5 High Quality Stocks on my Watchlist

I'm buying one of them (at least)

This has been the year of AI mania.

Semiconductors, GPU builders, and infrastructure names have gone vertical. The rally has been euphoric and largely beta driven. High quality compounders, which typically have lower beta, have underperformed the market significantly.

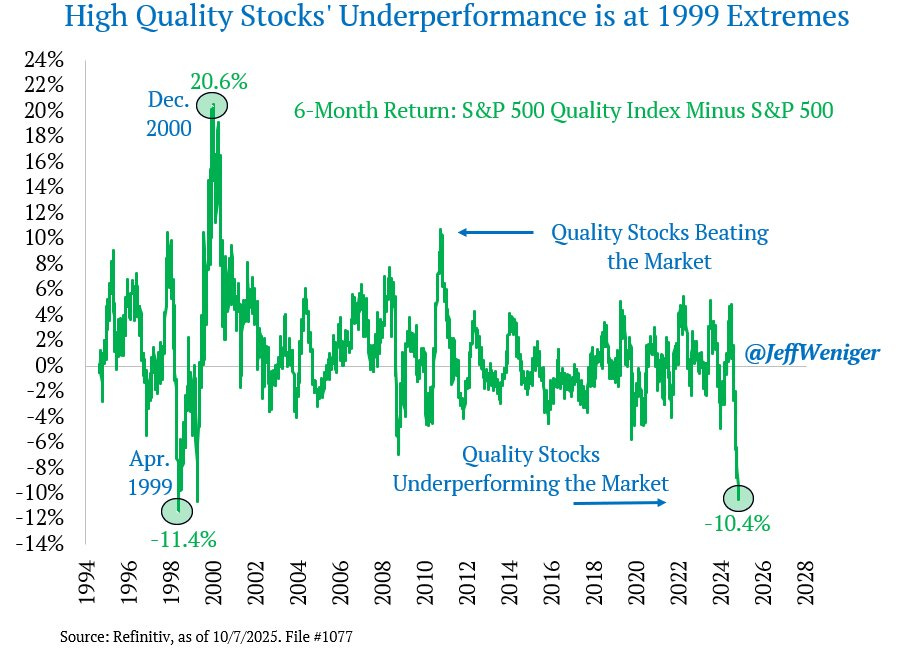

The last time quality stocks have underperformed the market to this extent was in April 1999. We know what happened next…

1.5 years later, quality stocks outperformed the market to the tune of 20.6%, a 32% swing in returns relative to the index.

While AI stocks have gone up hundreds of percent, many high-return, cash-generative franchises have been sold off for reasons that don’t hold up under scrutiny.

These have been driven by fears of AI disruption, temporary cyclical headwinds, and overstated regulatory risk.

These headlines typically drive sentiment in the short term, but they rarely change long-term value creation. These are not businesses in structural decline. They are simply being ignored because they are not part of the current excitement.

What is being missed is that these companies are not at risk of being replaced by AI. They are instead, more likely to beneficiaries of AI.

Despite this, a few of them trade at multi-year lows, with valuations that used to be reserved for average businesses. As I often advise, a combination of misunderstood narratives and depressed multiples is precisely where future outperformance usually begins.

As an investor, I prefer to zig when others zag. My philosophy has always been to stay grounded in fundamentals and focus on long-term value creation, not noise. It is easy to get carried away by what is working right now, but cycles always turn. Quality, cash flow, and durability always matter again in the end.

Below are five examples. Each is a proven compounder, some of which the market has discounted for the wrong reasons.

1. Fair Isaac (FICO)

Background:

Fair Isaac Corporation invented the FICO credit score and is a household name in the US. It is used by lenders to assess creditworthiness, predicting how likely an individual is to repay borrowed money.

FICO also provides predictive analytics, scoring algorithms, and decision-making software used by banks, insurers, and other enterprises to manage risk, lending, and fraud.

Why it fell:

The FHFA’s Bill Pulte went on a tirade a few months back, looking to broaden the use of competing models in mortgage underwriting, and claiming that FICO was overcharging and an effective monopoly (he’s not wrong in the latter point).

FICO has also been caught in the crossfire of a credit score war. Headlines over Equifax cutting VantageScore prices and offering free scores to select lenders has created panic that FICO’s pricing power may be collapsing.

Why that is wrong:

FICO’s data and analytics sit at the heart of lending in the US. It’s the standard that every bank, credit card company, and mortgage provider is built around, and embedded deep within the system.

FICO Scores are used in 90% of lending decisions by major lenders, including for mortgages, auto loans, and credit cards. Over 232 million US consumers can be scored by FICO, which is roughly 90% of the credit-eligible population.

Replacing FICO isn’t as simple as switching vendors. Lenders would need to reprogram their models, resubmit them to regulators, and rebuild their internal risk systems.

Investment Thesis:

FICO remains a mission-critical toll collector for the credit system, and I do not see that changing in the foreseeable future.

FICO is not a “cheap” stock at a 56x EV/FCF multiple. That said, the stock has never traded cheaply, with a median multiple of 39 in the past 10 years. However, I would argue that it is well deserved.

Since 2015, FICO has grown its FCF by 20% a year while its share count has fallen 20%. There are very few companies who are capable of this.

I added to my position at $1,300, around the 40x EV/FCF mark and updated subscribers in my latest portfolio update. Anything under 50x is a multiple I’m comfortable adding to.