Galaxy Digital (Deep Dive)

The pieces are in place for what I believe could be one of the most compelling opportunities in today’s market

Longtime readers will know I rarely cover companies that promise outsized gains in the near term. Instead, my usual focus is on businesses that can steadily compound value over long periods of time.

That said, I recently came across a company that I believe represents a particularly compelling opportunity in a sector that is becoming critical to the AI buildout.

Without further ado, let’s dive in.

Table of Contents

Introduction

Company History

Principal Investments/Ventures (Segment 1)

Digital Assets Operating Business (Segment 2)

Data Center Business (Segment 3)

Industry and Market Analysis

Competitive Analysis

Bull Thesis

Risks

CoreWeave Fears Addressed

Financials

Ownership

Valuation

Concluding Thoughts (What I am personally doing)

1. Introduction

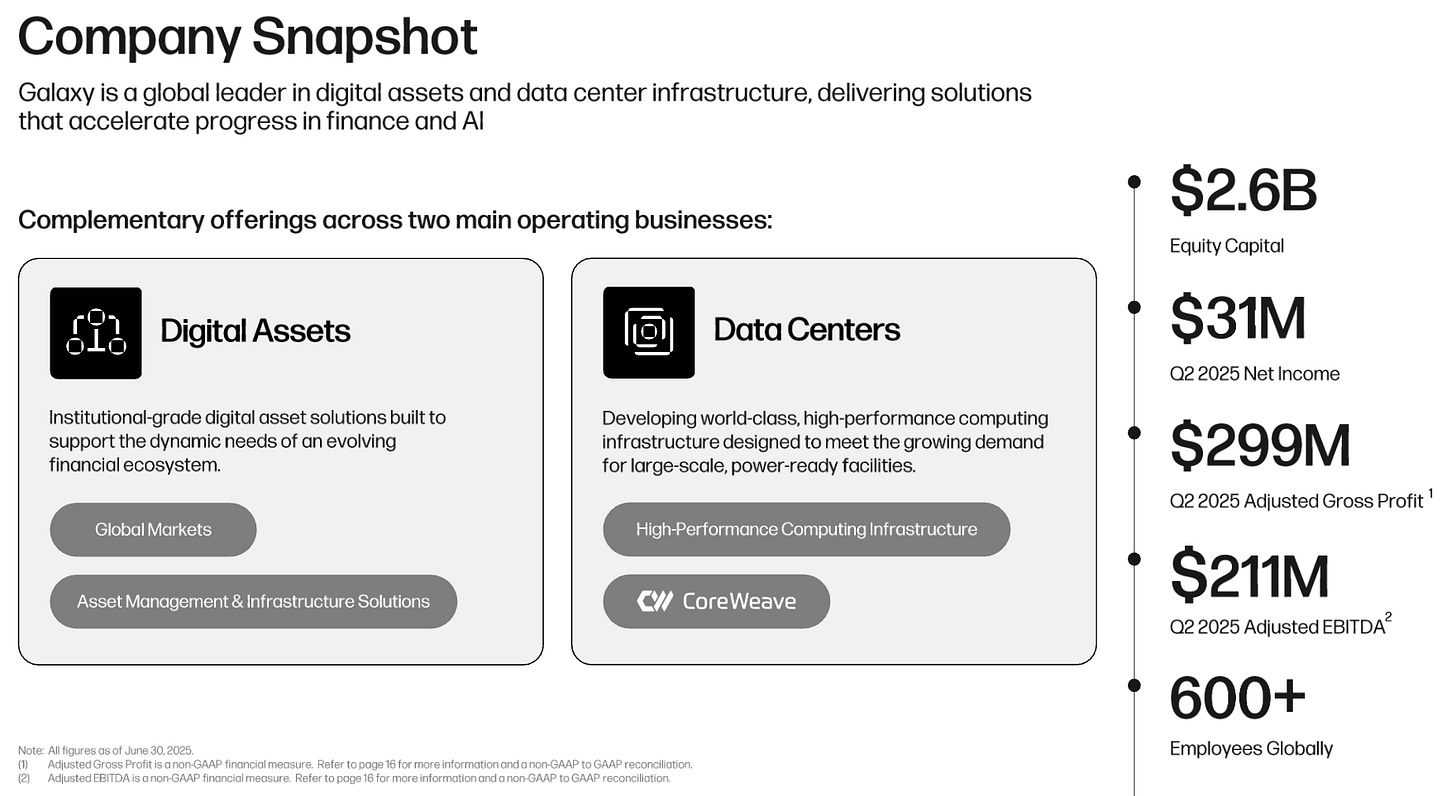

Galaxy Digital is a Crypto and AI infrastructure business and holding company that operates 3 primary segments.

It runs its own book of digital assets on its balance sheet.

A digital asset oriented operating business that includes financial services, investment banking, trading & lending.

Data Center campus in West Texas (Helios).

Among the three segments, the data center business stands out as the most compelling and forms the backbone of my investment thesis.

In late 2022, Galaxy stumbled onto the Helios space by accident as it attempted to build out Bitcoin mining rigs. Following the ChatGPT moment in November 2022, data centers for AI/HPC use became an incredibly valuable resource overnight.

In November 2024, Galaxy pivoted away from Bitcoin mining, sold its rigs and repositioned Helios for AI/High Performing Computing (HPC) data center operations.

What makes Helios so special is the incredible size of the campus and hence the corresponding potential for power generation.

The crux of the investment thesis is that investors currently do not realise the gold mine that Galaxy is sitting on as a result of pure dumb luck.

2. Company Overview & History

Galaxy was founded in 2018 by ex-hedge fund manager Mike Novogratz who launched the firm to bring Wall Street expertise into the nascent crypto industry.

Galaxy was conceived as a merchant bank for the digital asset space, modeled on the Goldman/Blackstone style of operations but focused entirely on crypto. Its early activities centred on trading, principal investments and advisory services, aiming to institutionalise crypto finance during the early wave of mainstream attention.

The company went public via a TSX Venture exchange listing in Canada and positioned itself as the go-to institutional gateway to crypto, paralleling Coinbase’s retail-first model. Galaxy benefitted enormously from the 2020-21 bull run, with record trading revenue and principal investments multiplying in value.

However, mistakes were made. The crypto winter of 2022 (Terra/Luna collapse, FTX implosion and broader credit stress) hit Galaxy’s balance sheet. Galaxy wrote down significant losses such as Terra/Luna and had to settle with the New York Attorney General for about $200M related to disclosures over that episode.

In late 2022, it acquired Helios, a Texas-based 200 MW Bitcoin mining facility, from Argo Blockchain. Management has since pivoted Helios into a broader data center business, positioning it as a core growth engine.

Its business model spans several segments including trading and brokerage, asset management, investment banking, principal investment/ventures and mining/digital infrastructure. Galaxy’s structure is sometimes compared to a mini-conglomerate (akin to a “Berkshire Hathaway” of crypto)

For the purpose of this deep dive, I will be focusing on just 3 business segments:

Principal Investments/Ventures

Digital Assets Operating Business

Data Center Business

3. Principal Investments/Ventures

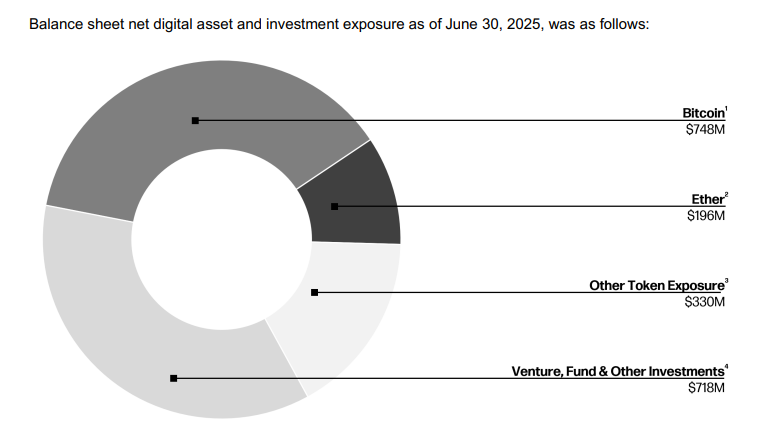

Galaxy invests in early-stage crypto and fintech companies. Its venture portfolio consists of equity stakes in companies such as Ethena, Monad, Fireblocks, Celestia, XRP and more. As of Q2 2025, the venture portfolio was valued at $718 million.

The bulk of its holdings however, sits in digital assets, with the large majority being Bitcoin and Ether. This accounted for a $1.27B stake as of Q2 2025.

In total, Galaxy’s combined exposure to digital assets and venture investments reached $1.99B as of Q2 2025.

4. Digital Assets Operating Business

Galaxy has 3 key segments here: trading & brokerage, asset management and investment banking.

Trading & Brokerage

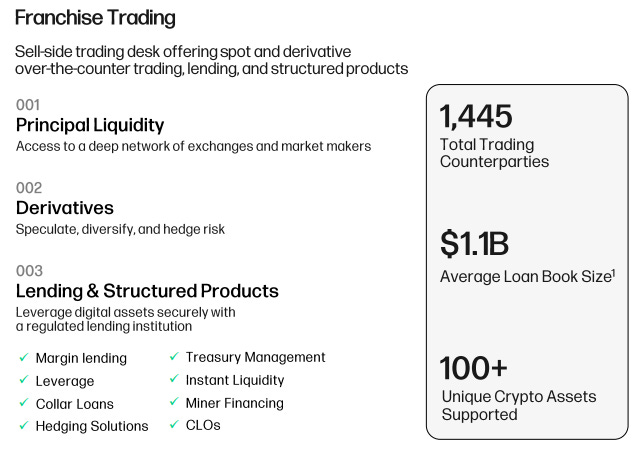

On the trading and brokerage front, Galaxy acts as a principal trader across spot crypto, derivatives, and structured products. It runs market-making for institutional clients, offers liquidity across multiple tokens and exchanges, and facilitates lending & financial solutions for clients.

Galaxy also provides over-the-counter (OTC) services, executing large block trades for institutions and wealthy individuals. Just last quarter, it executed an 80,000 Bitcoin sale for a client, totalling over $9B at current prices. The desk is seen as one of the top-tier counterparties alongside firms like Genesis (DCG), Jump Trading, and Wintermute.

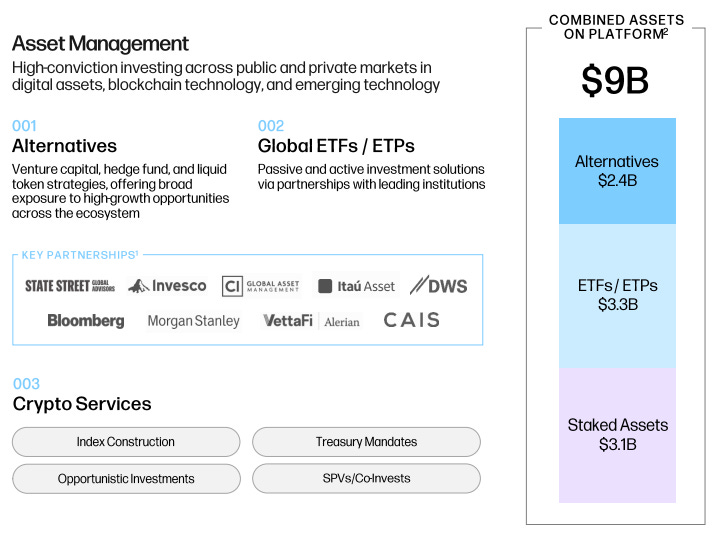

Asset Management

Galaxy operates a full asset management arm, building crypto-native funds and passive investment products. It co-manages the Galaxy Crypto Index Fund with Bloomberg, Bitcoin ETFs and Crypto ETPs in Canada and Europe and most recently have been expanding into active strategies like structured yield funds and venture capital pools.

As of Q2 2025, Galaxy holds over $9B in combined assets split across alternatives, ETFs/ETPs and staked assets and is among the largest crypto asset managers globally alongside Grayscale and Bitwise.

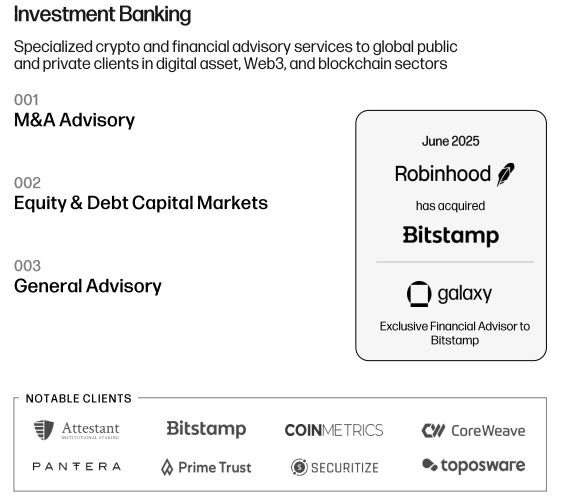

Investment Banking

On the investment banking front, Galaxy has attempted to position itself as the “Goldman Sachs of Crypto”. It provides M&A advisory to crypto and blockchain companies, runs capital market advisory, helping digital asset firms raise equity, debt or token-based financing.

Galaxy also advises on token launches, project financing and strategic partnerships. It also helps structure bespoke financing deals, including convertible notes and hybrid debt/equity/token arrangements.

5. Data Center Business

Galaxy stumbled onto the data center business as a result of its purchase of a large facility named Helios in late 2022, with the original intention of it being used as a data center for Bitcoin mining.