Chagee (Deep Dive)

Trading at just 11x PE with 97.5% LTM Revenue Growth & 20%+ Net Profit Margins

I’m writing about a slightly different type of business this time, compared to the usual technology-enabled businesses that I cover on this Substack.

However, I was so intrigued by the Chagee story that I decided to do a deep dive on the business.

Regardless of whether you decide to invest in it, I think it is a truly incredible story of a founder’s journey from rags to riches, and one of relentless execution.

Without further ado, let’s dive in.

Table of Contents

Introduction

Company History

Company Overview

Industry and Market Analysis

Competitive Analysis

Bull Thesis

GabGrowth Quality Score

Risks

Financials

Ownership

Valuation

Concluding Thoughts (What I’m Personally Doing)

1. Introduction

Chagee is a brand that most in the western world are likely unfamiliar with.

It is a brewed milk tea brand that hails from Yunnan, China, and aspires to be the Starbucks of Tea globally. To fulfil that dream, it has expanded rapidly across the country and the globe.

From 2022 to 2025, Chagee grew its store numbers from 100 to 6700. Today, it shows no signs of stopping with plans to expand its store count in Malaysia, Singapore, Thailand and the US.

Milk tea brands are not new, they’ve been around for decades. However, Chagee seeks to differentiate from competitors through its focus on high quality tea leaves, training consumers to enjoy the taste of tea, rather than the sugar.

2. Company History

2010: Chagee's Founder’s Journey

The story of Chagee begins with the remarkable journey of its founder, Zhang Junjie.

Orphaned at age 10, and effectively homeless for years, Zhang grew up in Yunnan under extreme hardship. By the time he was 17, he was functionally illiterate, having never attended formal school.

Desperate for work, he took a job as a low-level apprentice at a local milk tea shop in 2010 at the age of 15. There, he discovered a passion for the tea business.

Despite being unable to read the menu at first, he taught himself to read and write Chinese (relying on pinyin phonetics) so he could follow recipes and take orders. His grit paid off. In just three years, Zhang rose from sweeping floors to managing stores and eventually became a regional operations manager for the chain.

Zhang’s first taste of entrepreneurship came when he took over a struggling franchise outlet of the tea chain. With almost no capital, he negotiated a deal to buy the shop with deferred payment, then ingeniously boosted sales by pioneering local delivery services (handing out flyers and even selling tea on consignment at a nearby school).

The turnaround was swift. Under his management the once-failing outlet started grossing 8,000–9,000 RMB a day. This early success became his “first pot of gold” and proved his entrepreneurial mettle.

2017: Kunming Beginnings

However, Zhang was always hungry for more and wanted to open multiple shops. To avoid conflicts with his franchise contract, he temporarily stepped away from tea to work at a Shanghai robotics startup, where he broadened his corporate skills. In Shanghai, he observed the explosive rise of new-style tea brands like HeyTea (喜茶) and Lelecha (乐乐茶), which convinced him that the “new tea” market was booming and that he needed to act fast or risk missing the window. He reconnected with a few friends who had backgrounds in the tea industry, and together they pooled over 1 million RMB to start a new tea venture.

At that time, fruit teas were extremely popular, and the early Chagee menu reflected that, focusing on fresh fruit tea and various popular drinks trending in the market. While the product offering mirrored the times, Zhang had a bigger vision: to create a tea brand that would one day be known globally.

2018: Early Validation and Regional Focus

In 2018, Chagee entered its early validation phase. The company focused on refining its flagship product line, raw-leaf fresh milk tea, while concentrating operations in Yunnan and surrounding provinces. Zhang assembled a core team, including co-founder Shang Xiangmin, and even established an overseas division despite having fewer than 100 stores at the time, signalling global ambition from the outset.

The brand leaned heavily into its Yunnan tea heritage, emphasising high-quality sourcing. Notably, Chagee received a world record for the largest organic oolong tea plantation, reinforcing its authenticity and product differentiation.

2019: First Overseas Expansion

In 2019, Chagee began expanding internationally. It launched its first overseas outlet in Malaysia, selling over 1,000 cups on opening day in Kuala Lumpur. This marked the formal start of Zhang’s “tea + culture” global strategy.

Simultaneously, Chagee opened pilot stores in Singapore, further testing its overseas product-market fit. Meanwhile, at home, its differentiated no-cheese, raw-leaf milk tea menu steadily gained traction. By the end of 2019, Chagee had built a growing franchise network and a few hundred stores.

2020: Resilience Amid the Pandemic

2020 tested Chagee’s resilience as COVID-19 disrupted the global food and beverage industry. In August, Chagee entered Singapore, opening a flagship store at Funan Mall. Despite the pandemic, the outlet sold ~450 drinks on its first day and stabilised at 600–700 cups daily.

In Malaysia, the brand refined its local franchise model. By late 2020, franchisees were consistently moving high volumes of core products, proving that a tight menu focused on strong items could yield reliable profits even in tough times. While expansion slowed during lockdowns, Chagee emerged with a sharper focus on efficiency.

It also upped its marketing game, hiring Malaysian badminton legend Lee Chong Wei as a brand ambassador and expanded into East Malaysia. These moves helped maintain momentum through uncertainty.

2021: The Big Pivot

2021 proved to be a pivotal year for Chagee. In February, it entered the Thai market with its first Bangkok store. In June, Zhang relocated Chagee’s headquarters to Chengdu, known as the “milk tea capital” of Western China. This move marked the beginning of a brand 2.0 upgrade, featuring a redesigned logo, more upscale packaging, and, in September, the opening of a new flagship on Chunxi Road.

Investor confidence surged. In October, Chagee raised 300 million RMB across two financing rounds, drawing support from major funds. By the end of the year, Chagee had hundreds of stores in dozens of cities and a war chest to support further growth. It also stood out from competitors by doubling down on raw-leaf fresh milk tea, ignoring fads like cheese tea and fruit-heavy menus.

2022: Scaling the Tea Empire

In 2022, Chagee entered hyper-growth mode. Its franchise-first expansion model paid off handsomely. It surpassed 1,000 stores nationwide by year-end. The success was fuelled by a blockbuster product strategy: though the menu featured 20+ drinks, ~70% of sales came from just 3–4 key items, especially the flagship “Boya Juexian” jasmine green milk tea, which alone made up ~30% of total sales.

Chagee embraced cultural storytelling in its marketing, launching heritage-inspired products like Rose Pu’er tea, running cinematic ads about ancient tea trails, and weaving Chinese opera motifs into its store design and packaging. By late 2022, the company was nearing profitability and gaining serious buzz, not just as another milk tea chain, but as a rapidly emerging tea empire with a clear identity.

2023: Blockbuster Growth

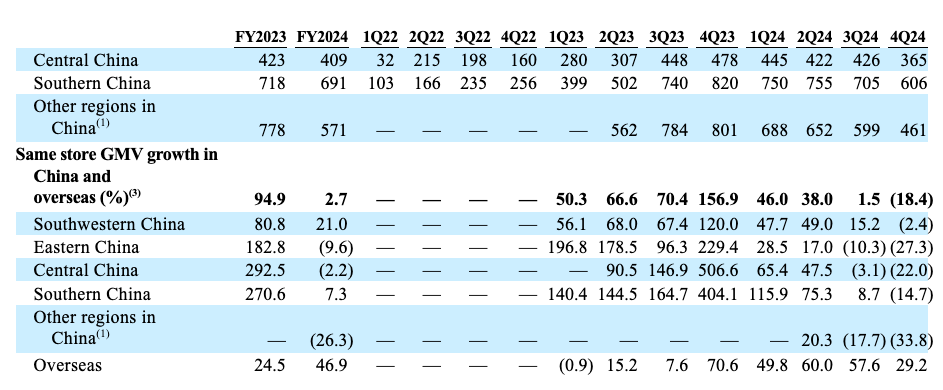

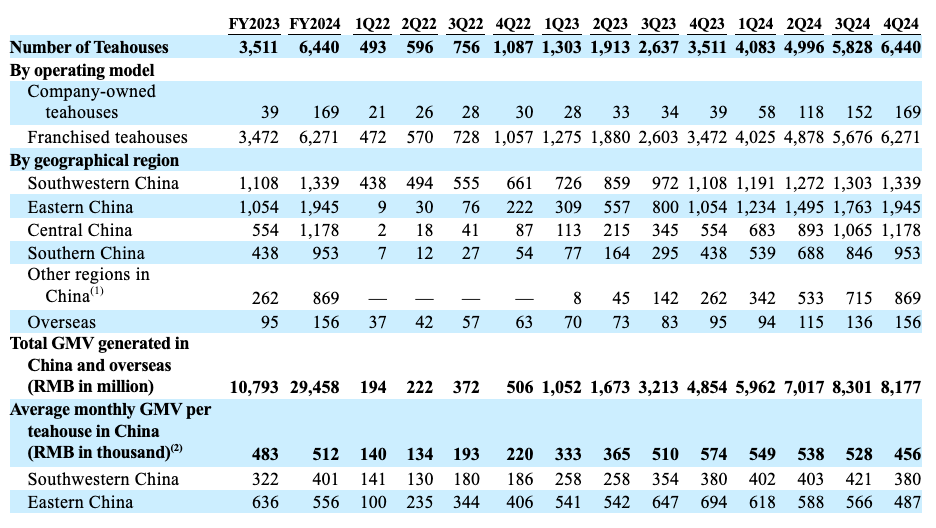

2023 was a blockbuster year. Chagee recorded 10.8 billion RMB GMV in China, making it the 4th largest tea brand by sales, despite having fewer than half the stores of its largest rivals. Store count exploded from 1,087 at the end of 2022 to 3,500+ by end-2023, more than 3x growth in a single year.

A new Global Business Center was launched in Shanghai to manage overseas operations and product development. The signature Jasmine Green Milk Tea sold over 230 million cups in 2023 alone, and 91% of total sales now came from the fresh milk tea series. Proprietary machines like “Teaspresso” and QR-code-enabled brewers ensured fast, consistent drinks, as fast as 8 seconds per cup.

Marketing was bold, sometimes controversial. From Starbucks-style rebranding to LV/Dior-themed cup designs, Chagee generated viral buzz (“milk tea in designer disguise”). It also became the first milk tea brand to publish calorie and nutrient info for every product, catering to health-conscious consumers.

2024: Peak Metrics and Cracks Beneath

By 2024, Chagee had reached peak metrics: 6,440 stores, 130 million members, and 29.5 billion RMB GMV, up 173% year-on-year. Of those stores, 6,217 were franchised, and Chagee booked 2.52 billion RMB in net profit (a 20.3% net margin). Their signature “Boya Juexian” milk tea surpassed 600 million cups sold as of August 2024.

However, trouble was brewing. Same-store sales fell 18.4% YoY in Q4, a sign of cannibalisation and urban market saturation. Chagee launched a premium sub-brand, Chagee Freshly Brewed, targeting purist tea drinkers with higher-end offerings (13–22 RMB per cup). Meanwhile, its logistics and automation continued to shine: just 5-day inventory turnover and <1% logistics cost, best among its peers.

Internationally, Chagee operated 156 overseas stores by year-end and planned to add 1,000-1,500 globally in 2025. But cracks emerged: in Singapore, a franchise dispute led to all 12 outlets rebranding as “Amps Tea”, forcing Chagee to reboot under a fully-owned model. In Malaysia, a “Tear & Win” promotion went viral for the wrong reasons after staff were caught rigging prizes, triggering backlash and public apologies.

2025: IPO and the Global Stage

On April 17, 2025, Chagee went public on the Nasdaq (ticker: CHA), raising $411 million at a $7.66 billion valuation. Zhang Junjie, then 30, became one of the youngest Chinese CEOs to lead a company to a U.S. listing. With its IPO war chest, Chagee announced plans to enter North America with a Los Angeles flagship and even hinted at a European rollout.

But expansion wasn’t without turbulence. In early 2025, Chagee’s mobile app was found displaying a map with China’s controversial “nine-dash line”, sparking boycotts in Vietnam and Malaysia.

Still, the company remained undeterred. It reiterated its long-term goal: 15 billion cups served annually in 100 countries. As of mid-2025, Chagee stands at a watershed moment, with China growth slowing, but global ambition accelerating.

In my opinion, the key question is: can Chagee continue to expand and sustain its best-in-class margins amidst aggressive competition?

That is the aim of the deep dive.

3. Company Overview

Chagee’s mission is “to foster global connections through tea, while their vision is to modernize the tea-drinking experience through technology and innovation”.

Its long term goal is to serve 15 billion cups of tea per year to tea lovers globally, across 100 countries with 300,000 partners.

For context Chagee served approximately 1 billion cups in 2024, based on disclosed “Boya Juexian” milk tea volumes and product mix ratios, and worked with ~1,000 partners across 5 countries. It is still far from its goal but rapidly working towards it.

Business Model

Chagee operates primarily under a managed franchise model, which has been key to its rapid but controlled expansion. Unlike traditional franchising where franchisees handle day-to-day operations, Chagee takes a more hands-on approach initially. The rollout framework is dubbed “1+1+9+N.”

In each new region or market, Chagee follows these steps:

“1” – Establish a local headquarters/subsidiary.

First, Chagee sets up a regional office or joint venture to anchor its presence.

“1” – Open a flagship store directly.

Next, Chagee opens one company-owned flagship teahouse in a prime location. This store serves as a showcase and training hub, fully operated by Chagee to set the standard.

“9” – Open 9 directly managed franchise stores.

Then, Chagee partners with franchise investors to open about 9 additional stores in the region. These are “managed franchises” where the local franchisee provides capital, but Chagee’s own management team runs the operations (hiring staff, managing inventory, etc.).

These pilot franchises allow CHAGEE to fine-tune its model in the local context while maintaining full control over quality and service during the critical early phase.

“N” – Scale up traditional franchises.

Once the initial 10 stores (1 flagship + 9 managed units) have proven the concept and economics, Chagee opens the gates to broader franchising. The “N” stands for an unlimited number of standard franchise stores.

These follow the typical model: franchisees invest their capital and manage day-to-day operations themselves (with Chagee’s training and oversight). At this stage, expansion can accelerate quickly, since many franchisees can be onboarded.

This staged approach ensures tight quality control in early phases while enabling scalable, capital-light growth later.

Franchisees pay upfront fees, annual licensing, and royalties on sales. They must also source ingredients and supplies from Chagee, which adds margin to the company. Additional income comes from service fees for training, tech support, and compliance deposits. A typical store in China costs 1–2 million RMB to set up, but franchisees gain access to Chagee’s brand, training, and centralised systems.

Standardisation and Store Format

One of Chagee’s strengths is its high degree of standardisation, which drives consistency and efficiency. Virtually all Chagee teahouses are 60-80 m² in size with a modern, upscale design that blends Eastern motifs with a cozy café vibe.

Chagee provides detailed specifications for layout, lighting, décor, and even ambient scent, aiming for a tranquil, inviting space where customers can unwind. Seating areas, soft lighting, and refined furnishings are part of the “tea house” ambience (differentiating Chagee from grab-and-go kiosks). In prime locations, Chagee often positions itself near or even next to Starbucks, essentially hinting its intention to be the Starbucks of tea.

Operationally, Chagee’s processes are meticulously standardised from leaf to cup. The company prides itself on what it calls the “3 zeros” standard for its drinks:

Zero non-dairy creamers

Zero hydrogenated oils

Zero trans fats

All drinks use fresh milk and tea leaves, sourced and tracked through its own supply chain. Ingredients are pre-portioned and QR-labelled for full traceability.

At the core of store operations are Chagee’s proprietary “teaspresso” machines, which automate the brewing process. These devices can produce drinks in 8 seconds with <0.2% taste variance. This allows consistent quality even from minimally trained staff, enabling high order throughput with fewer employees.

This means a barista with minimal training can produce a cup virtually identical to one made by an experienced staffer, and do it extremely fast. Speed has been a competitive advantage allowing Chagee stores to serve customers quickly even when there are long lines.

Chagee has also digitised its entire backend. All teahouses (franchised or not) run on the company’s centralised IT platform that manages ordering, inventory, and CRM. Sales data flows in real-time to headquarters. This system handles ordering, inventory, and CRM, with real-time data feeding back to headquarters. It automates stock replenishment, route optimisation, and helps Chagee track customer preferences and store performance in granular detail.

Operational Oversight

To maintain standards across thousands of franchises, Chagee employs rigorous oversight by conducting regular and random audits of franchise stores covering product quality, service, cleanliness, and customer feedback.

Each franchised teahouse is graded monthly on an A-D scale. Those consistently scoring “A” get rewards (rebates or higher profit share), while low scorers face corrective action. If a store falls into the bottom tiers and doesn’t improve, Chagee will dispatch a task force to literally take over on-site management until it meets standards. In extreme cases of non-compliance or underperformance, Chagee can terminate the franchise and shut the store (this happened to roughly 0.5% of franchises in 2023 and 1.5% in 2024). This has been key to its extremely low closure rate (1-2% of stores per year), despite rapid expansion.

By end-2024, Chagee had 6,440 stores, of which 6,271 were franchised and 169 were company-owned. Among these, 398 were directly managed, including all company stores and 229 managed franchises. This hybrid model allows Chagee to scale quickly while maintaining quality control.

Next, we’ll examine the broader industry context in which Chagee operates and how it positions itself against competitors.

4. Industry and Market Analysis

Tea: A Massive (and Evolving) Market

Tea is the second most consumed non-alcoholic beverage in the world (after water), and in China it’s an institution. China has over 680 million tea consumers, nearly half the population, and tea culture dates back thousands of years. However, the “new style” tea market; modern tea-based drinks like bubble tea, fruit tea, cheese-topped tea, etc. is a relatively recent phenomenon and has been growing explosively.

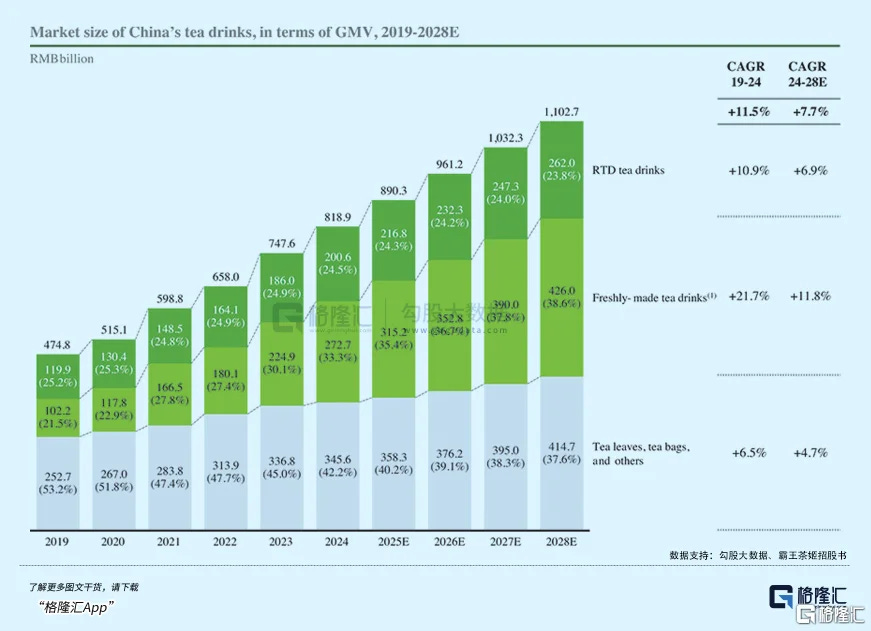

Freshly-made and Premium Tea Segments

In China, the freshly-made tea drinks market, which is Chagee’s arena, has grown from 102.2 billion RMB in 2019 to 272.7 billion RMB in 2024. It’s projected to reach 426.0 billion RMB by 2028. Within this, the premium segment (drinks priced ≥17 RMB, roughly USD $2.50, per cup) has expanded even faster, rising from 10.9% of the market in 2019 to 25.9% in 2024.

By 2028, premium tea drinks are expected to be 167.1 billion RMB (about 31.7% of the total market). This reflects how Chinese consumers are trading up for better ingredients and experiences in tea, much as they did for coffee. As incomes grow and health awareness increases, people are willing to pay more for tea without artificial creamers and with higher-quality leaves.

Intensely Competitive Chinese Market

That said, competition in China is fierce. By some estimates, there are over 500,000 outlets selling new-style tea or milk tea in China. The market leader by store count is actually a budget brand, Mixue (蜜雪冰城). Mixue, while positioning itself as a tea seller, is arguably a sugar seller. It is known for its $1 ice cream and tea with 46,000+ stores worldwide, making it larger than even Starbucks globally.

Other big players include Auntea Jenny (沪上阿姨) with over 9,000 stores across China, as well as HeyTea, Nayuki, Yi Dian Dian, Coco, and many regional chains. In fact, China’s tea shop market is more crowded and localised than the coffee shop market. For context, Starbucks has about 6,000 stores in China; there are at least half a dozen tea chains that each exceed that number of outlets. Consumers have endless choices, from fancy lounges to sidewalk stalls.

Chagee’s direct competitors in the premium freshly-made tea segment are brands like HeyTea (known for cheese-foam teas), Nayuki (fruit teas and bakery-cafes), Cha Yan Yue Se (cultural tea shops mainly in Hunan province), and newer entrants like Lelecha.

However, Chagee is also competing indirectly with coffee chains like Luckin Coffee and Starbucks. Notably, Chagee and Luckin Coffee have a very similar customer base of young urbanites, and when located near each other, they inevitably compete for the same spending. In 2023-2024, Luckin (China’s biggest coffee chain) started encroaching on milk tea territory by launching a “Light Jasmine Milk Tea” for 9.9 RMB, roughly half the price of Chagee’s flagship drink. Consumers immediately dubbed Luckin’s version the “9.9 RMB Chagee Boya Juexian,” noting it tasted nearly identical. This sparked a mini price war, with Luckin leveraging its deep pockets and massive footprint (10,000+ stores) to undercut tea brands. Barriers between tea and coffee segments in China are much lower than I expected, and Chagee indeed faces threats from all sides.

Distinct Niche

Despite these challenges, Chagee managed to stand out in China’s crowded market by carving a distinct niche. Its focus on raw-leaf milk tea positioned it between the inexpensive mass-market (like Mixue’s powder teas) and the ultra-premium novelty shops. Chagee hit a sweet spot: a mid-premium price (18–25 RMB per cup) justified by real tea and fresh milk, plus a cafe-like environment to sit, but with the speed and convenience of a chain.

By emphasising health and tradition (zero creamer, real tea, published calorie counts) it appealed to young consumers who see it as a “better choice” daily drink. At the same time, by limiting frills (no toppings, simpler menu) it kept costs down so it could price below some competitors. This combination of quality + efficiency has given Chagee an edge. It also built a strong brand story around Chinese culture at a time when “guochao” (Chinese retro-chic) was trending; the Peking Opera logo and tea-house vibe resonated as proud, local yet modern.

Expansion Plans (Overseas + Horizontal)

Chagee’s success in China bodes well for its overseas potential, but the company is being strategic in how it internationalises. So far, it has targeted markets with either a large Chinese diaspora or established bubble tea habits: Malaysia (entered 2019, now ~150 stores), Singapore (2020, a reboot halfway through, and now a re-expansion), Thailand (2021, a handful of stores), and recently North America.

This move makes a lot of sense. Chinese milk tea is already popular across Southeast Asia, so Chagee can capitalise on that existing demand but differentiate itself as a premium, health-conscious option. The brand localises where needed (e.g. offering halal-certified ingredients in Muslim-majority Malaysia), but generally it has found that its core products (jasmine tea latte, oolong milk tea) sell well overseas with minimal change, a sign that the taste translates across cultures.

One of Chagee’s value propositions abroad is also its health angle. Many Southeast Asian consumers enjoy bubble tea but worry about the high sugar content. Chagee highlights that its drinks use fresh dairy milk, quality tea, and less sugar, even displaying nutrition info, trying to position itself as the “guilt-free” choice compared to super sweet boba drinks. This could also appeal in Western markets where consumers are label-conscious.

Beyond storefront expansion, Chagee is also eyeing adjacent market opportunities. The broader global tea beverage market (including bottled teas, home tea, etc.) was worth $467 billion in 2024 and is projected to reach $602 billion by 2028. Chagee doesn’t want to limit itself to freshly-made in-shop drinks. The company is already exploring ready-to-drink (RTD) bottled teas, tea bag products, and even capsule tea machines for home use (akin to Nestlé’s coffee capsule systems).

In early 2025, management announced plans for an at-home capsule brewing machine that would let customers make its milk tea easily, an effort to capture tea drinkers in offices and homes, not just retail shops. It has also been testing bottled versions of its signature milk teas in some markets.

Another avenue is the “Super Tea Warehouse” cafe format that Chagee has just begun to launch. Essentially, Chagee is toying with the idea of full café outlets that serve tea, pastries, merch, and provide a “third place” for hangouts like Starbucks Reserve. In Shenzhen, the pilot Super Tea Warehouse store that opened in 2025 offers bakery items (priced 15-26 RMB) alongside tea, in a spacious sit-down environment. These larger formats cover an area of more than 200 m².

Outlook

The industry trends favour Chagee in some ways. Tea is growing in popularity worldwide, and consumers are gravitating to higher-quality beverages. But competition is intense and evolving. In China, price wars and copycats are a constant threat (Luckin’s 9.9 RMB tea being a prime example). The market may consolidate or shake out the weaker players in coming years, especially if growth slows. Chagee will need to continuously reinforce its brand value to avoid getting dragged into pure price competition.

Overseas, Chagee has a clearer run since the concept of Chinese milk tea is still novel in many regions. But it will face local challengers (for instance, bubble tea chains from Taiwan are everywhere, and new local startups could emerge). It also must adapt to local taste preferences; sweetness level, dairy alternatives, etc. Encouragingly, Chagee’s model of focusing on a few core products could travel well, because it allows localisation around those items rather than an entire sprawling menu.

Chagee has emerged victorious in arguably the world’s toughest tea market (China) by being disciplined and different. That track record suggests it could perform well overseas too, so long as it adapts to local contexts and continues to leverage its strengths in efficiency, quality, and branding.

The next section will delve into exactly what those competitive strengths are and how Chagee built a moat in a space known for its low barriers to entry.

5. Competitive Analysis

As we discussed above, Chagee is indeed one of many players in the market and faces competition from all directions.

However, I think there are several key competitive advantages that have enabled Chagee to grow faster and more profitably than its peers:

1. Lightning-Fast Automation and Consistency

Chagee has transformed the art of milk tea preparation into a science. Every store is equipped with proprietary brewing machines that can produce a tea latte in ~8 seconds. These “Teaspresso” machines, along with pre-measured tea packets (each with a QR code for traceability), ensure that a cup of Chagee tea tastes virtually the same everywhere, with flavour variance of less than 0.2%.

By automating the process, Chagee slashes labour costs (fewer staff needed per store) and shortens customer wait times. During peak hours, a Chagee line moves much faster than at a traditional bubble tea outlet where each drink is hand-shaken.

Consistency is also a huge plus. Customers know that whether they buy in Shanghai, Kuala Lumpur, or Singapore, they will get the same quality. This level of operational efficiency is akin to McDonald’s in fast food, a reproducible model that can be scaled rapidly without being bottlenecked by skilled labor.

2. Streamlined Core Menu with a Health Focus

Unlike rivals that constantly churn out new flavors or seasonal specials, Chagee has narrowed its menu to a handful of hits. It essentially bets on tea lattes (tea + fresh milk) as the one category that matters. They have been proven right by the data thus far too.

In 2024, 91% of Chagee’s sales were from its fresh milk tea series. Just 3 SKUs (the top three drinks) accounted for 61% of revenue. This extreme focus brings multiple benefits:

Fewer ingredients mean simpler supply chain and inventory. Chagee mainly needs tea leaves, milk, and a few syrups, which it can source in bulk at high quality.

Faster service, since staff aren’t juggling dozens of complex orders.

Reinforces Chagee’s “healthier choice” narrative. All its core drinks use whole-leaf tea (rich in antioxidants), fresh dairy (protein and calcium), and none of the artificial creamers that cheaper shops use. Chagee even discloses calorie counts (a medium jasmine latte ~130 kcal, about half an avocado’s worth) and offers lower-sugar, lower-caffeine options for each drink.

3. Rigorous Control and “Asset-Light” Expansion

Chagee’s unique 1+1+9+N expansion model that was described earlier, gives it a rare combination of control and scale. By planting corporate-run flagships and managed stores first, Chagee sets the bar for quality in each market. The monthly grading system and mystery shopper audits keep franchisees on their toes. This reduces the risk of brand-damaging incidents at far-flung outlets. At the same time, because the majority of stores are franchised, Chagee uses other people’s capital to grow.

Franchisees fund the store opening costs and pay Chagee fees and royalties, which is why Chagee enjoys ~50% gross margins and didn’t have to burn cash to open thousands of locations. This is how it has expanded from 1,000 stores to 6,400 in just two years without a collapse in quality.

Quick Roundup

To illustrate Chagee’s strengths with a quick comparison, Nayuki Tea, a once-hyped premium tea chain in China, has ~1,800 stores and has struggled to break even till today. Luckin Coffee has better profitability (~10% net margin) and grew to 10,000+ stores, but it relies on heavy discounting and still mostly sells coffee (its foray into tea is new). Mixue is wildly successful in scale (46k stores) and decent margin (18% net), but it targets a very different low-end segment and has wages so low that it faced labour criticism.

Chagee, by contrast, managed ~20% net margin in 2024 while tripling stores, a balance of growth and profit that stands out. In essence, Chagee found a Goldilocks formula that competitors are now trying to emulate, which is perhaps the best validation of its competitive edge.

6. Bull Thesis

The bull case for me rests on several pillars. Chief of which is the culture of the company which has driven a few of the key bull points.

1. Owner-Operator

One of the key factors I look out for in successful businesses, and potentially generational businesses is the quality of management. Ideally, I would like a founder operator at the helm. Why is that?

“The best businesses are often built by entrepreneurial owner-operators with a long-term vision, and it’s our job to find them before the market fully recognises their potential.”

Bill Ackman

“If you own the business, you think differently — you think long-term, you think quality, you don’t outsource responsibility.”

Nick Sleep

Chagee’s founder and CEO Zhang Junjie has proven to be an exceptional leader. He’s young, deeply experienced in the tea business (having worked in the industry since he was just 15), and still owns a majority stake (with ~90% voting control). His personal journey from illiterate teen to CEO underscores a drive and adaptability that permeates the company’s culture.

Zhang has also shown he knows when to pivot and when to double down, two very important traits that shows decisiveness of a CEO.

He shifted from fruit teas to milk teas in 2021 seeing data on repeat purchases and reined in domestic expansion a bit in 2024 when saturation signs appeared, and simultaneously ignited three new growth engines to carry Chagee forward:

International expansion clusters: Chagee has gained a foothold in SEA and is now moving into the West. Notably, its initial overseas stores have done exceedingly well. For e.g., the first few Singapore outlets averaged around S$340,000 (1.8 million RMB) GMV per month, roughly triple the sales of a mature Chinese store, indicating pent-up demand in these new markets.

“Super Tea Warehouse” café format: This is essentially Chagee’s answer to Starbucks Reserve, a larger format store that serves not just drinks but also pastries, snacks, and sells merchandise (tea gift sets, etc.). The idea is to boost the average ticket size and create a “third place” for customers to hang out, all while not sacrificing the 8-second fast service for drinks.

“Second Cup Tea” RTD and capsule line: Chagee is extending its brand into ready-to-drink bottled teas and home/office brewing machines. This taps into massive markets. Bottled tea is huge in convenience stores, and a Chagee capsule machine could be popular in offices (imagine replacing the office coffee pot with milk tea on tap). These products leverage Chagee’s existing tea sourcing and recipes, but open up entirely new distribution channels (retail, e-commerce). If even one flavour of bottled Chagee milk tea becomes a hit, it could add significant revenue without the overhead of stores. Longer term, being present in supermarkets and vending machines would also reinforce brand recognition.

Each of these growth avenues builds on Chagee’s core competencies (tea brewing tech, supply chain, brand) so they are extensions rather than diversifications. If any one of them takes off, it could be a billion RMB business on its own.

The fact that Zhang has already green-lit and invested in these adjacencies (while still actively leading the core business) shows a founder who is thinking several steps ahead. Founder-led companies often command a premium because of this visionary drive, and Zhang’s track record thus far (from 0 to 6.6k stores and counting) suggests he’s the kind of leader who can execute big ideas.

2. Scalable, Risk-Controlled Operating Machine

Chagee’s operations are built to scale. The company proved this by nearly doubling its store count in 2024 without breaking. Its managed franchise model means store openings are almost plug-and-play. Chagee can roll out dozens of new shops a week because the formula is so standardised.

This is a big advantage in an industry where many brands struggle operationally when they grow too fast (quality drops, service slows, etc.). For Chagee, adding stores actually improves some efficiencies (economies of scale in purchasing, stronger network effects in marketing). Also, because expansion is largely franchise-funded, Chagee’s own financial risk is limited. It doesn’t have to shell out tens of millions in CAPEX for new shops. This scalability with controlled risk is reminiscent of how McDonald’s expanded via franchising worldwide.

3. Best-in-Class Unit Economics

One of the most bullish points for Chagee is simply how good its unit economics are. Thanks to the franchise model, Chagee enjoys gross margins around 50% and net margins of ~20%, which are extraordinary in food & beverage.

Every franchised store contributes through multiple streams: an upfront fee (pure profit for Chagee), ongoing royalties (usually ~6-8% of sales), and the margin on ingredients (Chagee sells tea leaves, cups, etc. to franchisees at a markup). Because franchisees cover rent and salaries, Chagee’s costs are mostly corporate overhead and marketing, which scale with revenue much more slowly than new store sales do.

Additionally, franchisee economics seem favourable, which is why Chagee has no shortage of interested franchise partners. It’s said that a Chagee franchise can pay back the initial investment in about 12-18 months, which is very attractive. Chagee claims franchisee store-level profit margins around 20% as well. This win-win (franchisees earn, franchisor earns) makes the model sustainable.

4. Menu Minimalism

As mentioned, Chagee’s decision in 2021 to axe fruit teas and peripheral items and focus on its core milk tea line was a masterstroke. It went against the grain but it paid off in efficiency and branding.

The company doesn’t have to worry about sourcing dozens of fruit purees or developing new flavours every month. It also reduces training complexity; staff aren’t overwhelmed by learning 50 recipes, just a dozen or so. Inventory management is simpler, with less waste from rarely ordered items. Customers aren’t confused by too many choices, Chagee’s menu fits on one page and every item is a proven hit.

This focus has led to tremendous sales concentration: from ~79% of sales being milk tea in 2022 to 91% in 2024. It’s basically a “one product company” (milk tea) with a few flavors. Such focus is usually risky (change in tastes and preferences), but Chagee has built a strong brand around being the go-to for that category, much like Coca-Cola is for fizzy drinks. As long as tea latte as a category remains popular (and given tea’s 3,000-year history, it likely will), Chagee should maintain its relevance.

In summary, the bull thesis is that Chagee is not just a trendy tea shop, it’s a scalable platform with multiple avenues to grow (geographically and into new channels), led by a visionary founder, and supported by superior economics and a clear brand. The company resembles a fast-growing franchise success story (think early Starbucks or McDonald’s) more than a short-lived bubble tea fad.

If it executes well on its global expansion and adjacent product lines, Chagee could become one of the first Chinese beverage brands to achieve true international prominence.

7. GabGrowth Quality Score

Regular readers will know this is one of the key facets for me in evaluating businesses.

You can view my full methodology below.

Here’s how Chagee stacks up:

Visionary Founder/Operator: (2/2)

Zhang is a founder with a compelling vision (“tea in 100 countries”) and he retains ~90% voting control and has majority of his net worth in the business, ensuring long-term commitment. He has navigated pivots successfully (from fruit tea to milk tea focus) and anticipated saturation by seeding new growth areas (cafés, RTD line).

Skin in the Game: (1/1)

Zhang owns ~54% of the company’s outstanding shares and ~90% voting control, a textbook example of skin in the game.

Exposure to Emerging Markets & Secular Tailwinds: (1/2)

Chagee has a head start in Southeast Asia and early mover advantage in taking a Chinese tea brand global. That said, I docked a point as growth in China’s new tea sector is slowing somewhat (from ~40% to ~12% forecast in two years), which means Chagee will rely more on international expansion to sustain high growth, which can be challenging.

Large & Growing TAM: (1/1)

The addressable market is huge. Tea is a multi-hundred-billion-dollar global market, and the premium freshly-made segment in China is growing double digits.

Contrarian but Right: (1/1)

This is certainly a contrarian pick, with the business trading at just 13x PE and the stock down 25% since IPO. It is clear that the market believes the competitive landscape will lead to subnormal profits in future.

Asset Light Model: (1/1)

Operating brick and mortar stores would normally result in Chagee scoring zero here. However, its franchise model has allowed it to stay relatively asset light in expansion.

Operating Leverage: (1.5/2)

Chagee’s brand is distinctive and it has operational advantages in automation and scale. However, in consumer brands the moat depends on continuous execution and brand equity, which can be eroded if trends shift.

Recurring/Sticky Revenue: (0/1)

Being a consumer discretionary product with tons of alternatives, I do not ascribe much value to Chagee in having recurring or sticky revenue.

Optionality/Multi-Product Potential: (1/2)

Chagee does have options to expand into horizontal products like it is doing now with the introduction of RTD etc.. However, it is relatively limited.

Sustainable Competitive Advantage: (1/2)

Chagee’s competitive advantage rests in the culture of the business and its operational efficiency. However, it has only been in the market for less than a decade, and it remains to be seen how sustainable their advantage is.

Dominant or Disruptive Position: (0/1)

While Chagee is arguably the leader on margins, it is neither a disruptive force nor a scale leader in the market.

Brand/Cultural Affinity: (1/1)

This is arguably one of Chagee’s strongest assets. It has strong emotional resonance with Chinese heritage and tea culture and has appealed well to younger generation like Gen Z and Millennials who see it as an aspirational Chinese brand.

High Growth at Sustainable Rates: (0.5/1)

Chagee is expected to grow at 20% for the next few years but beyond that, it is tough to see sustainable high growth for a milk tea brand.

Scalable Unit Economics: (1/1)

Chagee definitely has scalable unit economics with its strong franchise interest that provides attractive returns at store level and high-margin drinks.

Cash Burn/Profitability: (0.5/1)

The business is profitable but could see some cash burn in the coming years as it looks to expand into Western markets.

In terms of potential risks, I gave Chagee negative 1.5 points, specifically for:

Regulatory/Geopolitical Risks (-1)

Chagee operates in China where we have seen policy shifts change the trajectory of a business. For example, in 2021, the Chinese government cracked down hard on the education sector which led to the bankruptcy of multiple players in the market.

Lack of Moat (-0.5)

There is no real barrier to switching to a competing tea brand for customers. Taste and preferences can change easily and sway customer behaviour.

Adding it up, Chagee scores 12/20 points. That puts it in the category as a viable investment, but not a high conviction or best-in-class business.

8. Risks

No investment is without risks, and Chagee has its share of them.

Before I dive into them, I think it is important that we address the elephant in the room. Could Chagee be a similar case to Luckin Coffee? (For those who are unfamiliar, Luckin Coffee was caught fabricating its numbers, which led to near-bankruptcy and an entire overhaul of the management team)

Being a Chinese business and experiencing incredible growth prior to IPO, it is reasonable to question if Chagee is a similar case to Luckin. Here are my thoughts:

Firstly, Chinese businesses seem to have an unnecessary negative bias with people often dismissing them as the next Luckin if their numbers seem too good to be true. However, we’ve seen cases of American fraud businesses like Enron and even European fraud cases like Wirecard.

That said, is a non-zero chance of fraud for Chagee, as there is for every business in the world. However, I do not believe Chagee is a fraud for several reasons:

Chagee has had 2 big four auditors on board; PwC in 2022/2023 and KPMG since 2024. Luckin had no big four auditor at the time of fraud.

Chagee’s free cash flow has tracked net profit closely. Ingredient sales are largely cash-based. Luckin had operating cash flow far below the reported profit during the fraud period.

Chagee has a seven-member board that consists of 5 outsiders, including Zhang Yong (Haidilao Founder). A person of Zhang Yong’s reputation would not risk ruining it by sitting on the board of a potentially fraudulent business. In contrast, Luckin’s group was founder dominated with limited industry outsiders.

These are a list of other risks that I believe Chagee will face, ranging from near-negligible risks to potentially thesis changing risks.

U.S. Delisting & Audit Risk

As a U.S.-listed Chinese company, Chagee falls under the HFCAA. If U.S. regulators are blocked from inspecting its China-based auditors for two consecutive years, it could face forced delisting from Nasdaq. While inspection access has been granted recently, rising geopolitical tensions could quickly change that. Even the threat of delisting could crush the stock before anything happens.

Capital Controls & Repatriation Risk

Chagee generates most of its cash in China, and moving that money offshore is sometimes tricky and could include regulatory hoops as Chinese authorities often limit and scrutinise large outflows of capital.

If the Chinese governments tightens capital controls (especially in a U.S.-China spat), Chagee might struggle to get cash out, with will be needed for expansion internationally.

Geopolitical & National Sensitivities

Chagee is proudly Chinese, which is a strength at home, but could be a double-edged sword abroad. As it expands across Southeast Asia and North America, it could find itself mired into controversies over political and cultural sensitivities. A misstep in one country can spark regional backlash with could affect the business as a whole.

Franchise Quality Control

As Chagee continues to expand abroad, it will undoubtedly face risks and challenges with quality control. For example, Chagee had franchise issues in Singapore in 2024 where the franchisee essentially went rogue and rebranded the stores.

While rare, it could be a damaging situation and one that could affect the overall brand of the business, which is key to a business like Chagee. Hence, it will likely take longer to choose their partners which could affect the speed of expansion and hence pace of growth.

Fierce Competition & Price Wars

Competition in the Chinese market is extremely cutthroat for a few reasons. Firstly, China itself is the size of multiple large countries with 1.4 billion people and a rapidly rising middle class. Their domestic market is incredibly lucrative, which results in every startup, legacy brand and multinational fighting for a slice of the pie.

In sectors like tea where there are low barriers to entry, it is relatively easy to replicate a business model. Chinese startups are also famously aggressive in speed, which rewards agility and punishes slow movers, which ultimately happens to all incumbents.

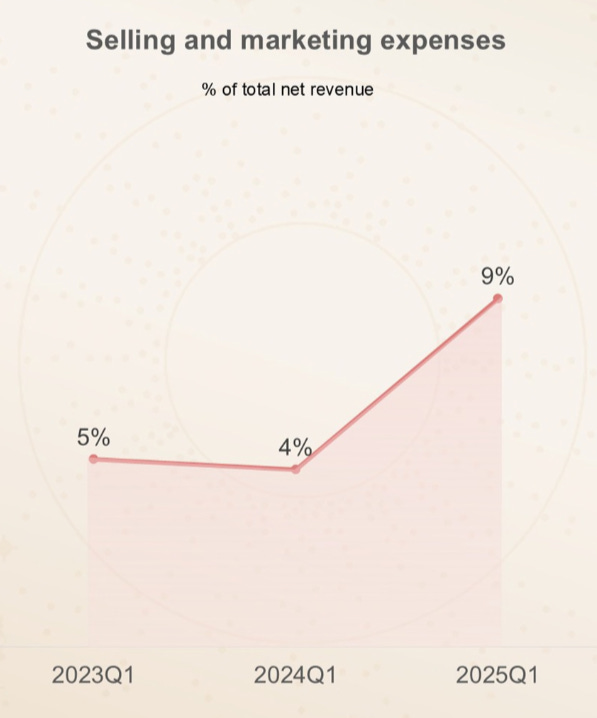

Chagee’s marketing spend as % of revenues has increased significantly from 5% to 9% in one year. This is likely due to the incurred upfront brand awareness costs in new markets but could also signal more aggressive campaigning to substitute for decreased demand. It will be key to watch this space.

Product Concentration Risk

Chagee makes ~60% of its sales from just three drinks. That makes their process and model extremely efficient, but also fragile. Any disruption, such as supply chain issues, taste and preferences shifts or even a bad viral rumour could hurt sales meaningfully.

Key Man Risk

This is a risk for most amazing businesses, but especially for Chagee. Zhang is the face of Chagee and the architect of its strategy and culture. He holds ~54% equity and ~89% voting power, making him firmly a control. This does pose a risk if something were to happen to him or if he were to step back.

There is currently no indication of that, and at just 30 years old, he has many decades ahead of him. However, unforeseen events could impact the bull case and pose a major risk to the business. Investors will have to accept that the fortunes of the business are closely tied to his continued leadership.

Format Expansion & Brand Dilution

Chagee is branching into new concepts; larger café formats, RTD tea drinks and Super Tea Warehouses. While these could act as growth levers, it could also add operational complexity and result in brand dilution.

9. Financials

Chagee has best-in-class margins, but how about the other segments of its financials? Breaking it down:

Revenues

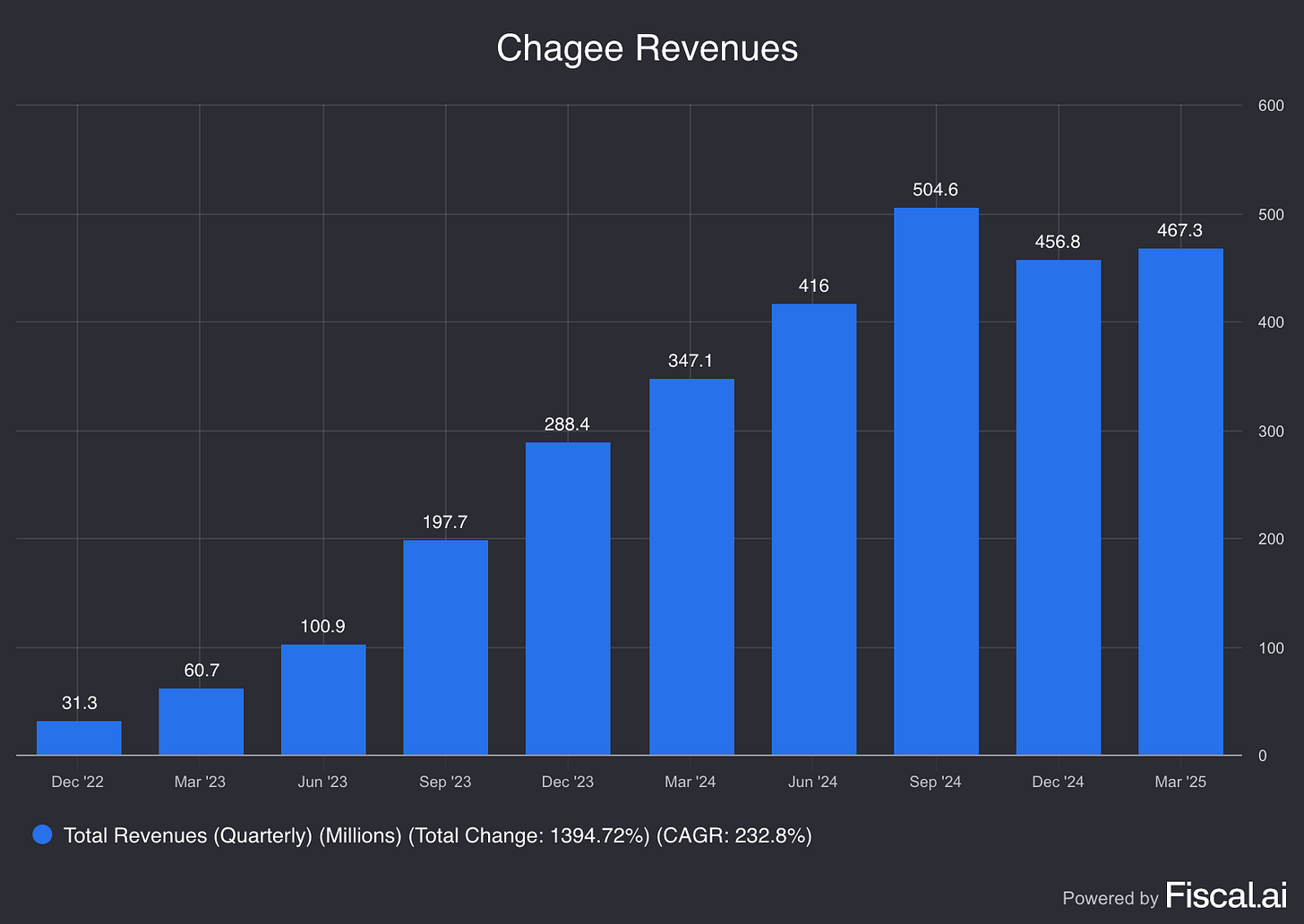

Chagee’s revenue has soared as store growth went from 1,000 to 6,000+ in the past 2 years. In 2023, net revenue was up 844% from 2022. In 2024, it gained a further 167% year-on-year. Simply incredible numbers.

In Q3 2024, Chagee brought in $500M in quarterly revenues. Just 7 quarters ago, it was at only $31M. A 16x increase in revenues in under 2 years. Part of this is the low-base effect, but it also shows how quickly new stores contributed to overall revenues and how effective the franchising model is at generating sales without bottlenecking capital.

Gross Margins

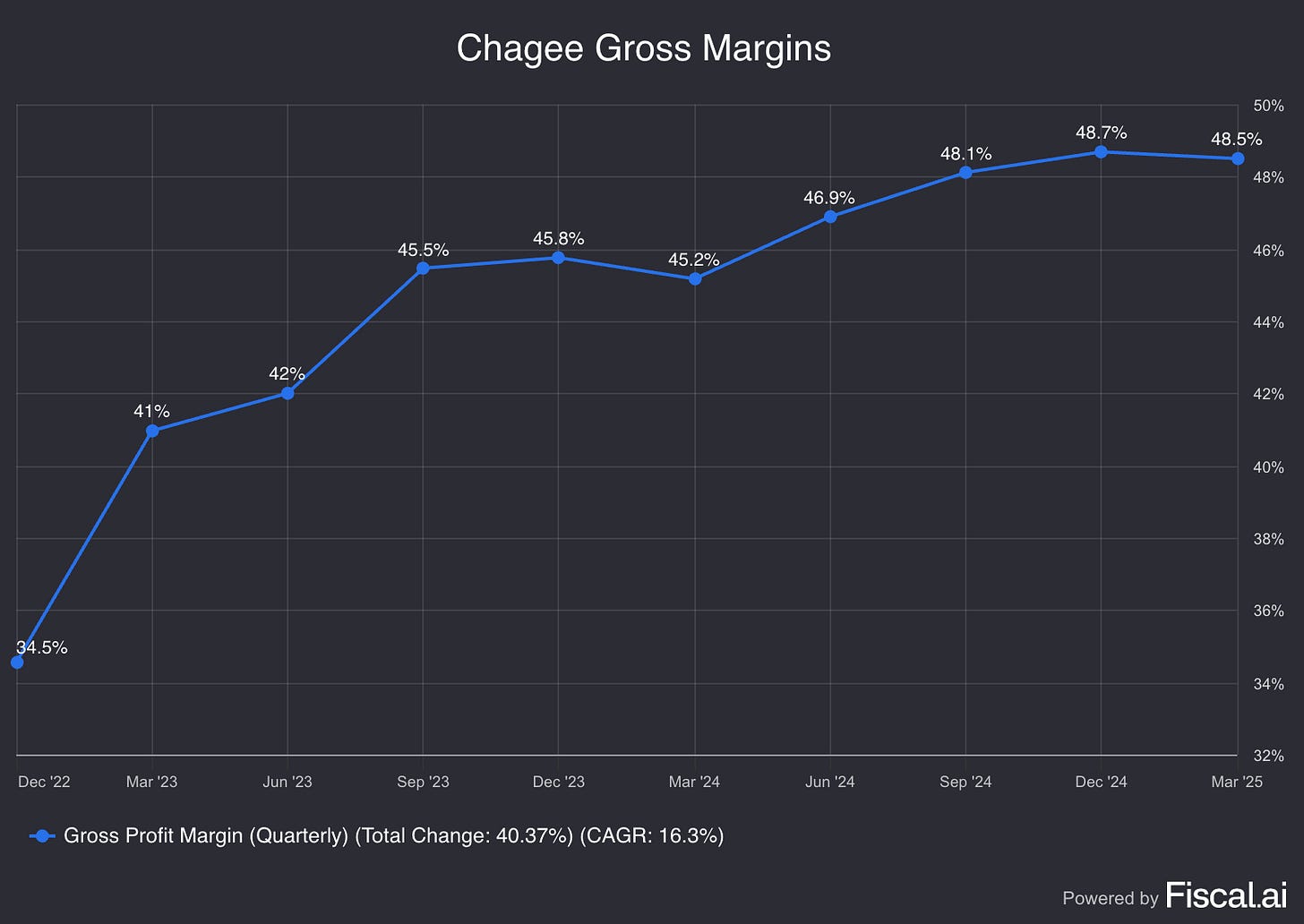

Chagee has best-in-class gross margins for a retail F&B chain of ~50% with an impressive ramp up as the business scaled significantly over the past 3 years.

This is mostly achieved from these 2 key factors:

Chagee’s franchise model where it sells tea ingredients and packaging to franchisees at a markup.

Fewer SKUs and streamlined operations reduce wastage, prep time, and complexity, all contributing to better cost control.

However, it is also key to note that Chagee’s gross margins appear to have peaked at roughly 48.7% and should plateau around this region.

Operating Margins

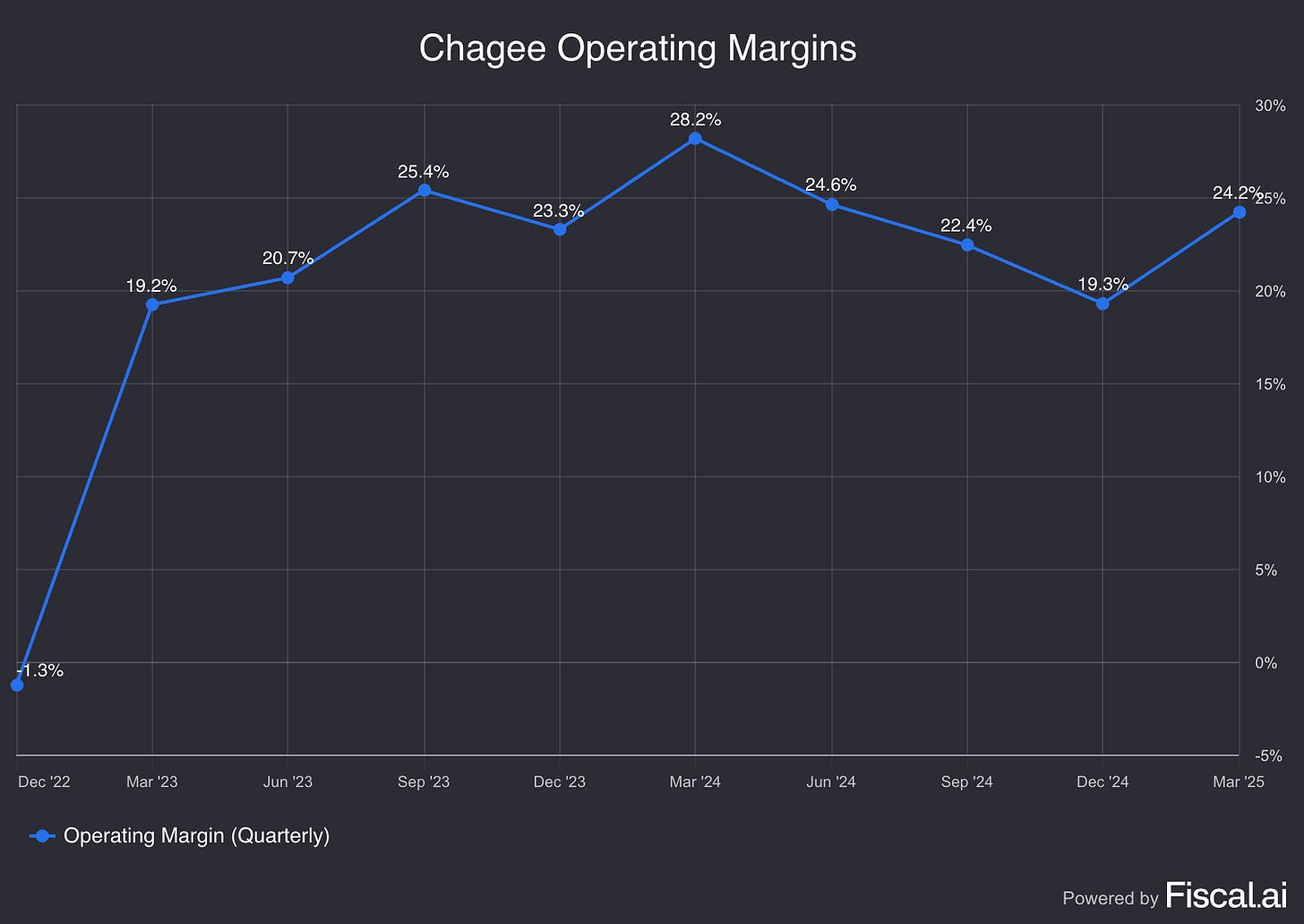

Chagee’s operating margins are also best-in-class with the main OPEX spend coming from G&A and marketing.

Despite ramping up G&A and marketing in 2024, Chagee continued to post mid-20% operating margins. However, similar to gross margins, it is clear that operating margins have seemingly reached a ceiling. Regardless, it is an extremely healthy operating margin.

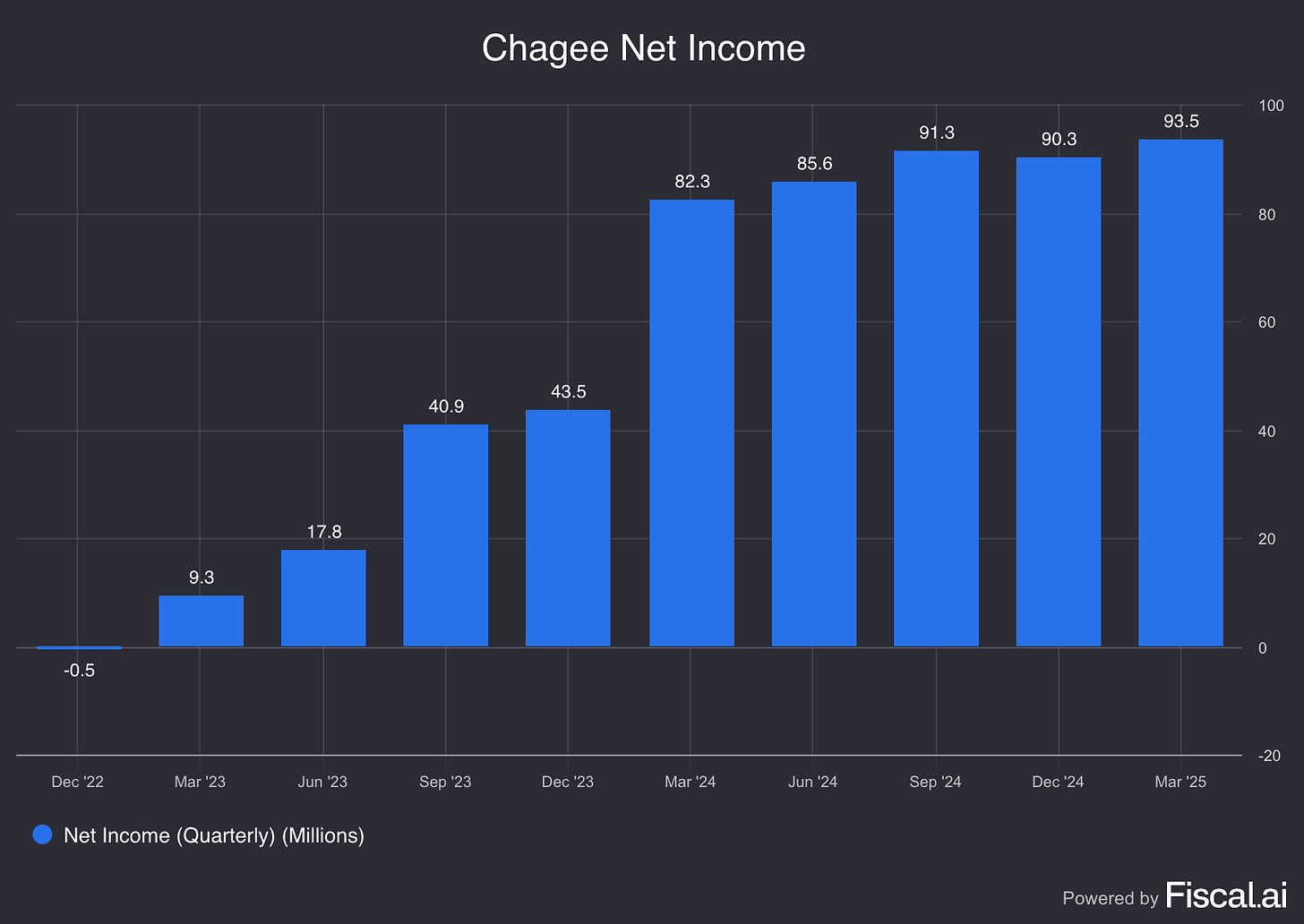

Net Income

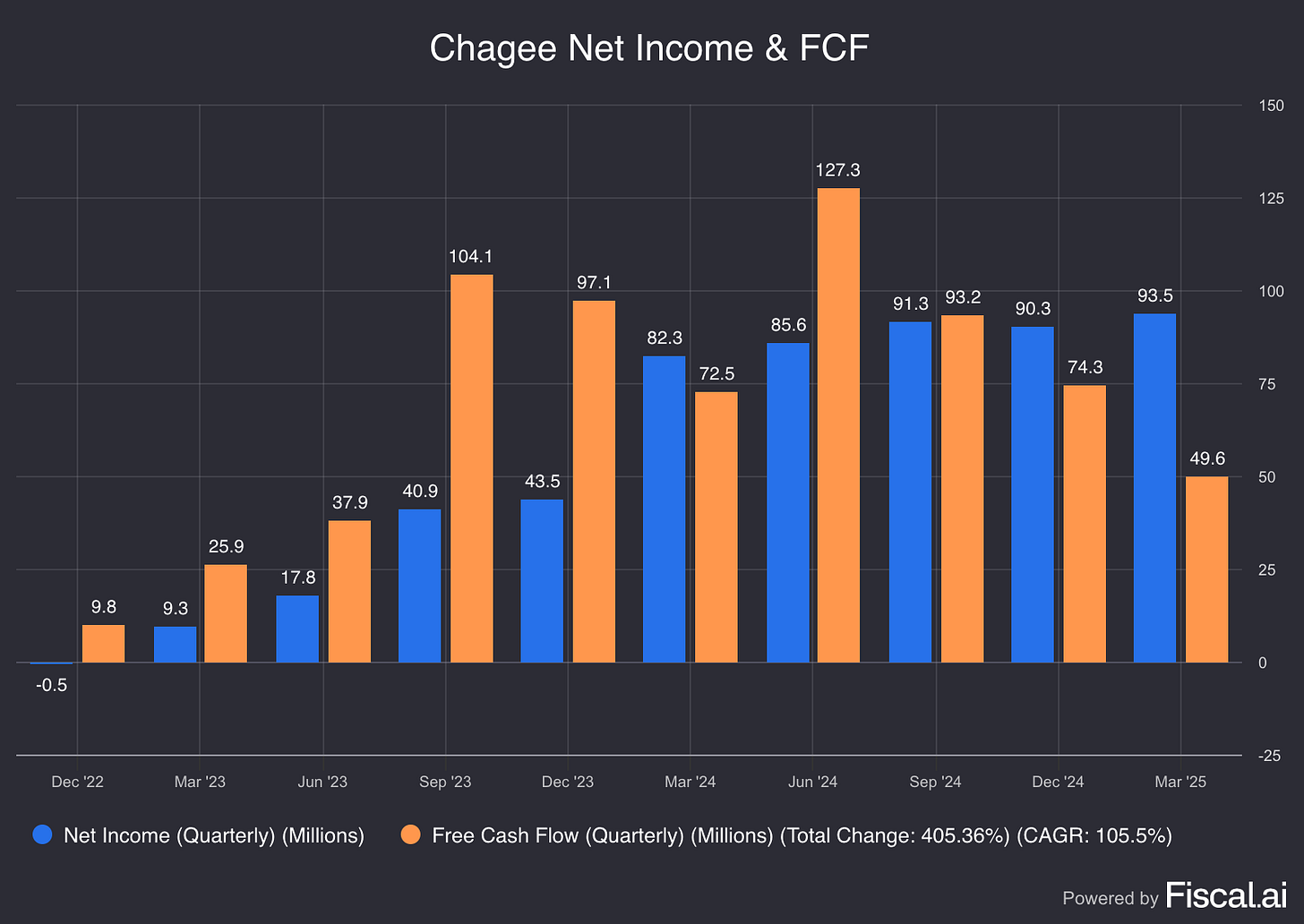

Chagee turned profitable in 2023 and saw incredible profit growth in 2024 as operating leverage came into play.

Chagee’s net income margin of ~20% is the best among its peers with only Mixue and Guming comparable in margins. Players such as Luckin Coffee, HeyTea and Nayuki have net margins ranging from 1% to 10%.

Chagee is at the very top of the profitability ladder in its sector. It’s quite rare for a company growing triple digits to already have 20% net margins and it speaks to the strength of their operational model.

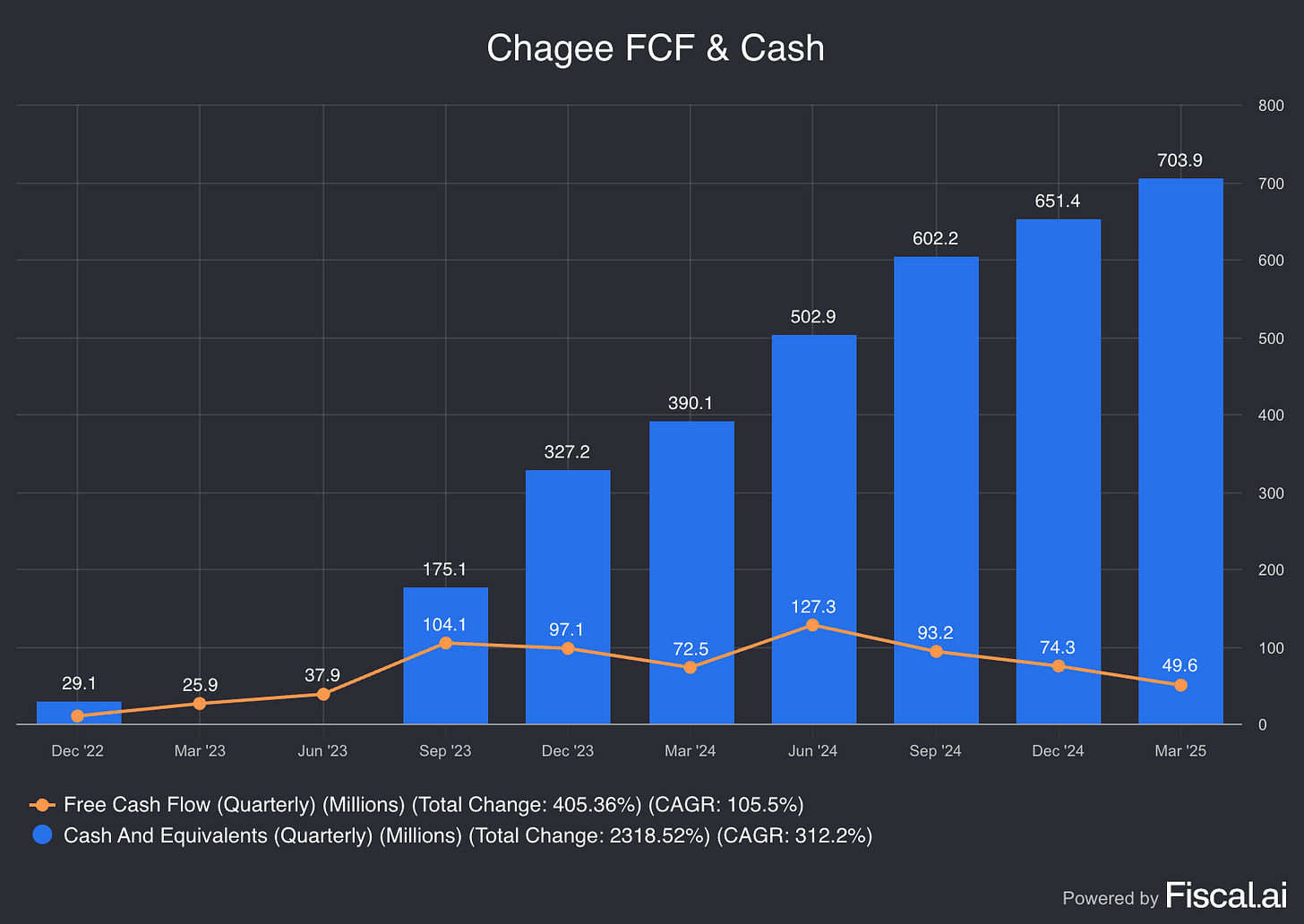

Free Cash Flow

Chagee became free cash flow positive in 2023 and saw a huge rise in 2024 as profits flowed from franchise fees and company-owned store growth. The business generally has low CAPEX needs due to its franchising model which has led to a steady growth in their cash balance which stands at $700M today.

This gives them a significant war chest of liquidity for expansion needs and buffer for any bumps they may face along the way.

Balance Sheet

Chagee’s balance sheet is extremely strong with minimal debt and a small amount of bank loans. The business has a debt to equity ratio of just 0.23.

The IPO raised $411M which puts Chagee in a strong cash position, along with a clean cap-table due to its founder retaining huge equity ownership and voting power.

Registered Members/Active Members

Chagee has a membership program for customers, with two key overarching metrics, namely “Registered Members” and “Active Members”.

Registered Members refers to top-of-funnel reach, every customer who has ever signed up for Chagee’s loyalty mini-app, received coupons or stored payment details.

Active Members refers to customers who have made at least one purchase in the past 12 months.

As of 1Q25, Chagee had 192.4M registered members and 44.9M active members. This underscored a 110% and 21% growth in registered and active members respectively.

In my opinion, the key metric to watch out for is the Active/Registered member ratio. As of today, it stands at roughly 23%. This ratio will inevitably drift lower as each cohort produces a tail of customers who may move abroad, delete the app, switch preferences or simply lapse. What is key to watch, is the shape and speed of that decline. A gradual cliff of say 23% to 16% over the course of 2 years is entirely normal, but would be concerning if it happens over a quarter or two.

Store Economics

Each Chagee store (in China) on average did monthly GMV of RMB 512k in 2024, which is about RMB 6.1 million annual (~$850k) in sales. That’s the average including all the smaller franchise stores.

These are impressive unit volumes. To compare, a Starbucks in China might do around RMB 4–5m annual sales on average. Chagee’s high throughput thanks to quick service likely helps push more transactions per day than slower competitors. As of early 2024, Chagee also said the average cups sold per store per month was ~25,000 in China, up from ~9,000 in 2022, showing how much more popular each store has become.

One metric to watch is same-store sales (SSS) or same-store GMV growth in China. In Q4 2024, Chagee had negative ~18% SSS due to cannibalisation. For 2024 full-year, SSS was still positive considering H1 was very strong, but showed a clear decelerating trend. In Q1 2025 results that were released in May, Chagee’s average monthly GMV fell further to 431k RMB, which is a continued drop from 4Q24 numbers of 456k RMB and 1Q24 numbers of 549k RMB.

For FY2025, I believe SSS in China will be flat or even slightly down as they opened many new stores that are splitting the pie. The company will have to rely on new stores and new markets for growth, as mature store growth slows. This is a natural outcome of their expansion strategy, effectively trading some same-store sales for more total sales with denser presence.

In summary, Chagee has extremely strong financials. It has grown top line at a considerable pace with best-in-class margins and extremely high store-level profitability and productivity. It also has minimal debt and massive cash reserves that will enable it to fund growth internally.

However, high margins are a double-edged sword, especially for a business like Chagee with a low moat. There will be the temptation for competitors to price-compete to steal share (since Chagee could, in theory, cut prices 10% and still have healthy margins). How Chagee responds to that will be something to watch in the financials. E.g., if gross margin starts to dip, it might be absorbing higher costs or cutting prices.

10. Ownership and Management

You can probably tell by now that the business is basically run by the Founder and CEO Zhang and he is the key man here. However, in this segment, I will also dive into the other members of the ownership and management team.

Zhang Junjie (Founder, Chairman, CEO)

Zhang is 30 and owns roughly 54% of the company’s equity post-IPO and about 89% of voting rights that are Class B shares with 10x voting power.

This means that he retains effective control of the business.

Zhang is an extremely charismatic individual who is very hands-on with strategy. He reportedly reviews product changes, store designs and expansion plans personally.

Yin Dengfeng (COO)

Yin is 49 and has been with Chagee since 2019, leading daily operations and expansion. Prior to joining Chagee, he has had a long background in retail/operations.

He has been instrumental in scaling the store network.

Huang Hongfei (Aaron) (CFO)

Aaron, 51, joined Chagee in October 2024 as the CFO. My guess is he was brought in as an experienced personnel to be in charge of the IPO process. Prior to joining, he was a veteran in McDonald’s China with 28 years’ experience, starting from an accountant level.

Mian Lu (Director and VP)

Mian Lu is only 30 and has overseen the Southeast Asia business, mainly general operations, human resources and administration since July 2021.

Wei Jen Hu (VP)

Wei, 46, has had extensive experience at several Taiwanese bubble-tea brands as an R&D Director. Now, he is serving at Chagee as its VP of Product Development since 2021.

Chi Xu (VP)

Chi Xu, 35, has served as the VP of Branding & Marketing since 2021. Prior to joining Chagee, he was the marketing director of Chengdu Jimei Yutai restaurant.

Board of Directors

Chagee has a 7 member board that consists of a blend of food-service heavyweights with outside expertise. CEO Zhang and CFO Yin are on the board alongside 5 outsiders that includes Zhang Yong (the founder and chairman of Haidilao) who is extremely well respected in the F&B industry in China.

Li Yifan is a board director and VP of multiple groups including Geely Holding (automanufacturing business) and Sanpower Group. Yale Law Professor Zhang Taisu and former Alibaba Cloud counsel Yi Wang round out the three independent directors.

Chagee has also tapped former U.S. senator and ambassador Max Baucus as an external advisor on international expansion and ESG practices. In my opinion, this was a savvy move ahead of IPO to show they’re serious about global governance and to navigate U.S.-China nuances.

Overall, the board is a very experienced one that should provide strong guidance to Zhang, who despite being in the business for 15 years, remains a relatively young CEO.

Governance-wise, there is a risk in the super-voting shares (Zhang can outvote all other shareholders combined). However, many U.S. tech listings have that setup and investors are somewhat accustomed to it. Bringing in Zhang Yong is particularly noteworthy; it shows Zhang Junjie’s willingness to learn from other entrepreneurs.

In terms of management style, Zhang is known to be extremely data-driven despite his lack of formal education. He stresses data from the POS system, and the company culture is about efficiency and standardisation. Yet, he also encourages a sense of mission (making tea culture go global).

However, one concern I have is that as Chagee expands globally, would their China-centric team be able to adapt?

They may need more international hires and to empower local teams more. Cultural missteps are not a novelty, Alibaba made a huge mistake with Lazada as they put Chinese execs in charge of Southeast Asian countries that are extremely different, and these execs often lack understanding of the nuance of their customers.

11. Valuation

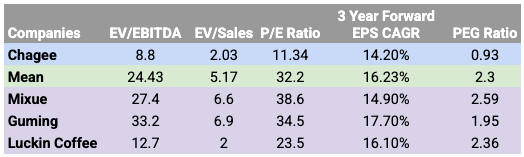

I personally think Chagee is relatively undervalued here, but not without reason.

Chagee currently trades at a $4.32B valuation. Accounting for net debt, it trades at only a $3.76B enterprise value.

Since its net margins are near-optimised (in my opinion, for a F&B franchise business), I believe using EV/EBITDA, EV/Sales, PE and PEG ratio are relatively good measures.

Incredibly, on every metric, Chagee trades at a much lower valuation than its peers.

It has a nearly 9% earnings yield on the stock with earnings growth expected to continue at around 14% for the next 3 years.

Not to mention, Chagee has higher margins compared to all the other businesses in this list and arguably deserves to be on the higher end of the range in terms of multiples.

So, it begs the question… Why is Chagee trading so cheaply and what is it that the market is underpricing?

ADR Discount

Mixue and Guming trade on the HKEX where investors better understand the story and it doesn’t have to same delisting risk that Chagee may have being on NASDAQ.

Limited Coverage

Chagee went public just 3 months ago and there has been very little coverage on the stock. There is relatively thin liquidity and limited knowledge about the business especially among U.S. investors. That could change with Chagee’s expansion into North America.

Price-War Anxiety

Investors could be pricing in a decline in Chagee’s margins as competitors such as Mixue and Luckin engage in aggressive discounting campaigns.

Large Private Investor Offloading (Possible)

Apart from Zhang, the other key investor in Chagee is XVC Entities, a venture capital fund from China that owns 20.3% of shares outstanding. Standard IPO lock-up periods tend to be 180 days and it is possible that investors are worried about the potential share sales by an investor as large as XVC.

It is inevitable that XVC will sell at least a partial stake as it has to return capital to its LPs and being a venture firm, its primary goal is to invest at early stages and to cash out once it IPOs.

Low Float

Only ~9% of total shares are in the free float. With limited institutional coverage or liquidity, even moderate retail turnover or algo-driven selling can drag prices substantially, which could explain the 27% drop since the IPO.

Ultimately, Chagee is trading at a very cheap valuation relative to its peers. However, these multiples could change quickly depending on margin pressure from competitors and the trajectory of Chagee’s top and bottom-line.

If investors believe that Chagee can sustain its margins and grow earnings sustainably over the next 3-5 years, Chagee definitely looks like a good business at a great price.

12. Conclusion (What I’m Personally Doing)

After weighing Chagee’s impressive fundamentals and attractive valuation against the risks that lie ahead, I am not yet a buyer.

The business is clearly exceptional by many operational measures and I have been extremely impressed by the prowess of the CEO in particular but I do have some concerns that have led me to make this decision.

What I Like:

The business is operationally excellent thanks to its fantastic franchise model, focus on quality and 1+1+9+N model. That has led to 50%+ Gross Margins and 20%+ Net Margins, which are arguably too good to be true in a F&B business.

Zhang Junjie has a track record of disciplined execution, decisive leadership and ability to strategically pivot which is rare in such a young CEO who could barely write at age 17.

There are multiple growth levers to pull with regards to international expansion and new product initiatives.

Why I Hesitate:

I am concerned about margin durability in the business. SSS has come down slightly as new outlets have cannibalised sales and overseas expansion is a tricky business. More importantly, there is a plethora of competitive businesses in China that are extremely aggressive and may put pressure on Chagee’s margins through its discounting tactics.

Chinese businesses are often subject to a valuation discount unlike its U.S. peers that often have a valuation premium. This is built into the psyche of market participants and it is incredibly difficult to change this. Hence, while Chagee may look optically cheap, that discount could remain for a long time.

With the business having already expanded to 6,490 stores in China as of 1Q25, it will likely have to look abroad for growth opportunities. While it has seen success in countries like Singapore, Malaysia and Thailand, its success could have been due to the similar taste of preferences of the Chinese diaspora in these countries. I would prefer to see 6-9 months of consistent overseas economics especially in countries like the U.S. before underwriting a multi-year expansion story.

The 180-day lock up period has 3 months to go and could act as an overhang on the stock as investors fear the consequences of XVC Entities or a similarly large party selling off a substantial stake in the business.

As long time followers will know, I hold a very concentrated basket of stocks and invest in only the very best businesses I can find, trading at fair valuations. I like to keep my holdings to a maximum of 12 names and that list is relatively full now with the recent addition of d-Local to my portfolio. (Check out my dLocal deep dive below if you haven’t yet)

For now, Chagee is high up on my “watchlist basket”. I will continue to keep a watchful eye on the business as it reports financials in the coming quarters and will give an update if I decide to invest in the business.

Thank you for reading this lengthy deep dive and I hope that it was helpful, not just in evaluating this business, but also in providing some key takeaways that could be valuable in finding potential great investments and/or avoiding potentially bad investments.

I would really appreciate if you could share this post with a friend if you enjoyed it. Thanks for the continued support and look forward to similar deep dives in future!