Bullish on Fat F*cks

12 Stocks to Profit from Obesity, Laziness, and the Convenience Economy

We live in the age of the couch potato economy. Society increasingly prioritises convenience and comfort, often at the expense of our waistlines.

Nearly 3 in 4 US adults are now overweight or obese. By 2030, it’s projected that one billion people globally will be living with obesity. By 2050, more than half of adults worldwide will be overweight or obese.

Over the past 15 years, the number of people who are obese or severely obese has surged by more than 35%.

Rather than lamenting this sedentary, obesity trend, we might as well profit from it.

Bullish on Fat F*cks

In this article, I write about the businesses that are best positioned to benefit from people being lazy, convenience-seeking and yes, fat.

I have split this into several different buckets:

One-Click Commerce & Delivery

MELI SE CPNG UBER GRAB DASH CART

Fast Food Favourites

DPZ YUM WING

Screen Time Glue

NFLX SPOT

Together, these buckets form a portfolio that is structurally long convenience, and by extension, the globally expanding waistline.

One-Click Commerce & Delivery

The most obvious beneficiary of people’s desire for convenience. One-Click Commerce & Delivery was accelerated by COVID, and despite a minor scare in the year post-COVID, it has become clear to all that it is here to stay.

This includes the likes of e-commerce, food delivery and ride-hailing platforms. Habits once formed, are difficult to erase, and this has been the case for consumers of these platforms.

As these businesses have scaled, costs have come down and operating leverage has kicked in, allowing once heavy cash-burners to transform into cash-rich businesses that own incredible mind-share.

E-Commerce

It is no longer a nice-to-have or a side channel for goods. Today, it is the default operating system for retail consumption, especially among the millennial population and younger.

Global online sales are projected to reach $6.6T in 2025 and add another $0.5T the following year. Consumers now treat same-day shipping, real-time parcel tracking and one-click returns as baseline rights. Meeting those expectations demands massive, data-driven logistics networks — barriers so high that a handful of platforms are pulling further and further ahead.

Mercado Libre, Sea Limited and Coupang are my picks here.

Each of these dominate their specific markets with between 30-55% market share, and continue to grow top-and-bottom line year after year. Each are founder-led and have leveraged their superior logistics networks to destroy the competition. Most importantly, each have a clear runway ahead with strong macro tailwinds to back their case.

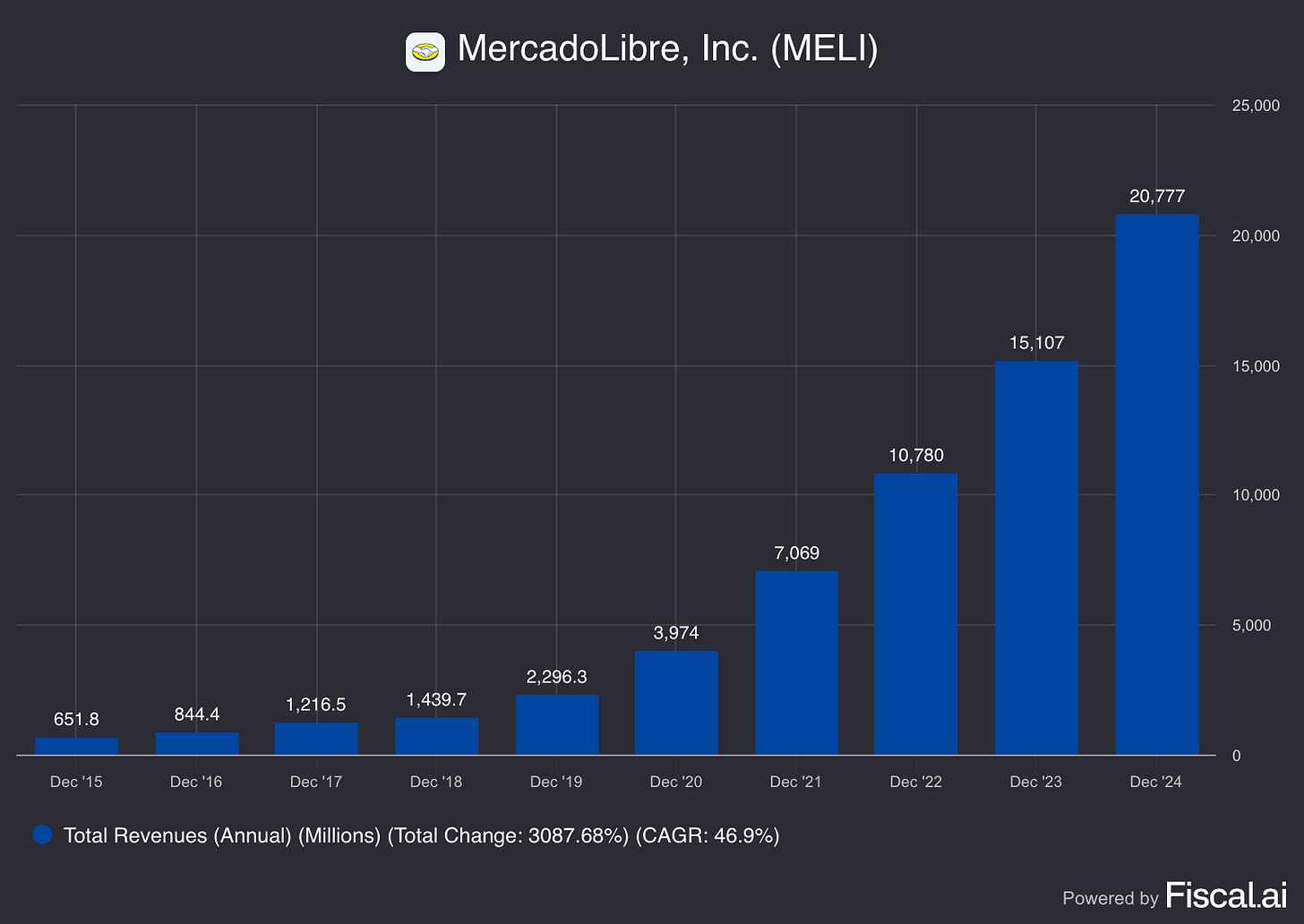

Mercado Libre (MELI):

Mercado Libre sits at the heart of a region where scorching weather, patchy public transport and security worries make a trip to the mall a chore.

Its end‑to‑end platform removes every friction: one‑click checkout with Mercado Pago, instant credit via Mercado Crédito, and a proprietary courier fleet that can drop a package in Mexico City the same day it was ordered.

It continues to widen its twin moats of logistics and FinTech. Scale, a proprietary courier fleet and a dominant payments ecosystem embedded in 18 markets make it hard for rivals to catch up, while e-commerce penetration in Brazil and Mexico remains barely half the U.S. level, leaving huge runway for growth.

Sea Limited (SE):

In many ways, Sea is the quintessential example of the “Bullish on Fat F*cks” thesis. It offers convenience and laziness on a whole other level through all 3 key segments.

Shopee has cemented itself as the #1 player in the Southeast Asian e-commerce market, dominating its rivals. Garena’s Free Fire has over 100M daily active users addicted to its games and increasingly spending more over time. Monee, its FinTech segment, brings in $1B in annualised EBITDA at a 30% margin and is growing its loans principal outstanding at 75% YoY.

Coupang (CPNG):

Coupang is the symbol of efficiency and perfection. In South Korea, it dominates e-commerce, and delivers at incredible speed with 99.6% of delivery orders fulfilled within 24 hours.

It has trained South Koreans to expect anything ordered before midnight to land on the doorstep by breakfast, no tip, no delivery fee, no reason to leave the apartment. In the trailing twelve-month period, Coupang printed $1B in free cash flow, and is merely at the inflection point of profitability.

As people’s habits get deeper, so will Coupang’s pockets.

Deliveries & Ride-Hailing

A decade ago the laziest meal option was a drive‑through. Today a tap on a phone summons everything from sushi to shampoo without us leaving the sofa.

That same tap on a phone can summon a car that removes the final vestige of exertion from urban travel. Instead of walking to a bus stop or cycling, we can simply order a car or bike (in some countries) that literally arrives at the doorstep.

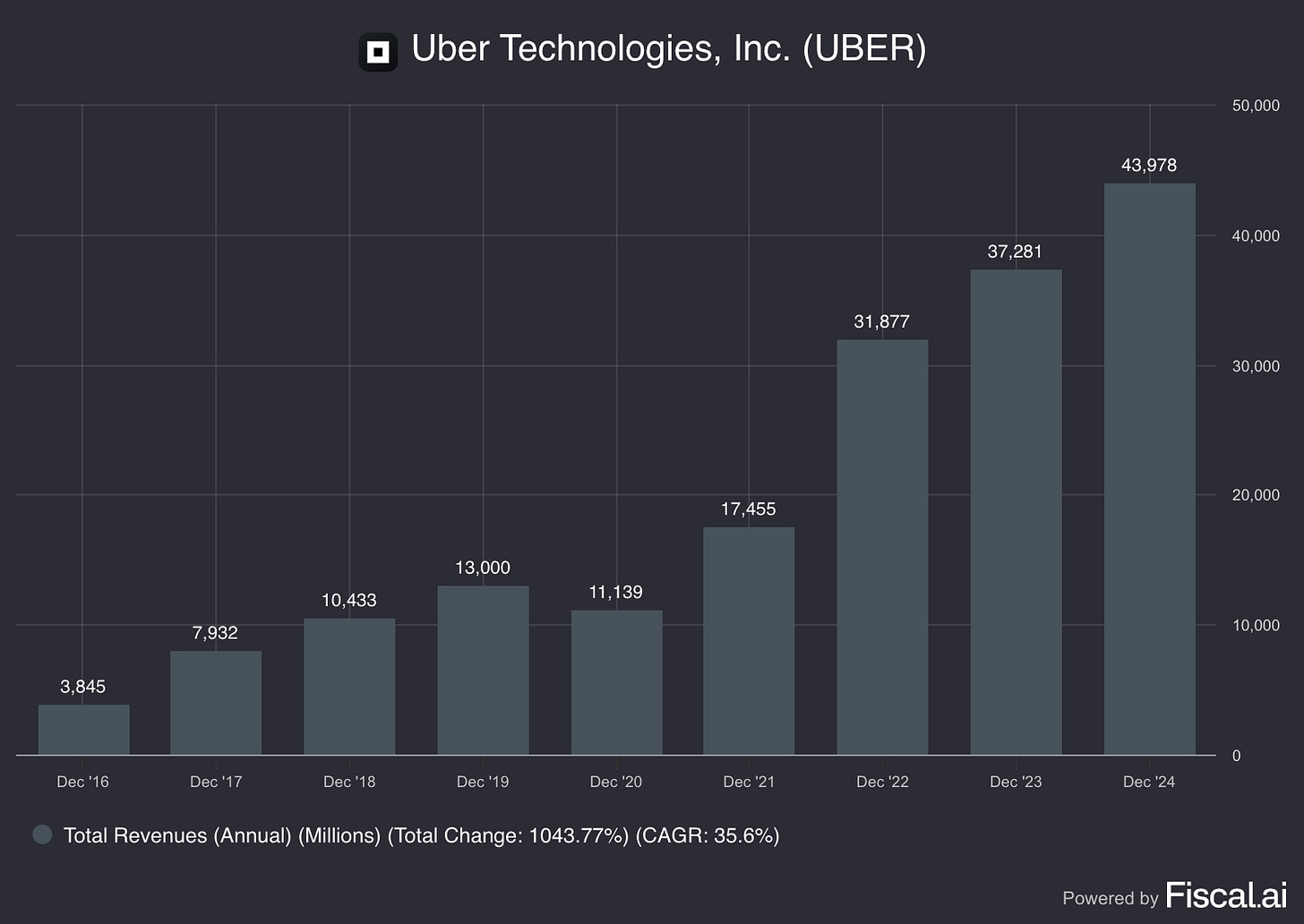

Uber (UBER):

The poster boy of convenience. In 2024, Uber logged 3.1 billion trips, roughly equating to 33 million per day. Uber bundles ride-hailing, grocery and restaurant delivery all in one app, capturing a user whether they leave the sofa or double-down on it.

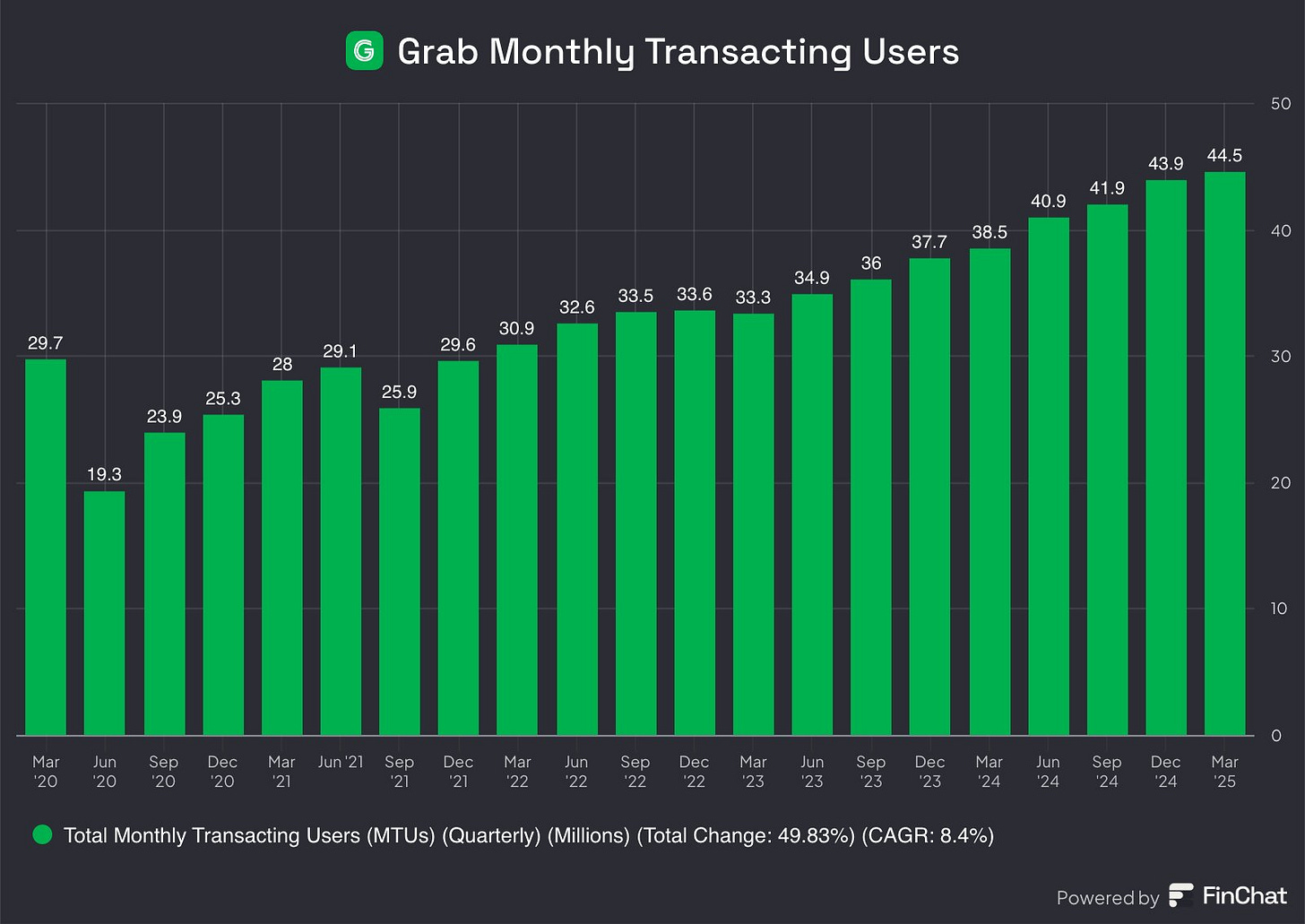

Grab (GRAB):

The Uber of Southeast Asia, figuratively and literally. Grab acquired Uber’s SEA operations, giving Uber a 22.5% stake in 2018 for the deal. Today, Uber still retains about 14%.

Grab has over 45 million monthly transacting users on its platform, utilising its ride-hailing, food delivery, and even financial services segment. It dominates the region with over 4x more market share than its closest competitors and it remains the only profitable player in the market.

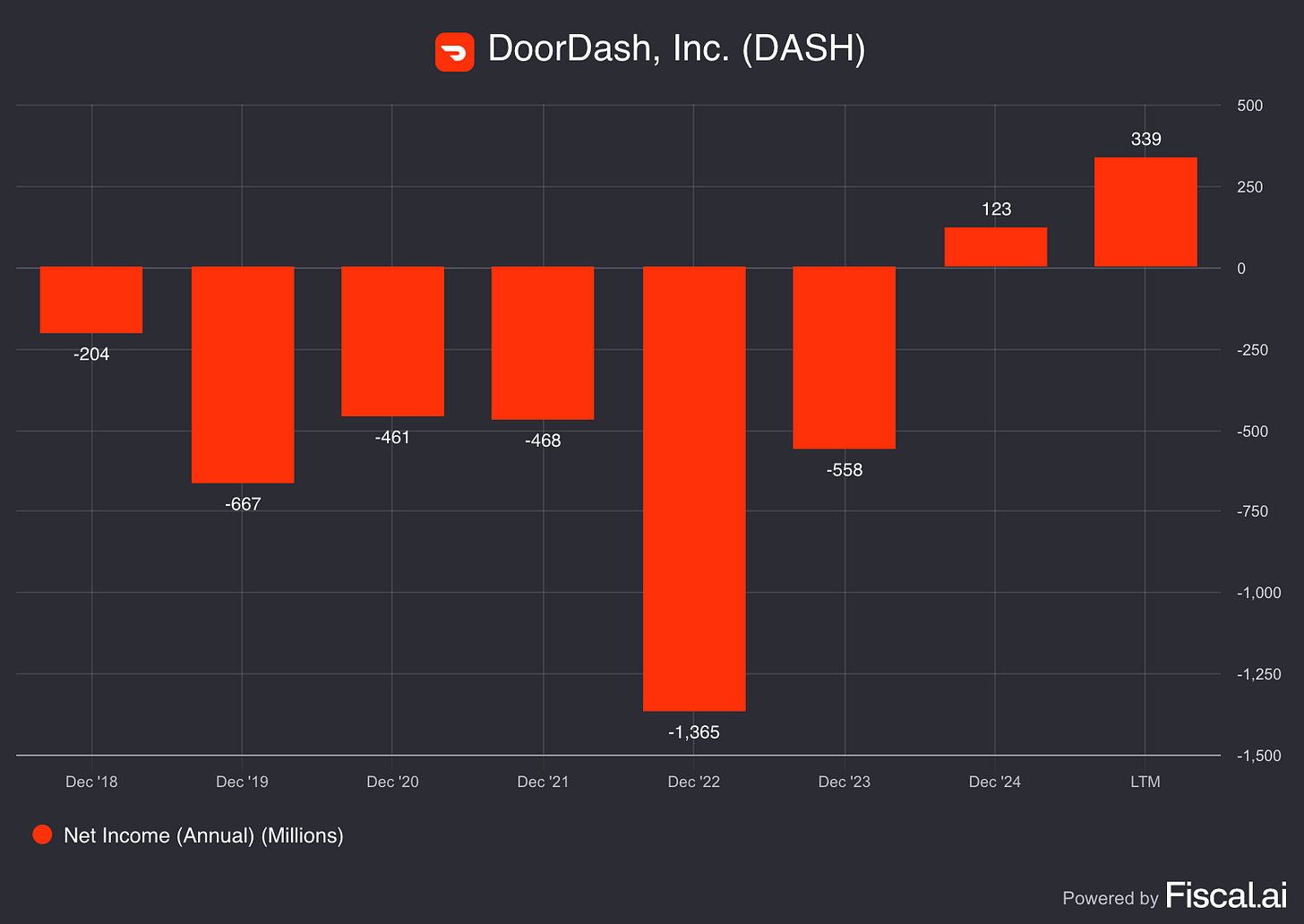

DoorDash (DASH):

DoorDash is the purest public market play on the decision of consumers to stay in, scroll and snack. With roughly 67% share of US meal delivery spend, a subscription service that exceeds 18 million members, and expansion into grocery, alcohol and convenience items, DoorDash monetises every moment a consumer decides to slack off.

Density drives margin: more orders per mile lower unit costs, creating a scale moat that smaller rivals cannot breach. As long as people keep outsourcing meals, groceries and other consumables, DoorDash clips a fee from each lazy impulse.

Instacart (CART):

Instacart owns the digitally lazy grocery run: it commands ~70% share of US online baskets over $75. It partners with more than 1400 retailers and 85,000 stores, meaning a suburban customer can outsource their entire fridge refill while binge-watching Netflix.

High-margin advertising and smart-cart technology has allowed Instacart to gain operational leverage without extra fulfilment costs. Instacart captures both transaction and ad dollars, turning the march towards obesity and convenience into a high-margin, asset-light growth beneficiary.

Fast Food Favourites

Cheap, calorie-dense and engineered for dopamine, fast-food meals are a perfect complement to one-click commerce. The payoff for consumers is pretty obvious, no groceries, no dishes, and no cooking required.

Fast food, ordered through DoorDash, UberEats or GrabFood, heaven for consumers.

There are many fast food chains out there, but some are simpler better than others, operationally, through aggressive digitisation, kitchen automation and flavour engineering. I would like to highlight 3 businesses in this article.

Domino’s Pizza (DPZ):

Domino’s remains one of the favourite pizza brands of all time. However, the business isn’t really a pizza chain, it is a logistics and software business that happens to sell 2,000 calorie dinners.

In 2024, it generated $19.1 billion in global retail sales across over 21,000 stores. Crucially, over 85% of US sales came through digital channels. The app remembers favourite orders, tracks drivers in real time and is now experimenting with AI voice bots and driverless delivery pods.

In a world where convenience beats home cooking, the company’s digital dominance and asset‑light model should continue to feed cash flow as reliably as it feeds its customers.

Yum! Brands (YUM):

Many would not have heard of this business, but will definitely know its subsidiaries. KFC, Taco Bell, Pizza Hut are among the top brands that it owns, together serving nearly 61,000 restaurants and opening a new site roughly every 2 hours.

In 2024, Yum! Brands posted $30 billion in digital sales, with more than half of system-wide revenue now ordered on phones or kiosks. Yum! is incredibly efficient with a sales-to-total-assets ratio of 1.18, meaning the company gets $1.18 in sales for each dollar in assets. In comparison, the industry average is just 0.97.

Wingstop (WING):

This is a personal favourite of mine. It has turned a single protein into a cult product that travels well and works as both a snack and meal. In 2024, system-wide sales jumped 36.8% to about $4.8 billion, marking the 21st consecutive year of same-store sales growth. Just incredible.

Roughly two-thirds of orders already arrive through digital channels, and management is pushing that mix even higher with app-exclusive flavour drops and delivery-only “ghost” kitchens that require little capital.

Since 98% of restaurants are franchised, Wingstop captures high-margin royalty income without tying up its own balance sheet in real estate. With runway to triple its current 2,200 locations and a strategic ambition to enter the global top 10 restaurant ranks, Wingstop is a pure play to the calorie trend, backed by a proven, asset-light growth engine.

Screen Time Glue

So we order the food, and the groceries, but what keeps us glued? Streaming.

Platforms like Netflix and Spotify monetise our downtime, turning attention into cash flows while reinforcing sedentary habits.

The longer someone binges a crime docu-series or cycles through an endless playlist, the more likely they are to order dinner through DoorDash and skip the evening walk.

Netflix (NFLX):

Netflix now counts over 300 million paying accounts and an estimated 500 million households thanks to shared profiles.

The average Netflix user watches 2h15mins per day with each additional minute monetised twice, firstly through a rising ARPU and then through merchandising/licensing of hit IP.

In 2024, revenue hit $39 billion with operating margin above 20% and $7 billion in FCF. All of this while content spend remained flat at $17 billion, proof of operating leverage as the catalogue amortises over a growing audience.

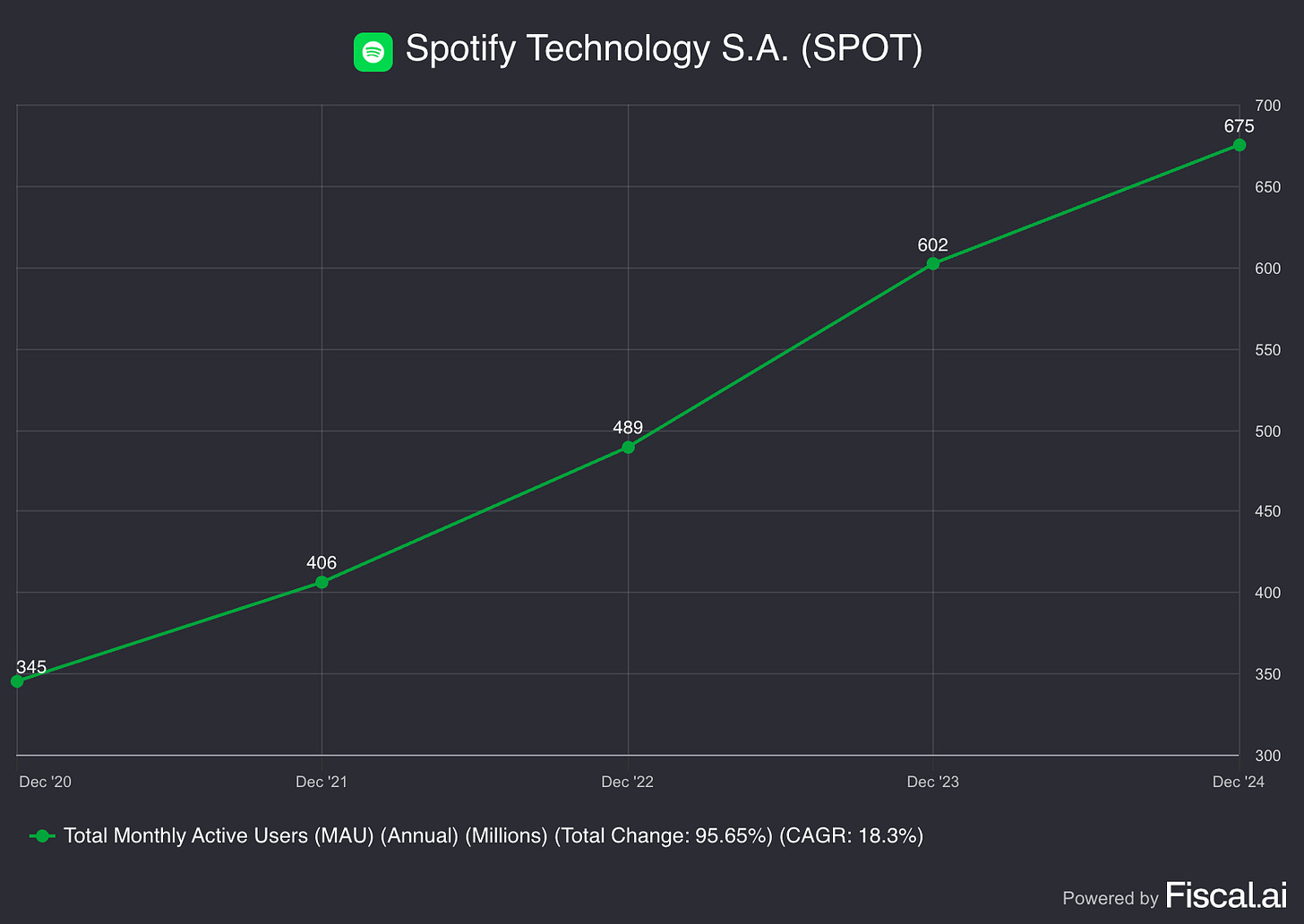

Spotify (SPOT):

If Netflix owns the eyes of the seated world, Spotify owns the ears. Audio streaming is inherently lazy-friendly, allowing listeners to binge podcasts, playlists, and now audiobooks with minimal effort.

As of Q4 2024, Spotify had 675 million monthly active users of which 236 million pay. The unit economics are improving quickly too, with a 30% surge in ad-supported revenue and higher subscription pricing.

At ~$8–10 per month, Spotify delivers far more value than it charges, in my view. This pricing power gives it room to continue raising prices, unlocking margin expansion and meaningful operating leverage over time.

Across quick commerce, delivery, fast food and streaming, these businesses are poised to continue outperforming the market as they deliver what modern consumers value most: zero friction.

The “Bullish on Fat F*cks” portfolio is structurally long convenience, and by extension, long the calorie-dense and sedentary lifestyles that define today’s consumer behaviour.

Thanks for reading!

Amazon is the OG of this thesis. It redefined laziness with next day and same day delivery.

I’d say better watch your language… Yes obesity is a real problem which will indeed be there for the foreseeable future but no need to be discriminative about it