Chagee (Mini Dive)

Renowned Asian Milk Tea Brand, Trading at an Attractive Valuation

Chagee is a rapidly growing Chinese milk tea beverage brand that recently IPO-ed on the NASDAQ in April 2025 under the ticker CHA.

Think of it as the Starbucks of China, but for Tea. It focuses on having a premium brand image, modern store designs, and has scaled to over 6,700 stores in under a decade.

Chagee was first founded in 2017 in Kunming, Yunnan by Zhang Junjie, a former bubble-tea apprentice. Zhang was orphaned at age 10, lived as a homeless person for 7 years and only learned to read and write at age 18.

In 2010, he started working at a Taiwan chain milk tea ship and advanced from assistant to shop manager, regional supervisor and regional head. In 2017, he returned to his hometown Kunming to establish Chagee.

In less than a decade, Chagee has moved from a single Kunming kiosk to a 6,000+ store publicly-listed chain with international traction.

Here is my mini-bull thesis for the stock.

Bull Thesis:

1. Premium Brand & Loyal Customer Base

Chagee has emerged as a leading premium tea chain thanks to its intense focus on “freshly-made” tea beverages that has resonated with a health-conscious and trend-aware customer base.

They have pulled on 3 specific levers to succeed:

Store Experience:

Chagee has opened flagships in marquee venues and >6,000 mall-based outlets that echo luxury retail.

It prides itself on upscale interior plus Instagram-able presentation, allowing the drink to feel like an affordable luxury drink.

Each store is positioned as urban oases and photo-friendly social spaces.

Product Quality:

Instead of the typical milk tea store that is essentially selling its bobas and sugar, Chagee prides itself on tea quality.

Specifically, it has built its core menu around raw-leaf fresh milk tea brewed on “teaspresso” machines that pull a concentrated infusion in 30 seconds, preserving the aroma, yet enabling Starbucks-like speed.

The tea is sourced directly from Yunnan and other “estate” suppliers; with a narrow SKU focus (91% of sales are from its signature tea-latte line)

Estate suppliers is shorthand for single-source, high-grade, traceable tea.

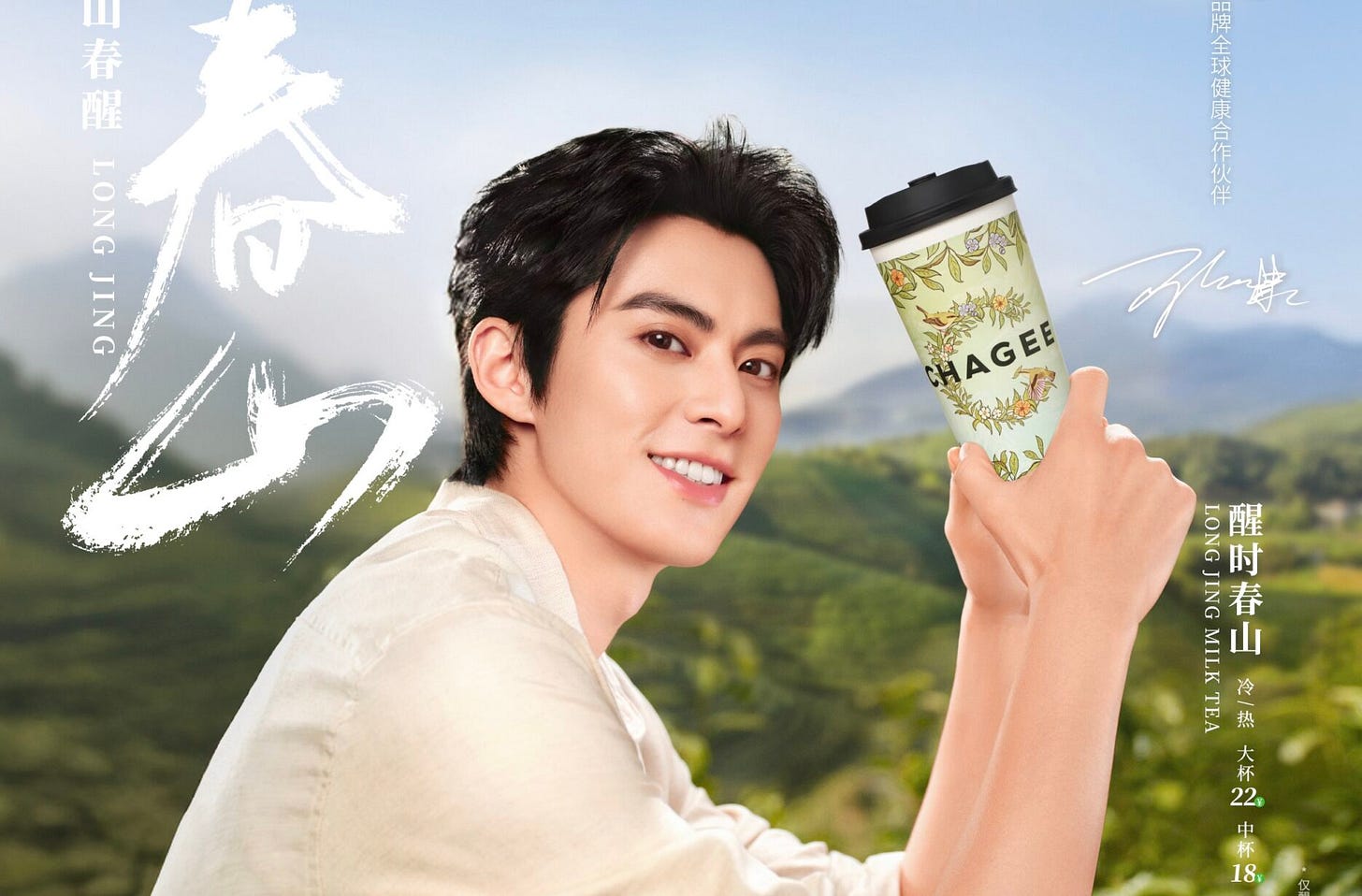

Celebrity Marketing

Chagee has leaned heavily into influencer marketing, hiring A-list stars to promote its drinks, elevating its brand cachet and deepening emotional ties to the brand.

In China, Chagee has brought the likes of Zheng Qinwen (Top Tennis Player), Dylan Wang (A-list Actor), Stefanie Sun (Mandopop Icon) and most recently Emily Ratajkowski as a star guest for its Los Angeles flagship ribbon-cutting ceremony.

These celebrities have a huge online influence, generating hundreds of millions of views on the likes of Douyin/Xiaohongshu (the equivalent of TikTok, Instagram).

2. Managed Franchise Model at Scale

A core pillar of Chagee’s ability to rapidly scale its stores is its asset-light, franchise-driven business model. 97% of its 6,000+ stores are franchised outlets.

However, the company enforces strict, uniform standards through a “managed franchise” system. This centralised approach has helped ensure consistent product quality, supply chain efficiency, and customer service across thousands of locations.

From just 200 stores in 2020, Chagee’s network rocketed to 6,440 stores by 2024, a compound growth rate of 145% annually. Chagee’s franchising strategy has enabled rapid penetration across 32 of 34 Chinese provinces and multiple countries, while minimising its corporate capital outlay.

Here’s exactly how its “Managed Franchise” model works:

Chagee adopts the model of “first building a branch and then opening a branch”

In order to ensure quality control and avoid management problems caused by uneven quality of franchises, Chagee adopted a hosting model and set up dedicated local support teams in 32 provinces, municipalities and autonomous regions.

Chagee takes care of everything from site selection to store decoration, from supply chain management to back-end e-commerce operations, and franchisees only need to provide locations and funds.

At the operational level, the store is equipped with fully automatic tea dispensers, tea espresso machines and carbon dioxide bottle coolers. There is no need to train employees for months. Instead, new employees simply scan the code to operate the fully automatic tea dispenser on their first day of work.

As the brand grows, Chagee’s requirements for franchisees have become increasingly strict. In 2021, the cost of opening a Chagee store for franchisees was 250K-350K RMB. In 2024, that number has tripled to 800K RMB and store area has increased from 40 square metres to 60 square metres.

In 2023, application approval rate was only 15%, reflecting Chagee’s high bar for quality.

Chagee HQ makes money four ways:

Upfront Fees - License + Training + Equipment Fitting Out

Ingredient & Packing Sales

Royalty & Marketing Levies (~3% of sales)

Profit Share from the 200+ Managed Outlets

3. Outstanding Store-Level Economics

The average monthly number of cups sold by Chagee stores in 2024 was ~25,000, nearly three times the 8,981 cups sold 2 years ago. Among them, the top 30% of stores with the best sales sells an average of 1,300 cups of tea per day, more than 3 times the industry average.

According to industry research reports, the cost recovery period of a single Chagee store is about 9 months, and the store operating profit margin is 20%, ranking among the top in the industry.

In 2023 and 2024, the store closure rate of Chagee was only 0.5% and 1.5% respectively. Peers such as Gu Ming and Mixue saw closure rates of 4.5% and 2.8% respectively.

In terms of inventory management, Chagee has learned from the Luckin Coffee model, building a centralised digital platform to monitor global store sales data in real time, dynamically adjusting raw material production and distribution. This has allowed Chagee to achieve an inventory turnover rate of just 5.3 days, the lowest among all Chinese ready-made tea brands with more than 1,000 stores.

Internationally, Chagee is averaging RMB 1.8M in monthly GMV in Singapore, more than 4x its domestic figure.

Financials

FY 2024 was a breakout year for Chagee. Both scale and profitability arrived together.

As of December 2024, it had 6,440 teahouses in China and overseas. The number of teahouses grew rapidly at 83% with total GMV of 29.5B generated, representing 173% growth year-on-year.

Revenue almost tripled to RMB 12.41B while net profit crossed RMB 2.5B, lifting net profit margin above 20%.

Gross Profit Margin for the year grew to 48% thanks to mark-ups on tea, milk and cups sold to franchisees, with operating margin moving above 23% as G&A grew far slower than system sales.

Risks

1. Unit-Economics Drift

Average GMV per store has started to ease as density rises. In Q1 2025, average monthly GMV per teahouse in Greater China decreased significantly to RMB 431K, from a previous year GMV of RMB549K.

If payback stretches beyond 18 to 24 months, new-store appetite may cool, and lead to a slowdown in store growth. While not an existential concern, it could lead to a lower multiple as the market re-rates its multiples to account for slower expected growth.

2. Input-Cost Leverage

Ingredient mark-ups assume steady commodity prices; milk or tea inflation could pressure the currently strong 49% product margin.

Chagee’s business is ultimately dependent on the raw material prices and hence could be affected from any supply chain issues.

3. Competition

The Chinese beverage market is extremely crowded and fast-moving. Competitors, both big and small, are vying relentlessly for market share.

Chagee’s reliance on its few core menu items means those must remain popular; any shift in consumer taste could result in a severe fall in sales.

Conclusion

The long-term bull case for Chagee rests on its ability to sustain rapid growth by creating a new global category leader in tea-based beverages.

If Chagee can successfully execute on its vision of making fresh-brewed tea “the next coffee” in terms of daily consumption, the upside is considerable.

There is potential for thousands more stores globally (management has hinted at tens of thousands of outlets eventually), which could drive many years of double-digit growth.

What’s Next?

I will be preparing a long-form deep dive on Chagee in the coming week to be released exclusively to paid subscribers.

If you would like to read high quality deep dives that could help with ideation, consider subscribing too! I truly appreciate the support.

Here are 2 deep dives that I have made public for reference:

Thank you for reading!