5 stocks I plan to own for >5 years

Generational Businesses

This is perhaps one of the most important quotes to sum up long term investing.

Investors often panic when going through drawdowns. But if you think about it logically, there is no reason to panic, if you know what you own.

If you believe your business is worth $1M and a potential acquirer comes along valuing your business at $500K, do you panic or do you simply move along, scoffing at the insanely “dumb” offer?

Today, I want to highlight 5 businesses that I view as safe, long-term holds. Businesses that I believe will do well for decades to come. Businesses I intend to hold for a minimum of 5 years from today.

Should we see a massive undervaluation of these businesses, you can be sure that I will be scooping them up at discounted rates.

1. Grab ($GRAB)

Grab is building the digital infrastructure for Southeast Asia, a region with 700M people, growing internet penetration and rising income levels.

Grab is tackling ride-hailing, food delivery and digital banking, key facets of the digital economy, integrating itself into daily life of Southeast Asians.

I believe this is one of the most compelling times to own Grab, as the company nears a key profitability inflection point. For much of the past decade, questions around product-market fit were valid, but those concerns no longer hold.

If Grab executes in digital financial services the way it has in mobility and deliveries, and I believe it will, it paves the way to becoming the rails for the SEA digital economy.

The long-term growth runway stretches decades, and I think the acquisition of GoTo would be a major catalyst, positioning Grab to dominate Indonesia, the region's most critical market, accounting for ~40% of Southeast Asia's population.

2. Sea Limited ($SE)

Sea is a unique three-engine business, of which all I believe have decades-long runways.

Garena has turned the corner on bookings, DAUs etc and Free Fire remains the most popular mobile game in the world.

Shopee is objectively speaking the MOST dominant e-commerce business in the world with 50%+ market share.

SeaMoney has grown from 0 to $2.1B in revenue in just 5 years and continues to grow loans outstanding at 65% YoY while maintaining a 1.2% NPL ratio.

I believe while Sea is already a juggernaut with almost $17B revenues in FY24, it is still in the very early innings of monetising its ecosystem. Sea will become a cash-generating machine in the coming 2 years.

3. Robinhood ($HOOD)

The pace of execution at Robinhood is unlike any business I have seen at this scale. Most think of it as a brokerage at this point, and frankly speaking, they aren't wrong.

Revenues are largely still tied to transaction revenues and will ebb and flow with animal spirits. ~40% of its transaction revenues come directly from Crypto trading.

As most understand, this is an entirely cyclical revenue line, with liquidity cycles dictating flows. As such, the market will continue to view Robinhood as a cyclical business for the foreseeable future.

However, Robinhood in 2-3 years will be a highly diversified machine, an effective full-stack financial platform with trading, retirement, crypto, options, credit cards, memberships and banking.

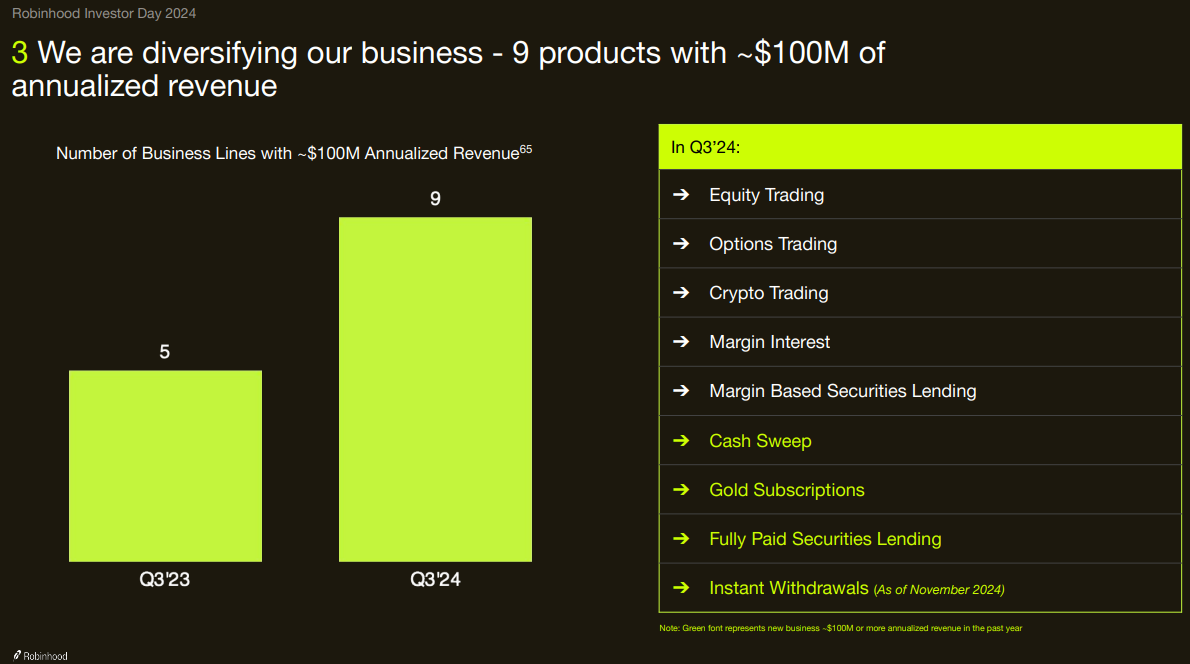

You could argue this is pure rhetoric, but the data is real: Robinhood already has 9 distinct revenue streams each generating over $100M in annualised revenue.

Robinhood is structurally underestimated. It offers arguably the best consumer-facing financial product on the market, with a world-class UI, embedded virality, and an execution-first team.

As it scales its asset base, monetises more products per user and expands internationally, it will eventually evolve into the consumer-facing Vanguard of a new era, owning the retail finance layer.

4. Tesla ($TSLA)

This is perhaps the most controversial of the 5 picks and seen as a contrarian investment at this point.

Most critics point to falling EV sales, Elon being distracted, FSD being a pipe-dream/Waymo being way ahead, Robotics being commoditised. At this point, the future looks extremely bleak, if you listen to the rhetoric of most X commentators.

Yet, this is a business that has proven time and time again to defy its critics. From its founding, the business has been criticised with claims of competition eating them alive. Instead, Tesla produced the world's top-selling car in 2023 and 2024.

On claims of Elon being distracted, this has always been the case. SpaceX, Neuralink, Twitter and now DOGE. Yet, the business' trajectory has continued upwards and to the right. He surrounds himself with high-calibre operations and delegates effectively, with a short leash.

Waymo may appear way more advanced, if you believe geo-fenced robotaxis and mapped routes are the future. Tesla is building for scale and from first principles; a camera-based, neural-net approach that learns in real time from a fleet of millions of cars.

Critics say Robotics will be commoditised. But they ignore how Tesla operates: vertical integration, custom AI hardware (Dojo), and real-world data advantage.

"Prototypes are easy, Production is hard"

The Roadster funded the Model S.

The Model S funded the Model 3/Y.

Model 3/Y funded batteries, Dojo and now CyberCab, Optimus.

Every step that critics doubted became the foundation for the next S-curve. I could be wrong on everything above, but I am willing to bear the risk, to reap the potential rewards, which I believe to be immense.

5. Mercado Libre ($MELI)

Mercado Libre is the undisputed leader in Latin America's e-commerce and FinTech space.

It is the leading FinTech player in the region with 56M+ active users, while TPV grows at 30%+. E-commerce and Bank Account penetration continues to increase rapidly in the region.

This is an exceptional business with a world class Founder-CEO, that has grown revenues at a 47% CAGR for over a decade and now generates extremely strong ROE of 29%, and ROCE of 25%.

Strong middle-class growth and demographic tailwinds will continue to allow this business to grow at an elevated double-digit figure for the foreseeable decade.

Final Thoughts

All 5 companies are structurally tied to secular trends:

Digital Penetration in EM: $GRAB $SE $MELI

Fintech Disruption: $HOOD $MELI $SE

Energy and AI transformation: $TSLA

I'm not betting on quarterly results — I’m betting on platforms, ecosystems, and the network effects they can compound over time.

Thank you for reading!

I would like to give a shoutout to FinChat.io. It is in my opinion, the best tool for investors. They provide access to fundamental analysis, financials going back 10 years, screening tools, insider trades, earnings reports, all in one place.

I use it everyday in my learning journey on the greatest businesses in the world and cannot recommend them enough.

If you would like to support my work and gain access to the best tool in finance, click on this link and get a 15% discount off the monthly subscription.

Disclaimer: The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

Great piece! I own $SE myself, and don’t imagine I’ll be selling anytime soon. Sometimes you just need patience to let these compound.