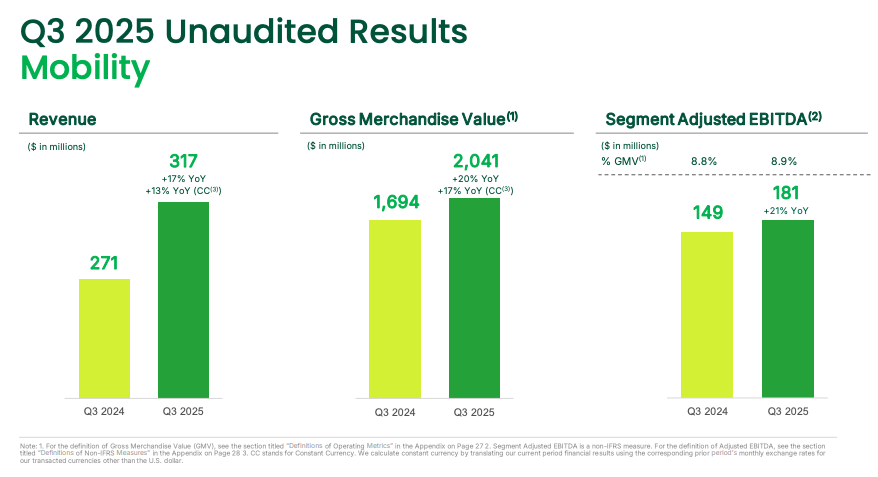

Mobility is Grab’s original business and the highest-margin segment by Adj. EBITDA. However, as I often discuss, it is a commoditised business. While there are ways to differentiate deliveries through merchant lock-in etc, mobility is standardised across the board. (Hence, Grab’s Adj. EBITDA nearing the long-term target of 9+% already)

Mobility GMV grew 13% YoY on a constant currency basis while transactions grew 30% YoY, far outpacing GMV growth. Again, this was largely a result of Grab’s affordability push, reinvesting the benefits of their scale economies to drive broader accessibility and increasing platform usage.

For Grab, mobility is simply a trojan horse to get consumers to use Grab more often, with the primary benefits being up-selling of deliveries, financial services, and increasing its economies of scale.

Segment Adjusted EBITDA continued to track nearer to Grab’s long-term steady state margin target of 9+%.

2. GFin, Financial Services

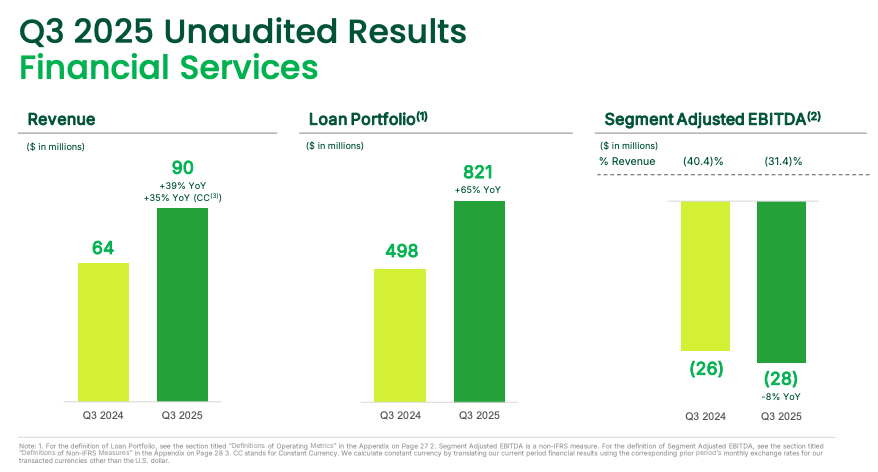

GFin continued to grow strongly with 65% YoY growth in its loan portfolio to $821M. Management expects its $1B target at the end of the year to be achieved comfortably.

Segment Adjusted EBITDA as a % of revenue improved from -40% to -31%, as Grab tracks closer towards profitability, which it expects in the 2nd half of next year.

Total loan disbursals accelerated sequentially to 56% YoY and shows Grab is being more aggressive in this segment, which is what I’ve been hoping to see.

I believe it still has a long runway for growth and expect it to continue accelerating.

3. GrabMart

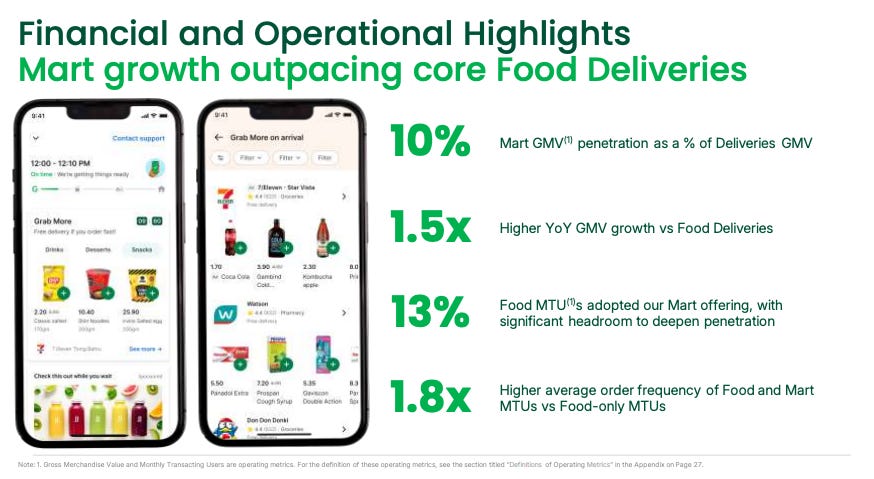

GrabMart is a segment I’ve highlighted several times as a key area to watch.

It continues to grow at 1.5x the growth rate of food deliveries and now represents 10% penetration of the Deliveries GMV.

I’ve used GrabMart several times when overseas on holiday in Southeast Asian countries and found it to be very useful and at a very affordable price. I believe this is a no-brainer for many consumers in SEA and expect this to be a massive growth driver for the business in the years to come.

4. GrabAds

GrabAds is Grab’s latest segment and potentially highest-margin business. I’ve written a piece on it if you’re interested in learning more.

The total number of quarterly active advertisers who joined the self-serve platform increased 15% YoY to 228,000 while average spend by Quarterly Active Advertisers increased 41% YoY, allowing for continued deepening of advertising penetration among merchant-partners.

5. Key Call Commentary

On Raised Guidance and Profitability

“You’ve seen our numbers from Q1 to Q3, how we’ve been performing. We’re continuing to have the consecutive QoQ growth and our EBITDA guidance. Part of that is the top-line growth we’re seeing in the business, deliveries business growing at 26%, mobility growing at 20% and financial services growing at 40% revenue.

Our loan book continues to hit all-time highs, so you’ve got nice momentum just overall from the top-line side. But also at the same time, we continue to be very disciplined on our cost structure. You see, our regional corporate cost increased only 8% YoY and what’s more important now is that we’re seeing 150 basis points improvement in operating leverage as a percentage of revenue of our regional corporate costs and that’s critical as we continue to make sure we’re spending in the right areas.

And so with that, we are more confident in raising our EBITDA guidance to the 490-500M for the FY2025.”

CFO Peter Oey

On Transacting Users

“MTU growth as you saw on-demand, grew 14% YoY. In fact, DTUs grew even faster. So our daily transactions are growing faster than monthly transactions. We are succeeding in our goal of being part of the daily lives of Southeast Asians.

The actual transactions grew 27%, so you can clearly see that increase in frequency effect as well. And that is very much part of our strategy for driving the flywheel of increased demand, increased supply, improved quality of services and driving further demand. In terms of demographics, saver deliveries have been instrumental in acquiring new users. Almost a third of our deliveries MTUs are joining the platform through saver deliveries. So that’s an important driver of the flywheel again this quarter.

High value services are also growing fast, high value rides grew 66% YoY and priority delivery is also growing fast. So we’re seeing growth at both ends of the pricing ladder, which is healthy. But the critical thing is that we’re also being successful in cross-selling and retaining these new users to build long-term customer value.”

COO & President Alex Hungate

On Growth Rates Moving Forward

“We still feel that our MTU penetration of SEA is low when you consider the size of the population and the growing spending power. So when you look at what’s driving these elevated growth levels in the last 3 quarters where we’ve managed to accelerate quarter after quarter, you can see that there are 3 elements which I feel are all sustainable going forward.

One is the product-led viral growth. Without increasing consumer incentives, we are able, with group orders and family accounts, to bring in new users. The ecosystem is self-generating and bringing in new users on its own.

We have also got this very strong GrabUnlimited base. GU is the biggest paid subscription program in SEA, users grew again 14% YoY to another all-time high. They now represent over 20% of our delivery MTU base. This is also a sustainable driver of future growth.

And then we have this adjacent GrabMart opportunity where now we have this functionality called GrabMore where a Food Delivery user can just add on a grocery order to the food delivery that they’re about to receive, proving to be very popular. That will allow us to penetrate more and more of our large food base so that we can keep GrabMart growing.”

COO & President Alex Hungate

On Capital Allocation

“On the capital allocation framework, no change in terms of how we’re thinking about it. Our focus has always been on three pillars. The first one is around investing for organic growth. You’re seeing that in the business, the profitability of our business and the growth that you’re seeing. Some of that came from also some product adjacencies and tuck-ins that we’ve done as part of that profitable growth that you’re seeing. The organic growth has been really critical.

One way that we’ve been deploying the balance sheet is on our loan book. If you look at the loan disbursal for Q3, for an example, we hit roughly $3.5 billion on an annualised basis on that disbursal. Q3 alone was up roughly about 56% on a year-over-year. A majority of that is on our balance sheet itself. It’s a great use of capital for us. Actually, it returns above our average cost of capital for us. We’ll continue to use that balance sheet as we recycle those loans.

That’s just one example in terms of organic allocation. We’re also obviously deploying some of those capital in terms of investing in terms of new products that we’re earmarking for 2026. The second pillar is around what we call very highly selective M&A, which are more opportunistic. Those have a very high bar, as you know. We’ve always talked about this. Where we have been investing in is in some of the longer-term bet that we’re looking at for things such as autonomous vehicles. We’ve deployed some of those capital in making those critical investments that we’re leaning into. You’ve seen the announcement that we made with WeRide, MayMobility as part of our strategic pillar in terms of making sure that we are the pioneer and we’re leaning in in terms of autonomous vehicles deployment here in Southeast Asia. Overall, as a framework, that M&A is a very high bar for us. We want to make sure that the synergies that we can extract are of a greater value. Third, where there’s excess capital, we will obviously look at returning it to our shareholders. Those remain critical, those three things.”

CFO Peter Oey

Experimenting with Quick Commerce

“We are experimenting with some of the newer business models that would open up more TAM for us. In Malaysia, where we have Jaya (Grocer), we are experimenting with Quick Commerce where we can really sweat the inventory and store assets. Without increasing our fixed costs, we’re able to drive up the volume of orders quite significantly. Even though the experiments there are primarily grocery-focused, we have seen a nice step-up in demand when quick delivery is an option for customers.”

COO & President Alex Hungate

On Autonomy

“Our recent AV investments are all very deliberate. It’s part of our long-term strategy to lead the adoption of AV and remote driving across Southeast Asia and to secure the technology supply chain through strategic partnerships. While AVs are already a reality in parts of the world, we expect a longer ramp-up to mainstream adoption in Southeast Asia for a few reasons.

One, Southeast Asia is still behind in the cost curve. Labor costs in Southeast Asia are significantly lower compared to the US, with Singapore being an exception. Now, we believe, therefore, it will require considerable time for the unit economics to reach parity with human drivers.

Second, the crossover point will occur when AVs become safer and even cheaper than alternative options before we see a huge transformation in the way current transportation is served. Now, as the largest mobility platform in Southeast Asia, AVs and remote driving are something we must lean into. We’ll continuously learn about the technical optimisation of AV performance on our platform. We’ll also maintain a hybrid fleet approach for the foreseeable future and intend to collaborate very closely with regulators across Southeast Asia.

An essential part of this strategy is to work alongside regulators to up-skill our driver partners as part of this shift. Our focus is to find the new jobs that will be required as we shift towards a hybrid transport world. We see new kinds of jobs emerging. For example, drivers could be remote safety drivers, data labellers. They could change LiDARs, cameras, and so forth. So as we lean into AVs and remote driving with several partnerships already under our belt and more underway, we remain very excited about the longer-term opportunity to build capabilities to operate a world-class hybrid human and autonomous fleet to deliver the best experiences for our customers.”

CEO Anthony Tan

On Data Advantage in GFin

“You asked what we were learning from the customers. We are, in many ways, a data science company. We are learning every single second of every single day from how our models ingest all of the different data points that we can generate through our ecosystem. Unlike banks, we can access a lot of unconventional markers of likelihood to repay that allow us to underwrite segments of the population in Southeast Asia that currently cannot access credit. These are often known as underbanked, unbanked.

A lot of what we do is about financial inclusion, bringing people into the market, allowing them to actually establish a credit record. About one-third of our customers could not access credit because they weren’t on a credit bureau prior to borrowing from Grab and our financial subsidiaries. This is very important to us and very much aligned with our mission. The repayment record from those customers is very pleasing. They know that when they repay us, they start to establish a credit record and they start to therefore become included in the financial and economic prosperity of Southeast Asia.

We’re very pleased to learn more about those customers and to bring them into the financial services domain for the first time. Every time we launch a new product, the credit models obviously take time to be established. What you’re seeing this quarter is that across the banks and GrabFin, we’re starting to see that we’ve got credit models maturing. We’ve got new models being launched all the time. We’re increasing the cycle speed with which our data science improves these models. That’s why going into this fourth quarter, if you run the numbers, we’re predicting an acceleration of the loan book size. We also are indicating that that acceleration will continue into 2026.”

CFO Peter Oey

6. Positives & Negatives

Positives:

Strong Profitability Trajectory

Adjusted EBITDA grew 51% YoY to $136M, with full year guidance raised to $490M-$500M. This shows sustainable profitability and management expects this profitability to continue into 2026.

Adj. Free Cash Flow grew to $203M and corporate costs grew only 8% YoY which reflects improving operating leverage (-150bps YoY).

Ecosystem Strength Improving

GrabUnlimited subscribers were up 14% YoY and now represent >20% of delivery MTUs, creating recurring revenue and higher retention. The delivery, mart, financial services and ads flywheel is visibly accelerating user frequency and monetisation.

Data & AI Advantage Showing

Grab discussed how 1/3 of borrowers were non-credit bureau users, proving its ability to utilise its proprietary ecosystem data to provide loans to new users. This strengthens the financial inclusion narrative and creates a new credit data moat for Grab.

High-Margin Business Accelerating

GrabMart GMV is growing 1.5x faster than GrabFood and is only at 10% penetration, there is clear runway ahead.

GrabAds advertisers grew 15% YoY and average spend was up 41% YoY, this is an extremely strong sign of the AI Merchant Assistant that Grab launched in April’s product day taking effect.

Loan Book Size Accelerating

Management expects the loan book size to continue accelerating into 2026. This is definitely possible with Grab’s $7B cash in hand to fuel this growth.

Negatives:

Mobility GMV Growth Lag

Mobility GMV grew only 13% despite transactions growing 30%. This shows the push for affordability is working, but also implies much lower average order value and price pressure.

Mobility is a commoditised segment and Grab will have to ramp other products to increase earnings power.

Top and Bottom Line Near Misses

I expected a beat on the top-line in particular and this Q3 weakness was slightly poor. I believe it can be attributed to the protests in Indonesia this quarter and do expect Q4 to be better.

Capital Allocation

Management appears to still be coy on any major acquisitions and in my view are being too prudent, at the expense of growth.

30% of cash in market cap is way too much for me, and I believe they should deploy it more aggressively, either into M&A or growth in new verticals. It would otherwise be unfriendly to shareholders.

7. Conclusion

I thought this was a great quarter from Grab in general. While the headline numbers were mediocre, under the hood, it was much better than I expected.

GrabMart and GrabAds are quietly emerging as powerful adjacencies that can meaningfully lift blended margins over the next few years. Importantly, management’s raised guidance on both revenue and EBITDA shows confidence that this trajectory is sustainable.

In particular, I am excited about the new products hinted by management in 2026. I believe that with Grab’s massive user base and driver/merchant partners, they should be able to expand into many more services.

There are valid concerns. Mobility remains a commoditised business that caps pricing power while Grab’s push toward affordability keeps user growth high but limits short-term monetisation. The balance sheet is arguably under-deployed. They are being very prudent, which is something I have concerns about, but this strategy has elevated them to being the key player in mobility and deliveries, so I will give them the benefit of doubt here.

Again, my hope is for management to have more urgency in spending the growing cash pile. They did invest in WeRide and MayMobility to boost the progress in autonomy, but I’m hoping for more substantial investments to accelerate top-line more substantially.

Overall, I think this was yet another steady quarter from Grab that we have come to expect and importantly, I believe the core flywheel is spinning faster than ever. I believe that with momentum across every business line and growing visibility into 2026 products, Grab is well positioned for the next phase of growth.

Thanks for reading! If you enjoyed this piece, please give it a like and consider subscribing to a tier of your choice.

As a reminder, paid subscribers receive 6-8 articles a month covering:

Earnings Reviews (Grab, Sea Limited, dLocal, Mercado Libre and more)

1-2 Deep Dives (always happy to receive suggestions)

Portfolio Review (sharing all my positions & changes)

Living in Malaysia, I couldn't imagine life without GRAB.

They will continue to grow and dominate life in SEA.

GO GRAB!

Good breakdown! Thanks for sharing