Coupang Q2 2025 Earnings Review

Steady growth with potential for acceleration

Coupang reported Q2 2025 earnings after the market close on 5th August 2025.

I previously wrote a long-form thesis on Coupang and I own it in my portfolio. Feel free to check out the deep dive below.

Revenue: $8.52B v $8.39B (+16% YoY, +19% FXN) 🟢

EPS: $0.02 v $0.06 🔴

The stock closed down 6% the day after earnings.

Selected Key Metrics

Gross Profit: $2.6B (+20% YoY, +22% FXN)

Net Income: $32M (up from -$77M in Q2 2024)

Adjusted EBITDA: $428M (+30% YoY, margin up 51bps YoY)

OCF: $1.9B (down $297M YoY)

FCF: $784M (down $729M YoY) *primarily driven by timing of CAPEX + impacts of working capital fluctuation that will normalise by EOY

Table of Contents

Introduction

Product Commerce

Developing Offerings

Management Commentary

Concluding Thoughts

1. Introduction

Coupang delivered a solid quarter on the top-line and gross-margin expansion. However, there was some disappointment on the cash flow side and earnings which came in slightly under expectations.

Coupang splits its business into 2 main segments: Product Commerce and Developing Offerings.

Product Commerce consists of Coupang’s flagship marketplace + first-party retail business is underpinned by Rocket Logistics — that has ~200 fulfilment and sortation hubs that puts 70% of South Koreans within a 10 minute drive and delivers 99% of orders in under 24 hours.

Developing Offerings is everything that is still climbing the S-curve: Taiwan Rocket Delivery, Coupang Eats, Coupang Play streaming and Farfetch. Taiwan is the key to watch here with triple digit YoY growth and 54% quarter-over-quarter growth, which is double the pace of revenue growth just 2 quarters ago (!)

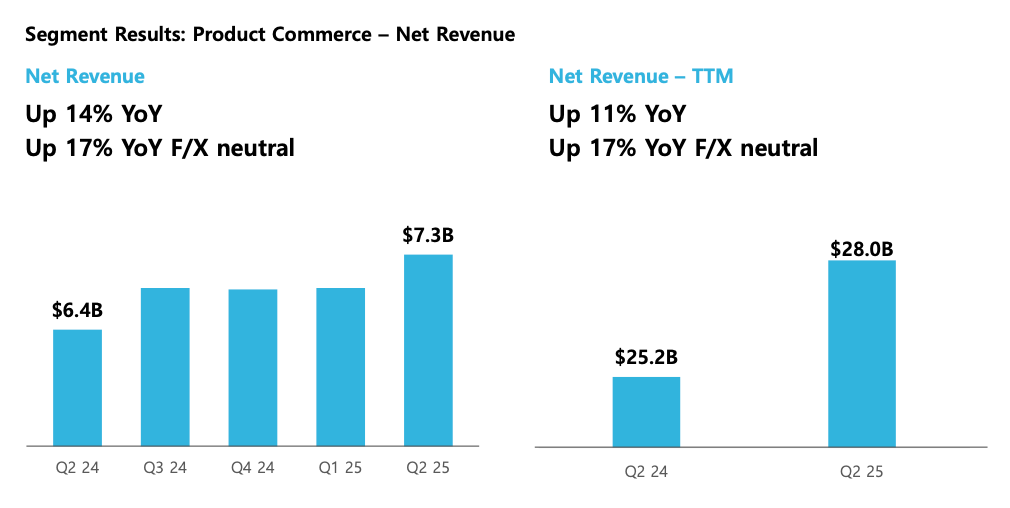

2. Product Commerce

Revenue: $7.33 billion (+14% YoY; +17% FX-neutral)

Gross profit: $2.39 billion (+23% YoY) with margin expanding 227bps to 32.6 %

Adj. EBITDA: $663 million (9% margin, +80 bps YoY)

Active customers: 23.9 million (+10% YoY); revenue per active customer $307 (+4% YoY)

Operational drivers highlighted by management:

Over 0.5 million new Rocket items added in the quarter and same-day & dawn deliveries up 40% YoY.

Fresh category revenue grew 25% in constant currency on broader produce, meat and seafood assortment.

Fulfilment & Logistics by Coupang (FLC) volumes and seller counts are “growing several times faster than overall Product Commerce,” reinforcing the fly-wheel and margin gains.

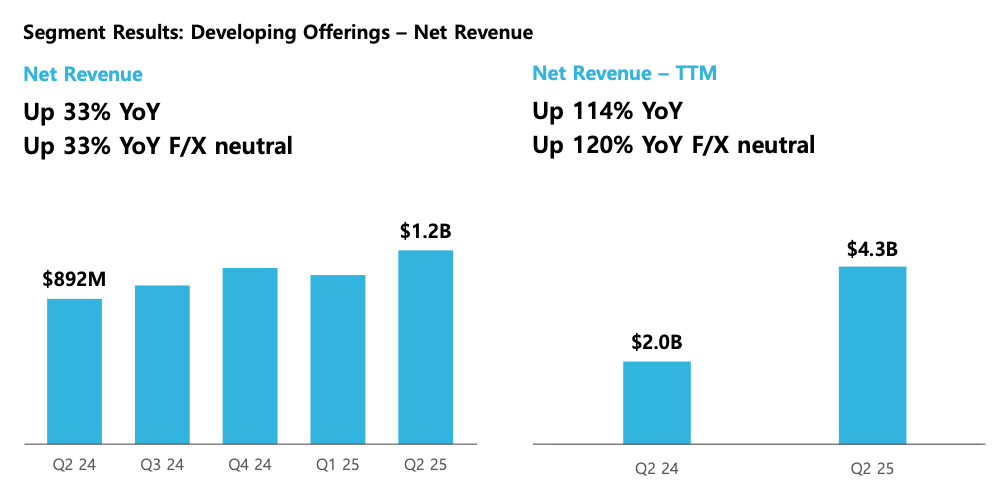

3. Developing Offerings

Developing Offerings

Revenue: $1.19 billion (+33% YoY)

Gross profit: $171 million (-11% YoY as mix skews to earlier-stage geographies)

Adj. EBITDA: -$235 million loss (reflecting stepped-up investment)

Key growth vectors:

Taiwan revenue accelerated 54% QoQ and triple-digit YoY, driven mostly by repeat customers as brand supply blossomed.

Coupang Eats kept a high-double-digit growth clip and looks to be putting pressure on market leader Baemin.

Coupang Play launched Sports Pass and widened free, ad-supported access to non-WOW customers, which should underpin future ad-monetisation and provide a minor growth vector for the business.

4. Management Commentary

On Taiwan:

“Our Taiwan offering is growing faster and stronger than even the most optimistic forecast we set at the beginning of the year. After ending last year in Q4 with a quarter-over-quarter revenue growth of 23%, this quarter revenues surged 54% quarter-over-quarter, more than double the pace of revenue growth from just 2 quarters ago. Year-over-year revenue growth was triple digits in Q2, and we expect that to be even higher in Q3.

What's most encouraging is that this growth is primarily fuelled by repeat customers. While new customer additions did contribute to growth and a quarter-over-quarter increase of nearly 40% in active customers, the majority of the revenue growth and acceleration we saw this quarter stem from the continued strengthening of spend and retention across our existing customer cohorts. Our conviction in the long-term potential of Taiwan is only growing as we're seeing a trajectory similar to what we saw in the early years of scaling our retail offering in Korea.”

On Developing Offerings EBITDA Loss:

“Developing Offerings reported EBITDA losses this quarter of $235 million, reflecting an increased level of investment over last year and last quarter due primarily to acceleration in growth we saw in Taiwan this quarter. As a result of rapidly increasing potential we see within Developing Offerings, most notably in Taiwan, we now expect Developing Offerings adjusted EBITDA losses for the full year to be between $900 million and $950 million.

This investment is a reflection of the increasing level of confidence we have in the near- and long-term potential for these offerings. Taiwan, in particular, accounts for the large majority of the revision in our full year estimate.”

On Bottom-Line:

“On a trailing 12-month basis, we generated $1.9 billion in operating cash flow and $784 million of free cash flow, which decreased $729 million versus last year. This decrease is primarily driven by timing of CapEx spend as well as impacts of certain working capital fluctuations in the current and previous trailing 12-month periods that we expect to normalize by the end of the year.

Our effective income tax rate was 84% this quarter, driven primarily by the losses in our early-stage operations in Taiwan as well as restructuring-related losses at Farfetch for which we received no tax benefit. We now anticipate a temporarily high effective tax rate of between 65% to 70% for the full year and our cash tax obligation for the year to be closer to 60%. Over the long term, we continue to expect to normalize to an effective tax rate closer to 25%.

On Top-Line Growth:

“I think it's worth reminding everyone that we're still a small share of the overall retail markets that we serve. And what drives our growth is this quarter and past quarters have not been onetime bumps or cycles, but deeper and increasing engagement from our customers. As I mentioned earlier, the spend of every single cohort of our customers, even our oldest, continues to compound and grow at strong double-digit rates.

And that's driven by continued improvement and obsession around our overall customer experience in areas like selection, service and price. And whatever the fluctuations in the macro environment that we've seen, as long as we deliver on selection, service and price and the customer experience, we're confident we can continue to significantly outpace the retail growth for years to come.”

5. Concluding Thoughts

Overall, this was a disappointing quarter for Coupang on paper, but in my view was a very positive quarter for the business. I would give it a 6.5/10 rating and personally I think a 6% sell-off was unwarranted, but at the same time not surprising, considering the stock was up 40+% YTD.

Free Cash Flow fell by 49% which isn’t pretty but as discussed by management, this was due to the timing of working capital and CAPEX investments, not a collapse in business fundamentals.

There were also exceptionally high effective tax rates of 84% that weighed on earnings. Longer term, management expects normalised tax rates of 25%, hence this is not a concern to me.

I particularly liked the Taiwan news. 54% growth is very impressive and shows that Coupang has another growth leg ahead. While this does mean that profitability may take awhile longer to come, I do believe this sets up for a longer growth tenure.

As my investment horizon for Coupang is over 5 years, I am willing to wait for the eventual profitability inflection and believe it should not take much longer.

As usual, I will share more thoughts in my monthly portfolio review. Feel free to check out the last one below if you missed it!