Debunking Myths about Grab

What people are missing...

Grab is often misunderstood and seen as a low-margin player in a highly competitive market with little to differentiate in terms of products, therefore having a bleak future.

That cannot be further from the truth.

Today, I would like to look at the 4 main bear arguments/myths about Grab and debunk them.

1. Grab is over-valued

Grab currently trades at a 23.5 P/FCF ratio. That is not excessively high, but also not exactly cheap, considering Grab operates at a high FCF margin currently of 29%.

When doing a discounted cash flow on these numbers and assuming revenue growth of ~15 over the next 4-5 years, we arrive at a ~25% upside for Grab stock, which is underwhelming to say the least.

THE TRUTH:

30% of Grab’s market cap is in cash.

This severely distorts the P/FCF ratio. Viewing Grab from an EV/FCF ratio would give us a number between 17 and 18.

But that is not the key here.

The key is that Grab plans to utilise the ~$6B in cash to acquire Gojek, its main rival and dominant ride-hailing business in Indonesia (the largest market in Southeast Asia, by far)

For context, Gojek currently brings in ~$1B in revenue, compared to Grab that brings in ~$3B in revenue.

Acquiring Gojek would allow Grab to immediately grow its revenues by ~33%, not to mention the cost synergies and benefits a virtual monopoly would bring for profit margins.

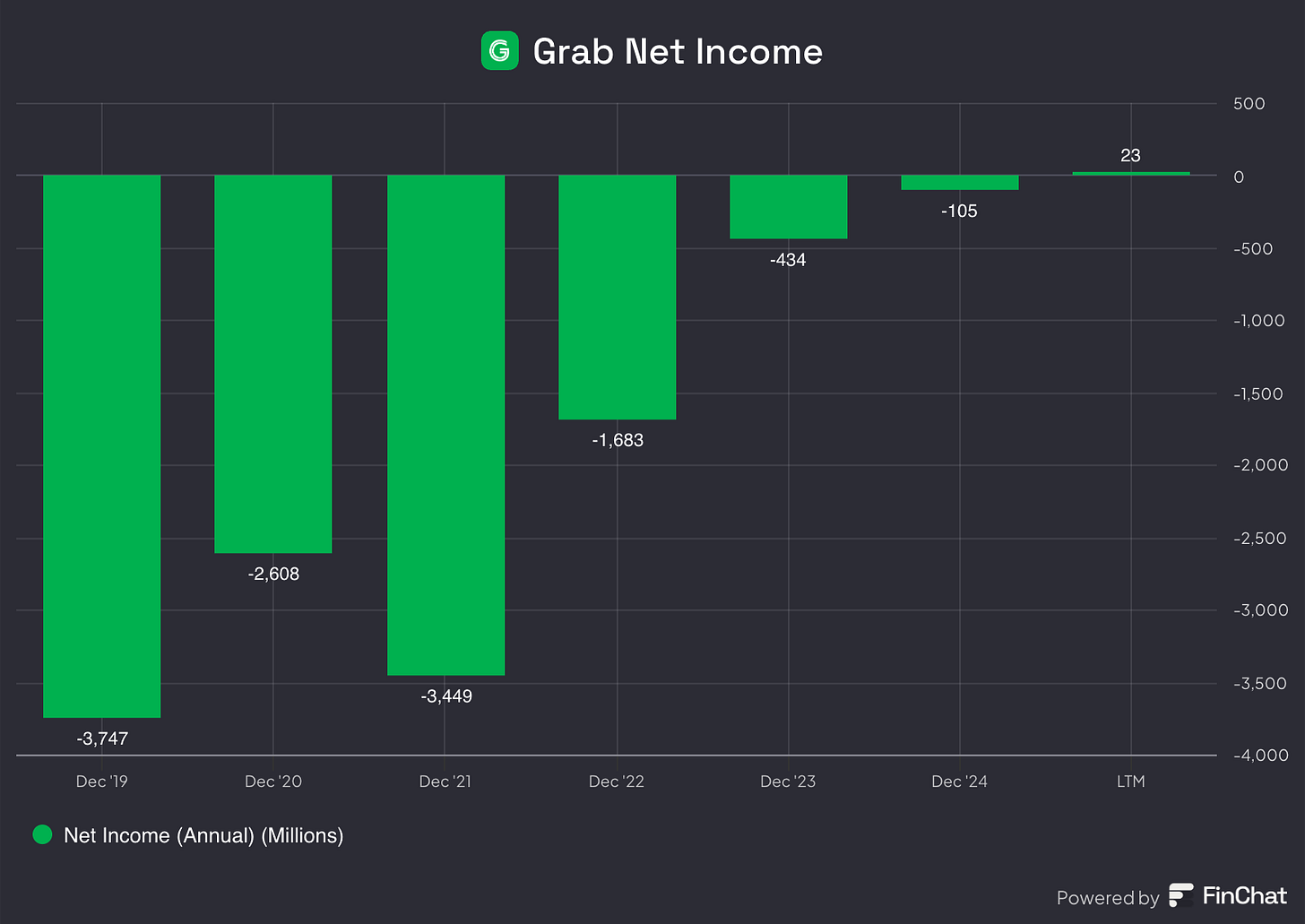

2. Grab burns cash and is unprofitable

People generally still assume that Grab continue to burn cash through incentives for driver-partners and consumers. Many also believe they are unprofitable due to the low margins of the mobility/delivery business.

I don’t entirely blame them, considering Grab was unprofitable for the last 13 years since its founding.

THE TRUTH:

However, Grab now operates from its greatest ever position of strength. It no longer burns cash and instead is both free cash flow positive, and profitable.

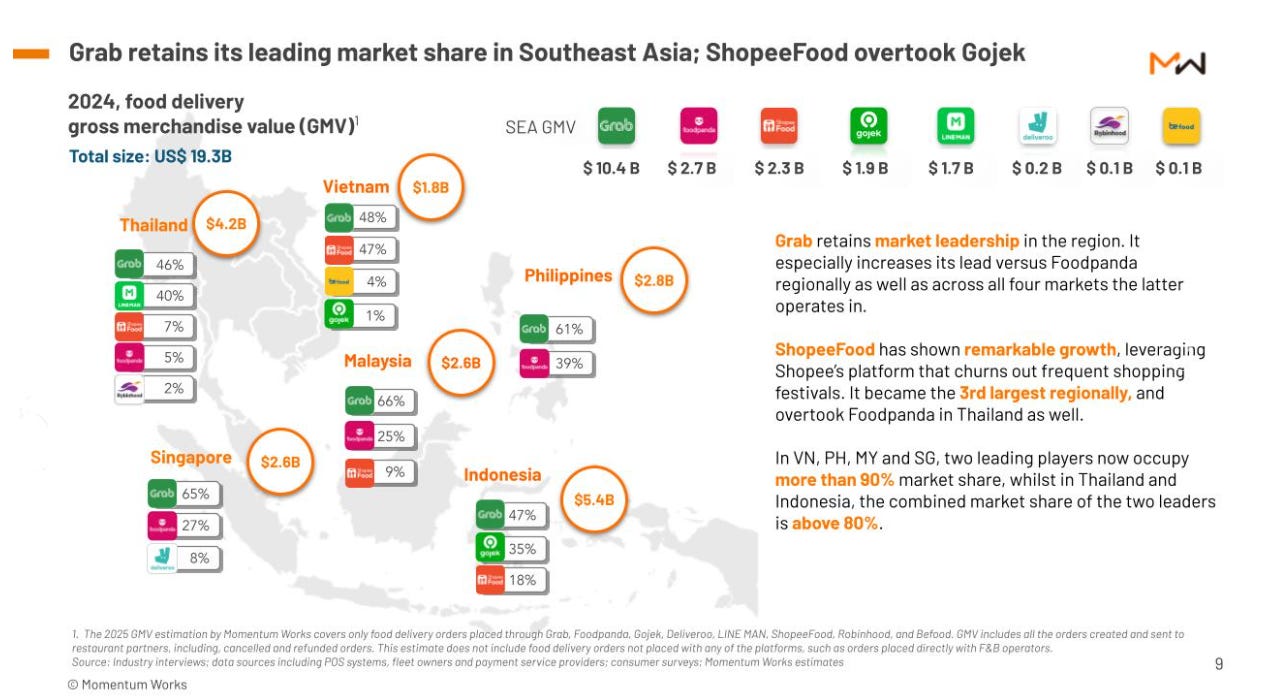

It has ~50-60% market share in mobility and deliveries in Southeast Asia, while also growing its FinTech business at ~40% YoY.

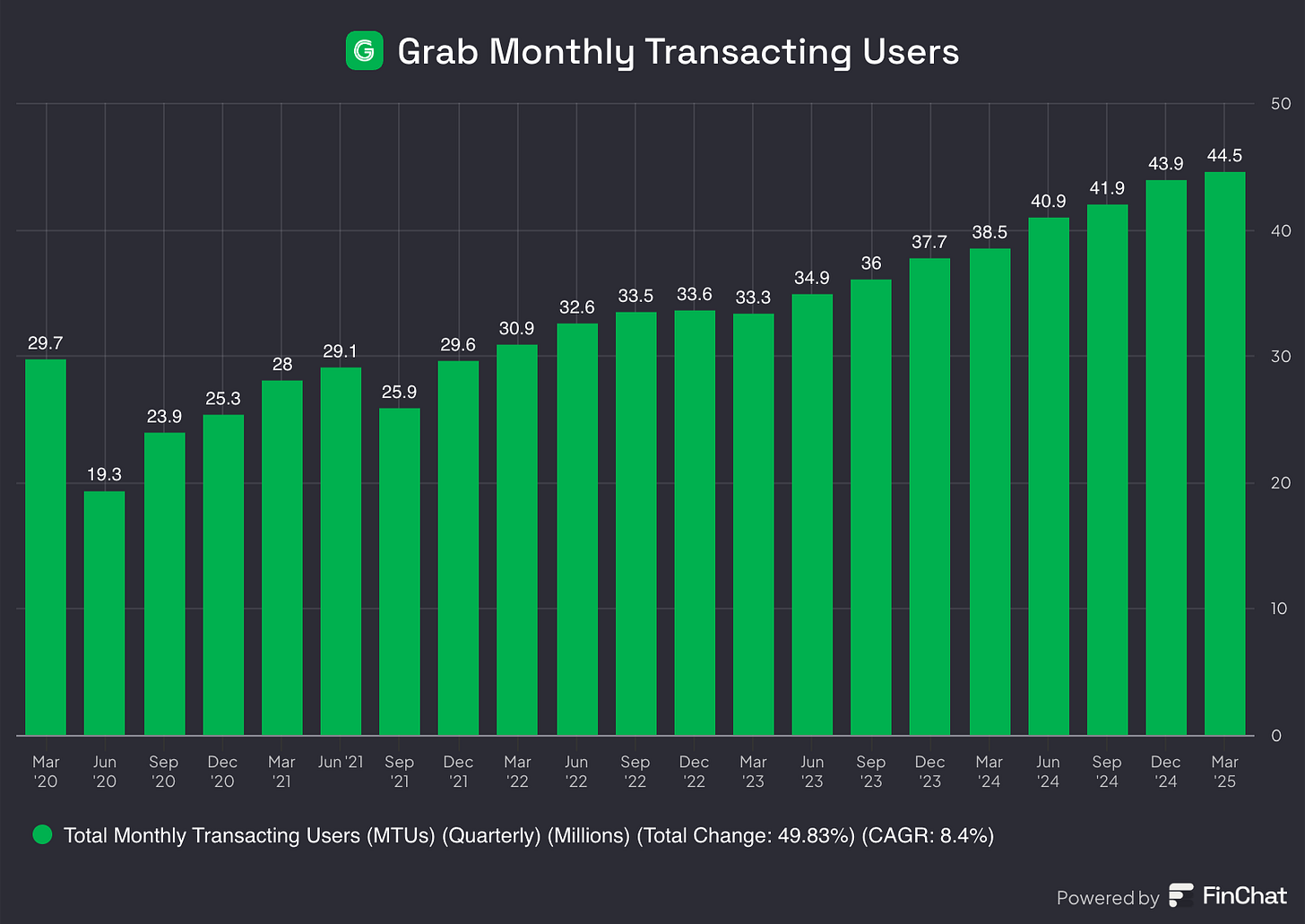

Take rates have drastically improved while demand has continued to grow. Monthly transacting users have increased for the last 9 quarters in a row. The business now serves 44.5M users in 6 countries and is merely at the beginning of the profitability inflection curve.

3. Grab has no moat, competitors will eat its lunch

Grab’s war of incentives first started with Uber in the mid 2010s and continues with Gojek and Shopee Food till today.

This has created a narrative that price-sensitive customers will churn the moment a rival offers a coupon. Critics conclude there is nothing to stop another deep-pocketed player from taking share.

THE TRUTH:

In reality, this is not entirely wrong, in the early stages of the incentive war game as companies build a flywheel of supply and demand. However, we are now in the end-game. The places have been set. Grab is the dominant force in Southeast Asia.

Grab’s mobility and deliveries share is ~4x the size of their next largest rival (Gojek and FoodPanda respectively). That scale drives higher asset utilisation, a core cost advantage competitors must out-subsidise.

Grab’s moat lies in its SuperApp advantage. 44.5M monthly transacting users across ride-hailing, food delivery, payments, insurance etc. These are all incremental services that keep customer acquisition costs low, allowing Grab to grow its flywheel.

Rather than eroding, Grab’s economic moat is widening. The business is now wildly free cash flow positive and also net income profitable. Dislodging Grab is now an increasingly improbable equation.

4. Grab is just a ride-hailing app

Grab started off as a ride-hailing app, a simple Uber clone. For the first 5 years, Grab’s only consumer proposition was rides. Today, the media continues to frame the business as a ride-hailing stock.

THE TRUTH:

However, Grab today, is much more than that. In FY24, Deliveries accounted for 53% of revenues, Mobilities 37% and GrabFin 9%, with other service revenue making up the remaining 1%.

Yet, that is not the key here. Grab is now a well diversified business. GrabMart (Groceries) and GrabExpress (Parcel Delivery) ride on the same driver fleet, filling idle time-slots, allowing for higher asset utilisation. Grab has also built a financial services stack with GrabPay e-wallet integrated across all verticals. It has digital banks in Singapore, Malaysia and a stake in Superbank (Indonesian DigiBank).

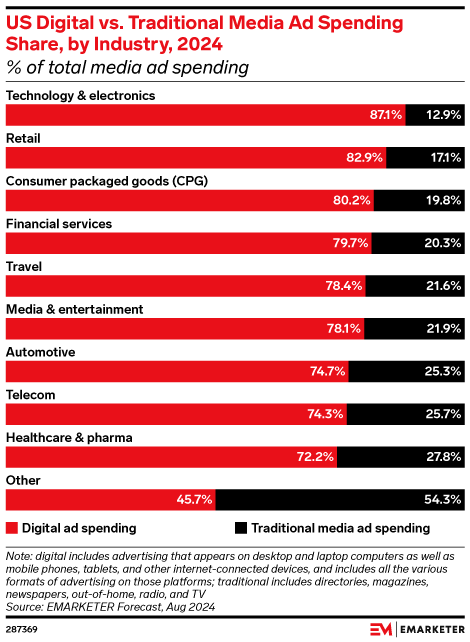

GrabAds will also be a key growth driver for the business. With Dine-out Discovery ramping up following the acquisition of Chope and Grab’s various features targeting both small merchants and restaurants, I expect this to be the next growth area for Grab. Crucially, Ads are a high-margin business with the best-in-class business averaging 80-90% margins.

As of Q4 2024, GrabAds were run-rating $216M annually while growing at 60%. Digital ad spending makes up just over a third of total ad spend in Southeast Asia. In comparison, digital ad spending makes up 77.7% of total media ad spending in the US. There is huge room for growth in Southeast Asia.

Summary

Grab is, in my opinion, misunderstood and mis-priced because perceptions lag reality.

Perceptions: Ride-Hailing, Cash-Burning, Subsidy Wars

Reality: Diversified SuperApp, Profitable & FCF Positive, High-Margin Verticals

The gap between those two is precisely where I believe the upside is for investors willing to look past yesterday’s narrative.

What is the % institutional ownership?