Grab Q2 2025 Earnings Review

Steady Compounding, Strong GFin Performance, but a few concerns...

Grab reported Q2 2025 Earnings after the market close on 30th July 2025.

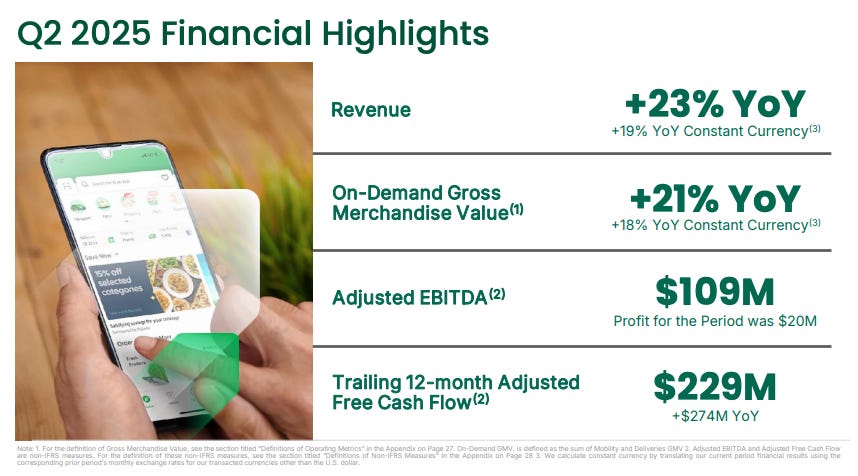

Revenue: $819M v $811M est. (+23% YoY, 19% Constant Currency)

EPS: $0.01 v $0.01 est.

Selected Key Metrics

On-Demand GMV: $5,354M (+21% YoY)

On-Demand GMV per MTU: $127 (+5% YoY)

Group MTUs: 46.2M (+13% YoY)

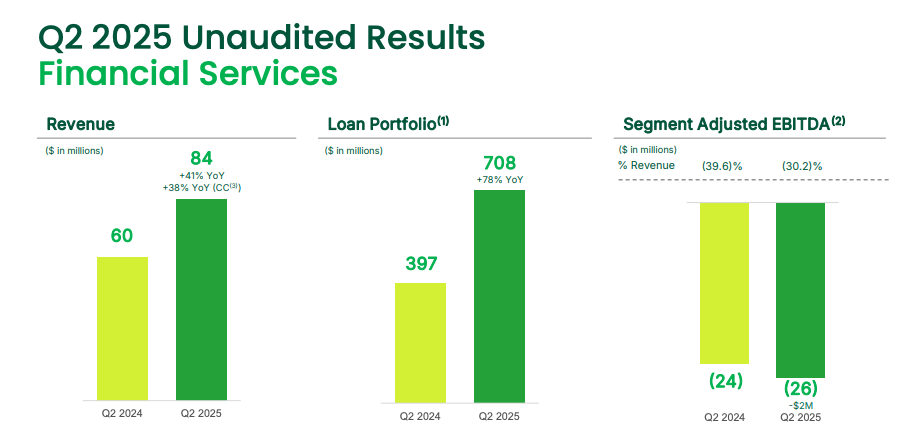

Loan Portfolio: $708M (+78% YoY)

Adjusted EBITDA: $109M (+69% YoY)

Adjusted Free Cash Flow: $112M (+177% YoY)

Grab reported strong earnings numbers for Q2 2025, with continued growth in GMV and MTUs, the two key metrics that I track in the business.

In particular, the loan book growth was extraordinary at 78% YoY.

Management decided not to raise guidance on Adj. EBITDA, but I do believe they will in Q3 to $500M from the current $460M to $480M.

In this piece, I will breakdown what I liked about the report, management commentary during the call, and some concerns I have…

Table of Contents

Deliveries & Mobility

GFin, Financial Services

GrabMart

GrabAds

Key Call Commentary

Positives & Negatives

Conclusion

1. Deliveries & Mobility

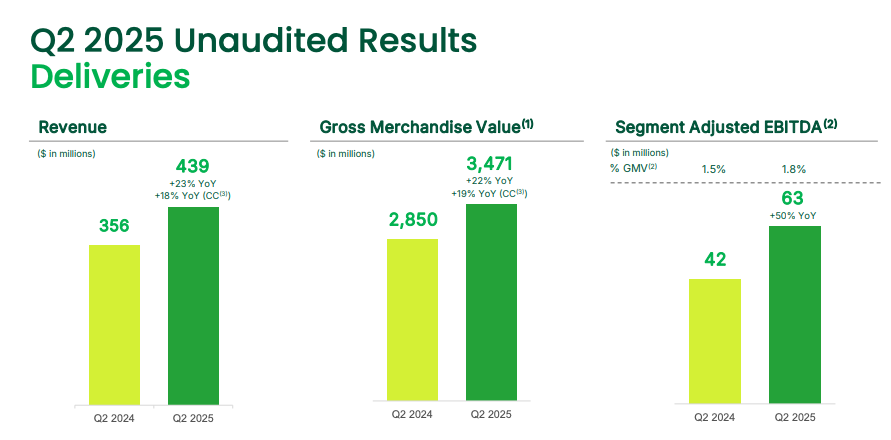

Deliveries had a strong showing, with 19% YoY GMV growth on a constant-currency basis. Adj. EBITDA grew from 1.5% to 1.8% mostly thanks to ad growth.

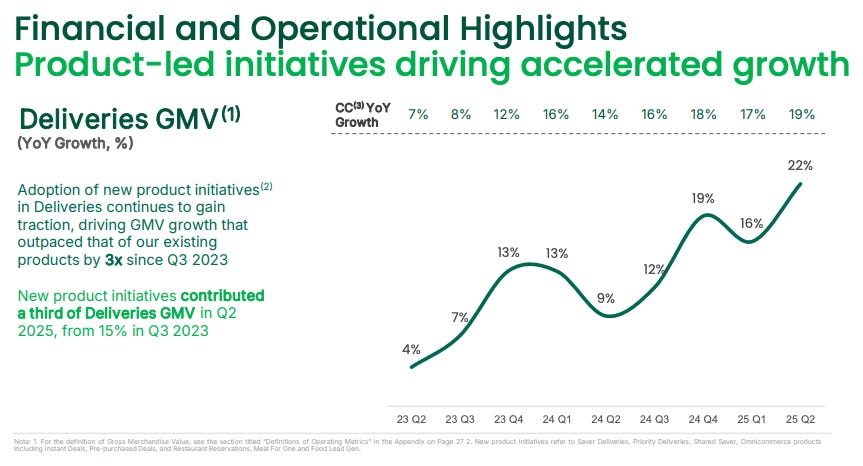

This was an acceleration in the growth rate primarily led by Grab’s new products such as Dine Out Discovery, Family Accounts and Group Orders. Grab mentioned that these have proved to be very effective and are attracting new users through network effects and shared experiences.

Grab also shared that the GMV from these new product initiatives shared at the GrabX Product Day accounted for a total of 1/3rd of Deliveries GMV and is growing 3x faster than existing products.

Saver deliveries have been one of the key contributors to Deliveries GMV, accounting for 34% of transactions compared to 28% last year. However, segment margins have still increased by 34 basis points from 1.5% to 1.8%, proving that margins can still improve despite greater affordability for consumers.

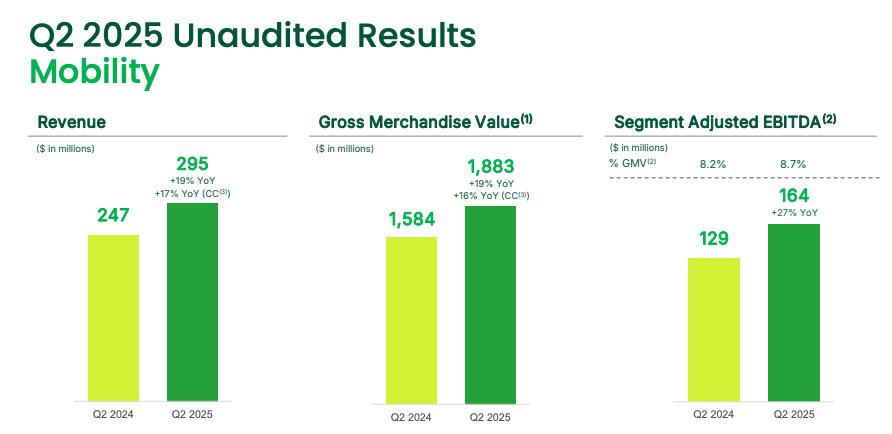

Mobility GMV grew 16% YoY on a constant currency basis while transactions grew 23% YoY, outpacing GMV growth. Grab has done this by prioritising affordability over the past 2 years. They have also reinvested the benefits of their scale economies to drive broader accessibility and increase platform usage.

I think focusing on improving utilisation is key for Grab as it helps to attract new cohorts and improves retention, which is ultimately key for the business to remain a staple in every Southeast Asian consumers’ pocket.

It was interesting to hear from management that the 4% YoY drop in trip fares was due to Grab’s own decision of lowering fares, rather than driven by competitive activity.

Something that must be realised too, is that the eventual goal of this is to drive more users into the ecosystem to allow for cross-selling into Deliveries and Financial Services. This has also not come at the expense of profitability as margins rose to 8.7% which is not far from Grab’s steady-state margin target of 9%+.

2. GFin, Financial Services

Financial Services revenue grew 41% YoY with a very impressive 78% YoY growth in the loan portfolio. Segment Adj. EBITDA margin fell from -40% to -30% YoY.

We are beginning to see an acceleration on the Fin Services segment which is something I have been hoping to see. This has largely been driven by the availability of personal loans in all 3 GXS Banks, BNPL and the acquisition of Validus.

In the coming quarters, I hope to see a continued acceleration on growth here as I believe Grab has somewhat disappointed in this segment in recent years and has some catching up to do. (See Sea Limited’s Monee for reference)

Grab also shared that it expects to finish the year with a loan portfolio larger than $1B, which would mean an increase of 86.5% YoY. This essentially means management is guiding to continued acceleration in the second half of this year.

“The reason why we're very confident that we can exceed $1B is because of the very strong product lineup we have both for GrabFin, our fintech arm, and for the digital banks. So for the first time, we've got personal lending products available for all three banks. We've got BNPL available through GrabFin in multiple markets.

And as of the middle of this year, so going forward for the full second half, we have the supply chain financing capability that we got by acquiring the Validus business in Singapore, which has now been rebranded GXS Capital through GXS Bank. So we've been financing SMEs through the supply chain, in other words, with a well-managed risk profile because based on the risk of larger corporate offtakers. And it's a very good fit with our ecosystem.”

3. GrabMart

"This is an area where the TAM is very large potentially, much larger than the food delivery market in the longer run."

Alex Hungate, President and COO of Grab

I think this sums it up. Earlier last week, I posted on X about this exact topic, and how GrabMart is one of the largest areas for growth in the long run.

Online grocery penetration in SEA is barely less than 5%. Grab also revealed that Mart is currently less than 10% of the deliveries business but growing faster than food deliveries, about 1.5x the growth rate.

Grab has purchased Jaya Grocer and Everrise in Malaysia, supporting their O2O experience there, which is in their words, the leading edge of the customer experience that they are developing.

Jaya Grocer is already heading towards 15% online penetration of GMV, clear proof that it can be done and attracts partners in other markets to work with Grab to achieve those similar levels.

Grab also disclosed that FMCGs in SEA find it hard to get strong data on their sales due to the multi-tier distribution of the traditional retail environment in the region. Grab is able to give them first-party data, which is very valuable.

4. GrabAds

The Ads business is a segment i’ve discussed often in recent months including this piece that runs through the nuances and potential:

In Q4 2024, it was at a $216M run rate. Hence, the $20M bump is slightly underwhelming. However, H2 is often a much stronger period for Ads due to festivities and cyclicality.

Grab COO Alex Hungate also discussed about how Ads has the potential to have an exponential impact:

The number of advertisers that are actually trying Grab as a retail media network continues to grow.

Grab is still at less than 50% penetration of its merchant base that have tried the Ads product.

Of those who have used, return on advertising spend is averaging >9x (!)

Retention of those who have used it is very high.

Penetration YoY grew 42%, existing advertisers spent 31% more YoY.

5. Key Call Commentary

On Autonomy

“We are leaning heavily into the AV opportunity across Southeast Asia. We are in a prime position to support the AV transition over the next few years. We have a very significant role to play via a hybrid fleet…

When you think about our right to win, we think about, number one, we have, and continue to build, strong relationships with AV players as well as OEMs across the world. Second, our scale, our network across the region, that allows us to provide the best-in-class utilisation rates, which is very important … to make the unit economics work.

Third, the brand trust and a long track record of safety and of working constructively with regulators and governments to ensure community safety. We have also built our own mapping tech with very rich local data sets that provides millions of real-world driving hours, real-world user pickup, drop-off points, patterns, traffic flows, heat maps across highly complex SEA-specific urban environments.”

On Autonomy Partnerships

“We also have several pilots we planned. At the moment -- earlier this month, we announced A2Z, partnership with a Korean full-stack AV manufacturer. Now that culminated in the announcement of the first autonomous electric shuttle bus in Singapore.

Now in Philippines, we are working with regulators closely and property developer Megaworld to launch a pilot study on drone-powered commercial delivery.

Looking ahead, you can expect to hear new partnerships with more global AI and driverless AV partners. We'll continue to explore potential high-value, new job opportunities that this sector could create for the communities we serve. Expect to hear more pilots to understand the operational conditions for different driverless vehicle services in the region."

On Capital Allocation

“We always want to create, generate shareholder value on a long-term basis. And if you look at where we've been deploying our capital, it's really fueling the growth of our business through organic growth. And that's going to be P0 for us. It's going to be high top of the list for us, and you're seeing that playing out in this result, which is fueled by the previous deployment of capital towards all the product innovations and the tech innovation that we've been doing. That will continue to fuel the growth that we're going to see in our business as we move forward. Now with that being said, with M&A, we're always on the lookout. With a strong balance sheet and with the recent capital raise, it does give us that strategic flexibility.

And that flexibility is important because M&A comes and goes. So we'll be continuing to scout the market in terms of what's available. But at the same time also, the bar is just so much higher when you compare it to the organic growth that we continue to prioritise over our business today. Now in terms of buyback, we did complete the $500 million buyback. It was done concurrently with the recent convertible note that we raised. There's no plans for new buyback programs. That's something that we'll continue to explore with our Board. But in this quarterly earnings, there's nothing for us to announce. Again, it's all about, for us, prioritising the right sort of capital management in our business. And when we have a new buyback, we'll definitely share it with all of you.”

On Ads

“The advertising business has doubled a couple of times over the last couple of years. So you can see that we're growing super fast. There's an exponential impact in here that I should explain. One is the number of advertisers that are actually trying Grab as a retail media network for the first time continues to grow. We're still at less than 50% penetration of our merchant base in terms of those that have tried us. So there's still upside there in terms of expanding the penetration of our merchant base. And because their return on advertising sales is averaging 8x, we know that it's a great product for them, and it can help them grow. So as the retention of those that do try us is very high, and therefore, we're getting that exponential impact of existing advertisers spending more while we grow the penetration at the same time. So the penetration year-on-year grew 42%. So that's the first part of the exponential.

And then those existing advertisers on the self-serve platform also increased 31%. So really good opportunity for us there. Advertisers, as you know, want reach. So the bigger we get, the more attractive we are on a cost per point basis as well. So the pricing on the network gets larger, gets higher as we get larger simply because they -- all they care about is the returns ultimately to their investment. So this is why you're seeing those kinds of exponential growth rates on advertising. If you look across the world, penetration of advertising to GMV in various markets can get much higher than where we are today. We're seeing examples of 2% penetration, 3% penetration, even 4% penetration, particularly when you get into the Mart type of ecosystems. So I think depending on our different verticals, including mobility, by the way, where we've now introduced ads, we see opportunity to increase advertising penetration much higher than the current penetration that we have of 1.7%.”

6. Positives & Negatives

Positives:

Top-line and GMV acceleration

This was mostly driven by the focus on affordability and the release of Grab’s Product Day releases. IMO, Grab should be focusing on growing, with less regard for profitability at its current stage.

Mobility was volume-led while margin improved

Despite a 4% decrease in fares (which was a planned strategy), margins continued to climb, showing efficiency in cost and a larger driver pool paying off.

Loan Portfolio growth

The 78% YoY growth on the loan portfolio was great to see. But more incredibly, the guidance for 86.5% YoY growth in H2. I’ve long felt GFin would be the hidden gem in the business and it could be coming true soon.

Product momentum & ecosystem stickiness

Grab’s new product releases are growing 3x faster than other products in deliveries and now drives over 1/3rd of the volume, just incredible.

Negatives:

Lack of discussion around capital allocation

Going into the call, I had shared that I would like management to discuss in depth about their usage of the huge war chest, especially with the $1.5B convertible note raise.

Management gave some vague commentary on it, but nothing concrete. This will unfortunately act as an overhang on the stock in my opinion, until a major buyback program or major acquisition is announced.

Partner incentives continued to outpace GMV growth

Partner incentives grew 28.3% to $239.5M, which means an increase in % of GMV spent, from 4.2% last year to 4.5% this quarter.

This is not ideal, but as management has reiterated multiple times, this will ebb and flow over the quarters depending on demand and supply. This could also be related to the driver protests in Jakarta that happened a couple months back. If so, that is a one-off issue that should not affect the business long term.

7. Conclusion

Overall, I think this was a great quarter for Grab and more or less in line with what I expected. I would like to see management have some urgency in terms of spending the ever-growing cash pile. That said, I think the prudent approach could pay dividends here, especially as its competitors continue to be picked off one by one.

The GoTo acquisition was certainly one of the elephants in the room that wasn’t brought up. With the recent news of the Chromebook fraud case, I think it is now extremely unlikely that Grab moves ahead with an acquisition.

That is undoubtedly a positive for Grab as it moves to secure a more dominant position in the largest Southeast Asian market, and a market that will prove crucial for Grab over the coming decade.

Personally, I am not making any moves at the moment, unless Grab sees a sell-off on the back of this rather stellar earnings report. I am happy with my position but will update subscribers should there be any changes.

If you enjoyed this piece, please give it a like and consider subscribing to a tier of your choice.

As a reminder, paid subscribers will receive 8-10 articles a month covering:

Earnings Reviews (Grab, Sea Limited, Coupang, dLocal, Robinhood and more)

Min. 2 Deep Dives (always happy to receive suggestions)

Portfolio Review (sharing all my positions & changes)

Thank you for all the support!