dLocal Q2 2025 Earnings Review

Triple Beat, Raised Guidance, New Experienced CFO

dLocal reported Q2 2025 earnings after the market close on 14th August 2025.

Revenue: $256.5M v $229.7M (+50% YoY, +63% FX-Neutral) 🟢

Adj. EBITDA: $70.1M v $55.8M est. (+64% YoY, +21% QoQ) 🟢

Guidance:

Selected Key Metrics

Incredible QoQ Growth on 5/6 Key Metrics:

TPV: $9.2B (+14% QoQ) ✅

Revenue: $256M (+18% QoQ) ✅

Gross Profit: $99M (+17% QoQ) ✅

Adj. EBITDA: $70M (+21% QoQ) ✅

FCF: $48M (+22% QoQ) ✅

Table of Contents

Introduction

Financials

Guidance

Product Development

Stablecoins

Management Commentary

Concluding Thoughts

1. Introduction

dLocal is a Latin American business that facilitates payments for large conglomerates on a B2B basis, specifically in underserved emerging markets. It is a capital-light “toll bridge” business with a decade-long head start in local rails.

dLocal is my most recent position, having written a comprehensive deep dive on the business exactly 1 month ago.

In the article, I wrote: “At today’s price, the market is pricing in perpetual take-rate erosion and stalled growth, yet even a bear-case model points to a mid-teens IRR. In my view, the skew is asymmetric.”

I still hold onto that view today and believe the risk/reward, despite the 25% pop in AHs post-earnings remains one of the best in the market.

Let’s dive into the earnings!

2. Financials

There are 2 key metrics to track for dLocal in my opinion.

Total Payments Volume (TPV)

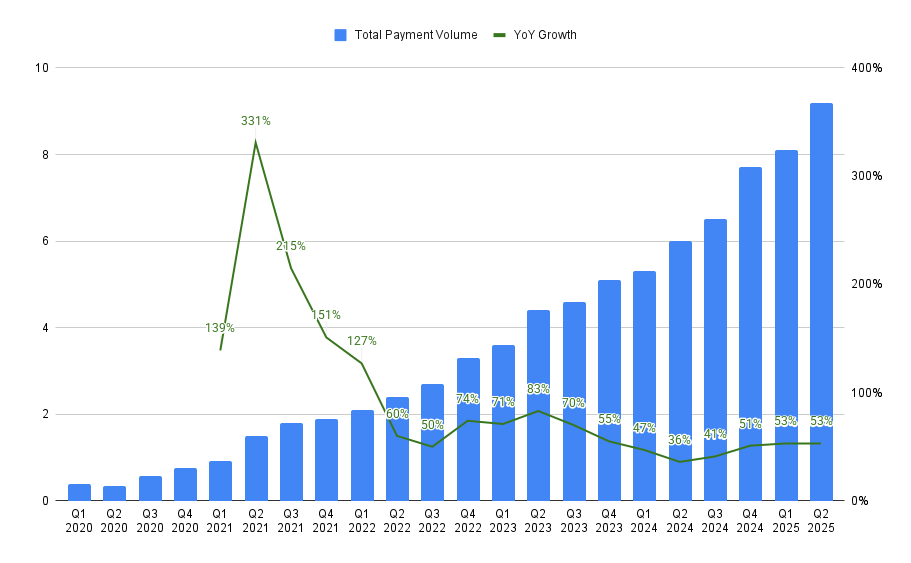

TPV was up 53% YoY and 14% QoQ which is extremely impressive.

This marked the 5th quarter in a row of acceleration in the TPV growth rate.

Take-Rates

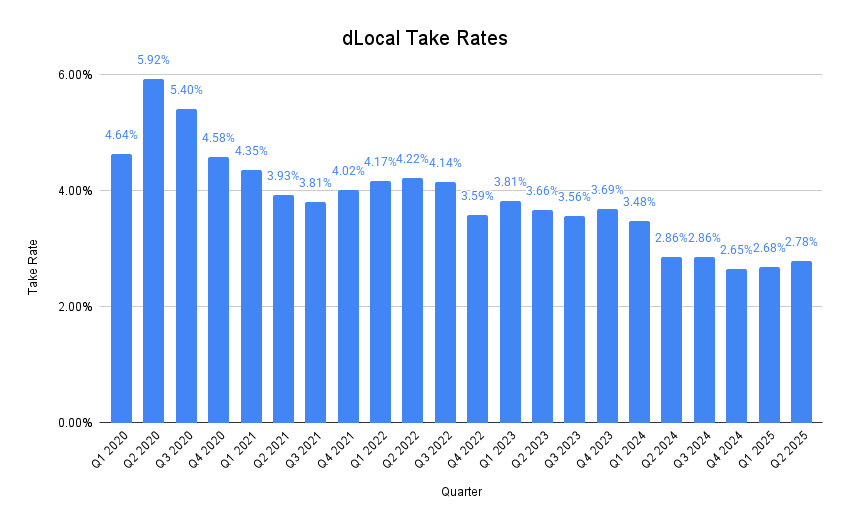

Take Rate for the quarter was 2.78%, a 10bp increase QoQ.

Coming into this earnings, my base case was for a continued decline in take rates, as per management’s guidance, owing to the nature of the payments business.

However, if we are to see a more stable take-rate and a slower decline, analysts will definitely have to scramble to re-adjust their price targets.

Pedro also mentioned during the call that he maintains previous guidance of take-rate gradually reducing as a result of merchants exerting downward pressure on the cost of processing payments.

However, he believes the last few quarters has validated that the erosion in take rate is gradual and that as it expands into frontier markets and accelerates its go-to-market on new products and value-added services, it could lead to a slower pace of decline and a more constructive view of what the bottom may be.

Other Metrics

In addition to these 2 key metrics, Gross Profit, Adjusted EBITDA, and Free Cash Flow were all equally strong, growing double digits QoQ and exceeding 40% YoY.

One metric that Pedro loves is the Adjusted EBITDA/Gross Profit ratio, that has reached 71% as of this Q, not too far from the 75% range that dLocal used to be at.

If that ratio were to climb, it would signal significant operating leverage as a result of the increased technological integration of products and services across the entire dLocal organisation.

3. Guidance

dLocal raised their guidance on all 4 key metrics, with a particularly large raise in both profitability metrics, showing operating leverage in the business.

I personally have been following Pedro for some time since his tenure as CFO at Mercado Libre and he is also a large factor for me investing in this business.

He is a very prudent and honest individual, who I believe will not come up with ridiculous expectations if he is not confident the business can achieve them.

He has played his cards incredibly well in 2025, starting off with a very conservative guidance, and now raising those numbers much higher. I expect that these numbers are still sandbagged to an extent, and we should see a gradual guidance raise each quarter for this year as the business begins to see operating leverage kick in.

4. Product Development

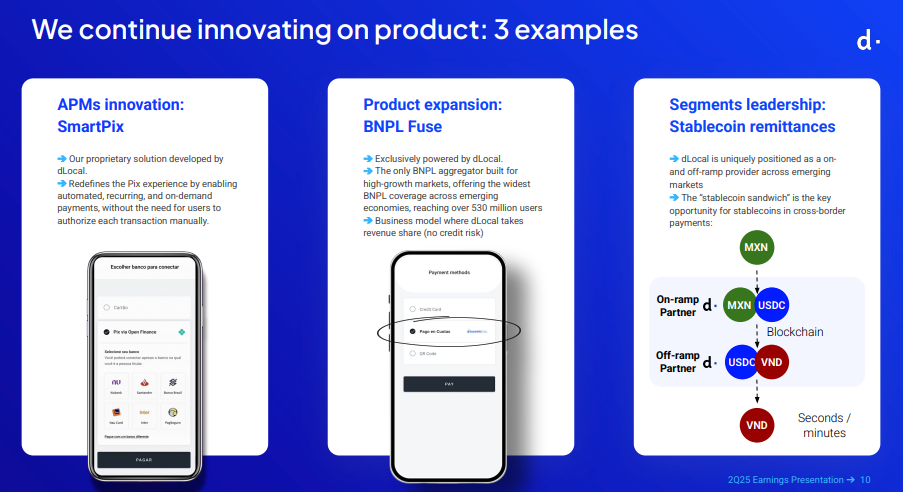

In recent quarters, dLocal has stepped up their deployment of innovative products. Just last week, it launched SmartPix in Brazil that redefines the Pix experience which is so integral in Brazil payments and replicates most of the functionalities and convenience of card-on-file payments for merchants.

In Q2, dLocal also launched multiple BNPL integrations in several markets where they integrated them to global merchants checkouts. Importantly, dLocal is not taking any credit risk themselves, but is benefitting from revenue share on the credit yields made by BNPL partners.

On the stablecoin front, they have also forged partnerships with Circle and BVNK to leverage the advantages of the technology.

Pedro also mentioned in the earnings call that dLocal is seeing more merchant demand for offline payment solutions. Hence, another area of product development is developing technology to integrate dLocal’s tech stack into offline payments.

5. Stablecoins

As I discussed in my thesis, I believe stablecoins are a key part of the future of this business, whether as a tailwind or a threat.

Stablecoins are critical to dLocal’s business because it addresses exactly the same inefficiencies that dLocal is solving for its customers, mainly instant settlement, low to no transaction fees, avoids FX exposure and provides absolute transparency.

Hence, stablecoins provide both an opportunity and a risk for dLocal’s business, depending on how they progress with the technology.

During the earnings call, Pedro doubled down on his view that dLocal will benefit from stablecoin adoption, stating:

“With our broad EM presence, highly developed payout and pay-in infrastructure, local FX liquidities and capabilities and years of experience with stablecoins, we are a perfect on-ramp and off-ramped provider for stablecoin players and merchants looking to leverage the advantages of this emerging technology.”

He also went on to elaborate during the call Q&A when analyst asked him about the threat of stablecoins impacting the business. It was a long answer, but here is the summary:

Pedro believes stablecoins being a threat is a misconception. He believes dLocal is uniquely positioned to take advantage of stablecoin adoption because:

dLocal’s core role in on/off-ramps:

The biggest value in the stablecoin ecosystem lies in converting fiat ↔ stablecoins, which requires local liquidity and competitive FX, both are dLocal strengths due to its pay-in/pay-out infrastructure.

Fiat-Stablecoin conversion step, where dLocal sits, is a high margin opportunity.

dLocal has a dedicated vertical sales and product team pursuing stablecoin-related merchant needs.

Pedro doesn’t believe all trade will move entirely to USD stablecoins, so there will always be demand for hybrid fiat–stablecoin solutions, a space dLocal specialises in.

6. Management Commentary

On Raised Guidance:

“We see the business with a much stronger momentum than we were seeing when we entered the year. I think it's fairly spread across the board. We saw Brazil rebound very quickly. Mexico was up again after a weak quarter. With the exception of Egypt, the rest of Africa and Asia also doing really well. And other, LatAm, as we mentioned, Colombia with negative impact on gross profit from -- retries from prior quarters. But other than that, a lot of strength there as well. So it's really across the border. As we've said, we think that part of the shifting landscape geopolitically has shined a greater light and greater relevance on emerging markets as a venue for growth for global merchants. And when you look at the S-curve explanation that we were giving during the prepared remarks, I think what we're trying to say is that we see a pickup in interest in localizing payments from global merchants.

We're seeing them take on more markets with us, more local payment market methods in markets where they were already operating. So again, always hard to predict across EM what's going to happen 24, 36 months out. But we feel that this surprise to the upside for us in how the first half of the year has played out seems to be something that we will continue to see into the back half of the year. There are risks that we've outlined. So we're being somewhat cautious on the guidance. But in general, we've seen the business enter the third quarter with the same kind of positive momentum that it exited the first half.”

Pedro Arnt, CEO dLocal

On Stablecoins:

“When you think about how stablecoins are increasingly being adopted, there is still enormous need for the on-ramps and the off-ramps, and really on-ramps and off-ramps from fiat to stable and from stable to fiat, we are uniquely positioned to offer that service. They are about local liquidity and attractive FX rates, both of which are strengths of dLocal because of our pay-ins and payouts businesses across multiple, multiple emerging markets. We also already offer our merchants the ability to settle to us or from us in stablecoins so as to accelerate settlement times of cross-border flows. And so if you think about it that way, our belief is that some of the hardest parts to build within the stablecoin value chain, which is the shift from fiat to stable and then back from stable to fiat and also where a lot of the margin in stablecoins lies because of FX is exactly where dLocal plays and participates."

So very specifically, we have a vertical sales force and a vertical product team focusing on this, and we actually think that there's an opportunity for us to capture. More conceptually, if you think about what we do, we essentially solve merchants' needs for different ways to pay and to settle money cross-border. And so unless you're an absolute maximalist and you believe that fiat will altogether go away or local currencies will altogether go away and all of global trade all of a sudden happens in U.S.-denominated stablecoins, which we certainly do not believe is the case, then that generates all sorts of merchant needs around their stablecoin infrastructure that dLocal and its partners are really -- that's what we do. That's what we're all about. So we currently see stablecoins as an opportunity much more than a threat.”

Pedro Arnt, CEO dLocal

On Tariff Risk:

“I think there's two things we need to monitor closely. And in a way, they're related to the rapidly shifting tariff wars or tariff being used as a central part of geopolitics. So for example, Mexico has recently increased the de minimis on imports of e-commerce. And obviously, that's something that potentially could impact our merchants. We haven't seen any negative impact so far, but that's something to monitor closely. And what we highlight as a potential risk is simply as there's greater clarity on how the U.S. starts imposing tariffs on trade partners, are there retaliatory measures, how does the Brazil-U.S. issue end up, I think it's still unclear. So I think this is a potential risk, not a risk that we are calling out because of any headwinds that we have seen so far in our business.”

On Take-Rate Guidance:

“It remains unchanged. I think even if you look at the guidance, we continue to see our merchants significantly growing their volumes with us, potentially hitting new pricing tiers. I think in general, we continue to exert downward pressure on our acquirers and processors, but we also see merchants exerting downward pressure on the cost of processing payments on us. So we still believe that the general trend is a downward trend.

Now what we've been saying for some time now, and I think the last few quarters have validated is that, that erosion in take rate is gradual, that as we offer more frontier markets and mix shift moves away from some of the larger markets. And more importantly, as we accelerate our go-to-market of new products and new value-added services such as Buy Now Pay Later, those are also potentially higher take rate products. And so that all in, although we still think take rates will continue to decline, we probably have a more constructive view in both the pace of that decline and also what the bottom may be.”

7. Concluding Thoughts

dLocal delivered an extremely strong quarter on all key metrics. The business is accelerating which usually sets up for a potent few years ahead.

dLocal also introduced the hiring of a new CFO, replacing interim CFO Jeffrey Brown with Guillermo López Pérez.

Guillermo López Pérez has extensive experience in the payments space, having worked at American Express for 13 years, been made CFO at Visa for Continental Europe and CFO for 2 of Visa’s large acquisitions: Tink and Featurespace.

Pedro is now forming his own team and I am fully in support of it. There is no one in my view that is a better fit for the role of CEO of dLocal at this current point in time and Pedro remains one of the key factors for my strong conviction in the business.

As I discussed with paid subscribers in the dLocal deep dive, I initiated a x% position on dLocal with a view of adding more contingent on the business’ continued execution.

This quarter has certainly lived up to my expectations and I am not hesitant to add to my position despite having to average up on my cost basis.

dLocal still faces real challenges, and the path forward is not without risk. The payments space is fiercely competitive, with global giants like Stripe, Adyen, and regional players aggressively expanding their reach.

That said, the market’s obsession with take-rate erosion feels overdone. Yes, blended gross take rates have come down from the early days, but much of the recent compression has been driven by mix shift (higher enterprise penetration, geographic diversification) rather than pure pricing pressure. dLocal still enjoys strong pricing power in many complex situations and geographies, and stablecoins may even help defend margins by reducing FX slippage and settlement costs.

A reminder that dLocal trades at just 24x PE. This is a business growing revenue 63% on a constant currency basis and growing all key metrics at double-digits quarter on quarter.

I believe it remains one of the most asymmetric risk/reward opportunities in the market and will wait out for a re-rating.

Thanks for reading!